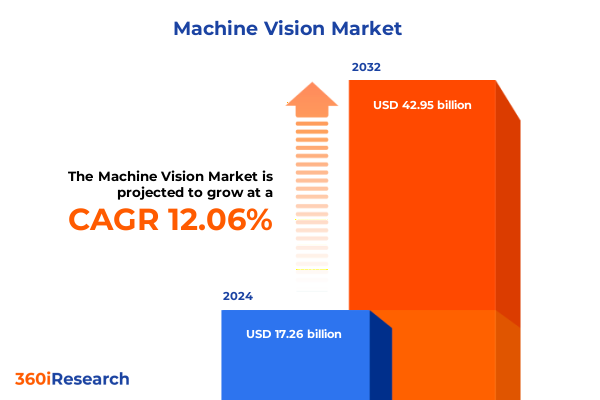

The Machine Vision Market size was estimated at USD 17.26 billion in 2024 and expected to reach USD 19.25 billion in 2025, at a CAGR of 12.06% to reach USD 42.95 billion by 2032.

Unveiling the Emergence of Machine Vision Technologies Transforming Industrial Processes and Driving Innovation Across Diverse Sectors

Over the past decade, machine vision has evolved from simple optical inspection systems to sophisticated, intelligence-driven platforms that seamlessly integrate into digital transformation initiatives. Initially adopted for basic quality inspections on assembly lines, these systems now harness advanced artificial intelligence algorithms and high-resolution imaging to provide real-time analytics, enabling manufacturers to detect minute defects with unprecedented precision. This shift has dramatically reduced waste, improved yield rates, and enabled predictive maintenance protocols that anticipate equipment failures before they occur, thereby minimizing downtime and operational costs.

Beyond manufacturing, the application of machine vision extends into healthcare, logistics, and consumer electronics, where it supports critical tasks such as automated diagnostic imaging, parcel sorting, and surface quality checks for ubiquitous devices. The convergence of high-speed cameras, miniaturized sensors, and scalable computing resources at the edge has unlocked new possibilities for data-driven decision-making. Furthermore, advances in edge computing and high-speed connectivity, including 5G networks, have enabled distributed vision architectures, reducing latency and empowering real-time decision-making closer to the point of capture. As organizations seek scalable platforms that accommodate future growth, the fusion of robust hardware with cloud-native services emerges as a compelling pathway for sustainable innovation.

Exploring the Pivotal Shifts and Emerging Trends Redefining Machine Vision Applications from Automation to Artificial Intelligence Integration in 2025

The rapid advancement of artificial intelligence, particularly in deep learning, has revolutionized the capabilities of machine vision systems. Modern convolutional neural networks can now process complex visual data streams to identify patterns, anomalies, and contextual relationships with a level of accuracy previously attainable only by human experts. This deep learning integration has facilitated the migration of vision tasks from centralized data centers to the edge, where inference engines embedded in cameras and processing boards deliver sub-millisecond response times. As a result, critical applications such as robotic guidance, real-time safety monitoring, and high-speed quality inspection have become more reliable and versatile than ever.

Simultaneously, innovations in sensor technology and illumination have broadened the spectrum of machine vision applications. Hyperspectral imaging, once confined to laboratory environments, is now accessible for inline food inspection and crop health monitoring, enabling detection of chemical compositions and material properties at scale. Thermal vision, leveraging both long wave and short wave infrared, is increasingly used in predictive maintenance and security screening, while emerging X-ray imaging solutions provide non-destructive inspection of complex assemblies. Together, these technology shifts are driving a more holistic and multi-modal approach to visual analytics, fostering novel use cases and expanding the market footprint of machine vision solutions.

Assessing the Far Reaching Consequences of Recent United States Tariff Policies on the Machine Vision Ecosystem and Supply Chains in 2025

In 2025, the introduction of new tariffs on imported imaging sensors, precision lenses, and vision processing boards has introduced a level of complexity into global supply chains that reverberates across the machine vision industry. Many leading hardware components are sourced from specialized manufacturers in East Asia and Europe, and the added duties have prompted OEMs to reevaluate vendor relationships and cost structures. As procurement teams navigate increased component costs, projects that once boasted rapid return on investment have seen elongated payback periods, leading some end users to postpone or scale back planned automation upgrades. This dynamic has also accelerated conversations around domestic manufacturing and nearshoring to mitigate exposure to international trade fluctuations.

