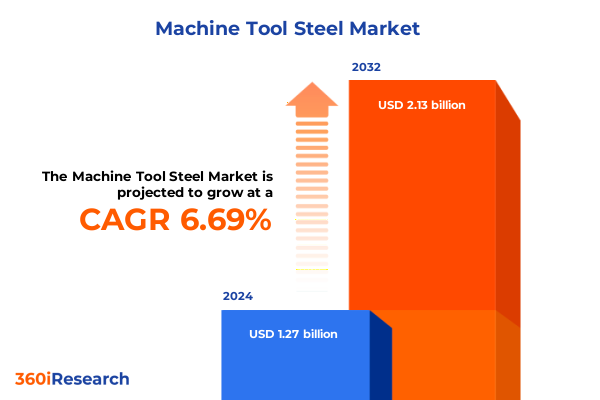

The Machine Tool Steel Market size was estimated at USD 1.35 billion in 2025 and expected to reach USD 1.43 billion in 2026, at a CAGR of 6.76% to reach USD 2.13 billion by 2032.

Laying the Groundwork for Comprehensive Machine Tool Steel Market Analysis: Context Objectives and Analytical Framework Explained

The machine tool steel sector underpins the precision machining operations that are essential for modern manufacturing across diverse end markets. This report begins by outlining the landscape’s foundational themes, framing the historical context of material development alongside current pressures from globalization, regulatory shifts, and evolving performance demands. By clarifying the study’s objectives, scope, and analytical framework, readers are equipped to understand the breadth of topics covered and the rationale behind the methodological approach.

Introduced here are the key research questions guiding the analysis: how emerging production technologies are reshaping supply chains, in what ways tariff policies are influencing strategic sourcing decisions, and which application segments are driving future innovation. This introduction details the report’s structure, highlights integration of primary interviews with leading manufacturers, and explains the blend of quantitative data and qualitative expert perspectives used throughout. By establishing these elements up front, the study ensures clarity of purpose and transparency in how insights have been derived, setting the stage for deeper exploration in subsequent sections.

Uncovering the Transformational Forces Redefining the Future Trajectory of Machine Tool Steel Industry Dynamics

The machine tool steel industry is experiencing transformative shifts driven by rapid technological advancement and changing end-user requirements. First, the integration of additive manufacturing processes with traditional metallurgical techniques has accelerated the development of novel tool steel grades that offer superior wear resistance and thermal stability. Manufacturers are increasingly adopting hybrid production lines that combine casting, forging, and powder metallurgy, enabling more complex geometries and tighter tolerances than conventional tooling.

Simultaneously, digitization is revolutionizing quality control and predictive maintenance. Smart factory implementations use real-time sensor data to monitor tool steel performance, enabling precise adjustments to heat treatment protocols and reducing scrap rates. Meanwhile, sustainability has emerged as a strategic imperative. Steel producers are investing in low-carbon electric arc furnace technologies and exploring recycled alloy feedstocks to lower environmental footprints without compromising mechanical properties. These converging forces are reshaping supplier-buyer relationships, driving collaborative R&D programs, and creating new competitive dynamics that will define the market trajectory over the next decade.

Analyzing the Far-Reaching Consequences of 2025 U.S Tariff Measures on Machine Tool Steel Supply and Value Chains

The cumulative impact of U.S. tariffs implemented in 2025 has reverberated across the machine tool steel ecosystem, prompting suppliers and end-users to reevaluate sourcing strategies and cost management practices. Higher duties on imported tool steel grades have effectively raised landed costs, encouraging domestic capacity investments and accelerating vertical integration initiatives among North American producers. At the same time, purchasers are seeking tariff-exempt supply routes by diversifying into regional free-trade agreements and strengthening relationships with partners in duty-free markets.

To mitigate margin erosion, many fabricators have adopted value-engineering approaches, optimizing tool steel specifications to balance performance with cost efficiency. Others have engaged in collaborative stockholding arrangements with mills to secure priority allocations and buffer against lead-time fluctuations. This tariff-driven market environment has also stimulated innovation in lean manufacturing, as companies streamline process steps to reduce material waste, and negotiate contracted pricing structures tied to value-added services rather than pure tonnage costs. Such strategic adaptations underscore the resilience of the industry and offer a blueprint for navigating future policy shifts.

