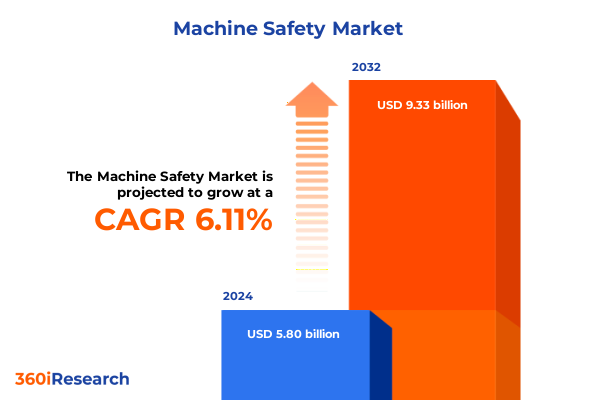

The Machine Safety Market size was estimated at USD 6.15 billion in 2025 and expected to reach USD 6.49 billion in 2026, at a CAGR of 6.13% to reach USD 9.33 billion by 2032.

Laying the Foundation for Next-Generation Industrial Machine Safety Through Cutting-Edge Technologies and Robust Compliance Frameworks

The rapidly evolving industrial landscape demands a renewed focus on machine safety as automation and digital transformation continue to reshape manufacturing, processing, and logistics environments. As advanced robotics, collaborative systems, and intelligent monitoring platforms become integral to modern facilities, organizations face mounting pressure to ensure that protective measures keep pace with technology. Compliance with global regulations, such as ISO 13849 and IEC 62061, serves as the baseline, but truly effective safety strategies extend beyond mere conformance, embedding risk prevention into every stage of the automation lifecycle.

In this context, emerging trends-ranging from integrated sensor networks to real-time analytics-underscore the need for a holistic perspective that unites hardware, software, and human factors. Safety must transcend physical barriers to encompass cybersecurity, user interface design, and predictive maintenance, forging a culture of continuous improvement. By understanding how these converging forces interact, decision-makers can craft resilient safeguards that address not only the hazards of yesterday’s machinery but also the complex risks introduced by smart systems.

This executive summary outlines the key dimensions of the machine safety ecosystem, examining transformative shifts, policy impacts, nuanced market segmentation, regional variations, and leading industry players. It also offers strategic recommendations for operational leaders and details the rigorous research methodology underpinning our findings. Ultimately, this analysis provides a roadmap for organizations seeking to navigate emerging challenges, strengthen compliance postures, and unlock new value through proactive safety investment.

Navigating the Convergence of Digitalization, Automation, and Artificial Intelligence Driving Paradigm Shifts in Machine Safety Practices Worldwide

The landscape of machine safety is undergoing a profound metamorphosis driven by digitalization, automation, and the rapid adoption of artificial intelligence. Whereas traditional protective measures focused on discrete emergency stops and fixed physical barriers, today’s paradigms integrate intelligent sensing, dynamic risk assessment, and adaptive control logic. Connected safety devices now continuously exchange data with programmable logic controllers and enterprise resource planning systems, enabling centralized oversight and predictive alerts before hazardous conditions arise.

Moreover, the rise of collaborative robots and human-machine interfaces has necessitated innovative approaches to presence detection, speed monitoring, and force limitation. Safety controllers and relays have evolved to support modular, scalable architectures that can be reconfigured with minimal downtime, while software-driven safety platforms deliver actionable insights into performance metrics, fault history, and operator behavior. Edge computing and cloud-based analytics further accelerate this shift by facilitating real-time anomaly detection and remote diagnostics, reducing the time between incident precursors and corrective actions.

Taken together, these shifts highlight a move from reactive safeguard installation toward proactive, system-wide risk management. Enterprises that embrace these capabilities can optimize production throughput, enhance workforce protection, and maintain regulatory compliance in an era defined by complexity. As these technologies continue to advance, organizations must adapt their safety strategies to harness the full potential of digital resilience.

