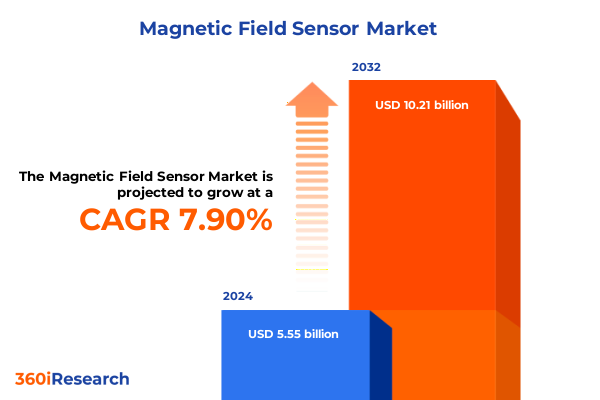

The Magnetic Field Sensor Market size was estimated at USD 5.93 billion in 2025 and expected to reach USD 6.33 billion in 2026, at a CAGR of 8.07% to reach USD 10.21 billion by 2032.

Introduction to the Dynamic Evolution of Magnetic Field Sensor Technology and Market Forces Shaping Strategic Opportunities

The magnetic field sensor market stands at a pivotal juncture marked by rapid technological breakthroughs and evolving end-user requirements. From the earliest fluxgate and induction sensors that enabled rudimentary compass applications, sensing capabilities have advanced to encompass sub-nanotesla precision and integration with digital control systems. This dynamic progression has created an environment where traditional performance metrics give way to demands for ultra-low power consumption, miniaturization, and seamless connectivity with broader Internet of Things ecosystems.

Against this backdrop, industry leaders and new entrants alike are compelled to refine their strategic approaches. Innovations in magnetoresistive technologies, from anisotropic magnetoresistive (AMR) designs to giant magnetoresistive (GMR) and tunnel magnetoresistive (TMR) variants, now offer unparalleled sensitivity for use cases ranging from medical imaging to autonomous navigation. Simultaneously, digital sensor platforms equipped with onboard signal conditioning and processing functionality have reduced the complexity of system integration, spurring adoption across automotive safety systems, industrial automation, and consumer electronics. This report lays the foundation for understanding how these developments converge, setting the stage for informed decision-making.

A Comprehensive Exploration of Disruptive Technological Advancements and Industry Shifts Revolutionizing Magnetic Field Sensing Capabilities

Technological innovation within the magnetic field sensor landscape has shifted the parameters of what is possible, enabling both incremental improvements and disruptive applications. Recent advancements in magnetoresistive materials have not only elevated sensitivity but have also driven down power requirements, facilitating the proliferation of battery-operated wearables and remote monitoring devices. Moreover, the convergence of sensor miniaturization and the rise of integrated circuits for signal conditioning has ushered in a new era where sensors can both sense and process at the edge, catalyzing real-time analytics for predictive maintenance in manufacturing and intelligent position tracking in robotics.

In parallel, the digital transformation of manufacturing processes and the emphasis on Industry 4.0 have heightened demand for robust position and speed detection solutions. Capacities for precise rotation sensing now underpin servo systems and drone stabilization platforms, while proximity sensing modules have become integral to next-generation safety frameworks in autonomous vehicles. These shifts have also spurred cross-industry collaboration, with suppliers of sensing elements forming strategic alliances with semiconductor manufacturers and software developers to deliver turnkey solutions.

As these trends accelerate, regulatory frameworks and standardized communication interfaces have evolved in tandem. The advent of new industry standards for sensor interoperability, coupled with stringent electromagnetic compatibility requirements, has created an environment that rewards agile product roadmaps. Companies capable of rapidly adapting to such shifts while maintaining rigorous quality controls are best positioned to capture emerging opportunities and sustain long-term growth.

Analyzing the Pervasive Effects of United States Tariff Policies Introduced in 2025 on Supply Chains Manufacturing and Competitiveness

With the introduction of new tariff measures in 2025, magnetic field sensor supply chains have experienced a notable recalibration. Components such as sensing elements and permanent magnets, previously sourced extensively from overseas facilities, now face increased cost pressures and lead time variability. This ripple effect has prompted manufacturers to reassess their procurement strategies, exploring nearshoring options and fostering deeper partnerships with domestic suppliers of communication interfaces and signal conditioning circuitry.

Beyond direct material costs, the tariff landscape has influenced strategic sourcing decisions at the design stage. Multinational sensor developers are now weighing the benefits of integrating higher-value modules, such as advanced processing circuitry, into their core offerings to offset rising import duties. This approach not only enhances the resilience of product portfolios but also aligns with broader industry goals of vertical integration and supply chain transparency. As manufacturing footprints adjust to mitigate tariff impacts, stakeholders across the value chain must remain vigilant in balancing cost, performance, and compliance considerations.

