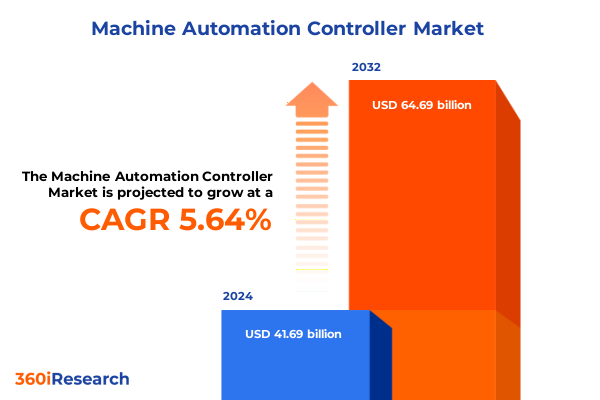

The Machine Automation Controller Market size was estimated at USD 44.04 billion in 2025 and expected to reach USD 46.26 billion in 2026, at a CAGR of 5.64% to reach USD 64.69 billion by 2032.

Exploring the Evolution and Strategic Importance of Machine Automation Controllers in Shaping Adaptive, Efficient, and Resilient Industrial Environments Worldwide

Machine automation controllers have evolved from simple relay-based logic units to sophisticated digital platforms that orchestrate complex industrial processes with precision and adaptability. In today’s era of rapid digital transformation, these controllers serve as the nerve center of manufacturing facilities, facilitating seamless interactions between sensors, actuators, and enterprise-wide systems. As decision-makers demand higher throughput, enhanced quality, and minimal downtime, the importance of selecting the right controller architecture has never been greater.

Furthermore, the heightened focus on sustainability, regulatory compliance, and workforce safety continues to redefine controller requirements. Organizations are now embedding advanced diagnostics, predictive maintenance capabilities, and cybersecurity safeguards directly within their control environments. Consequently, automation controllers are no longer viewed as isolated hardware assets but as integral elements of a holistic ecosystem that drives operational excellence. This shift underscores the imperative for industry stakeholders to remain informed about technological advances, market dynamics, and emerging strategic imperatives.

Unveiling Transformative Shifts in Controls Architecture and Integration Driving Next-Gen Automation Controller Performance

The landscape of machine automation controllers is undergoing a profound transformation, driven by the convergence of digital technologies and evolving industrial priorities. Edge computing has emerged as a pivotal enabler, allowing controllers to process critical data locally, thereby reducing latency and supporting real-time decision-making at the plant floor. At the same time, the integration of artificial intelligence and machine learning algorithms within controllers is empowering systems to optimize performance autonomously, detect anomalies earlier, and adapt to dynamic production requirements.

Simultaneously, hybrid control architectures-which combine centralized oversight with distributed intelligence-have gained traction as organizations seek to balance scalability with resilience. This hybrid approach ensures that localized control loops can continue operating independently even if connectivity to central systems is disrupted. Moreover, the growing emphasis on open standards and interoperable protocols is fostering greater flexibility in multi-vendor environments, enabling companies to integrate best-of-breed solutions without being locked into proprietary stacks. Collectively, these trends are reshaping controller capabilities and driving a new era of efficiency and agility in industrial automation.

Assessing the Comprehensive Impact of U.S. Tariff Policies on Machine Automation Controllers and Supply Chain Resilience in 2025

In 2025, U.S. tariff policies have exerted significant pressure on the machine automation controller ecosystem, altering cost structures and supply chain configurations. Many critical components, including Programmable Logic Controller modules and I/O cards, have experienced tariff-induced price increases ranging from 10 percent to 25 percent, prompting suppliers to adjust project bids and re-examine cost allocations within capital expenditure plans. Concurrently, delays in customs clearances and documentation have extended lead times by up to 12 weeks, compelling integrators to maintain higher buffer inventories and renegotiate delivery schedules with end users.

To mitigate tariff-related disruptions, industry participants are diversifying their sourcing strategies, redirecting procurement away from heavily tariffed origins toward alternative manufacturing hubs in Southeast Asia and Eastern Europe. Moreover, a resurgence in onshoring and nearshoring initiatives has gained momentum, as companies establish or expand production facilities in Mexico, Canada, and the United States to circumnavigate punitive duties. While these adaptations enhance supply chain resilience, they also invite new complexities around workforce skill development, certification compliance, and ecosystem validation. As a result, stakeholders must adopt comprehensive strategies that harmonize cost optimization with operational continuity.

