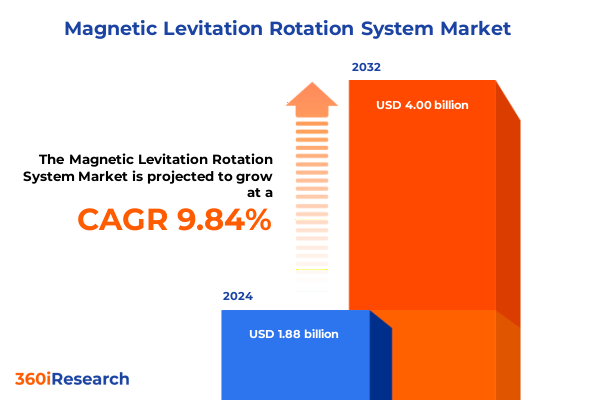

The Magnetic Levitation Rotation System Market size was estimated at USD 1.66 billion in 2025 and expected to reach USD 1.80 billion in 2026, at a CAGR of 8.96% to reach USD 3.03 billion by 2032.

Exploring the Evolution and Strategic Significance of Magnetic Levitation Rotation Systems in Shaping Next-Generation Industrial and Transportation Solutions

Magnetic levitation rotation systems represent a groundbreaking convergence of physics, engineering, and applied technology that is reshaping the boundaries of industrial and transportation applications. By eliminating mechanical contact through precise electromagnetic control, these platforms offer unparalleled performance advantages in terms of frictionless motion, reduced maintenance, and enhanced lifecycle reliability. As organizations across aerospace, energy, healthcare, and manufacturing sectors seek to optimize efficiency and sustainability, the adoption of levitation-based rotational mechanisms has rapidly transitioned from theoretical curiosity to practical reality.

This introduction sets the stage for an in-depth exploration of transformative shifts, regulatory influences, segmentation nuances, and region-specific dynamics that define the current maglev ecosystem. It underscores the imperative for decision-makers to internalize both technical and strategic dimensions-from advances in superconducting magnet integration to evolving tariff landscapes that affect global supply chains. By weaving together multidisciplinary perspectives and real-world examples, this summary aims to illuminate the strategic imperatives and actionable insights necessary for stakeholders to harness the full potential of magnetic levitation rotation systems.

Identifying the Key Drivers and Disruptive Breakthroughs Redefining Magnetic Levitation Rotation System Applications Across Industries and Technologies

The magnetic levitation rotation landscape has undergone significant upheavals driven by breakthroughs in material science, power electronics, and control algorithms. Recent advancements in high-temperature superconducting magnets have enabled more compact and energy-efficient designs, reducing cooling infrastructure burdens and opening doors to applications previously constrained by form factor limitations. Parallel progress in real-time sensor arrays and feedback stabilization loops has bolstered system resilience against external disturbances, enabling precise rotational control in harsh industrial environments.

Complementing these technical evolutions, the industry has witnessed the integration of hybrid system architectures that blend electromagnetic and pneumatic actuation to achieve versatile performance envelopes. This fusion of technologies has catalyzed new use cases in sectors ranging from clean energy generation-where levitated turbine shafts eliminate mechanical friction-to advanced robotics deployments in semiconductors, where contamination-free, ultra-clean environments are paramount. Consequently, stakeholders must remain vigilant to such disruptions, aligning R&D roadmaps and partnership models with these emergent capabilities to maintain a competitive edge.

Analyzing the Comprehensive Ripple Effects of United States Tariff Policies in 2025 on Sourcing Costs, Supply Chains, and Competitive Dynamics for MagLev Components

Tariff policies implemented by the United States in early 2025 have introduced material cost pressures and reshaped strategic sourcing paradigms for manufacturers of magnetic levitation rotation systems. Increased duties on imported rare-earth elements, high-grade steel, and specialized power electronics components have compressed supplier margins and prompted OEMs to reevaluate their supply chain footprints. In response, many innovators are intensifying efforts to localize core component production, thereby mitigating exposure to import levies and reducing lead times for critical subassemblies.

