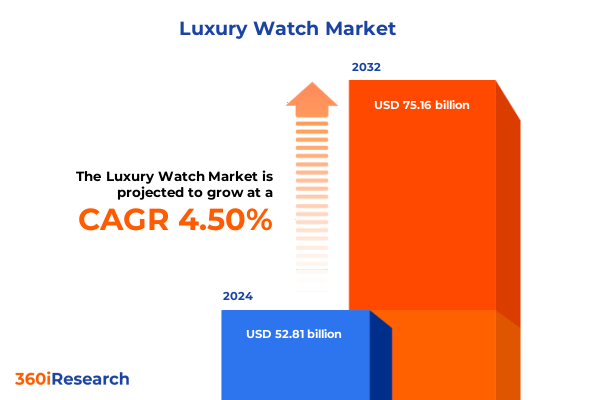

The Luxury Watch Market size was estimated at USD 45.97 billion in 2025 and expected to reach USD 47.97 billion in 2026, at a CAGR of 4.42% to reach USD 62.25 billion by 2032.

Establishing the Foundations of Enduring Excellence as Masterful Craftsmanship and Elevated Consumer Expectations Converge in the Dynamic Luxury Watch Landscape

The luxury watch industry has long stood as a testament to human ingenuity, blending meticulous craftsmanship with intricate mechanical technologies. At its core, this market thrives on the pursuit of horological perfection, where premium price points reflect not only status symbols but also the enduring legacy of master artisans. Recent market dynamics have been shaped by several converging factors, including the substantial surge in precious metal prices, which climbed by nearly 40% year over year, prompting leading brands to explore alternative materials to preserve margins. Such price volatility has underscored the tension between maintaining exclusivity and ensuring accessibility for discerning customers ©citeturn0news11

Simultaneously, digital engagement has emerged as a pivotal battleground for brand differentiation. The proliferation of online channels-ranging from brand-operated e-commerce platforms to specialized third-party marketplaces-has elevated consumer expectations for seamless, omnichannel experiences. As a parallel development, the pre-owned segment has gained remarkable traction, with proven growth in certified pre-owned offerings doubling consumer interest since 2020 and redefining traditional distribution models through enhanced authentication standards and trade-in programs ©citeturn0search0. This environment demands an integrated approach that harmonizes heritage craftsmanship with forward-looking innovations, setting the stage for a deeper exploration of transformative industry shifts.

Embracing Digital Disruption and Consumer Empowerment as Core Drivers Transforming the Dynamics of the Luxury Watch Market

The luxury watch sector is experiencing a profound pivot driven by digital transformation and evolving consumer behaviors. Brands are investing in advanced e-commerce infrastructures, leveraging virtual showrooms, augmented reality try-on features, and personalized digital experiences to replicate the intimacy of in-store interactions online. Such initiatives cater to a growing cohort of tech-savvy enthusiasts who value both convenience and high-touch service, effectively blurring the line between digital and physical retail ©citeturn0news12

Another defining shift centers on the integration of sustainability principles into product development and brand narratives. In response to rising environmental consciousness, manufacturers are increasing the use of recycled metals, responsibly sourced components, and eco-friendly packaging. This commitment to environmental stewardship resonates strongly with younger demographics who view luxury purchases through the lens of ethical consumption. Concurrently, the horological community has championed alternative materials such as ceramic, stainless steel alloys, and titanium to reduce reliance on volatile precious metal markets while offering novel aesthetic propositions ©citeturn0news11

Finally, the certified pre-owned market has evolved from a peripheral channel to a strategic complement of primary sales. By implementing rigorous authentication protocols and factory-backed servicing, major houses have fortified consumer trust and unlocked a pipeline of trade-in inventory. This bidirectional flow between new and pre-owned ecosystems is reshaping value perceptions, creating entry points for aspirational collectors, and extending brand loyalty across extended customer lifecycles.

