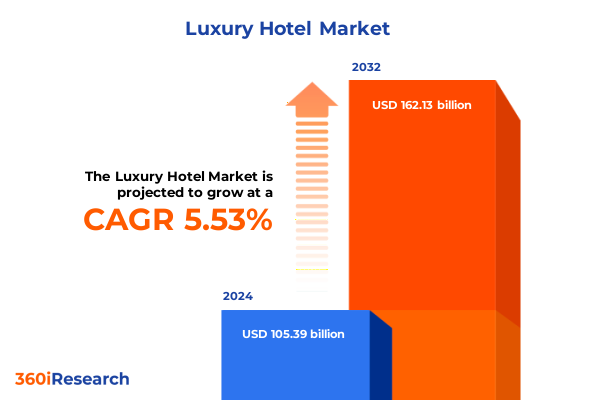

The Luxury Hotel Market size was estimated at USD 111.24 billion in 2025 and expected to reach USD 116.86 billion in 2026, at a CAGR of 5.52% to reach USD 162.13 billion by 2032.

Discovering the Foundation of Modern Luxury Hospitality and Its Pivotal Role in Shaping Discerning Guest Experiences in a Rapidly Evolving Market

The luxury hotel industry stands at a crossroads where timeless elegance meets modern innovation, setting the stage for a transformative chapter in guest experiences. As travelers increasingly seek bespoke offerings that marry personalized comfort with digital convenience, understanding the foundational drivers of this sector becomes essential. This report opens with a concise overview that contextualizes the evolution of luxury hospitality, tracing its roots from grand palaces of the past to today’s experience-driven portfolios that cater to a broad spectrum of high-net-worth individuals.

Against a backdrop of accelerating globalization and shifting consumer values, this introduction outlines the core objectives of the executive summary and the broader market research study. It highlights how luxury hotel operators are redefining service excellence through the integration of cutting-edge technologies, sustainability practices, and curated cultural immersion. By framing these pivotal trends from the outset, stakeholders can appreciate the complexity of today’s competitive landscape and the critical importance of strategic agility. This opening section seamlessly transitions into deeper analysis in subsequent chapters, ensuring readers are equipped with the contextual clarity needed to navigate the insights that follow

Unearthing the Major Shifts Reshaping Luxury Hospitality and How Technological Innovations Intersect with Sustainability to Create a New Guest Paradigm

The luxury hotel landscape is undergoing a profound metamorphosis driven by the convergence of technology, sustainability imperatives, and the experiential economy. What was once a business model focused predominantly on opulent physical assets now places equal emphasis on digital ecosystems and eco-conscious operations. Artificial intelligence and the Internet of Things have revolutionized how properties anticipate guest preferences, from predictive room customization to automated climate and lighting adjustments that cater to individual comfort profiles.

Furthermore, sustainability has moved beyond a niche endeavor to become a core strategic objective. Leading operators are adopting green building standards, implementing comprehensive waste reduction programs, and sourcing locally to minimize carbon footprints while enhancing community engagement. Equally significant is the rise of experiential offerings, where wellness retreats, culinary journeys, and cultural immersion packages are packaged alongside traditional accommodation to captivate today’s experience-hungry travelers. By recognizing these transformative shifts, industry leaders can align their capital investments and operational strategies to meet elevated guest expectations while driving sustainable growth

Evaluating the Comprehensive Economic Consequences of Recent United States Tariffs on Luxury Hotel Operations Supply Chains and Pricing Structures

In 2025, the imposition of United States tariffs on a range of imported goods-including premium construction materials, furniture, and high-end fixtures-has introduced a layer of complexity to capital expenditure plans and supply chain networks within the luxury hotel industry. As renovation cycles accelerate to refresh property portfolios, sourcing costs have surged, prompting operators to reassess procurement strategies and inventory buffers. Consequently, many hotel groups have engaged in proactive contract renegotiations with domestic suppliers to mitigate margin pressures without compromising on design excellence.

Moreover, the ripple effects of these tariffs extend to guest pricing structures, compelling revenue management teams to balance rate adjustments against the need to maintain competitive positioning. To preserve value perception, select operators have absorbed a portion of the incremental costs while exploring alternative product specifications that offer comparable quality at more favorable price points. This recalibration illustrates the sector’s resilience and capacity for adaptive supply chain management, underscoring the importance of strategic sourcing and flexible vendor relationships in navigating evolving trade policy environments

Interpreting the Diverse Booking Channels Customer Profiles and Stay Preferences That Define Segmentation Strategies in the Luxury Hotel Industry Today

The granular analysis of booking channels reveals that corporate agreements secured through direct contracts and travel management companies continue to anchor occupancy rates, while self-service platforms like hotel websites, mobile applications, and call center interfaces are capturing an ever-growing share of independent reservations. Simultaneously, the role of online travel agencies remains significant, although margin pressures drive hoteliers to incentivize direct engagement. Travel agents, both consortium-affiliated and independent, sustain niche demand by leveraging personalized advisory services, whereas seasoned wholesalers orchestrate group bookings that smooth seasonal volatility.

