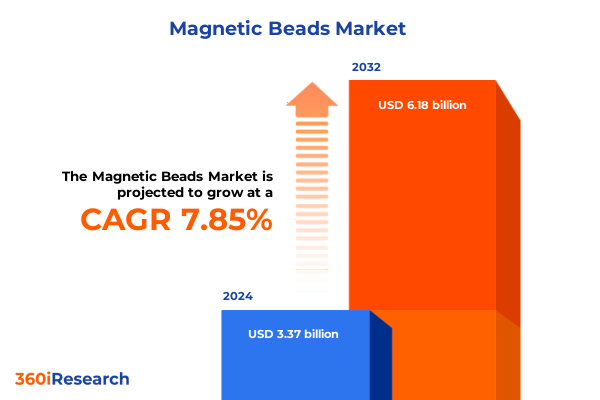

The Magnetic Beads Market size was estimated at USD 3.62 billion in 2025 and expected to reach USD 3.89 billion in 2026, at a CAGR of 7.92% to reach USD 6.18 billion by 2032.

Exploring the Fundamental Role of Magnetic Beads in Modern Research and Diagnostics Amidst Rapid Technological Evolution and Innovation

Magnetic beads are micron-scale particles engineered with magnetic cores and specialized surface chemistries to enable efficient capture, separation, and manipulation of biological targets. These versatile platforms were initially developed to simplify nucleic acid purification workflows in molecular biology laboratories. Over time, refinements in coating technologies and magnetic responsiveness have expanded their utility far beyond simple sample cleanup. As a result, magnetic beads have become indispensable tools in diagnostic assays, drug discovery pipelines, and environmental monitoring processes across academic, industrial, and clinical settings.

Transitioning from basic polystyrene-based beads, modern variants now feature cores of iron oxide or ferrite alloys with precisely controlled sizes and magnetic properties. Surface functionalization techniques allow conjugation of antibodies, proteins, and oligonucleotides to selectively isolate cell populations, viral particles, or genomic fragments. In parallel, advances in bead stability and biocompatibility have unlocked new opportunities in environmental and food safety testing, where rapid pathogen isolation is critical. The convergence of nanotechnology and automated platforms has further accelerated throughput and repeatability, enabling high-volume screening initiatives and point-of-care diagnostics. Consequently, magnetic beads continue to serve as foundational elements in emerging fields such as single-cell genomics, targeted therapeutic delivery, and real-time pathogen detection, establishing themselves as a cornerstone of innovation in life sciences research.

Charting the Transformative Advances Reshaping Magnetic Beads Applications in Biotechnology and Healthcare Over the Last Decade

Over the past decade, magnetic beads have undergone a paradigm shift driven by breakthroughs in nanofabrication, material science, and automation technologies. Initially designed for manual separation tasks, these beads are now integral components of fully automated liquid handling systems that deliver higher reproducibility and reduced human error. Concurrently, the emergence of superparamagnetic beads with zero remanence has significantly enhanced separation efficiency, preventing particle aggregation and ensuring cleaner elutions.

Moreover, the integration of magnetic bead workflows with microfluidic platforms has ushered in a new era of miniaturized diagnostics and high-throughput screening. By channeling minute sample volumes through precise microfluidic architectures, researchers can now perform multiplexed assays for pathogen detection, single-cell analysis, and epigenetic profiling with unprecedented speed. In parallel, custom material compositions such as cobalt ferrite and nickel ferrite have been optimized to tailor magnetic response profiles for specific applications, from drug delivery targeting to proteomic sample preparation. Additionally, the incorporation of real-time data analytics and AI-driven optimization within magnetic separation platforms is enabling predictive maintenance and assay customization, further elevating operational efficiency. As a result, transformative shifts in bead chemistry, instrumentation, and workflow automation are reshaping both research laboratory practices and clinical diagnostics. These advances are setting the stage for more personalized and decentralized healthcare solutions, while also broadening the scope of environmental and industrial monitoring.

