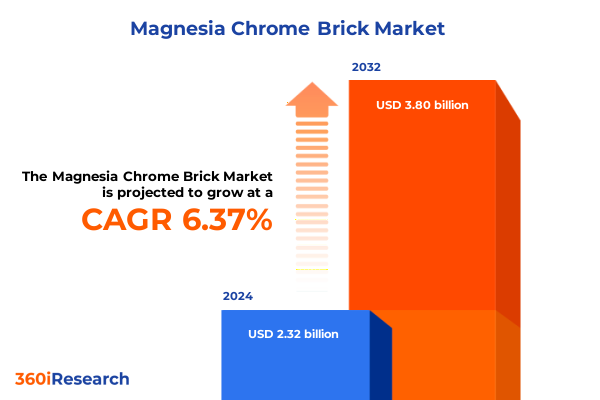

The Magnesia Chrome Brick Market size was estimated at USD 2.89 billion in 2025 and expected to reach USD 3.12 billion in 2026, at a CAGR of 8.74% to reach USD 5.20 billion by 2032.

Introducing the Critical Role of Magnesia Chrome Bricks in High-Temperature Industrial Furnaces and Their Significance in Modern Manufacturing

The magnesia chrome brick stands at the heart of modern high-temperature industrial processes, serving as a critical lining material in furnaces where temperatures routinely exceed 1,500°C. This specialized refractory product combines the thermal stability of magnesia with the structural resilience of chrome, creating a robust barrier against extreme thermal shock, corrosion, and slag attack. Consequently, industries such as steelmaking, cement production, and petrochemicals have come to rely on these bricks to maintain operational efficiency, reduce maintenance downtime, and extend the lifespan of their equipment. As global manufacturing standards tighten and energy efficiency becomes paramount, the role of magnesia chrome brick has never been more pronounced.

In recent years, heightened awareness of operational costs and environmental compliance has spotlighted the need for durable refractories that can withstand evolving process conditions. Technological advances in kiln and furnace design have pushed operating temperatures higher, demanding bricks with superior purity, density, and bonding mechanisms. Moreover, the drive toward leaner production cycles has compelled plant operators to seek materials that allow for longer service intervals without sacrificing performance. In this context, magnesia chrome brick emerges as a strategic enabler, balancing cost considerations with the rigorous demands of modern thermal processing.

Looking ahead, the industry is poised for continued innovation, with research focusing on optimizing raw material sourcing and refining sintering practices to enhance brick uniformity and mechanical strength. As companies navigate the dual challenges of profitability and sustainability, the introduction section underscores the foundational importance of magnesia chrome brick as a high-performance solution in today’s competitive manufacturing landscape.

Exploring Transformative Shifts Shaping the Magnesia Chrome Brick Landscape with Sustainability Initiatives Digital Integration and Supply Resilience

The magnesia chrome brick market has undergone a series of transformative shifts driven by sustainability mandates, digital integration, and supply chain resilience. Environmental regulations aimed at reducing carbon footprints have prompted refractory manufacturers to explore eco-friendly raw materials and recycling initiatives that minimize waste from spent bricks. Concurrently, the integration of advanced digital monitoring systems and sensor technologies in furnace operations has enabled real-time temperature mapping and early detection of lining degradation, fostering predictive maintenance models that significantly reduce unplanned downtimes.

Furthermore, global supply chain disruptions-from raw material shortages to geopolitical uncertainties-have compelled stakeholders to adapt by diversifying sourcing channels and establishing regional production hubs closer to key end-user clusters. This strategic realignment has accelerated collaborative partnerships between brick producers and major furnace operators, emphasizing joint research and co-development projects that tailor brick formulations to specific process requirements. In parallel, the rise of additive manufacturing techniques and novel binder chemistries offers promising avenues for custom-shaped refractory components and faster production cycles.

As industry players harness these innovations, business models are shifting toward service-oriented frameworks, where refractory providers offer comprehensive lifecycle support beyond brick delivery. This paradigm shift fosters enhanced customer loyalty and enables continuous feedback loops that refine product performance. Ultimately, these transformative trends are reshaping the competitive landscape, setting new benchmarks for quality, reliability, and operational intelligence in the magnesia chrome brick market.