This tariff-driven recalibration has also steered market participants toward forging closer upstream partnerships with domestic material suppliers and contract manufacturers. By establishing long-term agreements and volume-based incentives, system integrators are striving to stabilize costs and secure reliable throughput. At the same time, such adjustments have triggered ripple effects in global pricing structures, as international suppliers recalibrate export strategies to maintain competitiveness. As a result, companies must adopt dynamic sourcing frameworks that balance cost-efficiency with agility in navigating evolving trade regulations.

Unlocking Strategic Market Opportunities Through In-Depth Component, Technology, Speed, Application, Industry, and Sales Channel Segmentation Perspectives

In examining component segmentation, control systems comprise both feedback mechanisms and stabilization frameworks that govern levitation height and rotational stability, while magnets include electromagnets, permanent magnets, and superconducting magnets that deliver varying power densities and thermal requirements. Power supply units and sensors plus actuators work in tandem to deliver precise energy regulation and motion feedback, supported by structural elements such as housing, support structures, and levitation tracks that ensure mechanical integrity. Each component category demands distinct supplier capabilities and yields unique margins, influencing how companies allocate R&D resources and optimize procurement.

From a technology standpoint, electromagnetic systems continue to dominate applications that require moderate lift forces and lower capital intensity, whereas superconducting configurations promise higher efficiency and minimal energy loss at the cost of sophisticated cryogenic support. Hybrid systems-encompassing electromagnetic-pneumatic and electromagnetic-superconducting variants-offer compelling trade-offs between responsiveness and sustained force output, paving the way for applications that benefit from both rapid actuation and high load-bearing capacity.

Operational speed segmentation differentiates high-speed systems optimized for rapid rotational throughput and minimal vibration from medium-speed solutions that balance performance and energy consumption, as well as low-speed configurations designed for precision in assembly lines and automated storage systems. These distinctions influence design parameters such as coil winding density, sensor resolution, and cooling requirements, guiding engineering teams toward bespoke solutions.

Application segmentation spans energy systems-exemplified by levitated hydroelectric turbine shafts and wind turbine nacelles-industrial automation settings like assembly line robots and automated storage platforms, and transportation systems incorporating cargo handling, high-speed rail modules, and urban transit pods. Each application category encapsulates specific performance criteria, regulatory frameworks, and interoperability demands, shaping how solution providers package their offerings.

End-use industry perspectives reveal divergent priorities: aerospace applications prioritize weight minimization and fail-safe reliability; consumer electronics demand compactness and silent operation; energy verticals focus on uptime and thermal stability; healthcare environments require contamination-free designs and precision control; industrial and manufacturing sectors lean toward robustness and scalability; and transportation undertakings emphasize safety, speed, and system redundancy. Sales channels including direct sales, distributor networks, and rapidly growing online platforms influence how players engage with customers and scale aftermarket services. Understanding these layered segmentation insights enables stakeholders to target development efforts, craft differentiated value propositions, and optimize go-to-market strategies.

This comprehensive research report categorizes the Magnetic Levitation Rotation System market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Components

- Load Capacity

- Operational Speed

- Integration Type

- Sales Channel

- Application

Examining Divergent Regional Dynamics Across Americas, Europe Middle East & Africa, and Asia-Pacific for Tailored Magnetic Levitation System Strategies

The Americas region has emerged as a dynamic hub for magnetic levitation rotation system innovation, propelled by substantial venture capital investment in domestic startups and supportive government initiatives aimed at enhancing infrastructure resilience. North American priorities center on renewable energy integration and advanced manufacturing reshoring, while Latin American markets demonstrate growing interest in urban transit modernization, albeit moderated by funding and regulatory variability. This uneven landscape requires suppliers to adapt deployment models that reconcile high-margin OEM projects in the U.S. with collaborative pilot programs in emerging Latin American economies.

In Europe, Middle East, and Africa, stringent safety standards and ambitious decarbonization targets are catalyzing demand for levitation-enabled wind turbine and hydroelectric applications, alongside targeted investments in high-speed rail networks. The European Union’s regulatory emphasis on interoperability and standardized components fosters cross-border collaboration, while Middle Eastern sovereign wealth funds are underwriting flagship smart city initiatives that feature maglev transit prototypes. African stakeholders, though nascent in adoption, view magnetic levitation solutions as a leapfrog opportunity to address urban congestion and industrial diversification.

