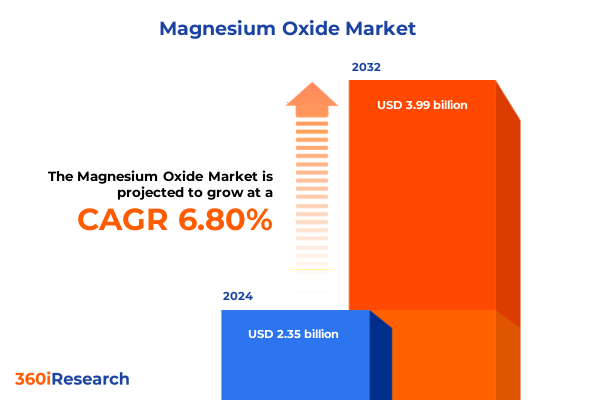

The Magnesium Oxide Market size was estimated at USD 2.51 billion in 2025 and expected to reach USD 2.68 billion in 2026, at a CAGR of 6.82% to reach USD 3.99 billion by 2032.

Setting the Scene for Magnesium Oxide Market Dynamics with Contextual Background on Key Industrial Drivers, Technological Advances, and Emerging Trends

Magnesium oxide plays a pivotal role across a diverse array of industrial and environmental applications, serving as a cornerstone material in sectors from refractory linings to environmental remediation. Its thermal stability, chemical inertness, and versatility position it as an essential component in processes that demand both performance and reliability. As end users confront evolving regulatory requirements and strive for greater operational efficiency, the demand for high-purity and application-specific magnesium oxide variants has risen, underscoring the material’s critical contribution to emerging industrial solutions.

In recent years, technological advances in calcination processes and raw material sourcing have transformed the production landscape for magnesium oxide. By leveraging energy-efficient kilns and exploring alternative feedstocks, producers have begun to address both cost pressures and sustainability objectives. Simultaneously, the integration of digital supply chain management tools has enhanced traceability from mine to end use, enabling more agile responses to market shifts. This introduction sets the stage for a deeper exploration of the forces shaping the magnesium oxide market and highlights the strategic imperatives that industry participants must navigate in a rapidly changing environment.

Uncovering Transformative Shifts That Are Reshaping the Magnesium Oxide Landscape Through Innovation, Sustainability, and Supply Chain Evolution

The magnesium oxide market is experiencing several transformative shifts that are redefining its development trajectory. First, the drive toward sustainability has spurred investments in low-carbon production techniques, with electrified furnaces and renewable energy integration becoming focal points for forward-looking manufacturers. These approaches not only reduce greenhouse gas emissions but also enhance cost competitiveness in regions with stringent environmental mandates.

Second, the rise of stringent air quality regulations has elevated the role of magnesium oxide-based solutions in flue gas desulfurization and wastewater treatment, prompting suppliers to innovate tailored grades for maximum pollutant capture. Concurrently, the construction sector is witnessing growing demand for specialized insulating materials and lightweight refractory components, further diversifying application opportunities.

Another defining shift is the advancement of supply chain digitalization. Real-time inventory monitoring, AI-driven demand forecasting, and blockchain-based provenance tracking are streamlining logistics, reducing lead times, and bolstering supplier reliability. Collectively, these disruptive trends are reshaping the competitive landscape, compelling stakeholders to adopt agile strategies and invest in next-generation technologies to maintain market relevance.

Analyzing the Cumulative Impact of United States Tariffs Imposed in 2025 on the Magnesium Oxide Supply Chain, Pricing, and Competitiveness

In early 2025, the United States implemented new tariffs on imported magnesium oxide, altering the cost structure and supply dynamics for downstream industries. While the measures aimed to bolster domestic production, they also introduced upward price pressures that reverberated through sectors reliant on cost-sensitive feedstocks. Fabricators of refractory bricks and environmental remediation additives faced margin compression, necessitating either cost absorption or the pursuit of alternate suppliers in exempt or lower-tariff jurisdictions.

Over time, these tariffs have driven a strategic pivot among buyers, accelerating efforts to qualify North American producers that expanded capacity in response to policy incentives. Such realignments have fostered greater regional self-sufficiency, though supply constraints still surface during peak demand cycles. Moreover, the evolving tariff framework has catalyzed collaborative ventures between domestic and foreign firms aimed at establishing joint processing facilities to circumvent trade barriers.

Looking ahead, industry participants must closely monitor further policy developments and adapt procurement strategies accordingly. Long-term competitiveness will hinge on balancing tariff-related costs with investments in local production capabilities, while simultaneously ensuring access to high-performance grades essential for specialized applications.