Unpacking the Cumulative Impact of United States Tariffs Introduced in 2025 on Magnesia Chrome Brick Supply Chains Costs and Industry Dynamics

Since the introduction of United States tariffs in early 2025, the magnesia chrome brick sector has witnessed significant ripple effects across supply chains, cost structures, and competitive dynamics. Importers of raw magnesia and chrome ore have faced steeper duties, driving a pronounced uptick in procurement costs that end users have had to absorb or pass through to maintain fiscal equilibrium. The increased import expenses have, in turn, incentivized domestic refractory producers to scale up local sourcing of raw materials, leading to new mining investments and partnerships within North America.

Consequently, the tariffs have accelerated the reshoring of brick manufacturing facilities, as companies seek to mitigate the uncertainty surrounding cross-border logistics and tariff volatility. Domestic furnace operators have begun re-evaluating long-standing contracts with overseas suppliers, prioritizing closer, more reliable relationships that ensure consistent brick quality and timely deliveries. In parallel, some international producers have responded by establishing joint ventures with US firms to circumvent tariff barriers and secure market access.

Moreover, the cumulative impact of these trade measures extends beyond cost implications; it has spurred end users to optimize furnace lining maintenance regimes and explore alternative refractory compositions that offer similar performance at competitive price points. As a result, the market has seen a proliferation of hybrid solutions that blend magnesia chrome brick with lower-cost refractory products, reflecting a pragmatic approach to balancing performance with budget constraints. Overall, the tariff-driven environment underscores the critical importance of strategic procurement and supply chain agility for industry stakeholders.

Unveiling Critical Segmentation Insights Across End-User Industries Applications Types Forms Silica Content Shapes and Sales Channels in the Brick Market

A nuanced examination of market segmentation reveals distinct patterns in brick demand and application preferences across diverse end users and operational environments. Based on End-User Industry, the market is studied across Cement Cooler Preheater and Rotary Kiln Glass Container Furnace Float Line and Tank Furnace Non-Ferrous Casting Furnace and Smelting Furnace Petrochemical Distillation Column Reactor and Steam Cracker and Steel Basic Oxygen Furnace Electric Arc Furnace Incinerator Ladle Furnace and Reheat Furnace each presenting unique thermal profiles and chemical exposures that inform brick composition and sizing requirements.

Insights derived from the Application-based segmentation indicate that refractory performance expectations vary widely when used in Basic Oxygen Furnace operations compared to Chemical Reactor or Electric Arc Furnace scenarios, while Glass Melting Furnace Ladle Furnace and Rotary Kiln processes demand specialized formulations to withstand corrosive flue gases and fluctuating temperature gradients. Furthermore, Type-based segmentation highlights preferences among High Chrome Brick Low Chrome Brick and Medium Chrome Brick, reflecting trade-offs between mechanical strength and resistance to basic slag infiltration. The Form-based segmentation underscores the operational flexibility offered by Cast Gunning and Pressed bricks, with each form factor delivering distinct installation and repair efficiencies. Meanwhile, Silica Content-based segmentation distinguishes Between 1% and 2% Silica Greater Than 2% Silica and Less Than 1% Silica grades to address thermal expansion considerations and slag compatibility. Shape-based segmentation differentiates between Special and Standard configurations that cater to bespoke furnace designs or standardized replacement cycles. Finally, Sales Channel-based segmentation, encompassing Direct Distributor and Online routes, sheds light on procurement trends shaped by service offerings, delivery lead times, and transactional volume preferences.

This comprehensive research report categorizes the Magnesia Chrome Brick market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Type

- Form

- Shape

- End-User Industry

- Application

- Sales Channel

Deciphering Key Regional Insights Across the Americas EMEA and Asia Pacific to Understand Diverse Market Dynamics and Strategic Growth Drivers

Regional dynamics in the magnesia chrome brick market underscore the interplay between industrial maturity, regulatory environments, and infrastructural imperatives across the Americas, Europe Middle East and Africa, and the Asia-Pacific. In the Americas, robust steel production hubs in the United States and expanding cement capacities in Central and South America have elevated demand for high-performance refractories. This region’s focus on domestic sourcing, magnified by recent trade policies, has catalyzed investment in local brick manufacturing facilities and downstream support services.

