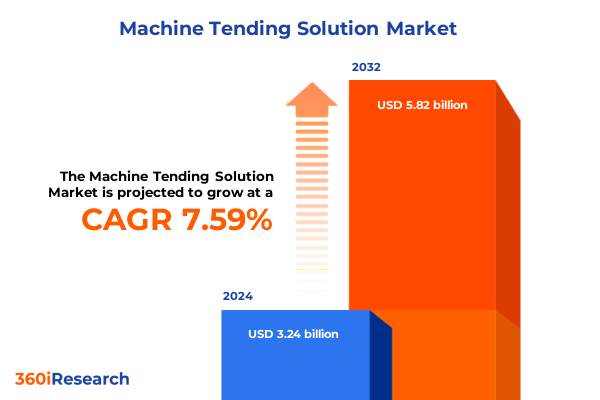

The Machine Tending Solution Market size was estimated at USD 3.46 billion in 2025 and expected to reach USD 3.73 billion in 2026, at a CAGR of 7.70% to reach USD 5.82 billion by 2032.

Setting the Stage for Revolutionary Machine Tending in the Age of Intelligent Manufacturing and Industry 4.0 Transformation Enabling Unprecedented Efficiency and Precision

The rapid convergence of advanced automation technologies and lean manufacturing philosophies has ushered in a new era for machine tending operations. Traditional approaches that relied heavily on manual interventions are giving way to intelligent, adaptive robotic systems that streamline production workflows and minimize human risk exposure. In this context, machine tending-once considered a peripheral automation task-has become central to driving operational agility and cost containment. As manufacturers across diverse industries seek to optimize throughput, reduce cycle times, and maintain consistent product quality, the deployment of machine tending solutions is transitioning from pilot projects to enterprise-wide initiatives.

At the heart of this transformation lies the integration of sensors, machine vision, and data analytics into robotic platforms, empowering real-time decision-making and predictive maintenance. This fusion of hardware and software capabilities supports dynamic task allocation, enabling robots to adapt to fluctuating production volumes and part variations without extensive reprogramming. Consequently, companies are witnessing stronger returns on automation investments as downtime is reduced and throughput gains are sustained. Moreover, as workforce demographics shift and skilled labor shortages intensify, the adoption of machines that can safely collaborate with human operators addresses talent constraints while enhancing workplace safety and ergonomics.

Furthermore, sustainability objectives and regulatory pressures are reinforcing the value proposition of machine tending automation. By optimizing energy consumption through intelligent cycle control and reducing material waste via precise handling, manufacturers can align productivity goals with environmental commitments. This introduction sets the stage for a comprehensive exploration of the market dynamics, technological enablers, and strategic levers that will redefine machine tending capabilities in the decade ahead.

Unveiling the Confluence of Digitalization Connectivity and Adaptive Intelligence That Is Redefining Machine Tending Workflows Across Modern Factories

The manufacturing ecosystem is undergoing transformative shifts as digitalization, connectivity, and artificial intelligence converge to reshape traditional production paradigms. Industry 4.0 principles are now foundational rather than aspirational, driving investments in networked robots that communicate seamlessly with enterprise resource planning systems and the industrial internet of things. This interconnected architecture allows machine tending solutions to operate as collaborative nodes within the broader factory fabric, dynamically allocating tasks, reporting status updates, and initiating corrective actions with minimal human supervision.

Simultaneously, the rise of smart factories has elevated the role of simulation and digital twin technologies. Manufacturers can now create virtual replicas of production cells, including robotic machine tending workflows, to test new configurations, validate cycle times, and identify potential bottlenecks before physical deployment. This proactive approach minimizes implementation risks and accelerates time-to-value, as insights from digital simulations inform hardware selection, end effector design, and cell layout optimization. In turn, the agility afforded by virtual commissioning encourages experimentation with advanced applications like adaptive fixturing and robot swarming.

Moreover, labor dynamics and talent expectations are catalyzing automation adoption. As seasoned machine operators retire and younger engineers gravitate toward software-driven roles, the skills gap widens. Organizations are responding by deploying intuitive programming interfaces, including vision-guidance systems and teach-pendant software, that democratize robot configuration and reduce reliance on specialized integrators. Consequently, machine tending solutions are evolving into turnkey offerings that deliver plug-and-play functionality, enabling manufacturers to scale automation projects quickly and efficiently.

