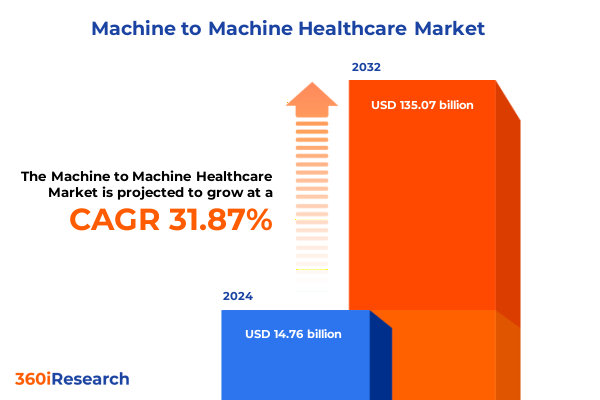

The Machine to Machine Healthcare Market size was estimated at USD 19.27 billion in 2025 and expected to reach USD 25.16 billion in 2026, at a CAGR of 32.07% to reach USD 135.07 billion by 2032.

Unlocking the Potential of Machine to Machine Healthcare Through an Overview of Connected Ecosystems and Emerging Digital Frameworks

Machine to Machine Healthcare represents a paradigm shift in how medical devices communicate, diagnose, and deliver patient care. By enabling direct data exchange between sensors, platforms, and healthcare management systems, M2M solutions facilitate continuous monitoring, predictive analytics, and automated responses that enhance clinical outcomes and operational efficiency. Emerging digital frameworks and standardized communication protocols now allow disparate devices-from bedside monitors to wearable sensors-to share real-time information seamlessly. This interconnected network creates a unified ecosystem in which data flows securely and efficiently, empowering clinicians to make informed decisions and patients to engage actively in their own wellness journey. Furthermore, regulatory bodies and healthcare organizations are embracing interoperability standards, fostering an environment of collaboration that transcends traditional care boundaries. As these foundations solidify, the industry stands at the threshold of a new era in which M2M Healthcare becomes the backbone of preventive medicine, chronic disease management, and emergency response workflows.

Exploring Pivotal Shifts Reshaping Machine to Machine Healthcare Through Telehealth Expansion and Advanced Data Analytics

The Machine to Machine Healthcare landscape is undergoing transformative shifts driven by rapid advancements in connectivity, sensor miniaturization, and data analytics. Telehealth expansion has accelerated demand for robust back-end systems capable of aggregating patient data from diverse endpoints, while artificial intelligence algorithms sift through continuous sensor feeds to detect anomalies before they escalate. Concurrently, the rollout of nationwide 5G networks unlocks lower latency and broader bandwidth, enabling high-resolution imaging scans and video consultations in real time. At the same time, the proliferation of edge computing architectures brings processing power closer to the data source, reducing reliance on centralized cloud infrastructure and enhancing system resilience. These developments, when combined with heightened cybersecurity measures and evolving interoperability standards, are reshaping clinical workflows-shifting from episodic, reactive interventions toward proactive, continuous care models that keep patients healthier and hospital systems more efficient.

Assessing the Cumulative Effects of New United States Tariffs on Medical Device Supply Chains and Production Strategies

The imposition of new U.S. tariffs in 2025 on electronic components, sensors, and telecommunications modules has introduced complexity into global medical device supply chains. Manufacturers reliant on imported semiconductor chips, radio frequency modules, and specialized sensors have faced increased production costs, driving them to reevaluate sourcing strategies and supplier diversification. In response, contract manufacturers have begun nearshoring critical assembly processes to mitigate duty burdens and to shorten lead-times. Furthermore, device OEMs are renegotiating long-term agreements with tier-one suppliers to secure tariff-protected quotas and preferential rates while investing in design modifications that reduce component content and exploit alternative materials. Simultaneously, compliance frameworks have been updated to provide clear guidance on classification and valuation disputes, minimizing the risk of retroactive assessments. These shifts collectively underscore the need for strategic agility in navigating trade policy dynamics while maintaining supply chain continuity and cost containment.

Integrated Insights from Device Types to Deployment Architectures Revealing Key Drivers in Connected Medical Solutions

