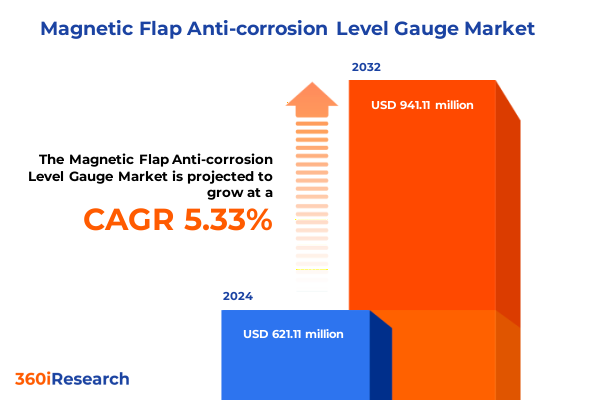

The Magnetic Flap Anti-corrosion Level Gauge Market size was estimated at USD 652.22 million in 2025 and expected to reach USD 690.12 million in 2026, at a CAGR of 5.37% to reach USD 941.11 million by 2032.

Surveying the Key Role of Magnetic Flap Anti-Corrosion Level Gauges in Enhancing Safety, Accuracy, and Operational Continuity Across High-Risk Industrial Environments

Magnetic flap anti-corrosion level gauges represent a class of industrial measurement devices engineered to monitor fluid levels in environments characterized by extreme corrosiveness, elevated pressures, and temperature fluctuations. These instruments utilize a float equipped with a magnetic element that actuates a series of linked flaps along an externally mounted indicator column, providing a clear visual analogue of the fluid level inside a vessel. This design inherently isolates the process fluid from the indicator mechanism, ensuring both measurement accuracy and protection against chemical attack. As industries increasingly prioritize sustainability and compliance, especially within water and wastewater treatment sectors, these gauges have become essential tools to prevent environmental contamination and maintain operational continuity.

Recent technological advancements further underscore their value. Modern models integrate digital diagnostics and remote monitoring capabilities, allowing maintenance teams to access real-time level data, identify potential anomalies before they escalate, and schedule predictive maintenance interventions. This convergence of robust material design with enhanced connectivity not only boosts safety but also drives cost efficiencies by minimizing unplanned downtime. Consequently, organizations across petrochemical, specialty chemical, food and beverage, power generation, and oil and gas industries are adopting magnetic flap anti-corrosion level gauges as integral components of their instrumentation portfolios, reflecting a clear shift toward smarter, more resilient process control solutions.

Uncovering the Transformative Technological and Operational Shifts Redefining Magnetic Flap Anti-Corrosion Level Gauge Applications and Performance Today

The magnetic flap anti-corrosion level gauge market is undergoing a profound transformation driven by rapid technological innovation and evolving operational demands. At the forefront is the integration of digital communication protocols and Industrial Internet of Things (IIoT) connectivity, which has elevated traditional analogue indicators into advanced monitoring systems. This shift allows for seamless data transmission to control systems, enabling real-time processing and analytics that facilitate predictive maintenance strategies. As a result, plant operators can detect subtle deviations in level trends, troubleshoot potential issues remotely, and optimize maintenance schedules, drastically reducing the risk of unplanned outages and enhancing overall plant reliability.

In parallel, breakthroughs in material science have yielded new alloys and coatings tailored to withstand aggressive chemical environments. These innovations have extended gauge lifespans and broadened their applicability to processes involving strong acids, alkalis, and other corrosive media. Moreover, the rise of bespoke solutions designed for specific industry requirements reflects a growing emphasis on customization. Whether catering to extreme temperature applications in power generation or accommodating stringent hygiene standards in pharmaceuticals and food and beverage, manufacturers are collaborating with end users to deliver purpose-built gauges. This customization paradigm underscores a market that is not only adapting to regulatory pressures and safety mandates but also proactively seeking to drive operational excellence.

