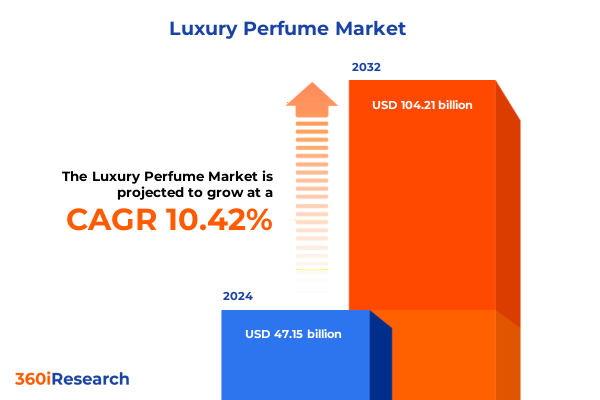

The Luxury Perfume Market size was estimated at USD 52.13 billion in 2025 and expected to reach USD 57.28 billion in 2026, at a CAGR of 10.40% to reach USD 104.21 billion by 2032.

Embarking on an Elevated Journey into the World of Luxury Perfumes Illuminating Trends Influencing Contemporary Fragrance Excellence

The luxury perfume market stands as a testament to the artistry and craftsmanship that define high-end fragrance creation. In recent years, the convergence of heritage brands and innovative newcomers has sparked a renaissance in scent development, prompting a profound shift in how consumers perceive and engage with premium fragrances. As this report unfolds, readers will embark on a journey through the sensorial and strategic dimensions of the luxury perfume domain, uncovering the pivotal factors that shape brand prestige and consumer loyalty.

With rising demand for unique olfactory narratives and sophisticated ingredient sourcing, industry players are reimagining traditional practices to deliver immersive experiences. Additionally, digital advancements have elevated the consumer journey, enabling personalized scent discovery through virtual try-on tools and data-driven recommendations. Together, these trends illustrate an industry at the crossroads of time-honored elegance and forward-looking innovation, setting the stage for a comprehensive exploration of market dynamics and actionable insights.

Unveiling the Transformative Forces Reshaping the Luxury Fragrance Domain Embracing Innovation and Consumer-Centric Evolution

Over the past several years, the luxury fragrance sector has experienced transformative forces that extend beyond conventional marketing strategies. One of the most consequential shifts involves the integration of sustainability into every stage of product development. From ethically sourced natural essences to biodegradable packaging materials, brands are redefining what it means to be ‘green’ without compromising on olfactory opulence. Consequently, eco-conscious consumers now evaluate luxury scents through a dual lens of sensory pleasure and environmental stewardship.

Moreover, the rise of immersive retail environments is reshaping the consumer-brand relationship. Flagship boutiques are adopting multisensory installations, where patrons engage with scent libraries, bespoke fragrance blending stations, and interactive storytelling exhibits. This emphasis on experiential retail not only strengthens brand heritage but also cultivates emotional connections that transcend transactional exchanges. In parallel, influencer collaborations and limited-edition releases have heightened exclusivity, prompting collectors and enthusiasts to seek out rare perfume drops via digital channels.

Furthermore, the proliferation of direct-to-consumer models has empowered niche houses to compete with legacy players. By harnessing first-party data, these emerging brands can tailor marketing messages and product launches with unprecedented precision. As a result, consumers benefit from hyper-personalized fragrance recommendations, while brands gain deeper insights into evolving preferences. Ultimately, these transformative shifts illustrate an industry in motion, where innovation and tradition coalesce to redefine the meaning of luxury.

Assessing the Far-Reaching Repercussions of 2025 United States Tariff Policies on the Luxury Perfume Industry’s Cost Structures and Supply Chains

The imposition of new tariff measures in 2025 has introduced a complex layer of cost considerations for stakeholders across the luxury perfume supply chain. Notably, import duties on high-purity botanical extracts and niche aroma chemicals have elevated procurement expenses for manufacturers reliant on European and Middle Eastern suppliers. Consequently, sourcing strategies have pivoted toward blended procurement models, balancing premium raw materials with domestically produced synthetics to mitigate overall cost pressures.