Revealing Key Insights from Diverse Magnesium Oxide Market Segmentation Based on Application, Product Type, Purity Grade, Form, and Distribution Channel

A nuanced understanding of magnesium oxide market segmentation reveals distinct opportunities and challenges across various dimensions. When assessing application segments, agricultural formulations address soil pH stabilization and animal nutrition, construction grades enhance fire resistance and thermal insulation, and refractory blends support high-temperature industrial processes. Meanwhile, environmental applications are bifurcated into flue gas treatment solutions designed for sulfur capture and wastewater treatment variants formulated for heavy metal precipitation, highlighting the material’s adaptability to pollutant control.

Turning to product type, dead burnt magnesium oxide offers superior structural integrity under extreme heat, electrically calcined grades provide precision-controlled particle properties for specialized industrial uses, and lightly calcined variants yield rapid reactivity suited for chemical synthesis and binding applications. Purity grade segmentation differentiates high-purity magnesium oxide-tailored for pharmaceutical, agricultural, and electronics sectors-from standard-grade material that meets broader industrial specifications. Further distinctions arise by form: granules facilitate ease of handling and uniform dosing, while powder forms enable fine dispersion in high-performance formulations. Finally, distribution channels ranging from direct sales relationships to third-party distributors and online platforms shape how end users source and engage with suppliers, reflecting the growing importance of digital commerce even in traditional industrial markets.

This comprehensive research report categorizes the Magnesium Oxide market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Purity Grade

- Form

- Application

- Distribution Channel

Highlighting Regional Dynamics and Opportunities for Magnesium Oxide Across the Americas, Europe, Middle East & Africa, and Asia-Pacific

Regional market dynamics for magnesium oxide vary significantly across the Americas, Europe, Middle East & Africa, and Asia-Pacific, driven by local resource endowments, regulatory landscapes, and end-use demand profiles. In the Americas, proximity to raw material deposits and supportive trade policies have underpinned growth in both refractory and environmental segments. Investment in domestic processing facilities has further enhanced the region’s capacity to supply value-added grades, positioning it as a strategic hub for North American end users.

Europe, Middle East & Africa exhibit a dual landscape: Western Europe’s rigorous emissions targets and circular economy mandates have propelled demand for advanced flue gas treatment solutions, while emerging economies in the Middle East & Africa are expanding infrastructure projects that rely on construction and refractory applications. Here, regional collaboration on research and joint ventures has emerged as a critical mechanism for transferring production technologies and meeting localized performance requirements.

Asia-Pacific remains the largest consumer region, driven by massive industrialization, urbanization, and environmental remediation efforts in key markets. Rapidly expanding steel, cement, and chemical sectors continue to absorb substantial volumes of magnesium oxide, even as regulatory pressures push for cleaner production methods. Together, these regional contours illustrate the importance of tailored approaches to product development, supply chain configuration, and partnership models across diverse geographic markets.

This comprehensive research report examines key regions that drive the evolution of the Magnesium Oxide market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Magnesium Oxide Companies with Strategic Initiatives, Market Positioning, and Technological Innovations Driving Industry Advancement

Leading magnesium oxide suppliers have adopted varied strategies to strengthen their market positions and capitalize on emerging trends. Key players have invested in capacity expansion and modernization of calcination facilities, integrating automated process controls to enhance consistency and reduce energy consumption. Concurrently, strategic alliances and joint ventures have been forged to secure feedstock reliability and gain access to specialized technology platforms.

Several companies have prioritized research and development, launching premium high-purity grades aimed at fast-growing sectors such as water treatment and advanced ceramics. Others have diversified their portfolios by offering turnkey environmental remediation services, bundling magnesium oxide products with engineering expertise to capture additional value. In parallel, select firms are pioneering digital customer engagement tools that facilitate order tracking, technical support, and data-driven product recommendations, thereby strengthening customer loyalty and enabling more agile demand fulfillment.

Ultimately, these strategic initiatives underline the competitive intensity of the market, as suppliers differentiate through technology leadership, vertical integration, and service-centric models to meet the evolving needs of a broadening range of end-use industries.

This comprehensive research report delivers an in-depth overview of the principal market players in the Magnesium Oxide market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Carmeuse NA, S.A.

- Haicheng Huayu Group

- Israel Chemicals Ltd.

- JSC Kaustik

- Konoshima Chemical Co., Ltd.

- Kyowa Chemical Industry Co., Ltd.

- KÜMAŞ

- Lehmann & Voss & Co. GmbH

- Liaoning Wang Cheng Magnesium Group

- LKAB Minerals AB

- Martin Marietta Materials, Inc.

- Meishen Technology Co., Ltd.

- Minerali Industriali S.p.A.