A detailed segmentation analysis reveals nuanced performance drivers across multiple dimensions of the Machine to Machine Healthcare market. When devices are categorized by type, connected imaging solutions such as MRI scanners, ultrasound machines, and X-ray systems demonstrate significant demand for high-speed data transfer and remote diagnostics capabilities; this contrasts with the rapid growth in home diagnostic tools like blood pressure monitors, glucometers, and pulse oximeters, which emphasize user-friendly interfaces and low-power wireless connectivity. Implantable devices, including continuous glucose monitors, neurostimulators, and pacemakers, demand robust security protocols and ultra-low-latency networks to ensure patient safety, whereas wearables such as fitness trackers, smart patches, and smartwatches prioritize battery life and multi-modal sensor fusion. Across clinical applications, chronic care management solutions leverage integrated health coaching platforms and medication adherence systems to drive longitudinal patient engagement, while emergency response deployments utilize alert systems and incident management dashboards to accelerate care delivery in critical situations. In inpatient monitoring environments, high-resolution data streams from ICU monitoring stations and vital signs monitoring modules feed centralized analytics engines that support real-time clinical decision support, whereas remote patient monitoring setups combine sensor data analytics with video consultation tools to extend the reach of specialist expertise beyond hospital walls. Connectivity technologies further differentiate solutions: Bluetooth Low Energy excels in short-range personal area networks, classic Bluetooth supports audio and file transfer use cases, and cellular networks-particularly 5G-enable wide-area coverage for mobile health units. Satellite communications, via geostationary and low earth orbit platforms, fill connectivity gaps in rural regions, while Wi-Fi 5 and Wi-Fi 6 deliver high throughput in dense hospital environments. End user segmentation underscores distinct adoption patterns; ambulatory surgery centers and diagnostic clinics prioritize flexible deployment models and minimal on-premises infrastructure, whereas assisted living facilities and nursing homes focus on turnkey remote monitoring kits with straightforward management portals. Agency-based and independent home healthcare providers demand solutions optimized for rapid setup and user training, and private and public hospitals require enterprise-grade security and integration with electronic health record systems. Finally, deployment models vary by organizational maturity, with private cloud architectures favored for scalable, multi-tenant environments and dedicated on-premises servers retained for highly regulated applications subject to stringent data residency requirements.

This comprehensive research report categorizes the Machine to Machine Healthcare market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Device Type

- Application

- Connectivity Technology

- End User

- Deployment Model

Analysis of Regional Variations Driving Adoption Patterns and Infrastructure Strategies Across Global Healthcare Markets

Regional dynamics in the Machine to Machine Healthcare arena exhibit pronounced variation shaped by local infrastructure, regulatory frameworks, and reimbursement models. In the Americas, robust investments in digital health initiatives and widespread 4G and 5G network availability enable extensive remote patient monitoring trials, particularly in rural regions underserved by traditional care facilities. Healthcare providers across North and South America are piloting cross-border telehealth platforms that integrate sensor data analytics with bilingual video consultation interfaces, reflecting the region’s linguistic diversity and need for scalable care delivery. Meanwhile, in Europe, Middle East, and Africa, stringent data protection regulations, including GDPR and national privacy statutes, necessitate compliance-centric M2M deployments with end-to-end encryption and anonymized analytics. European Union funding programs support multi-country interoperability pilots, while Middle Eastern nations invest heavily in smart hospital infrastructures. In Africa, satellite connectivity projects bridge gaps in regions lacking terrestrial networks, fostering remote diagnostics and emergency response services in off-grid communities. Across Asia-Pacific, governments are spearheading smart city and digital health mandates, fueling adoption of IoT-enabled wearables and home diagnostics portals. Rapid urbanization in East Asia drives demand for connected imaging centers equipped with edge computing capabilities, while Southeast Asian markets emphasize low-cost sensor arrays and cloud integration to meet budgetary constraints and to address burgeoning chronic disease incidence.

This comprehensive research report examines key regions that drive the evolution of the Machine to Machine Healthcare market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Strategic Partnerships and Technological Innovations Defining Leadership in the Machine to Machine Healthcare Ecosystem

An examination of leading organizations highlights strategic imperatives shaping the competitive landscape of Machine to Machine Healthcare. Medtronic has deepened its collaborations with telecom carriers to launch private 5G networks within hospital campuses, ensuring low-latency links for critical implantable device management. GE Healthcare has integrated advanced AI-driven image reconstruction algorithms into its connected MRI and CT scanners, reducing scan times and streamlining radiologist workflows. Philips has expanded its chronic care management portfolio with end-to-end platforms that unify wearable sensor data and telecoaching modules into a single user experience. Cisco continues to build out its healthcare networking suite, combining secure Wi-Fi 6 access points with edge computing appliances that run analytics near the point of care. Qualcomm has invested heavily in energy-efficient chipsets for wearables and home diagnostics, collaborating with OEMs to embed optimized cellular modems that extend battery lifespan. Collectively, these companies are forging partnerships and licensing agreements that emphasize interoperability, data security, and cloud-native architectures, underscoring the importance of open ecosystems and developer communities in driving long-term market growth.

This comprehensive research report delivers an in-depth overview of the principal market players in the Machine to Machine Healthcare market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Amazon Web Services, Inc.

- AT&T Inc.

- Deutsche Telekom Aktiengesellschaft

- Google LLC

- Microsoft Corporation

- NTT DOCOMO, Inc.

