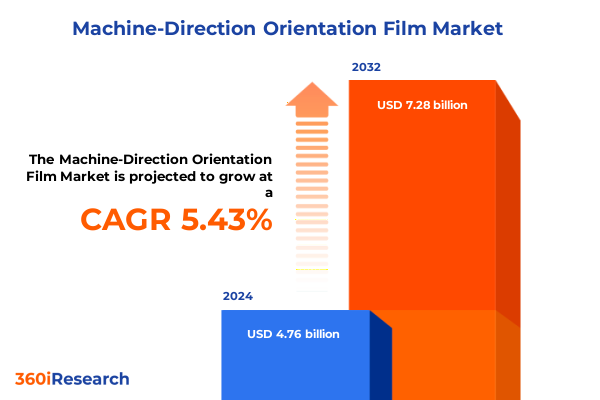

The Machine-Direction Orientation Film Market size was estimated at USD 5.00 billion in 2025 and expected to reach USD 5.24 billion in 2026, at a CAGR of 5.51% to reach USD 7.28 billion by 2032.

Revealing the Benefits and Evolution of Machine-Direction Orientation Films as a Crucial Enabler in Modern Packaging and Industrial Applications

Machine-direction orientation (MDO) films have emerged as a cornerstone technology in flexible packaging and industrial applications, combining the benefits of uniaxial strength enhancement and improved optical properties in polymeric films. Since Marshall and Williams Plastics pioneered the industry’s first MDO system in 1961, manufacturers have harnessed longitudinal stretching techniques to refine the mechanical and barrier performance of materials ranging from polyethylene to polyethylene terephthalate. This transformative process aligns polymer chains in the machine direction, thereby enhancing tensile strength and machinability while enabling down-gauging for cost-effective and sustainable film solutions.

As environmental regulations and consumer preferences increasingly favor recyclable and monomaterial packaging, machine-direction orientation films have grown in prominence. Recent EU legislation, such as the Packaging and Packaging Waste Regulation, mandates that all packaging be recyclable by 2030 and sets ambitious waste reduction targets, driving brands and converters to adopt MDO films that support mono-polymer formats and facilitate efficient recycling. Consequently, industry stakeholders are accelerating investments in advanced MDO lines and heat transfer simulation programs to optimize throughput and ensure regulatory compliance. In this context, understanding the technical merits and market drivers behind MDO films is essential for decision-makers navigating the evolving landscape of sustainable packaging and specialty film applications.

How Sustainability Mandates, Material Innovations, and Supply Chain Realignments Are Accelerating the Future of Oriented Film Manufacturing

The landscape of machine-direction orientation films has undergone profound shifts driven by sustainability mandates, material science breakthroughs, and supply chain reconfigurations. Governments across Asia-Pacific and Europe have implemented regulations that incentivize recyclable packaging, compelling converters to transition from multi-layer composites to monomaterial MDO structures with equivalent performance characteristics. This regulatory impetus has sparked innovation in barrier technologies, with specialty MDO films incorporating nano-coatings and coextrusion layers to achieve oxygen and moisture transmission rates previously attainable only by multi-polymer laminates.

Simultaneously, supply chain disruptions following geopolitical tensions and pandemic-related logistics challenges have prompted manufacturers to localize polymer sourcing and diversify extrusion capacities. Strategic alliances between resin producers and film converters are emerging, aimed at securing feedstock availability and accelerating adoption of heat-efficient MDO equipment. For instance, INEOS Olefins & Polymers Europe commissioned a pilot multilayer blown film line with integrated MDO capabilities in Brussels, demonstrating a commitment to sustainable packaging development and circular economy principles. In tandem, digitalization initiatives-such as real-time process monitoring and predictive maintenance-are enhancing throughput and reducing scrap, reinforcing the competitive value of MDO technologies in a dynamic market environment.