Assessing the Comprehensive Impact of United States Section 232 Tariffs and Subsequent Trade Measures on Gauge Manufacturing and Supply Chains

Throughout 2025, Section 232 tariffs have exerted significant pressure on the magnetic flap anti-corrosion level gauge supply chain, particularly in components reliant on steel and aluminum materials. On February 11, 2025, the U.S. reinstated a full 25 percent tariff on steel imports and elevated aluminum duties to the same rate, eliminating previous exemptions under national security provisions. This move aimed to bolster domestic production but also elevated raw material costs for gauge manufacturers and downstream users.

Further tightening occurred on March 12, 2025, when alternative trade agreements with Canada, Mexico, the European Union, Japan, and other key exporters were terminated, subjecting all steel and steel derivatives to the 25 percent tariff without exception. This decision, driven by concerns over import surges and transshipment, intensified cost volatility in material procurement, prompting many suppliers to reconsider inventory strategies or explore alternative sourcing pathways.

By June 4, 2025, tariff rates doubled to a uniform 50 percent for most steel and aluminum imports, significantly raising the breakeven threshold for manufacturers and introducing urgent incentives to localize supply chains or invest in high-grade composite alternatives. These successive policy actions have reshaped strategic planning across the gauge industry, compelling stakeholders to devise resilience measures against geopolitical risk, optimize operational footprints, and reinforce supplier diversification to mitigate future disruptions.

Revealing Key Insights into Market Segmentation of Magnetic Flap Anti-Corrosion Level Gauges by Product, Industry, Application, Material, Installation, and Sales Channels

Market segmentation reveals distinct growth drivers and usage patterns across various categories of magnetic flap anti-corrosion level gauges. Analog gauges continue to serve operations seeking simplicity and visual fail-safes, while digital gauges find favor where electronic integration with control systems and data logging is paramount. Remote gauges extend the reach of monitoring capabilities to hazardous or inaccessible zones, empowering maintenance crews to oversee fluid levels without direct field intervention.

End-user industries also exhibit nuanced requirements. Within the chemical sector, heavy-duty petrochemical operations demand rugged gauges for oil refining and gas processing, whereas specialty chemical producers prioritize precision in paints, coatings, and pharmaceutical processes to maintain stringent quality standards. The food and beverage industry places a premium on hygienic design and contamination prevention, integrating gauges with clean-in-place systems to ensure regulatory compliance and product integrity. In power generation, robust materials and high-temperature resilience enable accurate boiler and condensate monitoring, while oil and gas facilities leverage corrosion-resistant assemblies to endure harsh offshore and onshore environments.

Applications span from high-level alarms that protect against overflows to low-level alarms that safeguard pump integrity, with interface and liquid level measurements providing critical process control data. Material choices-ranging from alloy and carbon steels to PVC and stainless steel-balance cost, chemical compatibility, and durability, while inline or mounted installation types address spatial and operational constraints. Sales channels vary from direct sales and online platforms to distributor networks that include independent and OEM-focused partners, each delivering unique value propositions for pricing, service, and customization.

This comprehensive research report categorizes the Magnetic Flap Anti-corrosion Level Gauge market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- End-User Industry

- Application

- Material

- Installation Type

- Sales Channel

Analyzing Regional Market Dynamics for Magnetic Flap Anti-Corrosion Level Gauges Across the Americas, Europe Middle East & Africa, and Asia-Pacific Territories

Regional markets demonstrate differential adoption patterns reflecting localized industry priorities and regulatory landscapes. In the Americas, aging infrastructure drives investment in reliable monitoring solutions for water and wastewater treatment, oil and gas pipelines, and chemical processing sites. Public and private spending on modernization programs has elevated demand for gauges that align with environmental standards and promote operational uptime, fueling growth in North America and select South American hubs where energy, mining, and manufacturing activities are expanding.

Europe, the Middle East, and Africa present a complex regulatory mosaic shaped by the European Union’s revised Urban Wastewater Treatment Directive, which came into force in January 2025. Stricter requirements for tertiary and quaternary treatment, extended producer responsibility, and energy neutrality targets have underscored the need for precision level monitoring in treatment plants and industrial dischargers, accelerating uptake of corrosion-resistant and remotely monitored gauges across key markets such as Germany, the United Kingdom, and the Gulf Cooperation Council states.

