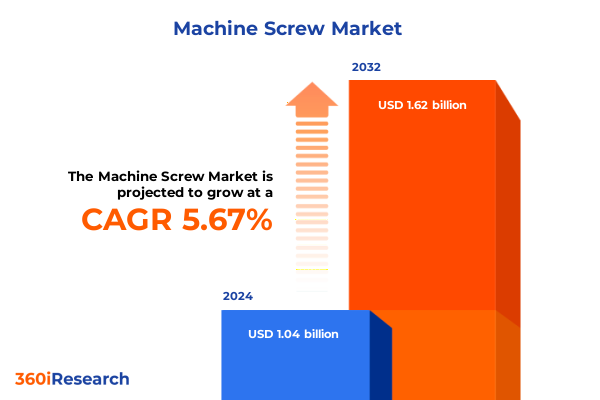

The Machine Screw Market size was estimated at USD 1.09 billion in 2025 and expected to reach USD 1.16 billion in 2026, at a CAGR of 5.83% to reach USD 1.62 billion by 2032.

Unearthing the Fundamental Role of Machine Screws in Ensuring Accurate, Reliable, and Efficient Mechanical Assembly Across Diverse Industrial Applications

A machine screw is defined as a small fastener, typically less than a quarter inch in diameter, featuring a recessed drive type to allow for precise torque application with a screwdriver. These components are fully threaded along their shank and are designed to engage with a pre-formed internal thread in either a nut or a tapped hole, ensuring secure mechanical assembly through stretching and clamp load generation

The manufacturing of machine screws involves three critical stages: heading, which shapes the screw head through cold forging; thread rolling, which forms the helical grooves under high pressure; and final coating applications such as electroplating or black oxide treatments to enhance corrosion resistance and surface finish

Machine screws serve as foundational components across industries ranging from electronics and automotive to industrial machinery and construction. Their ability to withstand vibration, maintain clamp load, and deliver repeatable torque performance underscores their role as indispensable elements in precision manufacturing settings

Transformative Shifts in the Machine Screw Landscape Propelled by Digitalization, Materials Innovation, and Supply Chain Resilience

The rise of Industry 4.0 has instigated a profound transformation in the machine screw landscape, with manufacturers integrating smart logistics systems that leverage Internet of Things (IoT) connectivity to boost transparency and efficiency. Solutions like Smart Factory Logistics employ weight-sensing bins and real-time data platforms to automate replenishment processes and eliminate stockouts, driving measurable reductions in procurement costs and administrative overhead

Concurrently, digital assembly platforms, often referred to as Smart Factory Assembly, guide operators through standardized processes using interactive work instructions. These platforms automatically record torque data and operator inputs, enabling full traceability and continuous process optimization, which significantly shortens training cycles and enhances product consistency

Material innovation and customization have also emerged as pivotal trends. Automotive-grade screws are now engineered to support motor downsizing and weight reduction targets, while bolt and screw manufacturers offer digital configurators to design bespoke fasteners tailored to specific application constraints. This convergence of advanced materials expertise and customer-centric digital tools is elevating performance standards across end use sectors

Supply chain resilience is being redefined as companies diversify sourcing strategies and strengthen domestic procurement channels. Firms with vertically integrated supply chains or those that partner closely with local distributors are better positioned to buffer price volatility and navigate geopolitical disruptions, underscoring the critical importance of supply network agility in today’s environment

Understanding the Cumulative Impact of Expanded 2025 US Steel and Aluminum Tariffs on Machine Screw Production Costs and Supply Chain Dynamics

Effective March 12, 2025, the U.S. government implemented a uniform 25% tariff on all imported steel and aluminum products under Section 232, extending coverage to derivative articles such as machine screws. This policy change removed prior exemptions and halted the renewal of product-specific exclusions, fundamentally altering the cost structure for firms reliant on foreign metal components