Exploring the Layered Impact of 2025 U.S. Tariffs on MDO Film Imports from China, Canada, and Mexico and Their Implications for Supply Chain Strategies

In 2025, the United States implemented a tiered tariff regime that significantly increased duties on plastic films, including machine-direction orientation grades derived from polypropylene and polyethylene terephthalate. Initially, a blanket 10% baseline tariff on all imports took effect in April, underpinning a reciprocal tariffs policy targeting trade deficit partners. Chinese-origin polymer imports faced additional Section 301 duties, first set at 10% and later raised to 20%, on top of the new baseline, resulting in an average tariff burden approaching 30% for raw polyolefins and oriented film exports. These enhanced levies effectively elevated the landed cost of imported MDO film substrates and resins, prompting downstream converters to reevaluate sourcing strategies and accelerate capacity expansions domestically.

Meanwhile, under emergency powers invoked in February, the government imposed a 25% ad valorem tariff on imports from Canada and Mexico for non-USMCA compliant goods, which encompassed a range of oriented film products and resins. Although a temporary one-month pause delayed implementation, the duties took effect in early March, further increasing cost pressures for North American converters reliant on cross-border supply chains. These cumulative tariffs have driven margin compression for import-dependent operations and incentivized investments in regional feedstock production and MDO line deployments. Consequently, film producers are realigning capital toward reshoring initiatives and forging partnerships with petrochemical firms to secure cost-competitive, tariff-exempt polymer sources.

Unpacking the Multifaceted Segmentation of MDO Films across Polymer Types, Thickness, End-Use and Surface Finishes to Inform Tailored Market Approaches

The machine-direction orientation film market is segmented across multiple dimensions, each offering distinct performance and commercial considerations. Materials selection, for example, spans polyamide, polyethylene terephthalate, and polypropylene variants, each tailored to meet specific strength and barrier requirements. This variation influences equipment settings, heat transfer profiles, and post-orientation processing parameters, compelling manufacturers to calibrate operating conditions and material formulations according to polymer characteristics.

End-use segmentation further refines market focus, encompassing insulation applications where high-temperature stability is paramount, and labeling solutions that split into pressure-sensitive and sleeve formats with divergent adhesion and conformability properties. Packaging demands branch into food, industrial, personal care, and pharmaceutical spheres, with food packaging subdivided into bakery and confectionery, dairy, frozen foods, and snacks. These layers of specialization drive granular technical development and commercial strategies tailored to each sub-segment’s performance threshold.

Thickness range also frames market approaches, with films below 20 microns enabling extreme down-gauging, those between 20 and 50 microns striking a balance between strength and optics, and above 50 microns offering enhanced mechanical durability for heavy-duty applications. Simultaneously, application categories differentiate between flexible packaging formats-flat pouches, side-gusseted and stand-up pouches-overwrap films that vary from plain to printed, and shrink films optimized for food-grade or industrial use. Lastly, surface finish options, including glossy, matte, and pearlized textures, deliver aesthetic and functional distinctions that align with brand identity and tactile requirements. Taken together, these interwoven segmentation criteria highlight the nuanced decision matrix guiding film selection and investment.

This comprehensive research report categorizes the Machine-Direction Orientation Film market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Polymer Type

- Thickness Range

- Surface Finish

- Application

- End Use

Contrasting Regional Growth Patterns and Strategic Imperatives for MDO Film Production and Adoption across the Americas, EMEA, and Asia-Pacific

Regional dynamics in the MDO films sector reflect divergent growth drivers and competitive landscapes across the Americas, Europe-Middle East-Africa (EMEA), and Asia-Pacific zones. In the Americas, legacy packaging hubs are investing in capacity expansions to mitigate tariff impacts, with the United States and Canada emphasizing reshoring initiatives and USMCA-aligned supply chains. Latin American converters, supported by proximity to resin producers, are leveraging flexible MDO solutions to cater to burgeoning demand in the food and beverage segment.