Assessing the Multifaceted Consequences of 2025 United States Tariff Measures on Supply Chains, Component Sourcing, and Pricing Strategies

In 2025, new tariff measures implemented by the United States imposed additional duties on key machinery components and electronic safety devices, reshaping procurement strategies across the industry. Manufacturers reliant on imported sensors, safety controllers, and programmable logic modules have encountered rising input costs, prompting a re-evaluation of global supply chain structures. This escalation has impacted negotiated pricing with original equipment manufacturers, shifted lead-time expectations, and intensified efforts to localize critical component production.

These cumulative effects extend beyond cost inflation; they have spurred a wave of supply chain diversification and strategic sourcing. In response, some stakeholders have turned to near-shoring partners in Mexico and Central America to mitigate tariff exposure and shorten delivery timelines. Others have negotiated long-term agreements with domestic suppliers, leveraging volume commitments to stabilize pricing. At the same time, the import duty environment has accelerated investment in high-efficiency manufacturing processes that reduce material waste and optimize resource utilization, offsetting a portion of the increased tariff burden.

As a result, organizations that proactively reassess their supplier portfolios and align procurement policies with evolving trade regulations can better maintain project schedules and budget targets. By combining scenario modeling with supplier risk assessments, leading companies are adapting to this new fiscal landscape, ensuring that safety enhancements remain both effective and economically viable.

Illuminating Strategic Market Segmentation Dynamics to Unlock Targeted Insights for Components, Functionalities, Connectivity, Installations, and Industry Verticals

Understanding the machine safety market requires a nuanced exploration of component-level, functionality-based, connectivity-oriented, installation-specific, and industry vertical segmentation. At the component level, manufacturers gauge demand for emergency stop devices including pull-cord systems and push-button units, weigh investments in safety relays and controllers, and assess adoption rates for safety programmable logic controllers. The growing complexity of sensor arrays has elevated interest in light curtains, safety interlock switches, and pressure-sensitive mats, while integrated safety software platforms provide continuous system monitoring and risk reporting.

When viewed through the lens of safety functionality, access control mechanisms, emergency stop configurations, presence detection systems, pressure-sensitive devices, speed and motion monitoring solutions, and two-hand control arrangements each address distinct hazard profiles. Connectivity preferences further shape implementation, with wired architectures offering deterministic performance and wireless safety networks enabling flexible layouts in dynamic production cells. Meanwhile, installation type influences project scope as new installations incorporate safety-by-design principles, whereas retrofit projects demand careful integration with legacy equipment to preserve uptime.

End-use industry segmentation reveals differentiated priorities: the automotive sector focuses on assembly lines and robotic cell safeguards, chemical processors manage bulk and specialty chemical line risks, and food and beverage producers deploy packaging and processing safety solutions. Metals and mining operations address heavy-duty machinery hazards, oil and gas stakeholders manage upstream exploration and downstream refining exposures, pharmaceutical organizations balance manufacturing and R&D safety protocols, and power generation facilities navigate both fossil fuel and renewable asset protection. Through this comprehensive segmentation framework, decision-makers can identify the optimal balance of protective measures tailored to their unique operational challenges.

This comprehensive research report categorizes the Machine Safety market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component

- Safety Functionality

- Connectivity

- Installation Type

- End Use Industry

Unveiling Regional Nuances and Growth Drivers Across the Americas, Europe Middle East and Africa, and Asia-Pacific Machine Safety Ecosystems

The Americas exhibit a mature safety ecosystem characterized by stringent regulatory oversight, well-established supply chains, and robust aftermarket support networks. In the United States and Canada, harmonization of safety standards has facilitated cross-border technology transfers, while advanced industrial clusters in Mexico have attracted investment in localized component manufacturing. North American firms increasingly leverage digital twins and virtual commissioning to expedite system validation, reducing time to market for safety upgrades.