Analyzing the Cumulative Consequences of U.S. Trade Tariffs on Swiss Timepieces and Their Strategic Ripple Effects Through 2025

The cumulative imposition of U.S. tariffs on Swiss watch imports, which escalated to approximately 31% by mid-2025, has exerted significant pressure on both pricing strategies and distribution channels. Luxury watchmakers have been compelled to absorb or partially offset these additional costs to preserve client loyalty, resulting in narrower margins and recalibrated retail pricing frameworks. While iconic brands have leveraged inelastic demand for blue-chip models to pass on marginal increases, many mid-tier players have opted for a shared-cost approach with authorized retailers to maintain competitiveness ©citeturn0news12

Tariff-related price adjustments have directly influenced consumer behavior, driving a measurable uptick in pre-owned purchases. Buyers seeking value propositions have increasingly gravitated toward secondary marketplaces where the impact of import duties is attenuated by prior ownership. This trend has contributed to a relative stabilization of resale valuations, evidenced by only modest quarter-over-quarter declines in 2025, the lowest since early 2022 ©citeturn0news12

In response to sustained tariff pressures, Swiss exporters have accelerated pre-tariff shipment strategies and diversified production footprints across alternative jurisdictions. Concurrently, industry associations and brand coalitions are intensifying advocacy efforts with U.S. trade authorities to negotiate exemptions or preferential treatments. These strategic maneuvers aim to mitigate cost escalation and secure a sustainable path for luxury watch exports in a complex geopolitical landscape.

Unearthing Segmentation Nuances from Mechanical Movements to Cloud-Based Distribution Channels Shaping Consumer Preferences and Brand Strategies

Insight into market segmentation reveals nuanced patterns that inform both product development and distribution strategies. When examining movement types, it becomes apparent that automatic mechanisms continue to dominate consumer interest due to their blend of mechanical intricacy and perceived prestige, while quartz watches appeal to buyers prioritizing precision and maintenance efficiency. Manual-wind timepieces occupy a specialized niche, attracting purists who value the ritualistic engagement of daily winding routines. Each movement category demands unique design, service, and storytelling approaches to resonate with its target audience.

Distribution channels have expanded beyond conventional boutiques to encompass a diverse ecosystem of auction houses, authorized retailers, brand-owned boutiques, and digital platforms. Auction houses, operating through both live rooms and online portals, have become vital conduits for rare and collectible pieces, offering provenance verification and competitive bidding dynamics. Authorized retailers sustain traditional touchpoints, whereas brand-owned boutiques reinforce curated brand experiences. Online retail channels, split between official brand websites and third-party marketplaces, cater to different cohorts-from brand loyalists seeking direct engagement to broader audiences exploring comparative offerings.

Evaluating end-user demographics highlights variations in stylistic preferences and purchasing motivators among men, women, and unisex buyers. While men’s watches often emphasize size, complication depth, and heritage references, women’s designs integrate finer aesthetic flourishes and compact form factors. Unisex models have surged in popularity by combining universal case proportions with versatile styling cues that appeal across gender lines. Material selection further differentiates offerings; ceramic, gold, stainless steel, and titanium each communicate distinct value propositions, from the warmth and rarity of precious metals to the robust lightness of advanced ceramics and alloys.

This comprehensive research report categorizes the Luxury Watch market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Movement Type

- Material

- Band Type

- Usage Occasion

- Distribution Channel

- End User

Mapping Regional Divergence and Convergence Across Americas, Europe Middle East Africa, and Asia Pacific to Illuminate Growth Pathways in Luxury Watches

The Americas continue to serve as a cornerstone for luxury watch consumption, driven by sustained affluence among high-net-worth individuals and a penchant for heritage marques. The United States in particular has emerged as a resilient growth engine, displaying robust consumer confidence and a preference for iconic blue-chip models. Canadian demand, while more conservative, underscores a growing appetite for mid-tier luxury brands and certified pre-owned offerings. Across Latin America, macroeconomic volatility has tempered new watch purchases, directing focus toward value-oriented segments and localized retail partnerships.