Asia-Pacific presents a dual-track narrative: advanced economies like Japan and South Korea lead in superconducting research and integration of maglev urban transit corridors, while China rapidly scales high-speed rail projects incorporating levitation rotation modules to reinforce its transport infrastructure leadership. Southeast Asian nations are piloting ports with levitated cargo handling units to enhance throughput, and Australia has initiated exploratory partnerships for renewable energy storage solutions leveraging low-friction rotational systems. As regional trajectories diverge, companies must tailor value propositions and partnership models to local regulatory environments, technological readiness, and infrastructure investment appetites.

This comprehensive research report examines key regions that drive the evolution of the Magnetic Levitation Rotation System market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Mapping Competitive Landscape with Profiles of Leading Innovators Shaping the Magnetic Levitation Rotation System Ecosystem and Industry Collaborations

Leading innovators in the magnetic levitation rotation domain are distinguished by their integrated expertise across component manufacturing, control algorithm development, and system assembly. Legacy industrial conglomerates leverage established supply chains and capital access to drive incremental improvements in motor torque density and thermal management. By contrast, specialized engineering firms carve out competitive niches through rapid prototyping capabilities and modular design architectures that accelerate time to market for customized solutions.

Strategic partnerships between material science leaders and electronics firms have given rise to turnkey offerings that bundle superconducting magnet units with advanced power electronics and digital twin simulation platforms. Such collaborations enable end-users to validate performance in virtual environments, reducing commissioning timelines and mitigating operational risks. Additionally, software-centric outfits that provide predictive maintenance analytics and remote monitoring frameworks are gaining traction by extending system uptime and lowering total cost of ownership.

Innovative startups are also making headway with hybrid system prototypes that blend electromagnetic and pneumatic actuation, targeting mid-range industrial applications requiring both high acceleration and sustained hold times. These entrants often secure pilot deployments through joint R&D funding from government agencies focused on industrial automation and renewable energy. Collectively, the competitive landscape is marked by convergence between traditional heavy machinery suppliers and agile technology disruptors, each vying to define the standards for next-generation levitation platforms.

This comprehensive research report delivers an in-depth overview of the principal market players in the Magnetic Levitation Rotation System market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Atlas Copco Group

- Mitsubishi Electric Corporation

- AB SKF

- ABB Ltd.

- Siemens AG

- Physik Instrumente (PI) SE & Co. KG

- Danfoss A/S

- Calnetix Technologies, LLC.

- Hitachi, Ltd.

- Rockwell Automation, Inc.

- AMT, Inc.

- BiVACOR Inc.

- Crealev BV by Appear Inc.

- CRRC Corporation Limited

- Evico GmbH

- General Atomics

- Hyundai Rotem Company

- IronLev by IronBox srl

- Kawasaki Heavy Industries, Ltd.

- MagLev Aero Inc.

- Nevomos by JMR Technologies

- SpinDrive Oy.

- Suzhou Supermag Intelligent Technology Co., Ltd.

- The Boeing Company

Empowering Industry Leaders with Tactical Recommendations to Accelerate Adoption and Optimize Integration of Magnetic Levitation Rotation Systems

To capitalize on emerging opportunities, industry leaders should prioritize cross-functional R&D initiatives that bridge material science advances with digital control platforms, thereby accelerating the maturation of high-temperature superconducting solutions. Establishing joint development agreements with strategic material suppliers will ensure early access to novel magnet alloys and composite structural elements, reducing dependency on constrained raw material channels.

Simultaneously, organizations must refine their supply chain strategies by adopting modular sourcing frameworks that allow seamless reconfiguration in response to tariff shifts and geopolitical uncertainties. Investing in regionalized manufacturing hubs equipped with localized assembly capabilities can buffer against trade disruptions and enhance responsiveness to customer-specific requirements.

On the commercial front, brands should develop value-based service models that integrate predictive analytics, condition monitoring, and performance optimization advisory services. Such offerings not only differentiate through enhanced uptime guarantees but also cultivate recurring revenue streams and deeper client engagements. Moreover, forging alliances with industry consortia and standards bodies will facilitate interoperability frameworks, de-risking large-scale deployments in critical sectors such as urban transit and renewable energy.