- Nedmag B.V.

- Omya AG

- Premier Magnesia, LLC

- Premier Periclase

- RHI Magnesita N.V.

- Russian Mining Chemical Company

- Sibelco Europe N.V.

- Tateho Chemical Industries Co., Ltd.

- Xinyang Mineral Group

Actionable Recommendations for Industry Leaders to Harness Sustainability, Optimize Supply Chains, and Capitalize on Emerging Magnesium Oxide Opportunities

To thrive amid intensifying competition and regulatory pressures, industry leaders should adopt a multifaceted strategy that emphasizes both operational excellence and market responsiveness. First, embracing sustainable production practices-such as renewable energy integration and low-emission calcination technologies-will not only reduce carbon footprints but also mitigate regulatory risk and appeal to environmentally conscious end users.

Second, companies must optimize their supply chains by diversifying raw material sources, leveraging digital forecasting tools, and establishing agile logistics networks that can adapt to tariff fluctuations and demand variability. A flexible procurement approach will cushion against external shocks while ensuring consistent access to high-quality feedstocks.

Third, fostering collaborative partnerships across the value chain-spanning research institutions, equipment suppliers, and end users-will accelerate innovation in specialty grades and application-specific formulations. By co-developing solutions that address emerging needs in environmental remediation and high-temperature industrial processes, organizations can capture premium margins and reinforce their market differentiation.

Collectively, these recommendations equip leaders to capitalize on growth opportunities, strengthen competitive positioning, and deliver sustainable value in the dynamic magnesium oxide landscape.

Unveiling a Rigorous Research Methodology Combining Qualitative and Quantitative Techniques for a Robust Magnesium Oxide Market Analysis

This research effort combines qualitative and quantitative methodologies to deliver a comprehensive market analysis. Primary research includes in-depth interviews with industry executives, technical experts, and procurement professionals, providing firsthand insights into production challenges, end-user requirements, and future demand drivers. These conversations form the foundation for identifying emerging trends, competitive strategies, and investment priorities across the value chain.

Secondary research sources encompass peer-reviewed journal articles, trade association publications, patent filings, and government documents, ensuring broad coverage of technological developments, regulatory frameworks, and raw material availability. Data from proprietary industry databases and shipping logs are analyzed to trace trade flows and assess the impact of policy measures on supply chains.

Quantitative analysis employs statistical techniques to evaluate correlations between consumption patterns and macroeconomic indicators, while scenario modeling projects potential outcomes under varying regulatory and trade policy environments. Rigorous data triangulation underpins all findings, ensuring that conclusions are robust, transparent, and actionable for decision-makers seeking to navigate the evolving magnesium oxide market.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Magnesium Oxide market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Magnesium Oxide Market, by Product Type

- Magnesium Oxide Market, by Purity Grade

- Magnesium Oxide Market, by Form

- Magnesium Oxide Market, by Application

- Magnesium Oxide Market, by Distribution Channel

- Magnesium Oxide Market, by Region

- Magnesium Oxide Market, by Group

- Magnesium Oxide Market, by Country

- United States Magnesium Oxide Market

- China Magnesium Oxide Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1113 ]

Concluding Perspectives on the Evolution of the Magnesium Oxide Market and Strategic Imperatives for Sustained Value Creation and Future Growth

The evolution of the magnesium oxide market reflects a convergence of technological innovation, sustainability imperatives, and shifting trade policies. As producers adopt energy-efficient manufacturing processes and end users demand increasingly specialized grades, the competitive landscape continues to fragment along lines of performance, purity, and service orientation. Tariff measures have further catalyzed regional realignments, emphasizing the need for agile supply chain strategies and strategic partnerships.

Looking forward, success will hinge on the ability to anticipate regulatory developments, leverage digital technologies for operational excellence, and co-create value with customers through tailored solutions. Organizations that can seamlessly integrate sustainability objectives with market-driven innovation will secure a decisive advantage, positioning themselves at the forefront of a market that is primed for transformation.

Empowering Your Organization with Exclusive Access to the Comprehensive Magnesium Oxide Market Research Report Through a Direct Conversation

Elevate your strategic decision-making with comprehensive insights tailored to the evolving magnesium oxide market. To secure immediate access to an in-depth analysis covering emerging trends, regional dynamics, and actionable recommendations, initiate a conversation with Ketan Rohom (Associate Director, Sales & Marketing at 360iResearch). He will guide you through the report’s critical findings and demonstrate how these insights can inform your growth strategies and competitive positioning. Engage today to transform your understanding of the magnesium oxide landscape and unlock the full value of this definitive market intelligence.

- How big is the Magnesium Oxide Market?

- What is the Magnesium Oxide Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?