Examining the Cumulative Effects of 2025 United States Tariff Policies on Machine Tending Supply Chains Cost Structures and Sourcing Strategies

In 2025, the United States placed targeted tariffs on imported goods, particularly those incorporating advanced manufacturing technologies, in response to shifting geopolitical trade policies and domestic industrial revitalization efforts. These measures have directly impacted the cost structures of machine tending solutions, as key components such as precision actuators, high-resolution vision systems, and specialized robotic end-effectors are often sourced from global suppliers. The resulting price adjustments have prompted manufacturers to reassess supplier diversification strategies and to explore regional sourcing alternatives that buffer against tariff-induced volatility.

Consequently, domestic automation providers have accelerated localized production capabilities to mitigate tariff pressures and shore up supply chain resilience. By establishing assembly operations and strategic partnerships within the United States, these vendors are reducing lead times and insulating customers from cross-border cost shocks. Meanwhile, integrators are leveraging modular system architectures that allow for component interchangeability, enabling end users to substitute tariff-exposed parts with domestically produced equivalents without extensive redesign. This strategic flexibility has become a critical differentiator in an increasingly tariff-sensitive landscape.

Furthermore, manufacturers are recalibrating total cost of ownership evaluations to incorporate tariff liabilities and foreign exchange fluctuations. Procurement teams are collaborating more closely with finance functions to model scenario-based outcomes, ensuring that investments in machine tending solutions will yield predictable returns even under adverse trade conditions. As a result, the cumulative impact of 2025 tariff policies has catalyzed a shift toward more resilient, agile sourcing frameworks and has underscored the importance of supply-chain transparency in shaping automation roadmaps.

Revealing Key Segmentation Insights Illuminating How End User Industry Robot Type and Application Dynamics Drive Tailored Machine Tending Deployments

Analyzing market segmentation through the lens of end user industries reveals nuanced adoption trajectories and application priorities. In the automotive sector, assembly, material handling, and welding processes are increasingly automated to meet rigorous precision and throughput demands, with robots integrating force-sensing capabilities to optimize part alignment and torque control. Consumer goods producers focus on packaging and palletizing operations, leveraging delta and scara robots for high-speed handling of lightweight containers and flexible packaging formats. Electronics manufacturers deploy articulated six-axis robots for delicate PCB assembly and semiconductor handling, while testing stations employ vision-guided delta systems for rapid inspection. In medical and healthcare applications, assembly and packaging workflows benefit from clean-room-compatible scara robots, ensuring high levels of hygiene and repeatability. Metal and machinery producers utilize cartesian and articulated platforms for precision cutting and milling, prioritizing rigid frame designs that deliver stable force application under heavy payloads.

From a robot type perspective, articulated robots-available in both four-axis and six-axis configurations-dominate complex three-dimensional tasks that require full freedom of movement. Cartesian robots excel in linear part transfers and machine loading scenarios where high positional accuracy along orthogonal axes is paramount. Delta robots, celebrated for their speed and lightweight arms, are the go-to solution for high-throughput pick-and-place functions in packaging and assembly cells. Scara robots, offered in horizontal and vertical variants, bridge the gap between speed and payload capacity, often deployed in compact machine tending cells that demand both rapid cycle times and moderate lifting abilities.

Evaluating payload capacity segmentation underscores diverse solution profiles ranging from micro-tending tasks up to 10 kilograms to heavy-duty operations exceeding 100 kilograms. Machines with 10 to 50-kilogram capacities find widespread use in consumer goods packaging and light assembly, whereas 50 to 100-kilogram systems and above-100-kilogram platforms address material handling and machining applications that involve bulky fixtures or metal workpieces. In parallel, application-centric segmentation highlights the importance of specialized functions: robot-based assembly encompasses screw-driving and welding sub-routines that demand precise end-effector control; machine loading processes cover raw material and workpiece loading, necessitating adaptive gripping solutions; machine unloading focuses on finished product extraction; and part transfer duties-both inter-cell and intra-cell-require rapid, collision-free motion planning. Finally, automation level considerations distinguish fully automated cells, which operate with minimal human intervention, from semiautomated setups that rely on operator oversight for tasks such as part quality checks or minor adjustments.