Despite these headwinds, the industry is demonstrating resilience through strategic sourcing diversification and collaborative partnerships. Several integrators have forged alliances with regional component producers to secure alternative supply channels, while some hardware providers are absorbing a portion of the tariff impact to preserve client relationships. In parallel, service-oriented offerings are capturing greater attention, as businesses seek managed services and professional deployment support to optimize existing assets rather than investing heavily in new equipment. These adaptations highlight the industry’s ability to pivot toward flexible, service-centric models in response to policy-driven cost pressures.

Gaining Critical Insights into Component Based Technology Application and Industry Segmentation Strategies Shaping Machine Vision Markets Globally

A deep dive into component segmentation reveals that hardware continues to command attention, with cameras, image processing boards, interfaces, lenses, lighting solutions, and vision sensors evolving to meet diverse operational requirements. Among cameras, area scan devices dominate traditional inspection tasks, while line scan units and three-dimensional imaging systems address high-speed production and volumetric analysis challenges. Meanwhile, the interface segment bridges on-premises equipment and networked systems, supporting rapid data exchange, and lighting solutions ensure optimal imaging conditions across varying environments. Service offerings, encompassing both managed and professional categories, have matured into crucial revenue drivers. Consultative services guide strategic implementations; deployment and integration specialists facilitate seamless system rollout; and maintenance and support teams ensure sustained performance and uptime.

On the software front, integration platforms, vision-specific applications, and visualization tools are converging to create unified environments for end-to-end workflows. Integration software underpins seamless communication between heterogeneous devices, while vision software spans two-dimensional, three-dimensional, and thermal analytics capabilities. Visualization software translates raw image data into actionable dashboards that empower operators to make informed decisions. When viewed through a technology lens, two-dimensional vision remains foundational, but structured light, stereo vision, and time-of-flight three-dimensional methods have gained traction for precise spatial measurement. Hyperspectral imaging, utilizing discrete wavelength and Fourier transform techniques, is unlocking new material characterization use cases, and thermal solutions in both long wave and short wave spectra are enhancing safety inspections. X-ray imaging further extends the market’s reach into highly regulated industries requiring non-destructive testing.

Within application segmentation, guidance systems have evolved to support part location and robotic navigation, while identification and authentication modules ensure secure access and traceability. Measurement solutions now encompass dimensional and volumetric assessments, facilitating tighter tolerances and complex geometrical evaluations. Quality inspection balances dimensional checks, presence-and-absence verification, and surface defect detection to uphold stringent standards. Across end-use industries, the automotive sector leverages vision systems for assembly line automation, electronics and semiconductor manufacturers utilize high-resolution inspection for microfabrication, food and beverage producers adopt imaging for contamination detection, healthcare and life sciences employ advanced optics for diagnostic and research applications, and logistics and postal operators implement sorting and parcel tracking solutions, underscoring the pervasive influence of machine vision technologies.

This comprehensive research report categorizes the Machine Vision market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Offering

- System Type

- Spectral Range

- Image Acquisition Mode

- Application

- Industry Vertical

- Sales Channel

Uncovering Regional Variations in Adoption Drivers and Technological Maturation throughout Americas Europe Middle East Africa and Asia Pacific Machine Vision Markets

Regional dynamics of machine vision adoption exhibit marked contrasts. In the Americas, strong ties between OEMs and tier-one integrators have fostered early adoption of advanced inspection and automation systems, driven by continuous innovation in sectors such as automotive manufacturing and consumer electronics production. The United States and Canada benefit from robust R&D ecosystems and government incentives aimed at reshoring critical technologies, which has led to increased investments in domestic sensor and camera development. Latin American markets, while exhibiting slower maturity, are embracing vision solutions in logistics and agricultural applications, where image-based sorting and crop monitoring deliver tangible productivity gains.

