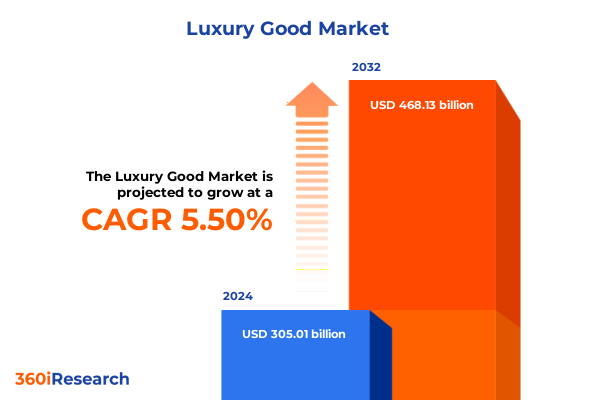

The Luxury Good Market size was estimated at USD 316.50 billion in 2025 and expected to reach USD 328.43 billion in 2026, at a CAGR of 5.75% to reach USD 468.13 billion by 2032.

Embarking on a Deep Dive into the Dynamics of the 2025 Luxury Goods Market and the Forces Redefining Consumer Expectations in the United States

The luxury goods market in 2025 stands at a pivotal juncture, shaped by converging forces of technological innovation, shifting consumer values, and macroeconomic turbulence. Amid global uncertainties, discerning clientele continue to seek exclusive experiences and products that reflect their personal identity and social values. This evolving backdrop has spurred brands to revisit traditional definitions of luxury, embracing digitalization, sustainability, and personalization as core pillars of differentiation. Consequently, stakeholders must navigate a complex interplay of consumer expectations, regulatory shifts, and competitive pressures to secure enduring brand relevance.

As foundations transform, industry players are compelled to adopt agile strategies that harmonize artisanal craftsmanship with cutting-edge technologies. Heightened emphasis on transparency and traceability has elevated the importance of ethical sourcing and circular business models, amplifying the demand for robust data frameworks. Moreover, the global luxury ecosystem is experiencing an accelerated decentralization, driven by digitization and cross-border e-commerce. Against this dynamic backdrop, this executive summary distills critical insights across transformative landscape shifts, the repercussions of United States tariff policies, nuanced segmentation analysis, regional differentiators, corporate performance benchmarks, and evidence-based recommendations. Together, these elements construct a comprehensive narrative to inform strategic decision-making in the rapidly evolving luxury sector.

Unveiling the Pivotal Technological, Social, and Economic Transformations Redefining Value Creation and Brand Engagement in the Luxury Goods Ecosystem

The landscape of luxury goods is undergoing transformative shifts propelled by technological advances, evolving social values, and reimagined economic paradigms. Consumers no longer perceive high-end products as mere status symbols but as authentic expressions of personal narrative and ethical commitment. As sustainability gains prominence, brands are deploying blockchain-enabled supply chain platforms to ensure verifiable provenance. In parallel, artificial intelligence-driven personalization engines tailor product recommendations and digital experiences to individual preferences, ushering in an era where mass customization achieves artisanal precision.

Moreover, demographic dynamics are reshaping the luxury clientele profile. Younger cohorts, particularly those aged twenty-five to thirty-four, are demonstrating unparalleled digital engagement, fostering direct-to-consumer modalities and social commerce collaborations. Simultaneously, legacy consumers are seeking heritage continuity, prompting established maisons to celebrate archival collections while infusing modern design nuances. In addition, the blending of physical and virtual realms-through immersive flagship stores equipped with augmented reality consultations-has redefined the purchasing journey. These multifaceted transformations underscore a fundamental shift: success in the future luxury marketplace requires a holistic approach that integrates digital mastery, experiential engagement, and unwavering adherence to ethical principles.