Revealing Critical Market Segmentation Patterns That Illuminate Production Technology Grade and Application Nuances

Insight into the market through the lens of production technology reveals a dichotomy between casting and forging practices. Casting-based approaches facilitate complex cross-sectional geometries and lower initial tooling costs, whereas forging yields superior grain structures that enhance toughness under cyclic loads. When viewed by grade type, carbon tool steel remains a cost-effective solution for general-purpose applications, while alloy tool brands address higher hardness requirements, and high-performance variants excel under extreme thermal and abrasive conditions.

In terms of product formats, bars and rods dominate machining operations due to their adaptability, whereas plates and sheets are integral for creating wear-resistant components in large-scale forming equipment. Process segmentation highlights the rising prominence of powder metallurgy, driven by its ability to produce fine microstructures and uniform carbide distributions, although traditional extrusion routes still offer scalable throughput. Finally, application insights underscore how aerospace and defense requirements for fatigue resistance contrast with agricultural sectors’ demand for toughness, while electronics and healthcare segments prioritize ultra-clean surface finishes and corrosion resistance, reflecting nuanced performance priorities across end uses.

This comprehensive research report categorizes the Machine Tool Steel market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Production Technology

- Type

- Product

- Process Type

- Application

Unveiling Regional Market Drivers and Innovation Ecosystems Shaping Machine Tool Steel Demand Globally

Regional dynamics in the Americas reveal robust demand tied to nearshore manufacturing trends and defense industry modernization programs. North American mills have ramped up capacity expansions to support reshoring initiatives, while South American fabricators are pursuing process upgrades to improve yield and quality control. Meanwhile, in Europe, Middle East & Africa, stringent environmental regulations are accelerating the adoption of low-emission production methods, and regional consortia are co-funding research into novel alloy chemistries that reduce cobalt content without sacrificing performance.

In the Asia-Pacific region, sustained capital investment in automation and export-oriented manufacturing is driving unprecedented consumption of high-performance tool steels. China’s integrated supply chains continue to achieve economies of scale, while Southeast Asian tooling hubs leverage competitive labor rates alongside government incentives to foster specialized powder metallurgy clusters. Across all regions, strategic alliances and technology licensing arrangements are increasingly common as players seek to localize capabilities, optimize logistics, and tailor solutions to regional application profiles, ensuring responsiveness to shifting customer demands.

This comprehensive research report examines key regions that drive the evolution of the Machine Tool Steel market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Examining How Premier Tool Steel Manufacturers Leverage Technology Integration and Strategic Partnerships to Lead the Market

Major industry participants are pursuing differentiated strategies to secure competitive advantage. One leading producer has invested heavily in digital twin technology to simulate heat treatment cycles and optimize microstructure properties across its high-performance tool steel portfolio. Another global supplier has pursued strategic acquisitions of specialty powder metallurgy plants to bolster its extrusion and sintering capabilities, enabling faster time-to-market for customized grades designed for additive manufacturing.

A third key player has established a joint development program with aerospace fabricators to co-create ultra-high fatigue-resistance alloys, while a fourth has focused on enhancing downstream services, offering turnkey tool design and repair solutions that lock in long-term service contracts. Across these varied strategies, a consistent theme emerges: integration of advanced metallurgical research, digital process control, and customer service innovation to drive differentiated value propositions and reinforce market leadership in an increasingly competitive landscape.

This comprehensive research report delivers an in-depth overview of the principal market players in the Machine Tool Steel market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Carpenter Technology Corporation

- China Baowu Steel Group Co., Ltd.

- Crucible Industries LLC

- Daido Steel Co., Ltd.

- ERAMET SA

- JFE Steel Corporation

- Kennametal Inc.

- Kobe Steel, Ltd.

- Mitsubishi Materials Corporation

- Nachi-Fujikoshi Corp.

- Nippon Steel Corporation

- OSG Corporation

- POSCO Holdings Inc.

- Sandvik AB

- Sumitomo Electric Industries, Ltd.

- Tiangong International Co., Ltd.