Conversely, Europe, the Middle East, and Africa present a mosaic of regulatory frameworks, manufacturing specialties, and investment appetites. European nations with precision manufacturing legacies continue to lead in high-performance machine vision deployments, particularly within aerospace and pharmaceutical industries that demand strict quality controls. Emerging markets in the Middle East are prioritizing security and surveillance use cases, leveraging thermal and identification technologies to address infrastructural challenges. In Africa, pilot projects are establishing proof of concept for vision-based resource management in mining and agriculture, setting the stage for broader rollouts. The Asia Pacific region remains the fastest-growing market segment, propelled by large-scale consumer electronics fabrication in China, semiconductor innovation in South Korea and Taiwan, and a burgeoning logistics automation wave in Japan. Collectively, these regional insights underscore the importance of tailored go-to-market strategies that align with local regulatory, economic, and technological contexts.

This comprehensive research report examines key regions that drive the evolution of the Machine Vision market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Navigating the Competitive Landscape through Deep Analysis of Leading Innovators and Strategic Partnerships Driving Machine Vision Advancements

The competitive topography of the machine vision industry is characterized by both entrenched multinationals and agile newcomers. Established incumbents frequently leverage broad portfolios, combining hardware, software, and services to deliver turnkey solutions that span the inspection continuum. These leaders invest heavily in global support networks and channel partnerships to maintain market share, while also pursuing targeted acquisitions to enhance capabilities in areas such as deep learning and hyperspectral analysis. Recent mergers and acquisitions have accelerated consolidation, with several prominent vision software vendors acquiring niche AI startups to integrate advanced analytics capabilities into their platforms, signaling an ongoing trend toward holistic solution offerings. By contrast, emerging players often specialize in niche segments-such as ultra-compact cameras or cloud-native analytics platforms-allowing them to innovate rapidly and disrupt traditional value chains.

Complementing organic growth strategies, alliances between technology providers, system integrators, and research institutions have become critical to accelerating solution development and market penetration. Cross-industry collaborations, such as partnerships between semiconductor manufacturers and vision software vendors, are advancing high-throughput inspection techniques tailored for next-generation chip fabrication. Similarly, joint ventures combining lighting expertise with advanced optics have yielded adaptive illumination systems that dynamically adjust to complex part geometries. These collaborative endeavors are enabling stakeholders to deliver integrated offerings that address evolving customer demands for modularity, scalability, and ongoing system optimization throughout the equipment lifecycle.

This comprehensive research report delivers an in-depth overview of the principal market players in the Machine Vision market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ABB Ltd.

- Ametek Inc.

- Atlas Copco AB

- Basler AG

- Baumer Holding AG

- Canon Inc.

- China Daheng Group, Inc.

- Cognex Corporation

- Datalogic S.p.A.

- FANUC Corporation

- Fujifilm Corporation

- Hangzhou Hikvision Digital Technology Co., Ltd.

- IDS Imaging Development Systems GmbH

- Imperx, Inc.

- Intel Corporation

- JAI A/S

- Keyence Corporation

- LG Innotek Co., Ltd.

- Mitsubishi Corporation

- MVTec Software GmbH

- National Instruments Corporation by Emerson Electric Co.

- Nikon Corporation

- Omron Corporation

- OpenMV, LLC

- Optotune AG

- Robert Bosch GmbH

- Rockwell Automation, Inc.

- Sick AG

- Siemens AG

- Sony Corporation

- Teledyne Technologies Incorporated

- Texas Instruments Incorporated

- TKH Group N.V.

- Tordivel AS

- Toshiba Corporation

- Wenglor Sensoric GmbH

- Zebra Technologies Corp.

- Zhejiang Dahua Technology Co., Ltd.

- Zivid Labs AS

Implementing Forward Looking Strategies and Tactical Recommendations to Strengthen Positioning and Accelerate Growth in the Machine Vision Sector

As the machine vision landscape continues its rapid evolution, industry participants must adopt forward-looking strategies to maintain competitive advantage. Investing in modular, software-defined architectures will enable firms to update analytics capabilities without incurring the cost and complexity tied to hardware replacements. By decoupling vision algorithms from proprietary platforms, organizations can integrate the latest artificial intelligence models on the fly, ensuring that inspection accuracy and decision support keep pace with emerging quality standards. Concurrently, expanding service offerings to include managed analytics and predictive diagnostics can transform one-time hardware sales into recurring revenue streams, fostering deeper customer relationships and generating continuous value across equipment lifecycles.