The blanket tariff applies to any screw manufactured from imported steel or aluminum unless the metal was melted, poured, smelted, and cast domestically. Furthermore, aluminum imports from Russia incurred an extraordinary 200% duty, while General Approved Exclusions were terminated on March 12, increasing administrative complexity for importers of specialized fasteners

Domestic manufacturers sourcing raw materials from U.S.-based distributors have largely shielded their operations from these levies. For instance, precision fastener producers serving medical, electronics, and security sectors report negligible impact on input costs due to their reliance on domestic supply chains and strong local training ecosystems

Import-dependent firms have faced significant cost inflation, with tariffs raising the landed cost of a typical 10-cent screw to approximately 17 cents. As a result, many have shifted procurement to alternative low-cost regions such as Taiwan or accelerated investments in domestic production capabilities to mitigate long-term exposure to international trade tensions

Unlocking Key Segmentation Insights Across Strength Grades, Thread Types, Length Ranges, Applications, Drive Types, Industries, Materials, Head Types, and Finishes

Insights across strength grade segmentation reveal that high-strength classes such as Grade 12.9 are increasingly specified for applications demanding maximum load-bearing capacity and fatigue resistance, while medium grades like 10.9 and 8.8 continue to address general industrial assembly needs at competitive cost points.

Within thread type segmentation, fully threaded screws dominate scenarios that require uniform engagement and torque distribution along the entire shank, whereas partial thread variants are selected for applications where clamping force control and shear load considerations are prioritized.

Length range segmentation reflects the customization of short screws under 20 mm for compact electronic assemblies, mid-length variants between 20 mm and 50 mm for automotive and machinery subassemblies, and longer screws exceeding 50 mm for structural fastening in construction and heavy equipment.

Application segmentation shows that metalwork environments rely on durable steel and alloy screws, plastic assembly leverages corrosion-resistant and low-torque materials, and woodwork demands specialized coatings and head geometries to minimize surface damage while ensuring secure seating.

Analysis of drive type preferences indicates a clear shift towards hex socket and Torx drives for higher torque requirements and improved cam-out resistance, though traditional Phillips and slotted drives remain prevalent in maintenance and repair contexts.

End use industry segmentation underscores the critical role of machine screws in aerospace ecosystems-spanning commercial and military domains-demanding rigorous certification and traceability. Automotive sectors, including commercial, electric, and light vehicles, increasingly adopt high-performance fasteners, while construction applications differentiate between commercial and residential projects. The electronics industry balances consumer and industrial segments, and manufacturing embraces both aftermarket and OEM sources. Marine engagements in commercial and recreational vessels prioritize corrosion resistance and specialized sealing features.

Material segmentation highlights the prominence of alloy and carbon steels in standard applications, with nickel alloys and titanium gaining traction for high-temperature and corrosion-critical environments. Stainless steel varieties, from austenitic through martensitic grades, offer tailored corrosion resistance, while brass serves niche electrical and aesthetic functions.

Head type segmentation demonstrates the continued use of flat and pan heads for flush installations and surface finishing, with hex, oval, and round heads addressing assembly ergonomics and torque tool compatibility.

Finish segmentation reveals that protective coatings such as zinc plating and black oxide remain staples for corrosion mitigation, whereas chrome and nickel plating address both functional and decorative requirements, and hot-dip galvanizing provides robust environmental resilience.