In Europe, Middle East, and Africa, market dynamics vary considerably by subregion. Western Europe, anchored by fashion capitals such as Paris and Milan, remains a stronghold for premium launches and flagship boutique expansions. The Middle East continues to exhibit high per-capita consumption, with Gulf Cooperation Council states driving demand for bespoke and diamond-encrusted models. Meanwhile, Africa represents an emergent frontier, characterized by increasing wealth concentration in select markets and a nascent interest in both new and pre-owned timepieces.

Asia-Pacific markets display a heterogeneous landscape. Mainland China’s watch sector is ultimately constrained by broader economic parameters, yet interest in cultural narratives and limited-edition releases persists among affluent urbanites. Southeast Asian hubs, including Singapore and Thailand, benefit from vibrant tourism flows and duty-free channels. Japan’s sophisticated collector base continues to prize mechanical innovation, while Australia’s market aligns closely with Western consumption patterns, valuing durability and reliability in daily wear timepieces.

This comprehensive research report examines key regions that drive the evolution of the Luxury Watch market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Distilling Competitive Advantage and Strategic Initiatives of Leading Luxury Watchmakers Defining Industry Leadership in a Crowded Marketplace

Leading luxury watchmakers have adopted distinctive strategies to reinforce their positions and capture emerging opportunities. Rolex has maintained its aura of exclusivity by tightly controlling distribution, withholding supply to preserve aftermarket premiums, and selectively raising prices for precious metal variants, even as second-hand valuations adjust. Patek Philippe’s Master Geneva approach underscores artisanal heritage and historical significance, driving collector loyalty through limited-series complications and museum-grade exhibitions. Audemars Piguet’s Royal Oak line continues to leverage industrial design partnerships and high-complication releases to appeal to both traditionalists and modernists.

Omega has harnessed its Olympic heritage and technological innovations, such as co-axial escapements, to target performance-oriented enthusiasts, with an emphasis on vintage reissues and sustainable production practices. Cartier blends horological prowess with luxury jewelry craftsmanship, positioning high-jewelry timepieces as cross-sector masterpieces. TAG Heuer and Hublot, by integrating smartwatch functionalities and celebrity collaborations, are broadening their consumer base through lifestyle branding and digital outreach. Meanwhile, emerging independents such as H. Moser & Cie. and MB&F use minimalist aesthetics and avant-garde movements to carve differentiated niches, attracting collectors seeking unconventional value propositions ©citeturn0news11.

This comprehensive research report delivers an in-depth overview of the principal market players in the Luxury Watch market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Apple Inc.

- Audemars Piguet Holding S.A.

- Breitling Group

- CASIO Computer Co. Ltd.

- Citizen Watch Company of America, Inc.

- Fossil Group, Inc.

- Le petit-fils de L.U. Chopard & Cie SA

- LVMH Moët Hennessy Louis Vuitton

- Montres Tudor SA

- Movado Group Inc.

- Patek Philippe SA

- Ralph Lauren Corp.

- Richard Mille

- Rolex SA

- Seiko Watch Corporation

- The Richemont Group

- The Swatch Group Ltd.

- Ulysse Nardin SA

- Vacheron Constantin SA

- William Wood Watches

Formulating Actionable Strategies Enabling Industry Leaders to Leverage Emerging Trends and Navigate Challenges in the Global Luxury Watch Sector

Industry leaders should prioritize the enhancement of digital engagement platforms, ensuring seamless omni-channel integrations that marry virtual showrooms with personalized service touchpoints. By embedding augmented reality try-on capabilities and AI-driven recommendation engines, brands can elevate consumer interactivity and foster data-backed personalization. Concurrently, expanding certified pre-owned initiatives through strategic partnerships and factory-backed authentication will strengthen lifetime value and capture secondary market share.