Supply chain diversification remains an imperative in the face of shifting trade policies and component shortages. Companies should establish dual sourcing arrangements for critical components such as lenses, sensors, and processing boards, balancing established suppliers with regional alternatives to mitigate disruption risks. Engaging with local research institutions and startup ecosystems can uncover innovative materials and imaging modalities that offer performance advantages. Finally, leaders should prioritize customer education and co-development initiatives to tailor vision solutions to unique operational challenges, effectively transforming end users into strategic partners. This proactive collaboration will accelerate deployment timelines, reduce change management friction, and solidify long-term client loyalty in an increasingly competitive environment.

Detailing a Rigorous Multi Methodological Research Framework Ensuring Credibility Transparency and Depth in Machine Vision Market Analysis

This report’s research framework integrates both primary and secondary methodologies to deliver a holistic view of the machine vision domain. Primary research comprises in-depth interviews with C-level executives, product managers, and system integrators across the hardware, software, and services spectrum. These conversations are complemented by structured surveys and expert panel discussions, which surface nuanced perspectives on technology adoption, regional market nuances, and evolving regulatory drivers. Secondary research synthesizes data from industry publications, peer-reviewed journals, and publicly available financial statements, providing a robust foundation for trend validation and competitive benchmarking.

Data triangulation ensures that insights reflect the convergence of multiple vantage points. Information gleaned from primary interviews is cross-verified against secondary sources, while qualitative findings are supported by quantitative metrics obtained from trade associations and government bodies. The combination of top-down market trend analysis with bottom-up segment profiling enables the identification of emerging opportunities and potential disruption risks. Throughout the process, rigorous quality checks and peer reviews uphold analytical integrity, ensuring the final recommendations align with the realities of technology development and commercialization timelines in the machine vision sphere.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Machine Vision market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Machine Vision Market, by Type

- Machine Vision Market, by Offering

- Machine Vision Market, by System Type

- Machine Vision Market, by Spectral Range

- Machine Vision Market, by Image Acquisition Mode

- Machine Vision Market, by Application

- Machine Vision Market, by Industry Vertical

- Machine Vision Market, by Sales Channel

- Machine Vision Market, by Region

- Machine Vision Market, by Group

- Machine Vision Market, by Country

- United States Machine Vision Market

- China Machine Vision Market

- Competitive Landscape

- List of Figures [Total: 20]

- List of Tables [Total: 2544 ]

Synthesizing Key Findings and Strategic Takeaways to Illuminate Future Directions and Imperatives for Machine Vision Stakeholders

Machine vision technologies have transcended traditional inspection roles to become integral components of digital transformation strategies, underpinning automation, quality assurance, and data-driven decision-making. Recent technological advancements, including edge-based inference, multi-spectral imaging, and AI-driven analytics, have expanded the scope of applications and unlocked higher levels of process transparency. Concurrently, geopolitical shifts and tariff policies have underscored the importance of resilient supply chain frameworks and the adoption of flexible service models that prioritize asset utilization over capex-intensive equipment refreshes.

Looking ahead, stakeholders must remain vigilant to nascent trends such as quantum imaging, explainable AI, and integrated robotics ecosystems that promise to redefine the performance and autonomy of vision systems. The convergence of sensor fusion, digital twins, and real-time feedback loops will further accelerate machine vision’s role as a strategic enabler. By embracing modular architectures, cultivating strategic partnerships, and adopting adaptive pricing models, organizations can harness the full potential of vision technologies to respond to rapid market changes and deliver sustained competitive differentiation in an increasingly automated world.

Secure Comprehensive Expertise and Actionable Market Intelligence by Engaging Directly with Associate Director Sales and Marketing to Obtain Tailored Solutions

To explore how these insights directly apply to your organization’s objectives and challenges, engage with Ketan Rohom, Associate Director of Sales and Marketing. Ketan’s deep expertise in machine vision market dynamics will guide you through a personalized briefing, revealing targeted strategies and bespoke recommendations. Connect today to secure this essential report and gain the competitive intelligence needed to navigate evolving technologies, supply chain complexities, and regional opportunities with confidence.

- How big is the Machine Vision Market?

- What is the Machine Vision Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?