Deriving Strategic Segmentation Insights Across Controller Types, Architectures, Control Modes, Industries, and Sales Channels

Examining the market through multiple segmentation dimensions reveals nuanced opportunities and distinct value drivers. Controllers are categorized by type, ranging from Distributed Control Systems with integrated and standalone platforms to Motion Controllers supporting single- and multi‐axis operations, and PC‐Based Controllers that include both industrial PCs and software-based PLCs. Programmable Logic Controllers encompass compact, DIN-rail, and modular architectures, while Safety Controllers deliver risk mitigation through safety PLCs and dedicated relay modules.

Control architectures further delineate the market into centralized topologies, fully distributed layouts, and hybrid systems that combine the best of both worlds. Control types range from closed-loop configurations, which deliver precise feedback and adaptive control, to open-loop designs suitable for simpler, cost-sensitive applications. From an industry perspective, adoption spans Aerospace & Defense-including civil aerospace and defense systems-through Automotive OEM and Tier 1 supplier segments, as well as Food & Beverage processing and packaging, Biotechnology and Medical Device segments in Healthcare & Pharmaceuticals, Batch and Discrete Manufacturing, and the Chemical, Oil & Gas, and Pharmaceutical verticals within the Process Industry.

Sales channels reflect direct engagements with OEMs and end users, indirect routes via authorized and independent distributors, and the rising influence of online platforms, complemented by system integrators who operate at both global and local scales. These segmentation insights highlight critical intersections where tailored solutions, strategic partnerships, and channel initiatives can unlock differentiated growth and competitive advantage.

This comprehensive research report categorizes the Machine Automation Controller market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Controller Type

- Control Architecture

- Control Type

- End User Industry

- Sales Channel

Illuminating Regional Dynamics in the Machine Automation Controller Landscape Across Americas, Europe-Middle East-Africa, and Asia-Pacific

Regional dynamics in the machine automation controller market underscore the importance of localized strategies and ecosystem alignment. In the Americas, reshoring trends have catalyzed investment in control hardware manufacturing, particularly in Mexico and the United States, where proximity to major OEMs and robust infrastructure support growth. U.S. tariff shields have nudged several integrators to partner with domestic producers, preserving margin stability while mitigating geopolitical risk.

In Europe, the Middle East, and Africa, stringent regulatory frameworks, sustainability mandates, and a steadily recovering automotive sector are driving modernization projects in both process and discrete industries. Companies are leveraging Europe’s strong supplier base and advanced digital infrastructure to deploy hybrid control ecosystems that meet stringent energy efficiency and safety requirements.

Meanwhile, Asia-Pacific remains a hotbed of controller adoption, supported by rapid industrialization in China, India, and Southeast Asian economies, and major investments in smart manufacturing corridors. Government incentives for Industry 4.0 initiatives, coupled with local supplier alliances, have accelerated the rollout of advanced control solutions in sectors such as electronics, chemicals, and automotive assembly. This fertile environment is expected to sustain elevated demand over the medium term.

This comprehensive research report examines key regions that drive the evolution of the Machine Automation Controller market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Leading Companies Shaping Innovation and Competitive Advantage in the Automation Controller Sector

Leadership in the automation controller sector is anchored by a handful of industry stalwarts whose strategic moves and operational resilience set the pace. Rockwell Automation has effectively mitigated approximately $125 million of tariff exposure by optimizing its global production footprint and implementing dynamic pricing models, while its e-commerce and warehouse automation businesses have outperformed expectations, demonstrating the company’s ability to capitalize on shifting customer priorities.

ABB achieved a historic Q2 2025 order intake of $9.8 billion, driven by a 37 percent surge in U.S. orders and robust demand for AI-enabling data center products. The company’s record performance was complemented by an 8 percent revenue increase and a 19.2 percent operational EBITA margin, illustrating how broad-based market strength can offset geopolitical headwinds.

Siemens sustained its growth momentum with a 7 percent rise in quarterly sales to €19.8 billion and a 29 percent jump in industrial profit to €3.24 billion, driven by strong mobility, smart infrastructure, and digital industries segments. This performance underscores the efficacy of Siemens’ ONE Tech Company strategy and its multi-year digital transformation initiatives.

Schneider Electric has committed over $700 million to expand its U.S. manufacturing and supply chain capabilities through 2027, while its North America energy management revenue grew organically by 15.5 percent in Q2, reflecting surging demand from data center and infrastructure end markets. These investments reinforce Schneider’s leadership in digital energy and automation solutions.

This comprehensive research report delivers an in-depth overview of the principal market players in the Machine Automation Controller market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ABB Ltd.

- ACS India

- Advantech Co., Ltd.

- AMETEK, Inc.

- Beckhoff Automation GmbH & Co. KG

- Delta Electronics, Inc.

- Dover Motion

- Emerson Electric Co.

- Estun Automation Co.,Ltd.

- Honeywell International Inc.