In Europe, the Middle East, and Africa, a diverse regulatory landscape spans the EU’s Machinery Directive and national standards across the region. Western European manufacturers lead in integrating IoT-enabled safety platforms, benefiting from widespread broadband infrastructure and high automation adoption rates. Meanwhile, emerging markets in Central and Eastern Europe, as well as the Gulf Cooperation Council, present opportunities for greenfield installations and retrofit projects driven by growing energy, mining, and chemicals sectors. These regions prioritize compliance with harmonized directives and invest in skill development to support next-generation safety solutions.

Across Asia-Pacific, rapid industrial expansion in China, India, and Southeast Asia fuels demand for cost-effective safety systems. Government initiatives promoting ‘Made in Asia’ supply chains have stimulated partnerships between local integrators and global OEMs. In Japan and South Korea, a focus on robotics and smart manufacturing has accelerated deployment of advanced sensor networks and AI-powered risk monitoring. As these diverse markets evolve, regional nuances-from infrastructure maturity to labor market dynamics-continue to shape tailored safety strategies, underscoring the importance of localized expertise and ecosystem collaboration.

This comprehensive research report examines key regions that drive the evolution of the Machine Safety market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Industry Leaders and Innovative Disruptors Shaping the Future of Machine Safety Through Strategic Partnerships and Technological Advancements

The machine safety sector features a competitive landscape in which established automation giants collaborate with specialized safety providers to deliver end-to-end solutions. Leading players harness strategic partnerships and acquisitions to expand their product portfolios and service capabilities, while emerging technology vendors focus on niche innovations such as wireless safety networks and machine-learning–driven diagnostics.

Global corporations prioritize cross-platform interoperability, integrating safety controllers and sensors with broader control architectures. They invest in global R&D centers to accelerate feature development and maintain compliance with evolving standards. Meanwhile, safety-focused firms concentrate on advancing functional safety performance, offering modular relays and configurable logic systems that can rapidly adapt to changing production requirements. Innovative disruptors differentiate through software-centric offerings, deploying cloud analytics and digital twin simulations to provide predictive maintenance insights and continuous risk reduction.

As a result, organizations seeking comprehensive safety frameworks can engage with ecosystem integrators offering turnkey solutions, while those with specialized needs can select best-in-class suppliers for discrete components. By monitoring competitive dynamics, stakeholders can anticipate consolidation trends, identify collaborative opportunities, and align procurement strategies with vendors that demonstrate both technical excellence and a clear vision for digital transformation in machine safety.

This comprehensive research report delivers an in-depth overview of the principal market players in the Machine Safety market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ABB Ltd.

- Banner Engineering Corp.

- Devidatt Enterprises Private Limited

- Emerson Electric Co.

- Fortress Interlocks Limited

- HIMA Paul Hildebrandt GmbH

- Honeywell International Inc.

- IDEC Corporation

- Keyence Corporation

- Mitsubishi Electric Corporation

- OMRON Corporation

- Phoenix Contact GmbH & Co. KG

- Pilz GmbH & Co. KG

- Rockford Systems, LLC

- Rockwell Automation, Inc.

- Sanocs Engineering Private Limited

- Schneider Electric SE

- SGS Société Générale de Surveillance SA

- Sick AG

- Siemens Aktiengesellschaft

Empowering Organizational Excellence With Actionable Strategies to Enhance Compliance, Drive Innovation, and Mitigate Operational Risks in Safety Management

To thrive in this dynamic environment, industry leaders must adopt a multi-faceted strategy that balances immediate compliance requirements with long-term innovation goals. First, organizations should incorporate digital twin technology to model safety scenarios, validate control logic changes, and simulate emergency stop sequences before deployment. This approach minimizes on-site testing disruptions and enhances confidence in safeguarding performance. Additionally, providing comprehensive workforce training-covering both technical maintenance procedures and safety culture best practices-ensures personnel understand the rationale behind protective measures and can identify anomalies promptly.

Next, enterprises should embrace modular safety architectures that allow scaled expansion. Investing in configurable safety controllers and relays with plug-and-play sensor interfaces enables rapid reconfiguration for product changeovers and line extensions. Concurrently, integrating cybersecurity protocols into safety networks protects against unauthorized access, safeguarding both data integrity and physical protection mechanisms. By establishing cross-functional teams that unite operations, IT, engineering, and compliance functions, companies can foster a holistic view of risk and maintain agility in adapting safety systems to new threats.