Assessing the Comprehensive Effects of 2025 United States Tariffs on Magnetic Beads Supply Chains and Industry Manufacturing Economics

The introduction of revised United States tariff schedules in early 2025 has created significant headwinds for magnetic beads manufacturers and end-users dependent on imported raw materials and components. Heightened duty rates on imported iron oxide precursors and specialty polymers have increased input costs, prompting many domestic producers to reassess their supply chain strategies. As a consequence, procurement teams are exploring alternative sourcing from tariff-exempt regions and renegotiating contracts to mitigate margin erosion.

In response to these fiscal pressures, several market players have accelerated investments in localized manufacturing capabilities and backward integration. By establishing domestic synthesis units for key ferrite materials and polymer coatings, companies aim to reduce exposure to volatile import tariffs and shorten lead times. These shifts are accompanied by collaborative agreements with domestic raw material suppliers to secure consistent supply and stable pricing structures. Furthermore, extended lead times and logistical complexities have underscored the importance of supply chain resilience, prompting stakeholders to adopt just-in-case inventory models rather than lean supply practices. However, smaller research laboratories and start-up biotechs continue to face challenges in absorbing increased reagent costs, leading to budget reallocation or delayed adoption of advanced bead-based workflows. Looking ahead, ongoing dialogue between industry stakeholders and trade authorities is expected to shape future tariff frameworks, influencing global competitiveness and innovation trajectories within the magnetic beads ecosystem.

Uncovering Critical Segmentation Dynamics That Define Market Performance Across Types, Materials, Sizes, Applications and Distribution Channels

Analyzing magnetic beads through type segmentation reveals distinct performance profiles, where paramagnetic beads remain indispensable for standard separations, yet superparamagnetic beads are increasingly sought for workflows demanding zero residual magnetism and superior recovery purity. In parallel, material composition segmentation highlights the continued prevalence of iron oxide beads, sought for their cost-effective synthesis and predictable magnetic characteristics, even as cobalt ferrite beads gain ground in high-sensitivity applications requiring elevated magnetic saturation. Meanwhile, nickel ferrite beads, though occupying a specialized niche, are instrumental in workflows that benefit from their unique magnetic hysteresis properties. Bead size segmentation further refines operational choices, with fine-grained 1–10 µm particles enabling subcellular isolation, mid-range 20–40 µm beads offering balanced surface area and handling, and larger 70–120 µm spheres optimized for efficient whole-cell recovery in automated platforms.

Transitioning to application-based segmentation, magnetic beads demonstrate versatility across bacterial detection and isolation, sensitive molecular biology and genomics protocols, comprehensive proteomics sample cleanup, clinical diagnostics assays, targeted drug delivery endeavors, and stringent environmental and food safety testing processes. This broad application spectrum drives adoption among diverse end users, including academic and research institutions advancing fundamental science, environmental agencies monitoring contaminants, hospitals and diagnostic laboratories deploying rapid point-of-care tests, and pharmaceutical and biotech enterprises incorporating bead-based approaches into drug discovery pipelines. Distribution channel segmentation reveals that while conventional offline networks continue to support high-volume reagent procurement, digital marketplaces and online storefronts are accelerating delivery timelines and democratizing access to sophisticated bead technologies.

This comprehensive research report categorizes the Magnetic Beads market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Material Composition

- Beads Size

- Distribution Channel

- Application

- End-User

Delineating Key Regional Dynamics and Growth Drivers Across the Americas, Europe Middle East Africa and Asia Pacific Magnetic Beads Markets

The Americas region, anchored by leading innovation hubs in North America, exhibits robust uptake of magnetic bead technologies within both academic research and clinical diagnostics sectors. Major life sciences clusters are driving continuous improvements in bead functionalization chemistries and separation instrumentation, supported by collaboration between universities, contract research organizations, and healthcare facilities. Furthermore, environmental monitoring initiatives across the region are leveraging bead-based assays for rapid detection of waterborne pathogens and pollutants, reinforcing the versatility of these platforms beyond human health applications.