In addition to direct material cost implications, logistics and distribution expenses have experienced upward momentum. Heightened customs scrutiny and administrative compliance requirements have extended lead times, compelling brands to reevaluate inventory management frameworks. As a result, many luxury fragrance houses are adopting agile sourcing networks, incorporating regional manufacturing facilities and localized ingredient partnerships to preserve production continuity.

However, these tariff-induced challenges have also spurred innovation. Ingredient suppliers and perfumers are investing in green chemistry techniques to develop novel aroma compounds that deliver comparable sensory attributes at reduced tariff liabilities. Moreover, collaborative alliances between fragrance houses and specialty ingredient producers are crystallizing, fostering co-development initiatives that spread cost burdens while accelerating time-to-market. In this evolving landscape, the cumulative impact of tariff policies underscores the critical importance of strategic flexibility and resilient supply chain design.

Decoding Consumer Preferences through Comprehensive Segmentation Analysis across Product Types Fragrance Families Ingredients Origins and Distribution Channels

Decoding consumer sentiment in the luxury fragrance arena demands a nuanced segmentation lens that captures the diverse palettes and purchasing behaviors of discerning clientele. By examining product type distinctions such as Eau De Cologne, Eau De Parfum, Eau De Toilette, and Eau Fraîche, brands can tailor concentration levels and olfactive intensity to meet specific usage occasions. Similarly, exploring fragrance families reveals deeper affinity trends: Floral compositions such as Jasmine, Lily, Orange Blossom, and Rose resonate in celebration and gift-giving contexts, while Fresh notes like Bergamot, Lemon, Mint, and Sea Breeze appeal to lifestyle-driven wearers seeking vibrancy and ease.

Transitioning to deeper aromatic territories, Oriental blends composed of Amber, Musk, Spices, and Vanilla convey opulence and warmth, particularly in evening wear, with Woody scents encompassing Cedarwood, Patchouli, Sandalwood, and Vetiver offering grounding, contemplative experiences. Additionally, the dichotomy between Natural and Synthetic ingredient origins informs storytelling and brand positioning strategies. Consumers increasingly align with narratives of traceable botanicals, yet many appreciate the creative possibilities unlocked by custom molecule development.

Equally important is the understanding of target audience segments-Men, Women, and Unisex-each reflecting distinct fragrance preferences and testing behaviors. Distribution channel segmentation further refines market engagement: Offline environments like brand stores, duty free shops, and hypermarkets/supermarkets serve as tactile discovery grounds, whereas online touchpoints via brand websites and eCommerce platforms deliver convenience and data-driven personalization. Together, these layered segmentation insights equip industry leaders to craft differentiated offerings and outreach strategies that resonate at every stage of the consumer journey.

This comprehensive research report categorizes the Luxury Perfume market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Fragrance Family

- Ingredients Origin

- Target Audience

- Distribution Channel

Exploring Regional Nuances Driving Divergent Luxury Perfume Demand Patterns across the Americas Europe Middle East Africa and Asia Pacific Markets

Regional dimensioning of the luxury fragrance market highlights the significance of localized consumer sensibilities and economic dynamics. In the Americas, a mature market landscape fueled by heritage luxury brands coexists with a growing appetite for artisanal and indie perfume labels. Consumers in this region place high value on brand legacy and prestige, yet remain open to novel scent narratives that align with contemporary wellness and self-expression movements.

Turning toward Europe, the Middle East, and Africa, cultural heritage profoundly influences fragrance preferences, with Oriental and Woody compositions commanding a strong presence. Luxury perfumery here often intertwines with ceremonial customs and regional scent rituals, thereby elevating demand for exclusive, bespoke creations. Additionally, duty free retail channels in key travel hubs stimulate cross-border purchases, reinforcing the region’s pivotal role in global fragrance tourism.

