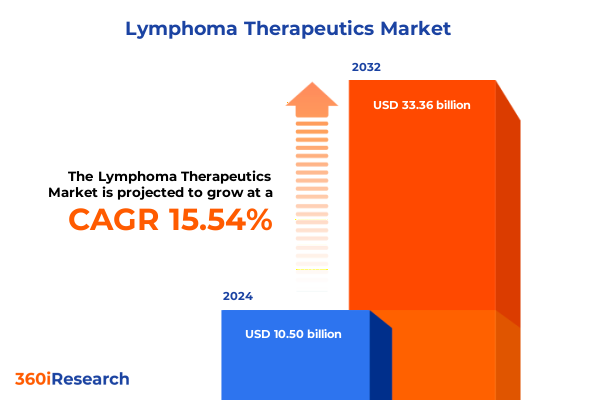

The Lymphoma Therapeutics Market size was estimated at USD 12.05 billion in 2025 and expected to reach USD 13.84 billion in 2026, at a CAGR of 15.64% to reach USD 33.36 billion by 2032.

Defining the current lymphoma therapeutics landscape and uncovering critical drivers shaping innovation patient outcomes and strategic growth opportunities

The landscape of lymphoma therapeutics has entered an era defined by unprecedented innovation, heightened regulatory focus, and intensifying competitive pressures. Advances in molecular biology and immunology have converged to create novel treatment modalities that challenge traditional paradigms. As patient populations grow and clinical needs evolve, stakeholders across the value chain are compelled to rethink strategies, embrace cutting-edge technologies, and align product development with the nuanced demands of personalized medicine.

Amidst these dynamics, the industry is characterized by an accelerating pace of clinical trials for next-generation immunotherapies, targeted agents, and combination regimens. Small molecules that inhibit key signaling pathways and biologics engineered for precision targeting are reshaping the therapeutic arsenal. At the same time, diagnostic capabilities have matured through biomarker identification and real-world evidence generation, enabling earlier detection and more tailored treatment approaches.

In response to these multifaceted shifts, this research report offers a holistic examination of the lymphoma therapeutics market. It delves into innovation pipelines, regulatory frameworks, and evolving patient access models. By weaving together strategic insights and empirical data, the following chapters aim to equip decision-makers with a deep understanding of the forces redefining lymphoma care and the opportunities that lie ahead.

Revolutionary advances and emerging modalities are reshaping lymphoma treatment paradigms and driving the next wave of therapeutic breakthroughs

The therapeutic landscape for lymphoma is experiencing a fundamental transformation driven by next-generation modalities and evolving clinical practices. Traditional approaches such as chemotherapy and radiation therapy continue to play a role in frontline settings, but their relative prominence is diminishing as entities like bispecific antibodies, antibody-drug conjugates, and chimeric antigen receptor T-cell therapies gain regulatory approvals and clinical adoption. This shift is underpinned by a deeper mechanistic understanding of tumor biology and the microenvironment, which has catalyzed the design of agents that precisely target malignant cells while preserving healthy tissue.

Concurrently, the rise of targeted therapies has unlocked new pathways for intervention. Agents that inhibit Bruton’s tyrosine kinase or block BCL2 proteins have demonstrated compelling efficacy in various B-cell and T-cell lymphoma subtypes, spurring further research into combination regimens. Moreover, real-world evidence is emerging to validate long-term benefits observed in controlled trials, influencing reimbursement decisions and clinical guidelines. As a result, treatment algorithms are being rewritten to integrate these transformative options earlier in the care continuum.

Looking ahead, innovators are exploring the intersection of digital health tools and therapeutic management, leveraging telemedicine platforms for patient monitoring and employing artificial intelligence to predict resistance patterns. These convergent trends are laying the groundwork for a new era of lymphoma care that prioritizes efficacy, safety, and patient-centricity.

Assessing the multifaceted consequences of US tariff policies on lymphoma therapeutics supply chains cost structures and industry competitiveness in 2025

The introduction of global blanket tariffs and targeted levies on pharmaceutical imports in 2025 has created significant headwinds for the lymphoma therapeutics supply chain. In April 2025, the United States implemented a 10% tariff on nearly all imported goods, encompassing critical active pharmaceutical ingredients and medical devices. At the same time, tariffs on Chinese imports were increased to as high as 245%, affecting the supply of generic APIs essential for cost-effective drug production. These measures are part of a broader strategy to bolster domestic manufacturing but have raised production costs and generated uncertainty for drugmakers.

Additionally, the United States Trade Representative finalized Section 301 tariff increases on specific products imported from China effective January 1, 2025. Among the impacted items are rubber medical and surgical gloves subject to a 50% tariff, with further escalations planned for 2026, and semiconductors facing a 50% rate under new tariff codes. Although these actions do not directly target therapeutic compounds, they indirectly influence operational expenses by increasing costs for packaging materials and diagnostic devices used in lymphoma care.