In Europe, the Middle East, and Africa region, regulatory harmonization and stringent quality standards underscore the adoption of magnetic beads in diagnostic laboratories and hospital settings. European Union directives on medical devices and reagent traceability have catalyzed the integration of magnetic bead methods into standardized testing protocols. Concurrently, Middle Eastern and African markets are experiencing gradual adoption driven by infrastructure investments in public health and environmental testing laboratories. Shifting focus to Asia-Pacific, this region is emerging as both a high-growth consumer and a key manufacturing base for magnetic bead materials and reagents. Significant capacity expansions in China, India, and Southeast Asia have enhanced global supply resilience, while rising pharmaceutical and food safety testing demands in the Asia-Pacific market continue to propel product innovation and localized customization.

This comprehensive research report examines key regions that drive the evolution of the Magnetic Beads market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Illuminating Competitive Strategies and Collaborative Efforts Among Leading Magnetic Beads Manufacturers and Innovators Worldwide

Leading market participants are pursuing differentiated strategies to solidify their positions within the magnetic beads landscape. Several large-scale reagent manufacturers are expanding portfolio breadth through the introduction of customized bead chemistries and proprietary surface coatings, catering to specialized applications ranging from single-cell sequencing to multiplexed immunoassays. Strategic collaborations between instrument providers and bead producers have also gained momentum, enabling turnkey solutions that seamlessly integrate magnetic separation modules with automated liquid handling and detection systems.

Mid-tier companies are positioning themselves through service-driven models, offering contract manufacturing and application development support to both academic and industrial clients. These value-added services facilitate rapid assay optimization and enable smaller laboratories to adopt advanced bead workflows without incurring significant capital expenditures. Meanwhile, emerging players and start-ups are distinguishing themselves via niche innovations such as stimuli-responsive beads and stimuli-release strategies for targeted drug delivery. Competitive dynamics are further influenced by mergers and acquisitions activity, as established life sciences conglomerates seek to acquire boutique bead technology specialists to augment their molecular biology and diagnostics portfolios. Across this evolving landscape, agility in product development and responsiveness to end-user needs remain critical success factors for both global and regional players.

This comprehensive research report delivers an in-depth overview of the principal market players in the Magnetic Beads market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Advanced BioChemicals Ltd.

- Alcon Scientific Industries

- Bangs Laboratories Inc.

- Bio-Rad Laboratories, Inc.

- Biotium, Inc.

- Boca Scientific Inc.

- Calbiotech by Transasia Bio-Medicals

- CardioGenics Inc.

- CD Bioparticles

- Cytiva by Danaher Corporation

- Ferrotec Corporation

- Geneaid Biotech Ltd.

- GenScript Biotech Corporation

- Kerafast, Inc. by LSBio

- MagBio Genomics Inc.

- MagQu Co. Ltd.

- Merck KGaA

- Micromod Partikeltechnologie GmbH

- Miltenyi Biotec

- MoBiTec GmbH by Calibre Scientific

- New England BioLabs Inc.

- Promega Corporation by Eppendorf AG

- Rockland Immunochemicals, Inc.

- Spherotech Inc.

- Takara Bio Inc.

- Thermo Fisher Scientific Inc.

Actionable Strategies for Industry Leaders to Capitalize on Emerging Magnetic Beads Trends and Strengthen Market Positioning

Industry leaders should prioritize investment in advanced bead functionalization techniques, such as modular surface chemistries that allow rapid adaptation to emerging biological targets. By fostering collaborative research partnerships with academic institutions and specialized component suppliers, companies can accelerate the co-development of next-generation bead assays tailored to high-growth sectors like single-cell genomics and point-of-care diagnostics. Moreover, diversifying raw material sources and strengthening backward integration efforts will build supply chain resilience in the face of geopolitical uncertainties and tariff fluctuations.

To enhance market reach, leaders are encouraged to develop comprehensive digital platforms that combine online procurement portals with interactive technical support and training resources. This approach not only streamlines purchasing processes but also empowers end users through virtual workshops and troubleshooting forums. In parallel, optimizing product offerings for sustainability-by reducing non-biodegradable polymer usage and adopting eco-friendly packaging-will also resonate with environmentally conscious research and corporate governance initiatives. Additionally, benchmarking performance metrics against industry best practices and publishing white papers can reinforce credibility and drive wider adoption of innovative bead technologies. Finally, a targeted focus on expanding service-based support models, including application development and contract testing services, can drive new revenue streams while deepening customer engagement across academic, clinical, and industrial market segments.

