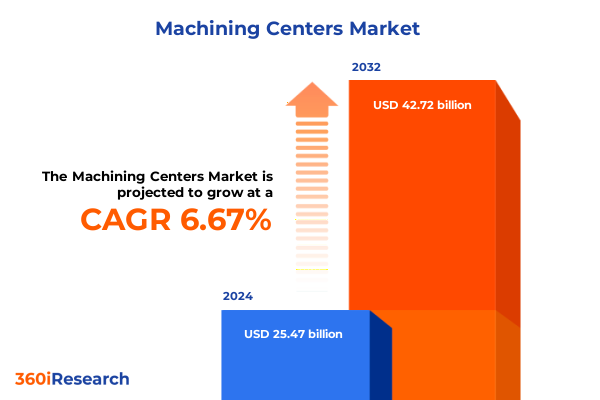

The Machining Centers Market size was estimated at USD 27.06 billion in 2025 and expected to reach USD 28.76 billion in 2026, at a CAGR of 6.73% to reach USD 42.72 billion by 2032.

Exploring the Evolving Machining Centers Market Through an In-Depth Overview of Technology Adoption, Competitive Drivers, and Emerging Opportunities

The machining centers market is at a pivotal inflection point, driven by rapid technological advancements, evolving customer demands, and intensified global competition. Rapid adoption of automation solutions, integration of advanced materials, and the push for shorter production cycles have combined to shape an environment where precision, speed, and reliability converge. As manufacturers strive to optimize processes, reduce costs, and maintain rigorous quality standards, the role of machining centers as the backbone of modern production has become increasingly critical.

Against this backdrop, stakeholders require a clear understanding of how digital transformation, additive integration, and next-generation control systems are influencing equipment design and end-user applications. Transitioning from traditional manual operations to computer numerical control (CNC) and beyond, the industry is witnessing a convergence of mechanical engineering and information technology. Decision-makers must therefore navigate a landscape characterized by the dual imperatives of scaling throughput and enhancing operational flexibility.

Unveiling the Pivotal Technological and Operational Shifts Redefining the Machining Centers Landscape in a Dynamic Industrial Era

The machining centers landscape is undergoing transformative shifts that are redefining manufacturing paradigms. One of the most pronounced changes is the integration of Internet of Things (IoT) connectivity, which enables real-time monitoring of machine health, predictive maintenance, and adaptive control strategies. This connectivity bridges the gap between the shop floor and enterprise-level systems, creating a seamless data flow that supports informed decision-making and continuous performance optimization.

Simultaneously, artificial intelligence and machine learning algorithms are being embedded within control architectures to optimize toolpaths, predict wear patterns, and autonomously adjust operating parameters. These developments are complemented by advances in multi-axis machining, where five-axis centers are leveraged to produce highly complex components with fewer setups and greater geometric precision. Together, these shifts are empowering manufacturers to achieve unprecedented levels of customization and cycle-time reduction, thus reshaping competitive dynamics across industries.

Evaluating the Far-Reaching Effects of 2025 United States Tariff Measures on Machining Centers Supply Chains and Cost Structures

The introduction of new tariff measures by the United States in 2025 has had a significant ripple effect on the machining centers market, particularly for imported capital equipment and critical components. These duties have elevated the landed cost of machinery produced in regions subject to higher rates, prompting firms to reassess sourcing strategies and supply chain configurations. In turn, some leading manufacturers have accelerated efforts to establish localized production or partner with domestic suppliers to mitigate the impact of increased import costs.

Moreover, the tariffs have influenced end-user investment decisions, as companies weigh the immediate cost burden against long-term productivity gains. Many have opted to extend the lifespan of existing assets through retrofitting and upgrading control systems, rather than pursuing greenfield purchases. Nonetheless, this shift has also sparked innovation in aftermarket services and retrofit solutions, giving rise to specialized service providers focused on optimizing the performance of legacy equipment under a new cost landscape.