Turning to customer profiles, the resurgence of business travel has bolstered weekday yields, with government and group travel segments reemerging steadily as organized events resume at scale. Leisure guests, in pursuit of restorative and exploratory experiences, now demand seamless integrations of wellness and culinary authenticity. Room type preferences spotlight a burgeoning appetite for premium deluxe configurations alongside superior deluxe categories, even as standard king and twin accommodations maintain baseline volume. The suite segment, particularly executive and junior suites, is evidencing the fastest growth, driven by affluent travelers seeking expansive living spaces and bespoke service tiers.

A closer look at pricing tiers shows that upper upscale properties continue to secure broad appeal, while ultra-luxury brands differentiate through exclusive amenities and hyper-personalized programming. Extended-stay offerings, propelled by remote work flexibility, complement traditional short-stay packages and mid-length reservations tailored to leisure itineraries. Guest meal plan selections illustrate a consistent predilection for bed and breakfast and full board arrangements, with room-only and half-board options favored by culinary-savvy travelers seeking local exploration. These segmentation insights underscore the necessity for operators to curate multi-dimensional portfolios that resonate across diverse booking, guest, and product categories

This comprehensive research report categorizes the Luxury Hotel market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Booking Channel

- Customer Type

- Room Category

- Price Tier

- Stay Duration

- Meal Plan

Mapping the Distinct Opportunities and Challenges Across Americas Europe Middle East Africa and Asia Pacific in the High End Hotel Sector Landscape

Within the Americas, North America remains the epicenter of luxury hospitality demand, characterized by urban oasis properties in gateway cities and resort destinations in coastal and wilderness settings. This region’s guests exhibit a strong preference for technology-enabled convenience and curated cultural engagements, prompting operators to invest in partnerships with local artisans and experience curators. Cross-border travel from Latin American markets has also intensified, catalyzing the expansion of branded residences and bespoke tour partnerships that enrich guest itineraries.

In Europe, the Middle East, and Africa, heritage properties in historic capitals and ultra-modern urban developments coexist with world-class resorts situated in sun-soaked coastal enclaves and desert landscapes. Europe’s deep cultural legacy fuels demand for heritage restoration projects and boutique luxury experiences, while the Gulf region’s sovereign wealth-backed investments continue to drive portfolio expansion. Meanwhile, Africa’s burgeoning safari lodges and eco-resorts are capturing international attention as sustainable tourism intersects with high-end service models.

The Asia-Pacific region stands out as the fastest-growing market, underpinned by rising domestic wealth and a revitalized outbound travel appetite. Established players are accelerating their footprint in key hubs, from Greater China to Southeast Asia, while bespoke brands from Australia and Japan leverage wellness and design-centric philosophies to differentiate. Across all regions, operators are leveraging localized partnerships and adaptive service models to address distinct tourism drivers, ensuring that each market’s unique cultural and economic context informs property strategies

This comprehensive research report examines key regions that drive the evolution of the Luxury Hotel market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Prestigious Hotel Leaders and Their Strategic Growth Initiatives That Drive Differentiation and Competitive Advantage in the Global Luxury Accommodation Market

Global luxury hotel brands continue to vie for market leadership through strategic expansions, brand innovations, and operational refinements. Major players like Marriott International with its Ritz-Carlton and St. Regis portfolios are prioritizing experiential differentiation and loyalty ecosystem enhancements. Hilton’s Waldorf Astoria and Conrad labels are focusing on asset-light growth and co-development partnerships to accelerate global footprint without excessive capital outlays. Meanwhile, Hyatt’s Park Hyatt and Andaz brands are building on design-forward concepts and cultivating bespoke local collaborations to deepen guest engagement.

European conglomerates such as Accor, with Raffles and Sofitel offshoots, and InterContinental Hotels Group, stewarding InterContinental and Six Senses, are doubling down on sustainability credentials and wellness integrations. Independent luxury operators like Four Seasons, Mandarin Oriental, and Aman continue to set benchmarks for personalized service and intimate, culturally resonant experiences. Each organization’s strategic playbook emphasizes a blend of targeted brand portfolio management, digital transformation roadmaps, and environmental social governance commitments to maintain competitive differentiation and future-proof their business models

This comprehensive research report delivers an in-depth overview of the principal market players in the Luxury Hotel market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Accor S.A.

- Aman Resorts

- Auberge Resorts Collection

- Belmond Ltd.

- Bvlgari Hotels & Resorts

- Capella Hotel Group

- Dorchester Collection

- Fairmont Hotels & Resorts

- Four Seasons Holdings Inc.

- Hilton Worldwide Holdings Inc.

- Hyatt Hotels Corporation

- InterContinental Hotels Group PLC

- Kerzner International Holdings Ltd.