Assessing the Aggregate Consequences of 2025 United States Tariff Measures on Import Dynamics, Margin Pressures, and Strategic Reshoring Decisions in Luxury Goods Trade

In 2025, the cumulative impact of United States tariff measures continues to reverberate across the luxury goods supply chain, compelling brands to reassess sourcing strategies and cost structures. Initially imposed to protect domestic industries and rebalance trade deficits, elevated duties on select apparel, leather accessories, and footwear imported from key manufacturing hubs have introduced persistent margin pressures. As a result, companies are navigating a delicate equilibrium between preserving product quality and absorbing incremental costs, with many opting to renegotiate supplier contracts or adjust collection velocity to mitigate financial strain.

Furthermore, the tariff landscape has catalyzed strategic reshoring and nearshoring initiatives. By relocating critical production phases closer to core markets in North America or Mexico, luxury houses aim to reduce lead times, enhance oversight, and diminish exposure to trade policy volatility. Nonetheless, these relocations entail significant capital investments and require cultivation of specialized artisanal skills, presenting both opportunities and challenges. Concurrently, hedging mechanisms-such as dual sourcing agreements-have gained traction, allowing brands to pivot between production sites in response to policy shifts. Collectively, these adaptive strategies are redefining competitive advantage in an environment where tariff-induced disruptions have transitioned from episodic events to integral components of long-term operational planning.

Delving into Multifaceted Segmentation Drivers Illuminating Product, Channel, Demographic, Price Tier, and Age Based Preferences in Luxury Goods Consumption

A granular segmentation perspective reveals that product type differentiation remains a cornerstone for targeted growth strategies. Within the broad spectrum of apparel, beauty products, eyewear, footwear, fragrances, handbags, jewelry, and watches, handbags stand out for their dual subcategories of canvas and leather, demonstrating varied consumer appeal based on cost sensitivity and heritage perception. Likewise, the jewelry landscape bifurcates into fashion and fine jewelry, with each tier demanding distinct marketing narratives and craftsmanship benchmarks. Watches further exemplify this dichotomy, as mechanical timepieces cater to connoisseurs valuing horological expertise, while smart watches attract tech-savvy consumers seeking connectivity.

Transitioning from product to distribution, the interplay between offline and online channels continues to evolve. Brick-and-mortar experiences remain instrumental for tactile engagement, with brand outlets, department stores, duty-free venues, multi-brand stores, and specialty retailers serving as critical touchpoints. Conversely, the digital domain is expanding through brand websites, e-commerce marketplaces, and third-party platforms, where seamless omnichannel integration becomes a decisive factor. End-user segmentation further refines strategic prioritization, as women’s and men’s lines must address divergent aspirational drivers, while children’s offerings for boys and girls necessitate distinct design and safety considerations. Moreover, unisex products are gaining traction among younger demographics, signaling a shift toward gender-fluid branding.

Analyzing price tiers uncovers escalated consumer stratification across accessible, premium, and ultra-luxury brackets. Audience cohorts aged twenty-five to thirty-four display notable interest in accessible luxury, whereas the forty-five and above segment gravitates toward ultra-luxury, aligning with stable disposable incomes and preference for exclusivity. Integrating age group insights ensures that product development and communication strategies resonate authentically across generational divides, enabling brands to align offerings with evolving life-stage priorities and value perceptions.

This comprehensive research report categorizes the Luxury Good market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Distribution Channel

- End User

- Price Tier

- Age Group

Comparing Regional Nuances Across the Americas, Europe, Middle East, Africa, and Asia-Pacific to Surface Dynamic Growth Patterns and Consumer Behaviors

Regional nuances continue to shape the luxury market’s trajectory, with the Americas, Europe, Middle East & Africa, and Asia-Pacific each exhibiting distinct growth vectors and consumer behaviors. In the Americas, digital commerce penetration is converging with experiential retail, prompting brands to curate immersive in-store events that emphasize local cultural affinities. Evolving consumer expectations around social responsibility are driving heightened demand for brands that champion equity, environmental stewardship, and community engagement across North and Latin American markets.