Meanwhile, the Asia-Pacific region presents an expanding frontier characterized by rising affluence and evolving consumer tastes. Traditional preferences for fresh and floral compositions are converging with a newfound fascination for complex, niche fragrances. Urbanization and digital connectivity further accelerate market access, enabling both global luxury houses and local brands to harness eCommerce platforms and social media engagement strategies. Collectively, these regional insights illustrate the imperative for adaptive brand narratives and distribution frameworks that account for cultural nuances and emerging consumption drivers.

This comprehensive research report examines key regions that drive the evolution of the Luxury Perfume market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Revealing Strategic Insights from Leading Luxury Perfume Companies Showcasing Innovation Differentiation and Competitive Positioning in the Global Marketplace

Leading luxury perfume companies are navigating the evolving landscape through multi-faceted strategic playbooks that emphasize brand heritage, innovation, and consumer intimacy. Iconic fashion and beauty houses continue to leverage legacy storytelling, releasing limited-edition collections that celebrate anniversaries, artistic collaborations, and cultural milestones. Simultaneously, these brands are deepening investment in research and development to pioneer next-generation fragrance technologies, such as encapsulated scent delivery systems and mood-responsive olfactory experiences.

At the same time, niche and indie fragrance houses are capitalizing on direct engagement models, cultivating dedicated communities via social media platforms and pop-up atelier experiences. These challengers often emphasize transparency in ingredient sourcing and artisanal production techniques, appealing to consumers seeking authenticity and exclusivity. Moreover, strategic partnerships with high-end retailers and lifestyle brands amplify their visibility in target demographics.

On the operational front, major players are optimizing omnichannel integration to blend in-store luxury experiences with seamless digital discovery journeys. By deploying data analytics and AI-driven recommendation engines, they personalize product suggestions and loyalty incentives, thereby enhancing consumer lifetime value. Additionally, procurement alliances with sustainable growers and biotech labs underscore a commitment to ethical sourcing. Collectively, these company-level insights reveal a balanced emphasis on preserving brand prestige while embracing agile, consumer-centric strategies.

This comprehensive research report delivers an in-depth overview of the principal market players in the Luxury Perfume market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Burberry Group PLC

- Calvin Klein Inc. by PVH Corp.

- Chanel Limited

- Clive Christian Perfume Limited

- Compagnie Financière Richemont SA

- Creed Fragrances by Kering S.A.

- Diptyque SAS

- Dolce & Gabbana S.R.L.

- FLORIS LONDON

- Gianni Versace S.r.l. by Capri Holdings Limited

- Giorgio Armani S.p.A.

- Hermès International S.A

- ITC Limited

- Krigler

- L&L Luxury Company Ltd.

- L'Oréal S.A.

- LVMH Moët Hennessy Louis Vuitton

- Maison Des Parfums

- Prada S.p.A.

- PUIG, S.L.

- Roja Parfums Holdings Limited

- Shiseido Company Limited

- The Estée Lauder Companies Inc.

Driving Strategic Growth through Actionable Recommendations Empowering Luxury Perfume Industry Leaders to Capitalize on Emerging Market Dynamics and Desires

Industry leaders seeking to thrive amid dynamic market currents should first prioritize end-to-end digital transformation initiatives. Establishing interactive virtual fragrance consultations and AI-powered scent discovery tools can elevate personalization efforts, strengthening emotional engagement and brand loyalty. In parallel, integrating blockchain or similar traceability solutions for ingredient provenance will reinforce transparency commitments, satisfying the growing cohort of ethically minded consumers.

Moreover, strategic collaborations between perfumers and biotechnology firms present an opportunity to co-create novel aroma molecules with lower environmental footprints. By investing in sustainable chemistry alongside traditional extraction methods, brands can balance olfactory excellence with regulatory compliance and tariff deflection strategies. Meanwhile, experiential retail should remain central to brand differentiation. Curating multi-sensory pop-up events, immersive flagship store concepts, and exclusive scent workshops will forge deeper narrative connections and stimulate word-of-mouth advocacy.

Finally, industry stakeholders must refine omnichannel distribution frameworks, ensuring that brand websites, eCommerce marketplaces, and physical retail spaces function as seamless touchpoints. Employing advanced analytics to monitor consumer behavior across channels will enable more effective inventory allocation and targeted marketing campaigns. By executing these actionable recommendations, luxury perfume organizations can navigate cost pressures, capitalize on emerging trends, and reinforce long-term resilience.