Within Europe Middle East and Africa, stringent environmental regulations in the European Union drive demand for eco-optimized magnesia chrome formulations, while Middle Eastern petrochemical expansion and North African steel ventures are fueling capacity additions. In this region, collaborative R&D initiatives between local research institutes and refractory producers accelerate the adoption of advanced binder systems and recycled raw materials, aligning with regional sustainability targets.

The Asia-Pacific market remains the largest driver of global brick consumption, powered by extensive steel growth in China and India, rapid cement infrastructure in Southeast Asia, and burgeoning aluminum and non-ferrous smelting activities. Manufacturers in this zone emphasize scale efficiencies, streamlined logistics, and cost-competitive raw material sourcing, often leveraging government incentives for domestic manufacturing. Collectively, these regional nuances shape a diversified market landscape where strategic partnerships and regulatory alignment are essential for sustained growth.

This comprehensive research report examines key regions that drive the evolution of the Magnesia Chrome Brick market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Companies in the Magnesia Chrome Brick Industry Highlighting Strategic Partnerships Product Innovations and Competitive Differentiators

Leading enterprises in the magnesia chrome brick domain have adopted multifaceted strategies to secure competitive advantages and drive innovation. Major producers are investing in proprietary binder technologies and advanced sintering processes to enhance brick density and uniformity, thereby improving thermal shock resistance and service life. Such R&D endeavors frequently involve partnerships with metallurgical institutes and technology providers to develop tailor-made formulations targeting high-stress zones in furnaces and reactors.

Strategic alliances and joint ventures have emerged as pivotal growth levers, enabling companies to access new markets and raw material sources while mitigating tariff and logistics risks. Additionally, forward integration into installation and refractory maintenance services has allowed select players to offer turnkey solutions, encompassing everything from product delivery through on-site lining repair and performance monitoring. This service orientation has strengthened client relationships and created recurring revenue streams beyond traditional brick sales.

At the same time, digital transformation initiatives, including the deployment of IoT-enabled refractory condition monitoring platforms, are redefining after-sales support and predictive maintenance capabilities. By leveraging data analytics and remote sensing, firms can provide real-time performance diagnostics, optimize maintenance cycles, and minimize furnace downtime. These concerted efforts underscore a broader industry shift from commodity-centric offerings to holistic lifecycle management services, marking a new era of value creation in the magnesia chrome brick sector.

This comprehensive research report delivers an in-depth overview of the principal market players in the Magnesia Chrome Brick market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- C. K. Associates

- Calderys

- Chosun Refractories Co. Ltd.

- Gita Refractories Pvt Ltd

- HarbisonWalker International

- KT Refractories

- Lanexis

- Magnezit Group Ltd.

- Mayerton

- Resco Products

- RHI Magnesita

- S.K. Gupta Pvt Ltd

- Sarvesh Refractories Limited

- Shinagawa Refractories

- Vesuvius

Delivering Actionable Recommendations for Industry Leaders to Navigate Tariffs Supply Chain Disruptions and Embrace Innovation for Competitive Advantage

To thrive amid evolving trade landscapes and technological advancements, industry leaders should prioritize diversified procurement strategies that blend domestic and global sourcing of magnesia and chrome ore, thereby mitigating tariff exposure and supply disruptions. Investing in collaborative partnerships with mining companies and research institutions will enable the co-creation of next-generation refractory formulations that balance performance with cost efficiencies. Organizations must also embrace digital tools for real-time furnace lining monitoring, as predictive analytics and IoT-enabled sensors can preempt failures and optimize maintenance schedules.

Moreover, companies are advised to expand service portfolios by bundling refractory supply with installation, repair, and performance tracking solutions, thereby fostering deeper customer engagement and recurring revenue opportunities. Pursuing sustainability credentials, including the use of recycled brick waste and low-carbon manufacturing processes, will be essential for compliance with tightening environmental regulations and for gaining favor with ecoconscious clients. Stakeholders should also conduct periodic tariff impact assessments and explore joint ventures or localized production facilities in key markets to circumvent trade barriers and reduce lead times.

Ultimately, a holistic approach that integrates supply chain resilience, technological innovation, and sustainability initiatives will position industry participants to capitalize on growth opportunities while ensuring operational robustness. By adopting these actionable recommendations, refractory manufacturers and end users can achieve both short-term stability and long-term competitive differentiation.