Across EMEA, stringent sustainability regulations-such as the EU’s Packaging and Packaging Waste Regulation-propel uptake of recyclable MDO films, prompting manufacturers to deploy advanced coextrusion and coating technologies in Germany, Italy, and France. Middle Eastern economies, with expanding healthcare and personal care industries, are adopting high-clarity, barrier-enhanced oriented films, while North African markets capitalize on competitive labor costs and logistical linkages to European distribution networks.

In Asia-Pacific, growth is anchored by fast-moving consumer goods expansion and e-commerce proliferation in China, India, and Southeast Asia. Regional resin producers are integrating vertically with film converters, offering cost-effective monomaterial MDO solutions. Countries like Japan and South Korea continue to lead in high-performance film innovation, focusing on nano-scale barrier enhancements and sustainable polymer chemistries, while emerging markets in Vietnam and Indonesia present opportunities for capacity additions driven by rising disposable income and retail modernization.

This comprehensive research report examines key regions that drive the evolution of the Machine-Direction Orientation Film market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Analyzing the Diverse Strengths of Resin Producers, Film Converters, and Equipment Innovators Driving the MDO Films Ecosystem

The competitive landscape for machine-direction orientation film production is shaped by a cohort of resin suppliers, film converters, and equipment innovators, each leveraging unique strengths. Resin giants such as Toray Industries integrate polymer chemistry and R&D capabilities to supply specialty PET and polyamide grades, facilitating advanced barrier film formulations. On the converter side, Jindal Poly Films and Uflex have capitalized on scale and cost leadership, operating high-capacity MDO line networks in India that serve global packaging and labeling clients.

Equipment providers also play a pivotal role, with Marshall and Williams Plastics maintaining a legacy of innovation in MDO systems. Their heat transfer simulation programs and modular stretch configurations enable precise process control and rapid material qualification, underscoring the critical partnership between converters and technology suppliers. Additionally, Amcor’s recent combination with Berry Global has consolidated flexible and rigid film offerings, driving monomaterial MDO product development for personal care and food sectors.

Meanwhile, specialty players like Taghleef Industries focus on high-clarity, ultra-thin oriented films that meet the aesthetic demands of premium consumer goods, while Mondi and Cosmo Films emphasize sustainability through post-consumer recycled content and mono-polymer designs. Together, these organizations form an ecosystem that balances scale, innovation, and sustainability leadership, guiding the evolution of oriented film applications worldwide.

This comprehensive research report delivers an in-depth overview of the principal market players in the Machine-Direction Orientation Film market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Avery Dennison Corporation

- Borealis AG

- CCL Label Eclipse Films

- Coveris

- Davis Standard LLC

- Exxon Mobil Corporation

- Futamura Group

- Hosokawa Micron India Pvt Ltd.

- Jindal Films

- Klöckner Pentaplast

- Lenzing Plastics GmBH

- Nova Chemicals

- Propuri CZ s.r.o.

- Rani Group

- SRF Ltd.

- Taghleef Industries

- Toray Industries, Inc.

- Trico Specialty Films by Arlin Mfg. Co., Inc.

- UFlex Limited

- UPM-Kymmene Corporation

- Windmöller & Hölscher

Strategic Pathways for MDO Film Industry Leaders to Secure Supply Chains, Enhance Production Agility, and Elevate Sustainability Performance

Industry leaders can capitalize on the evolving oriented films market by executing a multi-pronged strategy that aligns technical, commercial, and sustainability goals. First, establishing strategic supply partnerships with regional resin producers will secure cost-competitive feedstock and tariff-exempt sourcing, mitigating exposure to fluctuating duty regimes. This approach should be complemented by evaluating on-site polymerization or compounding ventures to integrate value chains vertically.

Second, investing in advanced MDO equipment with digital controls and modular configurations will maximize throughput and minimize scrap, ensuring rapid adaption to diverse polymer grades and thickness requirements. Collaborations with equipment suppliers to co-develop simulation and processing protocols can further streamline material qualification cycles.

Third, prioritizing monomaterial film solutions that meet emerging regulatory mandates will unlock new market opportunities, particularly in regions with stringent recycling requirements. Engaging with brand owners to co-innovate barrier coatings and post-consumer recycled content formulations will enhance market differentiation and support circular economy initiatives.