This comprehensive research report categorizes the Machine Screw market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Thread Type

- Strength Grade

- Length Range

- Drive Type

- Material

- Head Type

- Finish

- Application

- End Use Industry

Key Regional Insights Revealing How the Americas, Europe Middle East & Africa, and Asia-Pacific Are Shaping Machine Screw Market Dynamics

In North America, the machine screw market is anchored by a diverse industrial base encompassing automotive, aerospace, electronics, and construction sectors. The United States led the regional market with a projected CAGR of 5.5% between 2025 and 2030, driven by the presence of major automotive and aerospace OEMs and a mature network of C-parts distribution. Canada’s market growth is propelled by government investments in infrastructure and energy, while Mexico’s manufacturing expansion is underpinned by nearshoring trends and trade agreements boosting light vehicle and electronics assembly

Europe, Middle East & Africa exhibits heterogeneous dynamics. In Europe, market size continues to grow steadily with a focus on specialized fasteners for automotive, industrial machinery, and renewable energy projects, supported by stringent safety and quality standards. The Middle East and Africa region benefits from substantial infrastructure investments in oil and gas, transportation, and urban development. Saudi Arabia’s Vision 2030 initiatives and diversified manufacturing policies in the UAE and Turkey are catalyzing demand for both standard and high-performance screws across commercial and industrial applications

Asia-Pacific remains the fastest-growing region, underpinned by robust manufacturing hubs in China, India, Japan, and Southeast Asia. China’s dominance stems from its extensive automotive production, electronics assembly, and infrastructure development projects. India’s “Make in India” strategy and smart city initiatives are fueling strong demand across automotive, construction, and electronics verticals. Japan’s focus on precision engineering and high-end electronics drives requirements for specialized and miniaturized screw solutions, while emerging Southeast Asian economies are rapidly scaling up their manufacturing capabilities through competitive labor costs and supportive government policies

This comprehensive research report examines key regions that drive the evolution of the Machine Screw market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Key Company Strategies and Innovations From Leading Machine Screw Manufacturers Driving Efficiency Quality and Digital Transformation

Bossard has distinguished itself through the deployment of Smart Factory Logistics and Assembly solutions, seamlessly integrating IoT-enabled bins and ARIMS software to automate C-part replenishment and capture real-time assembly data. This holistic approach reduces procurement costs by up to 70% and enhances quality traceability for global manufacturers

LISI Group leverages in-house mastery of tooling, cold forging, wire drawing, and heat treatment to produce over ten million screws daily for demanding automotive and aerospace clients. Their deep materials expertise and process control enable optimized mechanical properties and weight reduction in vehicle subsystems, aligning with electrification and efficiency targets

Bulten differentiates with a user-centric digital design environment called Joint Master, allowing customers to tailor fastener specifications and download 3D models instantly. This on-demand configurator enhances collaboration, accelerates engineering workflows, and addresses bespoke requirements without lengthy lead times

Leading North American players such as Illinois Tool Works, Stanley Black & Decker, Arconic, Fastenal, and MSC Industrial Supply continue to shape the market through broad distribution networks, value-added services, and strategic partnerships. Their collective emphasis on inventory management solutions, technical support, and digital platforms ensures reliable access to critical C-parts for manufacturers across sectors

This comprehensive research report delivers an in-depth overview of the principal market players in the Machine Screw market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Adolf Würth GmbH & Co. KG

- American Bolt & Screw Co., Inc.

- Bossard Holding AG

- Bulten AB

- Fastenal Company

- Groupe LISI

- Hilti Aktiengesellschaft

- Illinois Tool Works Inc.

- KD Fasteners

- MW Components

- Screws Industries Inc.

- SFS Group AG

- Stanley Black & Decker, Inc.

- TR Fastenings Limited

- US Micro Screw Inc.

Actionable Recommendations to Navigate Machine Screw Industry Challenges Optimize Operations and Enhance Supply Chain Resilience

Industry leaders should prioritize the deployment of intelligent logistics and digital assembly platforms to drive operational excellence. Investing in IoT-enabled inventory systems and real-time data analytics can minimize stock disruptions, improve traceability, and reduce procurement costs. Simultaneously, engineering teams ought to evaluate alternative materials and coating technologies to satisfy evolving requirements for strength, weight, and environmental resilience.

Supply chain continuity plans must incorporate diversified sourcing strategies, balancing domestic production expansion with strategic partnerships in low-cost regions. Engaging with distribution partners on joint risk management, such as forward buying and supplier consolidation, can hedge against future tariff fluctuations and market volatility.