Deriving Actionable Insights from Machining Centers Market Segmentation by Type, Axis Configuration, Control Mechanism, Sales Channels, and End-Use Sectors

Analyzing the market through the lens of type segmentation reveals distinct demand patterns for horizontal machining centers, favored in high-volume applications for their greater stability and multiple pallet systems, versus vertical machining centers, which dominate job-shop environments that require greater visual accessibility and ease of setup. When considering axis configuration, three-axis centers remain the workhorses for standard milling operations, while four-axis setups allow for an additional rotational axis that enhances part complexity. Five-axis centers are gaining traction as end users pursue intricate geometries with minimal secondary operations.

Control mechanisms further delineate the market, with CNC machining centers setting the benchmark for repeatability, precision, and programmability over manual units. In parallel, the rise of e-commerce and digital marketplaces has influenced the sales channels landscape, as buyers increasingly explore online procurement portals alongside traditional offline dealer networks. End-use segmentation underscores divergent growth trajectories; aerospace and defense demand high-precision components under stringent certification requirements, automotive manufacturers emphasize throughput and lean integration, energy and power producers focus on ruggedized units for heavy-duty fabrication, medical device producers prioritize micro-machining capabilities for intricate implants, and metal fabrication shops continue to seek cost-effective solutions for sheet and block processing.

This comprehensive research report categorizes the Machining Centers market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Axis

- Control Type

- End-Use

- Sales Channel

Dissecting Regional Machining Centers Market Dynamics across the Americas, Europe Middle East & Africa, and Asia-Pacific Growth Corridors

Regional dynamics in the machining centers market are shaped by differing industrial bases, government policies, and investment trends. In the Americas, reshoring initiatives and federal incentives for advanced manufacturing are driving demand for state-of-the-art machining centers, as companies seek to onshore critical production and mitigate global supply chain risk. This trend is further supported by robust aftermarket and service infrastructure, which enhances the value proposition of new installations.

Within Europe, the Middle East, and Africa, strong footholds in automotive and aerospace manufacturing underpin continued investments in high-precision, multi-axis centers. Government-led programs aimed at decarbonization are compelling energy sector players to upgrade to more efficient and environmentally compliant equipment. Meanwhile, rapid industrial expansion in the Middle East, spurred by diversification away from hydrocarbon dependency, is opening new markets for machining solutions.

Asia-Pacific remains a powerhouse of production capacity, with China and Japan maintaining leading positions in both machine tool manufacturing and consumption. Recent policy shifts in India and Southeast Asia have expanded local content requirements, encouraging partnerships and joint ventures that bring advanced machining technology to emerging manufacturing hubs. As such, regional disparities in labor costs, technological readiness, and infrastructure continue to inform strategic planning across the sector.

This comprehensive research report examines key regions that drive the evolution of the Machining Centers market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Prominent Machining Centers Industry Players Driving Innovation, Competitive Positioning, and Strategic Collaborations Globally

The competitive landscape of machining centers is defined by a mix of global multinationals and agile regional players. Leading manufacturers have been focusing on expanding service networks, developing proprietary software ecosystems, and forging strategic partnerships with automation specialists. This approach allows them to offer end-to-end solutions that address both equipment performance and process optimization, thereby strengthening customer lock-in and driving aftermarket revenue.

Simultaneously, mid-tier and emerging players are carving out niche positions by prioritizing modular machine designs, rapid deployment models, and subscription-based financing options. These strategies resonate with small and medium-sized enterprises that seek flexible capital expenditure structures. Across the board, a race to integrate digital solutions into user interfaces and to standardize connectivity protocols has become a defining feature of corporate roadmaps.

This comprehensive research report delivers an in-depth overview of the principal market players in the Machining Centers market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Ace Micromatic Group

- Breton S.p.A

- Brother Industries, Ltd.

- DMG Mori Seiki Co., Ltd.

- DN Solutions Co., Ltd

- Fanuc Corporation

- FFG European & American Holdings GmbH

- GROB-WERKE GmbH & Co. KG

- Hardinge Inc.

- Hurco Companies, Inc.

- Jiuh-Yeh Precision Machinery Co., Ltd.