Finally, deploying data-driven market intelligence-leveraging real-time trade analytics and end-use demand forecasts-will inform capacity planning and product portfolio optimization. By balancing operational agility with strategic foresight, industry participants can fortify their competitive position and respond decisively to shifting market dynamics.

Outlining an Integrative Research Approach Combining Primary Stakeholder Interviews, Trade Data Analysis, and Scenario Modeling for Robust Market Insights

This research integrates both primary and secondary methodologies to provide a robust analysis of the machine-direction orientation film market. The study commenced with a comprehensive review of trade and tariff regulations from official government publications, including the Office of the United States Trade Representative and international customs databases. Secondary data encompassed company disclosures, regulatory filings, and peer-reviewed literature on polymer processing and oriented film performance.

Primary insights were gathered through structured interviews with key stakeholders, including resin producers, film converters, equipment suppliers, and end-use brand owners across major regions. These interviews provided nuanced perspectives on material selection criteria, investment drivers, and strategic partnerships. Complementing these qualitative inputs, proprietary supply chain models were calibrated using shipment and capacity data to assess the impact of 2025 tariff changes.

Data triangulation assured consistency, with cross-validation performed between financial reports, customs statistics, and expert interviews. Scenario analyses examined alternative regulatory and market conditions, while sensitivity testing quantified the effects of key variables such as resin feedstock costs, duty rates, and capacity utilization. This rigorous methodology underpins the reliability of our findings and supports actionable recommendations.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Machine-Direction Orientation Film market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Machine-Direction Orientation Film Market, by Polymer Type

- Machine-Direction Orientation Film Market, by Thickness Range

- Machine-Direction Orientation Film Market, by Surface Finish

- Machine-Direction Orientation Film Market, by Application

- Machine-Direction Orientation Film Market, by End Use

- Machine-Direction Orientation Film Market, by Region

- Machine-Direction Orientation Film Market, by Group

- Machine-Direction Orientation Film Market, by Country

- United States Machine-Direction Orientation Film Market

- China Machine-Direction Orientation Film Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1908 ]

Synthesizing Key Market Dynamics and Strategic Considerations That Will Shape the Future Trajectory of Oriented Film Applications

Machine-direction orientation films stand at the intersection of performance enhancement and sustainability advancement, offering compelling solutions for modern packaging and industrial needs. The evolution of MDO processes, driven by technical innovation and reinforced by regulatory imperatives, has reshaped material formulations and supply chain strategies. In this shifting landscape, tariff escalations and regional dynamics underscore the necessity for localized sourcing, supply chain resilience, and equipment agility.

Segmentation analysis reveals that film specifications-from polymer type and thickness to end-use and surface finish-demand tailored strategies to capture value in diverse applications. Key players differentiate through vertical integration, monomaterial innovation, and collaborative R&D efforts. As market participants navigate evolving regulations and competitive pressures, data-driven decision-making and strategic investment in advanced MDO infrastructure will become increasingly critical.

Ultimately, embracing a holistic approach that aligns supply chain fortification, technological excellence, and sustainability objectives will position industry stakeholders to unlock new opportunities and mitigate risks in the dynamic machine-direction orientation films market.

Empower Your Business Growth by Partnering with Ketan Rohom to Access Critical Market Insights on Machine-Direction Orientation Films

To explore the comprehensive findings, detailed insights, and strategic guidance presented in this report, connect directly with Ketan Rohom, Associate Director of Sales & Marketing. Whether you seek to deepen your understanding of the machine-direction orientation films landscape or prioritize tailored recommendations for your organization, Ketan Rohom will guide you through the process of acquiring the full market research report. Don’t miss the opportunity to leverage this meticulously crafted analysis to inform your investment, sourcing, and innovation strategies-reach out today and empower your business with actionable intelligence.

- How big is the Machine-Direction Orientation Film Market?

- What is the Machine-Direction Orientation Film Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?