Collaborating with fastener providers on co-development initiatives and leveraging digital configurators will accelerate time-to-market for custom solutions. Finally, embedding sustainability criteria within procurement and design processes-such as life cycle assessments and low-carbon sourcing-will align machine screw strategies with corporate ESG objectives and regulatory expectations.

Transparent Research Methodology Detailing Data Sources Analytical Techniques and Validation Processes for Machine Screw Market Insights

The research methodology underpinning these insights combines rigorous secondary and primary data collection. Analysts conducted an exhaustive review of government publications, trade associations, industry journals, and policy notices to establish the macroeconomic and regulatory framework.

To validate and enrich secondary findings, over fifty in-depth interviews were performed with supply chain executives, production managers, engineering leads, and distribution partners across key regions. Quantitative data was triangulated using multiple proprietary and public databases to ensure consistency and accuracy in segmentation analyses.

Advanced analytical techniques, including scenario mapping for tariff impacts and thematic coding for qualitative inputs, were employed to uncover both macro trends and operational best practices. Data integrity was maintained through iterative cross-checks, expert reviews, and continuous alignment with primary stakeholders’ feedback.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Machine Screw market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Machine Screw Market, by Thread Type

- Machine Screw Market, by Strength Grade

- Machine Screw Market, by Length Range

- Machine Screw Market, by Drive Type

- Machine Screw Market, by Material

- Machine Screw Market, by Head Type

- Machine Screw Market, by Finish

- Machine Screw Market, by Application

- Machine Screw Market, by End Use Industry

- Machine Screw Market, by Region

- Machine Screw Market, by Group

- Machine Screw Market, by Country

- United States Machine Screw Market

- China Machine Screw Market

- Competitive Landscape

- List of Figures [Total: 21]

- List of Tables [Total: 2862 ]

Conclusion Summarizing the Core Insights and Strategic Imperatives Underpinning the Machine Screw Market Outlook and Growth Drivers

The machine screw market is undergoing a period of rapid evolution driven by digital transformation, material innovation, and shifting trade policies. Industry 4.0 deployments in inventory automation and digital assembly guidance are setting new benchmarks for quality and efficiency. Concurrently, high-strength material grades and advanced coatings are expanding the performance envelope for critical applications.

The imposition of expanded 2025 U.S. tariffs has underscored the importance of supply chain resilience, prompting a recalibration of sourcing strategies and domestic production investments. Regional dynamics vary significantly, with Asia-Pacific leading growth, Europe balancing regulatory rigor with innovation, and the Americas leveraging legacy infrastructure alongside nearshoring trends.

Key players are differentiating through technological integration, digital solutions, and collaborative product design tools. Moving forward, embedding sustainability criteria, optimizing digital workflows, and strategically navigating geopolitical shifts will define the competitive landscape and unlock new opportunities.

Explore Our Comprehensive Machine Screw Report and Connect With Ketan Rohom for Tailored Insights and Strategic Guidance to Propel Your Business

Engaging with experts is critical for unlocking the full potential of machine screw insights and leveraging them for strategic advantage. Ketan Rohom, Associate Director of Sales & Marketing, possesses a deep understanding of industry drivers, customer needs, and emerging trends. By initiating a conversation, organizations can gain tailored recommendations on product portfolios, supply chain optimization, and technological investments that align precisely with their business objectives.

Purchasing the comprehensive market research report opens access to exclusive data analyses, detailed case studies, and forward-looking perspectives that go beyond high-level overviews. This in-depth resource supports informed decision-making across functions, from engineering and procurement to operations and strategic planning. Reach out to Ketan today to schedule a personalized briefing, explore bespoke consulting options, and secure the insights required to stay ahead of the competition and drive sustainable growth.

- How big is the Machine Screw Market?

- What is the Machine Screw Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?