Pharmaceutical companies are absorbing these tariffs in the short term, leveraging existing inventories to shield patients and payers from immediate price increases. Analysts estimate that the $213 billion pharmaceutical import market could face a $46 billion tariff burden, with generic manufacturers most exposed due to their thin margins. Industry voices caution that prolonged tariff pressures may force cost-containment measures, potentially impairing research staffing and prompting strategic shifts toward reshoring production facilities. This evolving trade environment underscores the need for robust supply-chain diversification and proactive policy engagement.

Unveiling strategic segmentation perspectives that reveal nuanced opportunities across therapy modalities product categories disease subtypes end markets age demographics and distribution pathways

A nuanced segmentation framework reveals critical pathways for value creation within the lymphoma therapeutics landscape. The therapeutic continuum is defined by established modalities such as chemotherapy and radiation therapy alongside innovative silos including immunotherapy and targeted therapy, with stem cell transplantation providing a vital treatment option for eligible patients. Differentiation also emerges through branded versus generic product categories, where intellectual property protections drive premium pricing and competition among innovators.

Disease subtyping adds depth to this segmentation, as clinicians distinguish between Hodgkin and non-Hodgkin lymphoma cohorts. Within Hodgkin lymphoma, classical and nodular lymphocyte-predominant subgroups exhibit distinct biological behaviors and therapeutic responses. Non-Hodgkin lymphoma further splits into B-cell and T-cell lineages, with the former encompassing subtypes such as Burkitt lymphoma, diffuse large B-cell lymphoma, follicular lymphoma, and mantle cell lymphoma, while cutaneous and peripheral T-cell lymphoma represent the T-cell segment. End-user differentiation highlights the roles of hospitals, specialized oncology clinics, research institutes, and dedicated treatment centers in delivering care across inpatient and outpatient settings.

Patient demographics also shape segment dynamics, with adult, geriatric, and pediatric populations exhibiting unique treatment tolerances and clinical outcomes. Finally, distribution channels-from hospital pharmacies to online and traditional retail outlets-define pathways for product access and supply resilience. By interlacing these dimensions, stakeholders can identify high-impact opportunities, prioritize resource allocation, and align their portfolios with precise market needs.

This comprehensive research report categorizes the Lymphoma Therapeutics market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Therapy Type

- Product Type

- Disease Type

- Age Group

- Distribution Channel

- End User

Exploring regional dynamics to reveal how the Americas EMEA and Asia-Pacific markets uniquely influence lymphoma therapeutic development access and collaboration landscapes

Regional dynamics play a pivotal role in shaping innovation, access, and investment within the lymphoma therapeutics domain. In the Americas, robust R&D ecosystems and well-established clinical trial networks drive rapid adoption of novel agents and facilitate seamless regulatory pathways. Patient advocacy groups and payer systems collaborate to accelerate access, though cost containment remains a perennial concern, prompting partnerships between industry and government entities to negotiate value-based agreements.

In Europe, the Middle East and Africa, heterogeneity in regulatory frameworks and healthcare infrastructures presents both challenges and opportunities. Western European markets benefit from centralized approval processes and coordinated reimbursement mechanisms, while emerging African and Middle Eastern economies exhibit varied levels of infrastructure and financing. This regional mosaic demands tailored strategies that account for national health priorities, local manufacturing capabilities, and evolving reimbursement paradigms.

Across the Asia-Pacific region, investment in biopharmaceutical infrastructure is surging, supported by public-private partnerships and expanding clinical research centers. Governments are keen to bolster domestic manufacturing and foster technology transfer, driving increased local production of biologics and generics. While regulatory harmonization remains a work in progress, the growth potential is significant, as patient populations expand and healthcare access improves.

This comprehensive research report examines key regions that drive the evolution of the Lymphoma Therapeutics market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting leading biopharma innovators and partnerships driving breakthroughs in lymphoma treatments through targeted investments and pipeline collaborations

Key industry players are spearheading the evolution of lymphoma treatment through diversified pipelines, strategic collaborations, and targeted acquisitions. Established biopharmaceutical firms are advancing next-generation CAR-T therapies designed to improve safety profiles and broaden patient eligibility. Simultaneously, major companies are in-licensing bispecific antibodies that engage both T cells and malignant B cells, aiming to deliver durable remissions in relapsed or refractory settings.

In parallel, smaller biotech enterprises are carving out niches within specialized subtypes, leveraging proprietary platforms to develop PI3K and BTK inhibitors with optimized selectivity and tolerability. These companies are entering collaborative partnerships with larger manufacturers to expedite late-stage development and commercial distribution. Efforts to integrate companion diagnostics into clinical pathways are also intensifying, as co-development agreements seek to align molecular testing with targeted therapeutic interventions.

Across the competitive landscape, mergers and acquisitions continue to realign portfolios, with deals that augment immunotherapy franchises and expand global reach. Through these strategic maneuvers, organizations are reinforcing their positions in key markets while de-risking early-stage research through milestone-based alliances. Collectively, these initiatives reflect a shared commitment to advancing patient outcomes and sustaining long-term growth in lymphoma care.

This comprehensive research report delivers an in-depth overview of the principal market players in the Lymphoma Therapeutics market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AbbVie Inc.

- ADC Therapeutics SA

- Amgen Inc.

- AstraZeneca plc

- Bayer AG

- BeiGene, Ltd.