To navigate raw material volatility, watchmakers must accelerate research into recycled metals and advanced composites, balancing innovation with heritage design languages. Strategic alliances with materials science labs can expedite pilot projects in titanium alloys and high-performance ceramics, reducing cost dependencies on gold and platinum. Supply chain resilience should be bolstered through dual sourcing and localized assembly hubs, mitigating tariff exposures and geopolitical risks.

Moreover, adopting transparent sustainability reporting frameworks, aligned with recognized ESG standards, will resonate with environmentally conscious buyers and institutional stakeholders. Engaging storytelling that communicates provenance, craftsmanship, and ecological stewardship will elevate brand equity. Finally, intensifying regional market intelligence-particularly within high-growth emerging economies-will enable nuanced product positioning and distribution strategies tailored to local consumer archetypes.

Employing a Rigorous Methodological Framework Combining Quantitative Data Expert Insights and Triangulation to Ensure Robust Market Analysis

This research integrates a mixed-method approach, combining quantitative data aggregation with qualitative insights to deliver a holistic market perspective. Secondary data sources include export–import registries, industry association publications, and fiscal reports of leading watch conglomerates. Complementary primary research was conducted through in-depth interviews with C-suite executives, authorized retailers, and certified pre-owned specialists across key regions.

For segmentation analysis, a layered framework was employed, dissecting movement types, distribution channels, end-user profiles, and material compositions. Transactional data from digital platforms and auction houses were triangulated against consumer surveys to validate emerging trends. Advanced statistical methodologies, including cluster analysis and conjoint modeling, provided a robust basis for identifying latent consumer preferences.

Supply chain assessments were informed by direct consultations with manufacturing partners in Switzerland, Asia, and North America, focusing on cost structures, tariff implications, and sustainability initiatives. All findings underwent peer review by an advisory panel of horology experts, ensuring analytical rigor and credibility.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Luxury Watch market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Luxury Watch Market, by Movement Type

- Luxury Watch Market, by Material

- Luxury Watch Market, by Band Type

- Luxury Watch Market, by Usage Occasion

- Luxury Watch Market, by Distribution Channel

- Luxury Watch Market, by End User

- Luxury Watch Market, by Region

- Luxury Watch Market, by Group

- Luxury Watch Market, by Country

- United States Luxury Watch Market

- China Luxury Watch Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1272 ]

Synthesizing Key Findings to Illuminate Future Imperatives for Innovation Sustainability and Resilience in the Luxury Watch Market

The luxury watch industry stands at a crossroads, where tradition and innovation converge to chart future trajectories. Established brands must balance the preservation of artisanal legacies with the adoption of digital and sustainable practices to satisfy evolving consumer expectations. The rising influence of certified pre-owned channels, alongside strategic diversification of materials and distribution networks, underscores the need for agility in operational and marketing frameworks.

As geopolitical complexities and material price cycles persist, proactive tariff mitigation strategies and supply chain resilience will distinguish industry leaders from their peers. Looking ahead, those organizations that effectively integrate data-driven personalization, environmental stewardship, and authentic storytelling will reinforce brand prestige and secure long-term relevance in a competitive market.

In sum, the interplay of heritage, technology, and strategic foresight will define success in the global luxury watch arena.

Activating Strategic Engagement with Sales Director Ketan Rohom for Tailored Insights and Immediate Access to the Comprehensive Luxury Watch Report

Engaging directly with Ketan Rohom will empower your organization to capitalize on comprehensive market intelligence tailored to strategic decision-making. By securing full access to the report, you will gain unparalleled insights into emerging consumer dynamics, competitive advantages, and actionable strategies that drive profitable growth. Ketan’s expertise in luxury watch market analytics ensures a smooth and confidential purchasing process, aligning your investment with the precise intelligence required to stay ahead of industry shifts. Reach out today to discuss customized licensing options, data delivery formats, and consulting services that complement the report’s findings, and take the decisive step toward elevating your brand’s market positioning.

- How big is the Luxury Watch Market?

- What is the Luxury Watch Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?