This comprehensive research report categorizes the Machine Tending Solution market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Robot Type

- Payload Capacity

- Application

- Automation Level

- End User Industry

Uncovering Distinct Regional Strategies and Adoption Patterns That Shape the Evolution of Machine Tending Across Global Manufacturing Hubs

Geographically, the Americas region exhibits a strong proclivity for integrated automation solutions that align with stringent labor regulations and sustainability mandates. North American manufacturers gravitate toward turnkey machine tending cells with built-in safety features and energy-efficient drive systems, while Latin American operations prioritize flexible, cost-effective platforms that support mixed-model production runs and rapid changeovers. In the Europe, Middle East & Africa landscape, regulatory frameworks emphasizing worker safety and environmental compliance stimulate investments in advanced vision-guided robots and closed-loop control systems that enhance process monitoring. Manufacturers in Western Europe leverage modular automation suites to meet Just-In-Time delivery schedules, whereas Middle East entities focus on boosting localized assembly capabilities to reduce import dependencies. Asia-Pacific’s trajectory is defined by its high volume electronics and automotive factories that demand ultra-high-speed machine tending solutions, with local automation vendors collaborating closely with global technology providers to tailor robots for region-specific voltage and safety standards. In Southeast Asia, small and medium-sized enterprises are increasingly adopting semiautomated cell designs as an accessible entry point to Industry 4.0 practices. Across all regions, cross-border standardization efforts and interoperability frameworks are emerging to simplify deployment and maintenance of machine tending ecosystems at scale.

This comprehensive research report examines key regions that drive the evolution of the Machine Tending Solution market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Dissecting the Competitive Arena Where Global Robotics OEMs Specialized Integrators and Innovative Startups Contend for Machine Tending Leadership

The competitive landscape features tier-one robotics OEMs that offer end-to-end automation platforms, including integrated hardware, software, and service portfolios. These leading providers differentiate through the breadth of their solution ecosystems, encompassing everything from robot controllers to digital twins and cloud-based analytics. Complementing these giants are specialized integrators that excel in niche applications, leveraging deep vertical expertise to deliver turnkey machine tending cells tailored to industry-specific quality and compliance standards. Meanwhile, agile newcomers and technology startups contribute innovative capabilities such as machine learning-driven visual inspection, force adaptive grippers, and robot-as-a-service models that reduce capital expenditure barriers. Strategic partnerships between robotics manufacturers and software developers are surging, as the push toward open platforms encourages interoperability and reduces vendor lock-in. Furthermore, aftermarket service providers are carving out differentiated positions by offering predictive maintenance contracts and remote monitoring solutions, ensuring that installed fleets of machine tending robots maintain optimal uptime and performance over extended lifecycles.

This comprehensive research report delivers an in-depth overview of the principal market players in the Machine Tending Solution market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ABB Ltd.

- DMG Mori Co., Ltd.

- FANUC Corporation

- Haas Automation, Inc.

- Kawasaki Heavy Industries, Ltd.

- KUKA AG

- Mitsubishi Electric Corporation

- Nachi-Fujikoshi Corporation

- Omron Corporation

- Robotiq Inc.

- Schneider Electric SE

- Seiko Epson Corporation

- Siemens AG

- Standard Bots

- Stäubli International AG

- Universal Robots A/S

- Yaskawa Electric Corporation

Actionable Recommendations for Industry Leaders Emphasizing Modular Scalability Analytics Integration and Resilient Sourcing to Accelerate Automation Success

Industry leaders should prioritize the development of flexible, modular architectures that support rapid redeployment across multiple production cells and facilitate incremental capacity expansions. By investing in user-centric programming interfaces and collaborative robot designs, manufacturers can lower the barrier to automation adoption and engage cross-functional teams in continuous improvement initiatives. In parallel, supply chain resilience must be strengthened through dual sourcing strategies and strategic inventory positioning to mitigate the impacts of geopolitical disruptions and tariff fluctuations. Organizations are advised to cultivate partnerships with regional component suppliers and integrators to localize critical subassemblies and enhance aftersales service reach.