- Bristol-Myers Squibb Company

- Celgene Corporation

- Eli Lilly and Company

- F. Hoffmann-La Roche Ltd

- Genentech, Inc.

- Gilead Sciences, Inc.

- Janssen Pharmaceuticals, Inc.

- Johnson & Johnson

- Kite Pharma, Inc.

- Kyowa Kirin Co., Ltd.

- Merck & Co., Inc.

- Novartis AG

- Pfizer Inc.

- Sanofi S.A.

- Seagen Inc.

- Spectrum Pharmaceuticals, Inc.

- Takeda Pharmaceutical Company Limited

Strategic imperatives for industry leaders to optimize portfolios mitigate risks navigate regulatory complexities and accelerate lymphoma therapy innovations

To thrive in this rapidly evolving landscape, industry leaders should pursue a multifaceted strategy that balances innovation with operational resilience. First, organizations must diversify their supply chains to mitigate tariff-related risks and safeguard access to critical active pharmaceutical ingredients. Establishing dual sourcing agreements or advancing on-shore manufacturing initiatives will be essential to maintain uninterrupted production.

Second, a focused investment in biomarker-driven R&D is imperative. By integrating molecular diagnostics early in development, companies can streamline clinical trials, optimize patient selection, and enhance reimbursement success. Collaboration with diagnostic developers and academic consortia will bolster this capability and accelerate time-to-market.

Third, forging value-based partnerships with payers and health systems will be critical to align pricing models with clinical outcomes. Innovative access programs, risk-sharing agreements, and real-world evidence generation can fortify product value propositions and support favorable coverage decisions. Finally, embracing digital health solutions for patient monitoring and adherence will complement therapeutic efficacy, improve real-world performance metrics, and differentiate offerings in a crowded marketplace.

Rigorous mixed methodology combining robust secondary research primary interviews and data triangulation to ensure accuracy credibility and actionable insights

This analysis employed a rigorous mixed-methodology approach designed to ensure validity, reliability, and actionable precision. The research framework combined extensive secondary research-encompassing peer-reviewed journals, regulatory filings, company publications, clinical trial registries, and public policy documents-with primary interviews conducted with key opinion leaders, including oncologists, supply chain executives, and health economics experts.

Data points were triangulated through a bottom-up approach that integrated qualitative insights with quantitative metrics. Where discrepancies arose, follow-up consultations were held to reconcile differing perspectives. Additional validation was achieved by convening an expert advisory panel to review preliminary findings and provide critical feedback on methodology and interpretation.

This multi-layered process ensures that the conclusions and recommendations presented herein reflect the most current intelligence, grounded in empirical evidence and enriched by the strategic viewpoints of stakeholders across the lymphoma therapeutics ecosystem.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Lymphoma Therapeutics market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Lymphoma Therapeutics Market, by Therapy Type

- Lymphoma Therapeutics Market, by Product Type

- Lymphoma Therapeutics Market, by Disease Type

- Lymphoma Therapeutics Market, by Age Group

- Lymphoma Therapeutics Market, by Distribution Channel

- Lymphoma Therapeutics Market, by End User

- Lymphoma Therapeutics Market, by Region

- Lymphoma Therapeutics Market, by Group

- Lymphoma Therapeutics Market, by Country

- United States Lymphoma Therapeutics Market

- China Lymphoma Therapeutics Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1749 ]

Synthesizing key findings and projecting the future trajectory of lymphoma therapeutics to inform strategic decisions and foster sustainable patient outcomes

In summary, the lymphoma therapeutics landscape is undergoing a period of rapid innovation, characterized by the convergence of advanced modalities, shifting policy environments, and evolving patient needs. The interplay of emerging therapies-from CAR-T and bispecific antibodies to next-generation targeted agents-promises to elevate clinical outcomes, yet also introduces complex commercial and operational challenges.

Regional disparities in access, regulatory heterogeneity, and supply-chain disruptions underscore the importance of agile strategies that accommodate diverse market conditions. Segmentation insights reveal unique value pools across disease subtypes, patient demographics, and care settings, guiding precision investments and tailored market approaches.

As the industry navigates tariff pressures and competitive realignment, stakeholders who proactively embrace supply-chain resilience, evidence-based pricing models, and collaborative innovation will be best positioned to convert scientific breakthroughs into sustainable patient benefits. This report offers the strategic blueprint necessary to chart a course through these complexities and capitalize on the transformative opportunities within lymphoma care.

Engage with Ketan Rohom to unlock comprehensive insights and propel your strategic growth through the purchase of the definitive lymphoma therapeutics market research report

For further exploration of this in-depth market research report and to secure a comprehensive understanding of the lymphoma therapeutics landscape, reach out to Ketan Rohom, Associate Director, Sales & Marketing at 360iResearch. He will guide you through exclusive insights and tailor solutions to your strategic objectives, ensuring you harness the full potential of these findings to drive sustainable growth and innovation. Connect now to unlock the definitive source of intelligence on lymphoma therapeutics and supercharge your competitive advantage.

- How big is the Lymphoma Therapeutics Market?

- What is the Lymphoma Therapeutics Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?