Detailing the Rigorous Multi-Stage Research Framework Employed to Ensure Robust, Objective Insights into the Magnetic Beads Ecosystem

This research adopts a multi-stage methodology combining rigorous secondary and primary data collection to ensure the delivery of objective and comprehensive insights. The secondary phase involved a systematic review of peer-reviewed journals, patent databases, industry publications, and relevant regulatory guidelines to capture the evolution of magnetic bead materials, applications, and technologies. In tandem, company filings, technical brochures, and conference proceedings were analyzed to establish a robust understanding of product portfolios and strategic developments.

Primary research was conducted through structured interviews and surveys with key opinion leaders, including R&D managers at biotechnology firms, procurement specialists at diagnostic laboratories, and regulatory experts in environmental testing agencies. These dialogues provided qualitative insights into emerging trends, application challenges, and procurement decision factors. Quantitative validation was achieved through data triangulation methods, where findings from expert interviews were cross-verified against shipment records, trade statistics, and selected case studies to enhance accuracy. Quality control measures, such as peer review of data inputs and logical consistency checks, were applied at each stage to maintain the highest research integrity and deliverables aligned with stakeholder expectations.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Magnetic Beads market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Magnetic Beads Market, by Product Type

- Magnetic Beads Market, by Material Composition

- Magnetic Beads Market, by Beads Size

- Magnetic Beads Market, by Distribution Channel

- Magnetic Beads Market, by Application

- Magnetic Beads Market, by End-User

- Magnetic Beads Market, by Region

- Magnetic Beads Market, by Group

- Magnetic Beads Market, by Country

- United States Magnetic Beads Market

- China Magnetic Beads Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1431 ]

Synthesizing Key Insights to Highlight the Future Trajectory and Strategic Imperatives in the Magnetic Beads Industry Landscape

In summary, magnetic beads have evolved from simple separation tools into versatile enablers of advanced diagnostics, genomics research, and targeted therapeutic applications. The interplay of innovations in core materials, bead functionalization, and automated separation platforms has expanded their utility across diverse sectors, from clinical laboratories to environmental monitoring facilities. Tariff-related pressures in 2025 have underscored the importance of supply chain adaptability and local manufacturing capabilities, reshaping procurement strategies and investment priorities.

Segmentation analysis highlights nuanced differences in performance and adoption across bead types, material compositions, size ranges, applications, end users, and distribution channels, while regional insights reveal dynamic growth patterns driven by regulatory frameworks and local industry strengths. Competitive landscapes are marked by strategic partnerships, mergers and acquisitions, and continuous product development, emphasizing the need for agility and customer-centric approaches. Looking forward, the convergence of AI-driven assay optimization and microfluidic integration promises to unlock even greater efficiencies, enabling rapid, on-demand testing across decentralized settings. As a result, organizations that invest in innovative surface chemistries, digital engagement tools, and sustainable practices are well positioned to lead future advancements. This comprehensive perspective underscores the critical role of magnetic beads in shaping the next frontier of life sciences and industrial applications.

Engage with Associate Director Ketan Rohom for Personalized Guidance and to Secure Your Comprehensive Magnetic Beads Market Research Report Today

For organizations seeking to harness the full potential of magnetic beads in their research, diagnostic, or industrial workflows, expert guidance is readily available. Ketan Rohom, Associate Director of Sales & Marketing, can provide personalized consultation to help align bead technology solutions with specific project requirements and strategic objectives. By engaging directly with his team, stakeholders can access tailored insights into product selection, workflow integration, and cost optimization.

Secure your comprehensive magnetic beads market research report today to gain an authoritative resource that empowers data-driven decisions and competitive advantage. Reach out to arrange a one-on-one briefing with Ketan Rohom to explore how this in-depth analysis can support your organizational goals and accelerate innovation in your field.

Act now to ensure your team remains at the forefront of magnetic bead advancements and capitalizes on emerging opportunities across biotechnology, clinical diagnostics, and environmental testing.

- How big is the Magnetic Beads Market?

- What is the Magnetic Beads Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?