Detailing a Robust Research Methodology Combining Primary Interviews Secondary Data Analysis and Expert Validation to Ensure Comprehensive Market Insights

This research employs a rigorous methodology combining primary and secondary data sources to deliver robust and comprehensive market insights. Primary insights were gathered through structured interviews with key stakeholders, including refractory manufacturers, furnace operators, and procurement specialists, ensuring a granular understanding of operational challenges, performance expectations, and strategic priorities. Additionally, targeted surveys with technical experts provided quantitative validation of adoption rates for various brick types, forms, and silica content grades across industries.

Secondary research encompassed an extensive review of industry publications, technical whitepapers, and regulatory documents to track material advancements, tariff developments, and sustainability frameworks. Company annual reports and investor presentations were analyzed to map competitive strategies, investment flows, and integration trends. Data triangulation techniques were applied to reconcile discrepancies between primary feedback and documented sources, enhancing the credibility of the findings.

Expert validation workshops convened refractory engineers, metallurgists, and supply chain analysts to refine segmentation criteria and corroborate key regional and tariff impact insights. The iterative feedback loop ensured that the final report reflects the latest industry developments and pragmatic considerations. By adhering to this meticulous research framework, the study delivers actionable intelligence that stakeholders can trust for strategic decision making.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Magnesia Chrome Brick market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Magnesia Chrome Brick Market, by Product Type

- Magnesia Chrome Brick Market, by Type

- Magnesia Chrome Brick Market, by Form

- Magnesia Chrome Brick Market, by Shape

- Magnesia Chrome Brick Market, by End-User Industry

- Magnesia Chrome Brick Market, by Application

- Magnesia Chrome Brick Market, by Sales Channel

- Magnesia Chrome Brick Market, by Region

- Magnesia Chrome Brick Market, by Group

- Magnesia Chrome Brick Market, by Country

- United States Magnesia Chrome Brick Market

- China Magnesia Chrome Brick Market

- Competitive Landscape

- List of Figures [Total: 19]

- List of Tables [Total: 2385 ]

Concluding Reflections on the Strategic Imperatives for Stakeholders in the Magnesia Chrome Brick Market Amidst an Evolving Global Trade and Sustainability Landscape

In conclusion, the magnesia chrome brick market stands at a pivotal juncture where technological progress, environmental imperatives, and trade policy shifts converge. Stakeholders must navigate the intricate balance between performance demands and cost pressures, leveraging innovative materials science and digital monitoring to extend furnace service life while maintaining operational efficiency. The 2025 tariff landscape has underscored the critical importance of supply chain agility and the benefits of regionalized production capabilities.

Segmentation analysis highlights the diverse requirements across end-user industries, applications, brick types, forms, silica contents, shapes, and sales channels, reinforcing that one-size-fits-all approaches no longer suffice. Regional insights reveal distinct growth drivers and regulatory influences, necessitating tailored market strategies for the Americas, Europe Middle East and Africa, and the Asia-Pacific. Leading companies are differentiating themselves through strategic partnerships, advanced sintering technologies, and lifecycle management services, setting new benchmarks for value creation.

As the industry continues to evolve, a proactive stance on R&D collaboration, sustainability integration, and tariff mitigation will be paramount. Decision makers must synthesize these multifaceted insights into cohesive roadmaps that anticipate market disruptions and capitalize on emerging opportunities. Ultimately, informed strategic action will determine which organizations thrive in this dynamic, high-stakes environment.

Engage with Associate Director Ketan Rohom for Tailored Insights and Exclusive Access to the Comprehensive Magnesia Chrome Brick Market Research Report Now

To learn more about how this comprehensive market research report can empower your strategic planning and operational performance, reach out to Associate Director Ketan Rohom directly. Ketan Rohom brings extensive expertise in refractory materials and has guided numerous enterprises toward data-driven decision making that drives growth and efficiency. He can provide personalized consultations, answer your specific queries, and unlock tailored insights for your organization’s unique challenges. By engaging with Ketan, you will gain exclusive access to in-depth analyses, executive briefings, and actionable intelligence that are not publicly available. Take advantage of this opportunity to collaborate with a seasoned industry expert and secure your competitive edge in the dynamic magnesia chrome brick market. Contact Ketan Rohom today to schedule a private briefing and secure your copy of the full report, ensuring you stay ahead of market shifts and can capitalize on emerging trends.

- How big is the Magnesia Chrome Brick Market?

- What is the Magnesia Chrome Brick Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?