- JTEKT Corporation

- JUARISTI Boring and Milling Machines S.L.U.

- Komatsu NTC Ltd.

- MAG IAS GmbH

- MAKA Systems GmbH

- Makino, Inc.

- Matsuura Machinery Corporation

- Mitsubishi Electric Corporation

- Okuma Corporation

- SCM GROUP S.p.A.

- Trevisan Macchine Utensili S.p.A

- WIDMA Machining Solutions Group Limited

- Yamazaki Mazak Corporation

- Yeong Chin Machinery Industries Co., Ltd.

Strategic Imperatives for Industry Leaders to Capitalize on Technological Advances, Supply Chain Resilience, and Market Diversification Trends

To thrive in this competitive and rapidly evolving environment, industry leaders must adopt a multi-pronged strategy. Prioritizing investments in digital twins and AI-driven predictive maintenance will help enhance equipment uptime and reduce total cost of ownership. Complementing this with workforce development programs ensures that operators are proficient in the latest control software and automation interfaces.

Moreover, companies should pursue strategic alliances along the supply chain to secure critical subsystems and raw materials, thus building resilience against external shocks. Expanding value-added services such as remote diagnostics, performance benchmarking, and process consulting can also differentiate offerings and generate recurring revenue streams. Finally, embedding sustainability metrics into machine design and production processes will not only satisfy regulatory requirements but also align with customer expectations around environmental stewardship.

Detailing the Rigorous Research Methodology Employed to Ensure Accuracy, Credibility, and Comprehensive Analysis of Machining Centers Market Data

This analysis was underpinned by a rigorous research methodology that combined primary and secondary data collection. Primary insights were gathered through in-depth interviews with senior executives, engineering leaders, and procurement specialists across key end-use sectors. These conversations provided first-hand perspectives on investment drivers, operational challenges, and future technology roadmaps.

Secondary research involved an extensive review of industry publications, company announcements, patent filings, and trade association reports to validate emerging trends and benchmark competitive strategies. Quantitative data was aggregated from customs records, trade statistics, and equipment shipment databases to identify patterns in regional trade flows and adoption rates. Throughout the process, findings were triangulated and cross-validated through expert panels to ensure accuracy, credibility, and neutrality in the final analysis.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Machining Centers market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Machining Centers Market, by Type

- Machining Centers Market, by Axis

- Machining Centers Market, by Control Type

- Machining Centers Market, by End-Use

- Machining Centers Market, by Sales Channel

- Machining Centers Market, by Region

- Machining Centers Market, by Group

- Machining Centers Market, by Country

- United States Machining Centers Market

- China Machining Centers Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 954 ]

Synthesizing Key Findings to Illuminate Strategic Pathways and Future Prospects for Machining Centers Industry Stakeholders

The totality of insights presented herein underscores a market in the midst of transformation, driven by technological integration, evolving policy landscapes, and shifting customer requirements. Stakeholders must recognize the critical interplay between digital innovation and traditional mechanical excellence, as this nexus will define competitive advantage in the coming years.

Operational agility, informed sourcing strategies, and a clear understanding of segmentation dynamics will be essential for navigating tariff-induced cost pressures and capitalizing on regional growth corridors. Furthermore, partnerships and service-led revenue models will emerge as powerful levers for sustaining profitability and fostering customer loyalty. As the industry moves forward, the ability to anticipate change and translate insight into action will distinguish leaders from followers in the machining centers domain.

Connect with Ketan Rohom to Unlock In-Depth Insights and Secure Your Comprehensive Machining Centers Market Research Report Today

If you are seeking to deepen your understanding of the machining centers market and gain exclusive access to comprehensive data, bespoke analysis, and expert commentary, contact Ketan Rohom, Associate Director of Sales and Marketing. He can guide you through the strategic value of this research and help you customize a package that addresses your organization’s unique needs. Engage with Ketan Rohom today to secure your purchase of the full machining centers market research report and leverage critical insights that will empower your decision-making and competitive positioning.

- How big is the Machining Centers Market?

- What is the Machining Centers Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?