Finally, implementing key performance indicators for machine safety-such as incident response times, mean time to repair, and near-miss reporting rates-provides transparent metrics for continuous improvement. Organizations that leverage these insights to drive iterative enhancements will better manage operational risks, reduce downtime, and elevate overall productivity, positioning themselves at the forefront of next-generation safety management.

Detailing Comprehensive Research Methodology Framework Ensuring Data Integrity Through Rigorous Secondary and Primary Analysis Processes

This analysis draws upon a rigorous research framework designed to ensure data integrity, relevance, and comprehensiveness. The secondary research phase encompassed a systematic review of global regulatory publications, technical standards documentation, industry association reports, and peer-reviewed journals. Trade data, tariff schedules, and government advisories were evaluated to assess the impact of recent policy shifts, while technology white papers and vendor datasheets illuminated evolving solution capabilities.

Primary research involved in-depth interviews with senior executives, safety engineers, and procurement leaders from leading manufacturing, processing, and energy companies. Through structured questionnaires and guided discussions, the study captured firsthand perspectives on implementation challenges, investment priorities, and lessons learned from recent safety initiatives. This qualitative input was complemented by a targeted survey of safety integration specialists to quantify adoption trends and operational metrics across diverse end-use segments.

Data triangulation techniques were applied to reconcile findings from secondary and primary sources, ensuring robustness through cross-validation. Experts in regulatory affairs and industrial automation peer-reviewed the insights, contributing feedback to refine key themes and verify technical accuracy. This mixed-methods approach yields a balanced, actionable set of conclusions grounded in empirical evidence and practical experience, providing stakeholders with a trustworthy foundation for strategic decision-making.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Machine Safety market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Machine Safety Market, by Component

- Machine Safety Market, by Safety Functionality

- Machine Safety Market, by Connectivity

- Machine Safety Market, by Installation Type

- Machine Safety Market, by End Use Industry

- Machine Safety Market, by Region

- Machine Safety Market, by Group

- Machine Safety Market, by Country

- United States Machine Safety Market

- China Machine Safety Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1749 ]

Synthesizing Key Findings to Reinforce the Imperative of Proactive Machine Safety Investment in an Evolving Industrial Landscape

As industrial ecosystems become more interconnected and automated, the importance of robust machine safety frameworks has never been greater. The synthesis of digital transformation, rising tariff pressures, and evolving segmentation dynamics underscores that safety is an enterprise-wide priority-one that demands collaboration across functions, geographies, and technology domains. By aligning strategic investments in digital resilience, modular architectures, and workforce competence, organizations can convert safety from a regulatory obligation into a competitive differentiator.

This study highlights the critical role of scenario-based planning in anticipating the ripple effects of trade measures and supply chain disruptions. It also emphasizes the value of granular segmentation analysis as a tool for tailoring protective solutions to specific operational contexts. Regional insights demonstrate that success hinges on blending global best practices with local expertise, while a clear understanding of vendor capabilities enables informed partnership selection.

Ultimately, proactive machine safety investment drives tangible benefits: lower incident rates, reduced unplanned downtime, and enhanced operational efficiency. As industry leaders embrace data-driven approaches and continuous improvement, they will both safeguard human capital and unlock the full potential of next-generation automation.

Engage With Our Expert for Tailored Insights and Secure Competitive Advantage by Acquiring the Comprehensive Machine Safety Market Research Report

For a more detailed exploration of these insights, tailored consulting support, and to secure your organization’s leadership in machine safety, reach out to Ketan Rohom, Associate Director of Sales & Marketing. Partner with our expert to access the comprehensive report, gain direct guidance on implementation strategies, and initiate a transformative safety journey that aligns risk management with your broader operational goals. Take the first step toward elevating your machine safety framework and unlocking actionable intelligence by getting in touch today.

- How big is the Machine Safety Market?

- What is the Machine Safety Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?