Turning to Europe, the cradle of heritage luxury, established capitals such as Paris and Milan remain influential, yet market expansion increasingly depends on outreach to secondary cities where affluent demographics are burgeoning. In the Middle East & Africa region, younger populations are embracing high-end labels as symbols of modern identity, stimulating demand for culturally resonant collaborations and regional exclusives. Within the Asia-Pacific sphere, rapid wealth accumulation, especially in Greater China and Southeast Asia, underpins sustained growth. Localized digital ecosystems, powered by super apps and integrated payment solutions, are redefining shopping convenience, while cross-border e-commerce is facilitating access to aspirational brands. These divergent regional patterns underscore the imperative for geographically tailored strategies that address unique market dynamics, regulatory environments, and consumer sentiment.

This comprehensive research report examines key regions that drive the evolution of the Luxury Good market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Competitive Differentiators and Strategic Innovations Leveraged by Leading Luxury Goods Players to Secure Market Position and Drive Brand Equity

Leading players in the luxury goods sector are leveraging distinctive strategic approaches to enhance brand equity and operational resilience. Established conglomerates are prioritizing vertical integration and direct-to-consumer channel expansion to capture greater margin share and foster enduring customer loyalty. At the same time, nimble independent maisons are carving out niche positions by championing artisanal craftsmanship and heritage storytelling, effectively differentiating their portfolios in crowded brand landscapes.

Innovation is also manifesting through cross-industry collaborations. Brands are co-creating limited-edition collections with tech firms to launch smart-enabled accessories, while partnerships with sustainability pioneers have resulted in circular initiatives that recover and repurpose high-value materials. Beyond product innovation, companies are adopting advanced analytics and predictive modeling to anticipate shifts in consumer sentiment and optimize inventory allocation. Concurrently, robust talent acquisition strategies are being employed to attract next-generation designers and digital marketers, ensuring that corporate cultures remain adaptive and forward-looking. These varied methodologies illustrate how competitive differentiation in luxury requires a harmonious blend of tradition, innovation, and strategic foresight.

This comprehensive research report delivers an in-depth overview of the principal market players in the Luxury Good market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Burberry Group plc

- Capri Holdings Limited

- Chanel Limited

- Compagnie Financière Richemont SA

- Hermès International SCA

- Kering SA

- LVMH Moët Hennessy Louis Vuitton SE

- Prada S.p.A.

- The Estée Lauder Companies Inc

- The Swatch Group Ltd

Formulating Tactical Imperatives for Industry Leaders to Capitalize on Emerging Consumer Trends, Supply Chain Resilience, and Digital Transformation Opportunities

Industry leaders must embrace a series of targeted actions to capitalize on emergent opportunities and fortify their market standing. First, investing in seamless omnichannel platforms that unify digital and physical touchpoints is essential to meet the expectations of tech-savvy demographics and deliver consistent brand storytelling. In addition, cultivating resilient and traceable supply chains through blockchain integration and nearshoring partnerships will mitigate tariff-induced disruptions and reinforce sustainability commitments.

Moreover, brands should tailor their product portfolios to align with shifting price tier preferences, offering accessible luxury editions to engage younger consumers without diluting premium or ultra-luxury positions. Engaging end users through immersive experiences-such as virtual try-ons and personalized concierge services-can enhance emotional resonance and foster brand advocacy. Leaders are also encouraged to deepen regional penetration by collaborating with local influencers and leveraging market-specific consumer data to craft culturally relevant campaigns. Finally, nurturing cross-sector alliances in technology and circular economy domains will catalyze innovation and future-proof product development pipelines. By operationalizing these recommendations, companies will be well-equipped to navigate complexity and accelerate sustainable growth.

Outlining the Rigorous Multi-Method Research Framework, Data Triangulation Processes, and Expert Validation Techniques Underpinning the Luxury Goods Market Analysis

The underpinning analysis is grounded in a comprehensive, multi-method research framework designed to ensure robustness, reliability, and relevance. Primary data collection involved in-depth interviews with senior executives across diverse luxury segments, capturing firsthand perspectives on strategic priorities, operational challenges, and consumer expectations. This qualitative input was complemented by a quantitative survey administered to a stratified sample of luxury consumers, facilitating granular insights into purchase drivers, brand perceptions, and price sensitivity.