Asia-Pacific leads in volume growth driven by rapid industrialization and urban water management initiatives, particularly in China and India. Massive infrastructure projects and sustainability mandates are compelling utilities and process industries to deploy advanced level measurement devices that deliver durability, accuracy, and digital integration. The region’s emphasis on smart city frameworks and factory automation further cements its role as the fastest-growing market segment for magnetic flap anti-corrosion level gauges.

This comprehensive research report examines key regions that drive the evolution of the Magnetic Flap Anti-corrosion Level Gauge market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Exploring Strategic Positioning and Innovation Patterns Among Leading Producers of Magnetic Flap Anti-Corrosion Level Gauges in a Competitive Arena

The competitive landscape is dominated by several global instrument manufacturers distinguished by their innovation pipelines, service capabilities, and breadth of product portfolios. Emerson Electric Co. leverages its deep expertise in process automation to integrate magnetic flap gauge offerings into broader digital ecosystems, emphasizing IIoT connectivity and advanced diagnostics. Siemens AG combines robust R&D investments with a vast international service network, delivering customizable level solutions tailored to sectors ranging from petrochemicals to water treatment. KROHNE Group stands out for precision engineering and modular design approaches, enabling swift adaptation to diverse process conditions.

Endress+Hauser AG prioritizes reliability and regulatory compliance, offering end-to-end level measurement packages that include calibration services, digital twin simulations, and remote support. Magnetrol International differentiates itself through specialized sensor technologies and application-specific coatings that extend gauge lifespans in corrosive environments. These companies consistently channel resources into material innovations, software enhancements, and strategic partnerships, ensuring resilient supply chains and rapid go-to-market capabilities even amid evolving trade policies and raw material constraints.

This comprehensive research report delivers an in-depth overview of the principal market players in the Magnetic Flap Anti-corrosion Level Gauge market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ABB Measurement & Analytics

- AFRISO-EURO-INDEX

- BCST Group

- Chemtrols Ind. Ltd.

- Clark-Reliance

- Emerson Electric Co.

- Fidicon Devices India Private Limited

- General Instruments

- KROHNE Messtechnik GmbH

- Magnetrol - AMETEK

- Parker Hannifin

- Petrotech Engineers

- Sichuan VACORDA Instrument Manufacturing Co., Ltd.

- Tecfluid S.A.

- VEGA Grieshaber KG

- WEKA AG

- WIKA Alexander Wiegand SE & Co. KG

Formulating Practical and Forward-Looking Operational Strategies to Capture Growth and Resilience in the Magnetic Flap Anti-Corrosion Gauge Market

To capture emerging opportunities and mitigate supply chain vulnerabilities, industry players should prioritize a balanced approach that emphasizes technological leadership and procurement agility. First, reinvest in research collaborations focused on novel corrosion-resistant coatings and high-strength composite materials as alternatives to traditional steel and aluminum components. Such initiatives can reduce tariff exposure while enhancing gauge durability in aggressive media. Second, accelerate the deployment of IIoT-enabled platforms that integrate gauge outputs into centralized asset management systems, enabling predictive analytics, remote diagnostics, and condition-based maintenance programs. This will drive operational efficiencies and reduce lifecycle costs.

Additionally, diversifying supplier networks across regions can insulate organizations from geopolitical disruptions. Engaging with partners in low-tariff jurisdictions or establishing local manufacturing hubs in targeted markets supports cost optimization and ensures continuity of critical component flow. Finally, expand service offerings with digital training modules, virtual commissioning tools, and subscription-based maintenance contracts to deepen customer relationships and create recurring revenue streams. By combining innovation with agility, companies can not only navigate the current tariff landscape but also position themselves to thrive amid the next wave of industrial digitalization.