Outlining a Rigorous Research Methodology Incorporating Primary Interviews Secondary Data Sources and Analytical Frameworks for In-Depth Market Insights

The foundation of this analysis rests on a meticulously structured research methodology that combines qualitative depth with quantitative breadth. Primary research involved in-depth interviews with a cross-section of stakeholders, including perfumers, ingredient suppliers, brand executives, and retail specialists. These conversations provided firsthand perspectives on evolving consumer demands, supply chain complexities, and innovation trajectories.

Complementing these insights, secondary data collection spanned a comprehensive review of industry publications, trade journals, and regulatory filings. This phase ensured a robust contextual understanding of tariff policy developments, sustainability initiatives, and technological advancements shaping the fragrance sector. Furthermore, distribution channel assessments evaluated the performance and consumer engagement strategies of leading eCommerce platforms and luxury retail networks.

Advanced analytical frameworks were then applied to synthesize findings, including SWOT and PESTEL analyses, to delineate strategic imperatives and potential risk factors. Segmentation mapping techniques translated nuanced consumer preferences into actionable category insights. Throughout the research process, data triangulation ensured consistency across multiple sources, while expert validation rounds confirmed the accuracy and relevance of conclusions. This rigorous approach underpins the credibility and strategic utility of the report’s insights.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Luxury Perfume market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Luxury Perfume Market, by Product Type

- Luxury Perfume Market, by Fragrance Family

- Luxury Perfume Market, by Ingredients Origin

- Luxury Perfume Market, by Target Audience

- Luxury Perfume Market, by Distribution Channel

- Luxury Perfume Market, by Region

- Luxury Perfume Market, by Group

- Luxury Perfume Market, by Country

- United States Luxury Perfume Market

- China Luxury Perfume Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1908 ]

Concluding Reflections on the Multifaceted Dynamics Shaping the Luxury Perfume Landscape and Their Strategic Implications for Industry Stakeholders

In conclusion, the luxury perfume market is characterized by a dynamic interplay of heritage craftsmanship and forward-looking innovation. As sustainability, personalization, and digital engagement continue to redefine consumer expectations, brands must remain agile in their strategic responses. The cumulative effects of tariff policies, coupled with regional demand disparities and complex segmentation patterns, underscore the need for adaptive operational and marketing frameworks.

Moreover, the competitive landscape-populated by legacy luxury houses and nimble indie challengers-demands a balanced emphasis on brand prestige, product differentiation, and consumer intimacy. Companies that successfully integrate cutting-edge R&D, experiential retail, and omnichannel connectivity will be best positioned to harness emerging opportunities. Ultimately, stakeholders who leverage the insights presented herein can anticipate more informed decision-making, strengthened market positioning, and enhanced capacity to navigate the evolving contours of the luxury fragrance domain.

Seize the Opportunity to Access Authoritative Luxury Perfume Market Intelligence by Engaging with Ketan Rohom Associate Director Sales and Marketing

By collaborating directly with Ketan Rohom, Associate Director of Sales and Marketing, you can unlock unparalleled access to the comprehensive luxury perfume market research report. This in-depth analysis is meticulously crafted to empower decision-makers with actionable intelligence on consumer behavior nuances, disruptive industry trends, and competitive positioning strategies. Engaging with Ketan Rohom ensures that your organization gains a tailored overview of emerging opportunities and potential challenges across global markets.

Through a personalized consultation, you will receive exclusive insights into segmentation breakdowns, regional demand drivers, and the transformative shifts redefining the luxury fragrance landscape. Moreover, Ketan’s expertise in guiding stakeholders through strategic implementation offers you a roadmap for optimizing product portfolios, enhancing brand experiences, and strengthening distribution channels. Don’t miss this chance to leverage authoritative market intelligence and secure a competitive edge in the evolving world of luxury perfumery.

- How big is the Luxury Perfume Market?

- What is the Luxury Perfume Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?