Secondary research reinforced these findings through rigorous examination of industry reports, financial disclosures, trade data, and regulatory filings. Data triangulation processes were employed to cross-validate information from disparate sources, enhancing the accuracy of conclusions. In addition, expert validation sessions with sector specialists served to refine interpretative frameworks and contextualize emerging trends. Finally, advanced statistical analyses and scenario modeling methodologies were leveraged to elucidate potential market trajectories and stress-test strategic assumptions. This integrated approach ensures that the insights delivered are not only empirically sound but also actionable for decision-makers seeking to thrive in the evolving luxury landscape.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Luxury Good market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Luxury Good Market, by Product Type

- Luxury Good Market, by Distribution Channel

- Luxury Good Market, by End User

- Luxury Good Market, by Price Tier

- Luxury Good Market, by Age Group

- Luxury Good Market, by Region

- Luxury Good Market, by Group

- Luxury Good Market, by Country

- United States Luxury Good Market

- China Luxury Good Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1908 ]

Synthesizing Core Findings to Illuminate Strategic Imperatives and Future Trajectories Shaping the Evolution of the Global Luxury Goods Market Landscape

The synthesis of this research underscores a pivotal reality: the luxury goods industry is in the midst of profound transformation, driven by technological adoption, consumer value realignment, and regulatory shifts. Brands that adeptly integrate digital capabilities with authentic brand heritage stand to capture disproportionate value, while those that neglect sustainability commitments risk reputational and operational vulnerabilities. Furthermore, the evolving tariff environment in the United States mandates proactive supply chain reconfiguration and strategic sourcing recalibrations to preserve profit margins and uphold quality benchmarks.

In navigating this complex terrain, segmentation insights illuminate the critical importance of tailoring product assortments, channel strategies, and marketing narratives to distinct consumer cohorts defined by age, price preference, and demographic profiles. Regional analyses reinforce the need for localized approaches that resonate with unique cultural and economic contexts across the Americas, Europe, Middle East & Africa, and Asia-Pacific. Ultimately, the convergence of these findings crystallizes into a set of strategic imperatives: embrace digital-physical integration, fortify supply chain resilience, and foster innovation through cross-sector collaboration. By internalizing these imperatives, industry participants will be ideally positioned to unlock new frontiers of growth and sustain competitive advantage.

Connecting You with Expert Guidance and Bespoke Insights through a Direct Engagement Opportunity with Ketan Rohom to Acquire the Comprehensive Market Research Report

To gain a competitive advantage and access a bespoke suite of insights, readers are invited to engage directly with Ketan Rohom, Associate Director of Sales & Marketing. He stands ready to guide you through the extensive depth and actionable granularity of this report. By reaching out to Ketan, you will unlock detailed briefings that align with your strategic priorities and organizational objectives. This personalized consultation will highlight key takeaways most relevant to your business, elucidate nuanced market dynamics, and pinpoint untapped growth opportunities within the luxury goods arena.

Securing the full report ensures your team will benefit from an unparalleled level of analysis, including proprietary segmentation insights, comprehensive tariff impact assessments, and forward-looking regional evaluations. Ketan’s expertise will facilitate seamless access to tailored recommendations, enabling rapid integration of findings into your strategic planning process. Whether you are looking to refine product portfolios, optimize distribution channels, or fortify supply chain resilience, this partnership will equip you with the tools necessary to make confident, data-driven decisions.

Don’t let critical market intelligence remain out of reach. Establish collaboration with Ketan Rohom to purchase the definitive luxury goods market research report and position your organization to excel amid evolving consumer preferences and regulatory landscapes.

- How big is the Luxury Good Market?

- What is the Luxury Good Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?