- Mandarin Oriental Hotel Group

- Marriott International Inc.

- Park Hyatt

- Raffles Hotels & Resorts

- Rosewood Hotel Group

- Six Senses Hotels Resorts Spas

- St. Regis Hotels & Resorts

- The Leading Hotels of the World Ltd.

- The Ritz-Carlton Hotel Company LLC

- Waldorf Astoria Hotels & Resorts

Crafting Forward Looking Strategic Recommendations to Empower Luxury Hotel Leaders to Innovate Elevate Guest Loyalty and Optimize Operational Resilience

Industry leaders are encouraged to accelerate investments in AI-driven personalization platforms that anticipate guest preferences and deliver hyper-tailored experiences at scale. Embracing blockchain and secure digital identity solutions can further enhance guest privacy while streamlining check-in protocols. To fortify supply chains against tariff-related disruptions, forging strategic alliances with regional vendors and exploring alternative material innovations will be critical.

Moreover, sustainability should be elevated from a compliance checkbox to a brand-defining pillar, encompassing renewable energy deployment, zero-waste initiatives, and transparent reporting frameworks. Operators must also refine segmentation-based offerings, bundling unique local experiences with tailored room categories and flexible meal plan options to capture incremental revenue. Strengthening loyalty programs through experiential rewards and tiered access to exclusive events will drive repeat visitation, while pursuing opportunistic expansion in high-growth Asia-Pacific and select urban markets in the Americas and EMEA will unlock long-term portfolio value

Detailing the Rigorous Research Methodology Data Sources and Analytical Frameworks That Underpin the Credibility of Insights in This Luxury Hotel Market Study

This study synthesizes insights from a mixed-methods research framework combining primary and secondary data. Proprietary interviews with senior executives across luxury hotel chains and specialized suppliers provided qualitative depth, while quantitative guest surveys and booking analytics furnished robust validation of consumer preferences. Secondary research encompassed an extensive review of industry publications, sustainability reports, financial statements, and publicly available trade data to ensure contextual accuracy.

Analytical rigor was maintained through triangulation techniques, cross-referencing multiple data sources to confirm consistency and identify emerging patterns. Segmentation models were developed using cluster analysis of booking and demographic variables, while regional assessments integrated macroeconomic indicators and tourism statistics. The methodological approach ensures that findings are both empirically grounded and strategically relevant, offering a transparent pathway from data collection to actionable market insights

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Luxury Hotel market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Luxury Hotel Market, by Booking Channel

- Luxury Hotel Market, by Customer Type

- Luxury Hotel Market, by Room Category

- Luxury Hotel Market, by Price Tier

- Luxury Hotel Market, by Stay Duration

- Luxury Hotel Market, by Meal Plan

- Luxury Hotel Market, by Region

- Luxury Hotel Market, by Group

- Luxury Hotel Market, by Country

- United States Luxury Hotel Market

- China Luxury Hotel Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 2067 ]

Concluding Insights on the Future Trajectory of the Luxury Hotel Industry Emphasizing Key Imperatives for Stakeholders to Navigate Emerging Opportunities

The evolving contours of the luxury hotel industry underscore a compelling interplay between technology, sustainability, and personalized service. As operators navigate tariff-induced supply chain shifts and intensifying competitive dynamics, the imperative to deliver differentiated experiences has never been more pronounced. Strategic segmentation across booking channels, guest types, room categories, and price tiers reveals untapped opportunities to enhance profitability and foster brand loyalty.

Regional trajectories in the Americas, EMEA, and Asia-Pacific illustrate that localized strategies, cultural authenticity, and agile partnerships will define success in the coming years. Leading companies have demonstrated that a balanced approach-blending asset-light expansion, digital innovation, and ESG leadership-serves as the optimal formula for enduring market relevance. By embracing the recommendations outlined in this executive summary, stakeholders are equipped to seize emerging opportunities, mitigate risks, and chart a progressive course for luxury hospitality in the decade ahead

Engage with Our Associate Director of Sales and Marketing for Exclusive Access to the Definitive Luxury Hotel Market Research Report Empowering Your Strategic Decisions

Embarking on a partnership with Ketan Rohom, whose depth of expertise and strategic insight has propelled numerous luxury hotel portfolios to unprecedented success, offers you a gateway to unparalleled intelligence and actionable recommendations. By connecting directly with the Associate Director of Sales and Marketing at our firm, you gain privileged access to the comprehensive market research report that synthesizes global trends, segmentation nuances, regional dynamics, and company strategies into a cohesive blueprint for growth. This opportunity allows your leadership team to harness data-driven guidance tailored to the unique challenges and opportunities of the luxury hospitality segment, ensuring every investment and initiative aligns with the expectations of today’s most discerning travelers. Reach out now to secure the insights that will inform your strategic roadmap, empower your decision-making, and position your organization at the forefront of the luxury hotel industry’s next chapter

- How big is the Luxury Hotel Market?

- What is the Luxury Hotel Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?