- Tungaloy Corporation

- Uddeholm AB

- voestalpine AG

- voestalpine Böhler Edelstahl GmbH & Co KG

Empowering Industry Stakeholders with Actionable Strategies for Digital Innovation Supply Diversification and Sustainable Growth

Industry leaders should prioritize investment in digital process optimization tools that leverage real-time production data to continuously refine heat treatment parameters and minimize variability. By deploying advanced analytics platforms, companies can pinpoint inefficiencies in extrusion and sintering workflows, ultimately reducing cycle times and enhancing metallurgical consistency.

In parallel, diversifying raw material sources through strategic alliances with specialized alloy producers in low-tariff jurisdictions can buffer against geopolitical disruptions and cost volatility. Leaders are advised to formalize co-development initiatives with strategic end-users in key verticals such as aerospace and automotive, ensuring that tool steel formulations are tailored from inception to meet evolving operational demands. Finally, embedding sustainability metrics into product innovation roadmaps not only addresses regulatory pressures but also resonates with eco-conscious OEMs, strengthening brand reputation and fostering long-term partner loyalty.

Detailing a Robust Mixed Method Research Approach Combining Secondary Data Analysis Primary Interviews and Statistical Validation

This study employs a multi-phase research methodology integrating both primary and secondary sources to ensure rigorous and unbiased analysis. Initially, extensive secondary research was conducted, drawing on technical journals, metallurgical association publications, regulatory filings, and proprietary databases that track alloy compositions and process parameters. Concurrently, primary research involved in-depth interviews with senior executives from leading steel producers, tool manufacturers, and end-user fabricators to capture real-world insights on process challenges and strategic priorities.

Data triangulation was achieved by cross-verifying quantitative indicators such as production throughput, defect rates, and energy consumption metrics with qualitative perspectives gleaned during expert consultations. Advanced statistical techniques were applied to identify correlations between production methods and performance outcomes, while scenario planning workshops with industry veterans helped validate key assumptions. The result is a robust analytical framework that balances empirical evidence with strategic foresight, ensuring that the findings are both actionable and grounded in industry realities.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Machine Tool Steel market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Machine Tool Steel Market, by Production Technology

- Machine Tool Steel Market, by Type

- Machine Tool Steel Market, by Product

- Machine Tool Steel Market, by Process Type

- Machine Tool Steel Market, by Application

- Machine Tool Steel Market, by Region

- Machine Tool Steel Market, by Group

- Machine Tool Steel Market, by Country

- United States Machine Tool Steel Market

- China Machine Tool Steel Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 954 ]

Synthesizing Core Findings to Illuminate Strategic Imperatives and Position Organizations for Long-Term Success in Tool Steel Markets

Throughout this executive summary, we have explored the pivotal factors shaping today’s machine tool steel market-from the disruptive impact of digital and additive manufacturing technologies to the strategic responses prompted by U.S. tariff policies. Segmentation analysis has highlighted the divergent needs across production technologies, steel grades, and application environments, while regional insights revealed how local regulations and investment climates are influencing supply chain structures.

Leading companies have demonstrated the importance of integrating advanced metallurgical research, digital process control, and service innovation to differentiate in a competitive landscape. Looking ahead, sustained focus on data-driven process optimization, supply chain resilience, and sustainable production practices will be critical for stakeholders aiming to secure long-term growth. By synthesizing these multifaceted insights, decision-makers are equipped to navigate complexities, capitalize on emerging opportunities, and foster enduring competitive advantage in the evolving machine tool steel sector.

Connect with our Associate Director to Secure Your Customized Machine Tool Steel Market Report and Gain Strategic Insights

To unlock the full strategic potential of this comprehensive machine tool steel market analysis and gain proprietary insights tailored to your business objectives, reach out directly to Ketan Rohom, Associate Director, Sales & Marketing at 360iResearch. With deep expertise in industrial materials and a proven track record of guiding leading manufacturers and service providers, he can help you navigate the complexities of production technologies, application trends, and regional dynamics. Engage with him today to secure your copy of the report, explore customized advisory services, or schedule an in-depth briefing on critical industry developments. Let his advisory support empower your organization to make informed decisions, optimize operations, and drive long-term competitive advantage in the evolving machine tool steel landscape

- How big is the Machine Tool Steel Market?

- What is the Machine Tool Steel Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?