Outlining the Rigorous Mixed-Methods Research Framework Employed to Generate Comprehensive Insights on Magnetic Flap Anti-Corrosion Level Gauges

This research leveraged a mixed-methods framework to ensure a holistic and validated perspective. Secondary research included exhaustive reviews of regulatory filings, government proclamations, industry white papers, and patent databases to capture the evolution of tariff measures, environmental directives, and technological milestones. Primary research comprised in-depth interviews with C-level executives, field instrumentation experts, and procurement leads across major end-user industries to triangulate secondary findings and uncover real-world adoption patterns. Quantitative data were cross-verified against publicly available company financials, trade association statistics, and market intelligence reports from independent research entities.

Analytical techniques employed include SWOT evaluations to assess competitive positioning, scenario modeling to simulate tariff impact on cost structures, and time series analysis for historical trend validation. Regional market sizing leveraged triangulation among installation volumes, replacement cycles, and average selling prices, while segmentation matrices were refined through iterative consultations with subject matter experts. The methodological rigor was further reinforced through peer reviews and an advisory board comprising industry veterans, ensuring objectivity and actionable insight across key market segments.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Magnetic Flap Anti-corrosion Level Gauge market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Magnetic Flap Anti-corrosion Level Gauge Market, by Product Type

- Magnetic Flap Anti-corrosion Level Gauge Market, by End-User Industry

- Magnetic Flap Anti-corrosion Level Gauge Market, by Application

- Magnetic Flap Anti-corrosion Level Gauge Market, by Material

- Magnetic Flap Anti-corrosion Level Gauge Market, by Installation Type

- Magnetic Flap Anti-corrosion Level Gauge Market, by Sales Channel

- Magnetic Flap Anti-corrosion Level Gauge Market, by Region

- Magnetic Flap Anti-corrosion Level Gauge Market, by Group

- Magnetic Flap Anti-corrosion Level Gauge Market, by Country

- United States Magnetic Flap Anti-corrosion Level Gauge Market

- China Magnetic Flap Anti-corrosion Level Gauge Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1749 ]

Summarizing the Critical Findings and Perspectives on the Future Evolution of Magnetic Flap Anti-Corrosion Level Measurement Technology

In conclusion, magnetic flap anti-corrosion level gauges have emerged as critical enablers of process safety, reliability, and regulatory compliance across demanding industrial environments. Technological advancements in connectivity, diagnostics, and material innovation are redefining their utility and differentiating gauge offerings in a competitive landscape. The interplay of US tariff policies has underscored the importance of supply chain resilience and strategic sourcing, while regional regulatory initiatives, particularly in wastewater treatment, have amplified the need for precision monitoring solutions.

Market segmentation reveals tailored demand drivers across product types, end-user industries, and installation modalities, highlighting opportunities for customized offerings. Regional dynamics further present growth hotspots in Asia-Pacific, regulatory-driven expansion in Europe, and infrastructure-driven requirements in the Americas. Leading companies continue to invest in R&D, digital platforms, and service ecosystems to capture market share and adapt to evolving operational imperatives. As the industry navigates geopolitical shifts and embraces Industry 4.0 paradigms, stakeholders equipped with robust data, flexible strategies, and collaborative partnerships will best position themselves to capitalize on the next phase of market evolution.

Engaging with Ketan Rohom for Customized Access to the Definitive Magnetic Flap Anti-Corrosion Level Gauge Market Intelligence Report

To secure your exclusive copy of the detailed Magnetic Flap Anti-Corrosion Level Gauge market intelligence, please connect with Ketan Rohom, Associate Director of Sales & Marketing. Ketan can guide you through the report’s comprehensive coverage of market drivers, segmentation analyses, and regional dynamics, ensuring you acquire the precise insights needed to inform strategic decisions and competitive positioning. Engage directly with Ketan to discuss tailored research add-ons, data licensing options, and group access packages that best align with your organization’s objectives. Reach out today to transform the depth of your market understanding and capitalize on emerging opportunities in the magnetic flap anti-corrosion level gauge landscape.

- How big is the Magnetic Flap Anti-corrosion Level Gauge Market?

- What is the Magnetic Flap Anti-corrosion Level Gauge Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?