- Orange S.A.

- Telefónica S.A.

- Verizon Communications Inc.

- Vodafone Group Plc

Actionable Strategies for Stakeholders to Enhance Interoperability, Security, and Edge Computing in Healthcare Connectivity

Industry participants must adopt a multifaceted strategy to secure a competitive edge in the evolving connected healthcare environment. First, prioritizing interoperability by embracing open standards and certification programs will facilitate seamless integration among device manufacturers, software vendors, and health information systems. Concurrently, allocating resources to strengthen cybersecurity defenses-through secure boot processes, end-to-end encryption, and real-time threat detection-will address growing concerns around patient data integrity and compliance. Moreover, investing in distributed computing architectures at the network edge will reduce latency, support offline analytics, and enable mission-critical applications such as remote surgery assistance. Forming strategic alliances with telecommunications carriers and satellite operators can unlock new service models for rural and mobile health units. In parallel, engaging early with regulatory authorities to align on device classification, clinical validation requirements, and tariff mitigation strategies will minimize market entry barriers. Finally, cultivating a data-driven culture by deploying advanced analytics and machine learning frameworks will empower healthcare organizations to translate continuous device data into actionable insights, enhancing patient outcomes and operational efficiency.

Comprehensive Methodology Integrating Secondary Research, Executive Insights, and Rigorous Data Analysis Frameworks

Our research draws upon a rigorous methodology combining comprehensive secondary research, expert interviews, and structured data analysis. Initially, an extensive review of peer-reviewed publications, industry white papers, and regulatory filings established a foundational understanding of technology roadmaps, standards frameworks, and policy developments influencing connected medical devices. This was complemented by qualitative interviews with senior executives, clinical informaticists, and telehealth program directors who provided firsthand perspectives on deployment challenges, procurement criteria, and user experience priorities. Quantitative data sets-sourced from proprietary patent databases, trade association reports, and global ICT connectivity statistics-were systematically triangulated to validate adoption trends, technology performance benchmarks, and supply chain dynamics. Analytical frameworks, including SWOT assessments and Porter’s Five Forces analysis, were applied to evaluate competitive positioning, regulatory risk, and market entry barriers. Throughout the process, iterative feedback loops with subject matter experts ensured alignment with evolving standards and real-world implementation scenarios.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Machine to Machine Healthcare market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Machine to Machine Healthcare Market, by Device Type

- Machine to Machine Healthcare Market, by Application

- Machine to Machine Healthcare Market, by Connectivity Technology

- Machine to Machine Healthcare Market, by End User

- Machine to Machine Healthcare Market, by Deployment Model

- Machine to Machine Healthcare Market, by Region

- Machine to Machine Healthcare Market, by Group

- Machine to Machine Healthcare Market, by Country

- United States Machine to Machine Healthcare Market

- China Machine to Machine Healthcare Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 3816 ]

Concluding Insights Underscoring the Imperative of Secure, Scalable, and Interoperable Connected Healthcare Solutions to Drive Clinical Excellence and Efficiency

Machine to Machine Healthcare is rapidly redefining the contours of clinical practice and patient engagement by leveraging connected devices, advanced connectivity, and intelligent analytics. The maturation of interoperability standards, coupled with the expansion of high-speed wireless networks, is enabling real-time monitoring and personalized care beyond the walls of traditional healthcare facilities. Meanwhile, evolving tariff policies and shifting supply chain dynamics underscore the need for strategic agility and cross-sector collaboration. By synthesizing insights across device types, applications, connectivity technologies, regional markets, and deployment models, stakeholders can identify high-impact opportunities and mitigate emerging risks. Ultimately, organizations that invest in secure, scalable, and interoperable M2M solutions will be best positioned to deliver enhanced clinical outcomes, operational efficiencies, and patient satisfaction in an increasingly digital healthcare ecosystem.

Take the Next Step Toward Comprehensive Insights in Connected Healthcare by Partnering with Ketan Rohom for Exclusive Report Access

If you are seeking to stay ahead of the curve and harness the power of connected medical technologies, our comprehensive market research report offers the insights and analysis you need to drive strategic decision-making. To explore the full spectrum of trends, drivers, and actionable strategies within the Machine to Machine Healthcare landscape, connect directly with Ketan Rohom, Associate Director of Sales & Marketing at 360iResearch. Engage with an expert dedicated to understanding your organization’s unique challenges and objectives, and secure access to proprietary data and in-depth examinations of device ecosystems, regulatory influences, and competitive dynamics. Reach out today to arrange a personalized briefing, receive a detailed proposal, and embark on a journey to unlock unparalleled growth and innovation in the rapidly evolving world of medical connectivity.

- How big is the Machine to Machine Healthcare Market?

- What is the Machine to Machine Healthcare Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?