Deep Insight into Market Segmentation by Sensor Type Component Category Application and End User Industries Driving Strategic Focus

The diversity of magnetic field sensing applications necessitates a nuanced view of market segmentation. Consider the landscape by type, where fluxgate sensors excel in geomagnetic mapping while hall effect sensors dominate current sensing in power applications. Induction sensors continue to serve legacy applications, whereas magnetoresistive sensors-comprising anisotropic magnetoresistive (AMR), giant magnetoresistive (GMR), and tunnel magnetoresistive (TMR) variants-are expanding into precision navigation and biomedical instrumentation. Meanwhile, SQUID sensors remain the choice for ultra-high-sensitivity niches, underscoring the importance of technology-fitting use case alignment.

When assessed by component, a more intricate network of suppliers emerges. Communication interfaces, which facilitate data exchange with host systems, must balance throughput and electromagnetic resilience. Permanent magnets supply the reference fields that underpin many sensing mechanisms, while sensing elements convert magnetic flux into usable electrical signals. Signal conditioning and processing circuitry then refine output quality and embed intelligence, enabling digital sensor category solutions that directly integrate analog front ends with microcontroller units. Analog modules continue to serve cost-sensitive applications, whereas digital platforms deliver added functionalities for system integrators seeking plug-and-play simplicity.

Application-driven segmentation reveals areas of robust demand and potential growth. Current sensing remains a cornerstone of energy management in smart grids and electric vehicles, while navigation and positioning modules underpin both industrial robotics and consumer electronics. Proximity sensing is integral to contactless safety systems, whereas rotation sensing and speed detection find uses in manufacturing equipment and automotive powertrains. Finally, end user industries ranging from aerospace and defense to automotive, consumer electronics, energy and utilities, healthcare, and industrial automation and robotics each present distinct performance thresholds and regulatory pressures that shape product roadmaps and go-to-market approaches.

This comprehensive research report categorizes the Magnetic Field Sensor market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Component

- Sensor Category

- Application

- End User Industry

Strategic Regional Perspectives Highlighting Market Dynamics Opportunities and Growth Drivers across the Americas Europe Middle East Africa and Asia Pacific

Regional dynamics play a critical role in shaping the competitive and regulatory environment for magnetic field sensors. In the Americas, infrastructure modernization efforts and the push toward electrification are fueling demand for precise current sensing in grid management and electric vehicle powertrains. Local content requirements and government incentives for domestic production have created fertile ground for both established manufacturers and innovative startups to collaborate on next-generation sensing modules.

Across Europe, the Middle East, and Africa, stringent environmental and safety standards are driving adoption of high-reliability sensors in aerospace, defense, and energy sectors. The region’s diverse market landscape-from the advanced manufacturing hubs in Western Europe to burgeoning infrastructure projects in the Gulf Cooperation Council states-necessitates flexible supply chain models and product portfolios calibrated to varying regulatory regimes. Meanwhile, ongoing investments in digital rail signaling and smart building initiatives are creating tailwinds for precise positioning and rotation sensing technologies.

In Asia-Pacific, manufacturing powerhouses and rapidly growing consumer markets are at the forefront of volume demand. Countries with robust semiconductor ecosystems are advancing integration of digital sensor platforms into consumer electronics, while the automotive industry’s shift to advanced driver-assistance systems is accelerating uptake of magnetoresistive and hall effect modules. Concurrently, energy and utilities players across emerging economies are leveraging proximity sensing and current monitoring solutions to optimize renewable energy integration and grid stability.

This comprehensive research report examines key regions that drive the evolution of the Magnetic Field Sensor market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Critical Analysis of Leading Industry Participants their Strategic Initiatives Collaborations and Product Innovations Shaping Competitive Dynamics

Leading stakeholders in the magnetic field sensor market have adopted differentiated strategies to secure competitive advantage. Some participants have pursued in-house development of sensing elements and signal processing microelectronics, reducing reliance on external component suppliers and enabling tighter control over intellectual property. Others have prioritized mergers and acquisitions to bolster portfolios with complementary technologies-particularly in magnetoresistive subsegments such as GMR and TMR, where advanced materials expertise can be a significant entry barrier.

Collaborations between sensor manufacturers and semiconductor foundries have become increasingly common, facilitating the co-development of application-specific integrated circuits that embed digital processing capabilities. Moreover, strategic partnerships with system integrators have enabled turnkey solutions targeted at key verticals such as industrial automation and healthcare imaging. These alliances often extend beyond product bundling to encompass joint research initiatives, reinforcing innovation pipelines and accelerating time to market.

In parallel, some companies are focusing on sustainability and lifecycle management, optimizing supply chains to minimize environmental impact and ensuring compliance with emerging regulations on hazardous substances. This emphasis on eco-friendly sensor materials and end-of-life recycling schemes not only addresses regulatory risk but also resonates with an expanding base of environmentally conscious end users.

This comprehensive research report delivers an in-depth overview of the principal market players in the Magnetic Field Sensor market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Aichi Steel Corporation

- Allegro MicroSystems, Inc.

- ams-OSRAM AG

- Analog Devices, Inc.