- HYDAC International GmbH

- Kollmorgen Corporation by Regal Rexnord Corporation

- Kontron AG

- Mitsubishi Electric Corporation

- MKS Instruments, Inc.

- NEXCOM International Co., Ltd.

- OMRON Corporation

- Parker Hannifin Corporation

- Robert Bosch GmbH

- Rockwell Automation Inc.

- Schneider Electric SE

- Siemens AG

- STMicroelectronics N.V.

- Tamagawa Seiki Co., Ltd.

- Yokogawa Electric Corporation

Implementing Actionable Strategies to Enhance Flexibility, Digital Twin Utilization, Cybersecurity, and Collaborative Innovation in Controller Ecosystems

To navigate ongoing geopolitical volatility and evolving customer expectations, industry leaders should prioritize supply chain diversification by establishing strategic procurement partnerships across multiple low-risk regions. This approach will balance cost efficiency with resilience and enable quick responses to future tariff shifts or trade disruptions.

Investing in digital twin and simulation platforms should be at the forefront of technology roadmaps, empowering organizations to model complex processes, predict maintenance needs, and optimize controller configurations virtually before deploying them in live operations.

Given the rising sophistication of cyber threats, embedding robust cybersecurity architectures directly into controller firmware and network topologies is imperative. Proactive threat hunting, regular patch management, and secure remote access protocols will protect critical production assets and maintain customer confidence.

Finally, cultivating deep domain expertise through partnerships with system integrators, academic institutions, and standards bodies will accelerate the development of tailored solutions for high-growth industries, such as life sciences, smart logistics, and digital energy management. Leaders must leverage these alliances to co-innovate, bundle services, and extend their value proposition beyond hardware.

Elaborating on a Robust Research Methodology Integrating Secondary Analysis, Expert Interviews, Data Triangulation, and Advisory Panel Validation

Our research methodology combines rigorous secondary and primary approaches to ensure data integrity and analytical depth. Initially, we conducted an exhaustive review of trade publications, regulatory filings, and corporate disclosures to map the competitive landscape and identify emerging technological trends.

Subsequently, we engaged with a cross-section of industry stakeholders-including controller OEMs, system integrators, end users, and trade association representatives-via structured interviews. This primary research phase validated key market drivers, tariff impacts, and adoption barriers while uncovering qualitative insights on buyer preferences and investment priorities.

Data triangulation was employed to reconcile conflicting inputs, using statistical techniques to normalize cost impacts and forecast scenario modelling to stress-test supply chain configurations under varying tariff regimes. Finally, an expert advisory panel comprising former C-level executives from leading automation companies reviewed our findings, ensuring our conclusions and recommendations reflect real-world feasibility and strategic relevance.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Machine Automation Controller market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Machine Automation Controller Market, by Controller Type

- Machine Automation Controller Market, by Control Architecture

- Machine Automation Controller Market, by Control Type

- Machine Automation Controller Market, by End User Industry

- Machine Automation Controller Market, by Sales Channel

- Machine Automation Controller Market, by Region

- Machine Automation Controller Market, by Group

- Machine Automation Controller Market, by Country

- United States Machine Automation Controller Market

- China Machine Automation Controller Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 2703 ]

Summarizing Strategic Imperatives and Competitive Levers for Capitalizing on Evolving Automation Controller Trends in a Dynamic Global Environment

The machine automation controller market stands at a critical juncture, where technological innovation, regulatory pressures, and shifting trade landscapes intersect to redefine competitive dynamics. Organizations that harness the power of advanced control architectures, digitalization initiatives, and strategic supply chain realignments will secure sustainable performance advantages.

As the industry moves toward intelligent, software-defined ecosystems, stakeholders must remain vigilant of geopolitical developments and invest in capabilities that reinforce operational agility. The synthesis of segmentation insights, regional dynamics, and leading company strategies presented in this executive summary provides a blueprint for informed decision-making.

By proactively aligning investment portfolios with emerging control paradigms-embracing open standards, edge computing, and AI-driven automation-companies can unlock new pathways to growth, mitigate tariff-related risks, and position themselves at the forefront of the next industrial revolution.

Unlock Comprehensive Automation Controller Intelligence by Engaging with Our Associate Director of Sales & Marketing for Report Purchase

For an in-depth exploration of the machine automation controller landscape and to gain comprehensive insights into strategic market opportunities, reach out to Ketan Rohom, Associate Director of Sales & Marketing at 360iResearch. Elevate your decision-making with our expertly curated analysis, proprietary data, and forward-looking intelligence designed to inform critical investments and competitive strategies. Contact Ketan today to purchase the full market research report and unlock the detailed findings that will drive your organization’s success in the evolving automation controller sector.

- How big is the Machine Automation Controller Market?

- What is the Machine Automation Controller Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?