Equally important is the integration of advanced analytics and real-time monitoring capabilities within machine tending cells. Harnessing data streams from drives, sensors, and vision systems enables predictive maintenance workflows that preempt equipment failures and optimize scheduling. Leaders should also explore the potential of artificial intelligence-augmented quality inspections, using neural network‐based algorithms to detect anomalies at micron-level tolerances. Finally, cross-disciplinary talent development programs that blend mechanical, electrical, and software engineering proficiencies will be vital for sustaining innovation; such initiatives should encompass hands-on training, virtual simulation exercises, and certification pathways that validate multi‐skill competencies.

Outlining the Robust Methodological Framework Integrating Primary Interviews Secondary Literature Data Analytics and Rigorous Triangulation

This research synthesizes primary insights drawn from interviews with C-level executives, automation engineers, and procurement specialists across key manufacturing sectors in the Americas, Europe Middle East & Africa, and Asia-Pacific regions. Secondary sources include technical white papers, industry consortium publications, and peer-reviewed journals on robotics, industrial controls, and smart manufacturing. Market intelligence was augmented through analysis of patent filings, press releases, and vendor technical specifications.

Quantitative assessments were informed by anonymized deployment data from global system integrators, capturing volume trends in machine tending robot shipments, payload ranges, and application breakdowns. Qualitative evaluations leveraged case study reviews and benchmark comparisons of system performance metrics, encompassing cycle times, mean time between failures, and energy consumption per operational hour. All data points were cross-validated through triangulation, ensuring that insights reflect both emerging innovations and proven best practices. This methodological rigor supports the credibility and relevance of the strategic guidance offered throughout this report.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Machine Tending Solution market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Machine Tending Solution Market, by Robot Type

- Machine Tending Solution Market, by Payload Capacity

- Machine Tending Solution Market, by Application

- Machine Tending Solution Market, by Automation Level

- Machine Tending Solution Market, by End User Industry

- Machine Tending Solution Market, by Region

- Machine Tending Solution Market, by Group

- Machine Tending Solution Market, by Country

- United States Machine Tending Solution Market

- China Machine Tending Solution Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 2544 ]

Concluding Reflections on How Integrated Automation Strategies and Data-Driven Insights Will Elevate Machine Tending into a Cornerstone of Manufacturing Excellence

The convergence of advanced robotics, data analytics, and resilient supply chain strategies is charting a course toward highly adaptable machine tending ecosystems that will define competitive advantage in modern manufacturing. As tariff landscapes evolve and digitalization imperatives intensify, organizations poised to leverage modular automation architectures and AI-enhanced monitoring will outpace peers in both efficiency gains and cost management. Through strategic alignment of technology investments with workforce development and sourcing agility, manufacturers can unlock new levels of operational excellence while mitigating external uncertainties.

Ultimately, the path forward for machine tending lies in holistic integration-where collaborative robots communicate seamlessly with enterprise systems, where data-driven insights drive continuous optimization, and where flexible cell designs support rapid market shifts. By embracing these principles, decision-makers can transform machine tending from a point solution into a cornerstone capability that fortifies resilience, accelerates innovation, and sustains long-term growth.

Seize the Opportunity to Unlock Transformative Insights and Drive Strategic Growth with Personalized Access to Our Comprehensive Machine Tending Research

We invite forward-thinking leaders and innovators to explore the comprehensive depth and actionable insights contained within this definitive research report on the machine tending landscape. By engaging with Ketan Rohom, Associate Director of Sales & Marketing, you gain privileged access to a tailored walkthrough of the critical findings, granular segmentation analyses, and strategic recommendations designed to empower operational excellence and competitive differentiation. Reach out to discuss how this research can be customized to align with your organization’s unique growth trajectories and technology adoption plans. Elevate your decision-making with data-driven clarity and secure your competitive edge by acquiring the full report today

- How big is the Machine Tending Solution Market?

- What is the Machine Tending Solution Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?