- Asahi Kasei Corporation

- Balluff GmbH

- BOURNS, Inc.

- Diodes Incorporated

- Ensinger GmbH

- Hans Turck GmbH & Co. KG

- Honeywell International Inc.

- ifm electronic GmbH

- Infineon Technologies AG

- Melexix NV

- MEMSIC Inc.

- Murata Manufacturing Co., Ltd

- NXP Semiconductors N.V.

- Panasonic Holdings Corporation

- PCE Holding GmbH

- Pepperl+Fuchs SE

- Robert Bosch GmbH

- ROHM Co., Ltd.

- Silicon Laboratories

- STANDEX INTERNATIONAL CORPORATION

- STMicroelectronics N.V.

- TDK Corporation

- Texas Instruments Incorporated

- Twinleaf LLC

- Zimmer Group

Actionable Strategic Guidance for Industry Leaders to Leverage Emerging Trends Overcome Challenges and Capitalize on Market Disruptions

Industry leaders should prioritize flexible supply chain models that can adapt to shifting tariff landscapes and regional regulatory changes. By diversifying sources for key components-such as permanent magnets and sensing elements-and investing in nearshore manufacturing capabilities, organizations can mitigate risk, streamline lead times, and maintain product quality. In addition, embedding signal conditioning and processing functionality at the sensor level can differentiate offerings through enhanced reliability and simplified system integration.

Furthermore, stakeholders must deepen customer engagement by developing solutions tailored to specific end use applications. For example, customizing magnetoresistive sensor performance for high-precision positioning in robotics or optimizing hall effect modules for current monitoring in electric vehicles can foster stronger partnerships and higher-value contracts. Complementary service models, such as sensor calibration and predictive maintenance analytics, can also unlock new revenue streams and reinforce customer loyalty.

Finally, companies should actively explore collaborative innovation initiatives. Partnerships with semiconductor foundries, material science research institutes, and software developers can accelerate the development of next-generation digital sensor architectures. By aligning R&D efforts with emerging industry standards and cross-industry use cases-particularly in smart infrastructure and medical diagnostics-organizations will be well positioned to lead market transitions and capture strategic opportunities.

Overview of Rigorous Research Methodology Data Collection and Analysis Approaches Underpinning the Magnetic Field Sensor Market Study

This study employs a multi-faceted research approach combining primary interviews with senior executives across the value chain and secondary data from regulatory bodies, industry associations, and academic institutions. Qualitative insights derived from supplier, end user, and technology partner discussions provide the context necessary to understand strategic priorities, regulatory impacts, and innovation trajectories.

Quantitative analysis integrates equipment shipment data, patent filings, and trade records to map technology diffusion patterns and supply chain shifts. Cross-validation with triangulated sources ensures consistency and reliability of findings, while scenario analysis techniques illuminate potential market trajectories under varying regulatory and geopolitical conditions. This rigorous methodology underpins the credibility of strategic recommendations and provides stakeholders with a transparent framework for decision-making.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Magnetic Field Sensor market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Magnetic Field Sensor Market, by Type

- Magnetic Field Sensor Market, by Component

- Magnetic Field Sensor Market, by Sensor Category

- Magnetic Field Sensor Market, by Application

- Magnetic Field Sensor Market, by End User Industry

- Magnetic Field Sensor Market, by Region

- Magnetic Field Sensor Market, by Group

- Magnetic Field Sensor Market, by Country

- United States Magnetic Field Sensor Market

- China Magnetic Field Sensor Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1113 ]

Summarizing Core Insights Strategic Implications and Future Outlook for Stakeholders in the Evolving Magnetic Field Sensor Ecosystem

The dynamic convergence of advanced materials, digital electronics, and evolving user requirements positions the magnetic field sensor market at the forefront of industrial and consumer technology innovation. Stakeholders equipped with a deep understanding of segmentation nuances, regional dynamics, and the strategies of key players will be best prepared to navigate emerging challenges and capitalize on high-growth applications.

As markets continue to shift in response to regulatory changes and technological breakthroughs, agility and collaborative innovation will serve as critical success factors. This report synthesizes core insights to enable informed strategy development, guiding organizations toward sustainable competitive advantage in an increasingly complex landscape.

Take the Next Step to Unlock In-Depth Magnetic Field Sensor Market Insights with an Exclusive Research Report from Our Expert Team

For organizations seeking an authoritative and comprehensive view of the magnetic field sensor landscape, our latest market research report offers the depth and clarity required to inform your strategic roadmap. Engage with Ketan Rohom, Associate Director of Sales & Marketing, to access tailored insights, detailed competitive analyses, and actionable intelligence that will empower your team to make data-driven decisions. His expertise ensures a seamless experience from inquiry through delivery, allowing you to immediately apply findings to product development, partnership exploration, and market entry strategies. Reach out today to secure your copy and position your organization at the forefront of sensor innovation.

- How big is the Magnetic Field Sensor Market?

- What is the Magnetic Field Sensor Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?