Finally, leadership teams ought to foster talent ecosystems by partnering with academic institutions on specialized curricula for maglev control engineering and cryogenic systems maintenance. Cultivating an internal talent pipeline will mitigate skills shortages and position firms to swiftly scale operations as market demand accelerates.

Detailing Rigorous Research Framework Combining Primary Engagements and Secondary Analyses to Ensure Robust Magnetic Levitation Rotation System Insights

This research leveraged a hybrid approach combining primary and secondary methodologies to deliver a robust, multi-dimensional analysis. Primary engagement included in-depth interviews with C-level executives, design engineers, and procurement specialists across key end-use industries, supplemented by surveys to capture comparative perspectives on technology readiness, adoption barriers, and service expectations. These engagements provided qualitative depth and grounded the report in real-world decision contexts.

Secondary analysis entailed a comprehensive review of technical white papers, regulatory filings, patent landscapes, and open-source academic research to map the evolution of magnet materials, control algorithms, and power electronics architectures. Data triangulation techniques ensured consistency between interview outputs and published sources, while trend extrapolation methodologies highlighted emerging trajectories without resorting to quantitative market sizing or forecasting.

The research scope was further refined through iterative validation workshops with subject matter experts, ensuring that the segmentation framework accurately reflects the diversity of components, technologies, operational speeds, applications, industries, and sales channels. Quality assurance processes included cross-checking terminology, verifying technical specifications, and stress-testing assumptions against alternative scenarios, thereby reinforcing the credibility and applicability of the insights.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Magnetic Levitation Rotation System market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Magnetic Levitation Rotation System Market, by Components

- Magnetic Levitation Rotation System Market, by Load Capacity

- Magnetic Levitation Rotation System Market, by Operational Speed

- Magnetic Levitation Rotation System Market, by Integration Type

- Magnetic Levitation Rotation System Market, by Sales Channel

- Magnetic Levitation Rotation System Market, by Application

- Magnetic Levitation Rotation System Market, by Region

- Magnetic Levitation Rotation System Market, by Group

- Magnetic Levitation Rotation System Market, by Country

- United States Magnetic Levitation Rotation System Market

- China Magnetic Levitation Rotation System Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 2067 ]

Concluding the Strategic Imperatives for Advancing Magnetic Levitation Rotation Systems to Drive Innovation and Competitive Advantage Across Sectors

In conclusion, magnetic levitation rotation systems stand at the confluence of transformative technological breakthroughs and evolving commercial imperatives. Companies that adeptly integrate advanced superconducting materials, digital control algorithms, and flexible supply chain architectures will unlock new performance frontiers in energy generation, industrial automation, and transportation. Moreover, responsive strategies to navigate tariff fluctuations and regional dynamics will prove critical in maintaining both cost competitiveness and strategic agility.

As competitive boundaries blur between established industrial players and agile technology disruptors, the ability to forge interdisciplinary partnerships and offer differentiated service models will define market leadership. Organizations that systematically apply the segmentation insights outlined-spanning components, technology variants, operational speeds, applications, end-use industries, and sales channels-will be equipped to tailor offerings and capture high-value opportunities.

Ultimately, this executive summary underscores the importance of a holistic, data-informed approach to decision making. By aligning R&D investments, commercialization roadmaps, and collaboration strategies with the evolving maglev ecosystem, stakeholders can accelerate adoption, mitigate risks, and secure sustainable competitive advantage in a landscape defined by rapid innovation and strategic complexity.

Connect with Associate Director Ketan Rohom to Unlock Exclusive Magnetic Levitation Rotation System Insights and Propel Your Strategic Market Decisions

To explore the intricate potential of magnetic levitation rotation systems and translate insights into strategic action, we invite you to reach out to Associate Director Ketan Rohom who can provide unparalleled expertise and clarify any questions you may have regarding this comprehensive market research report. Ketan brings a wealth of knowledge in sales and marketing dynamics specific to advanced magnetic levitation technologies, and his guidance will help you navigate the nuances of component selection, technology adoption, regulatory landscapes, and competitive positioning. By engaging directly with Ketan, your team will accelerate decision-making processes, access nuanced intelligence tailored to your unique strategic objectives, and gain the confidence to invest in next-generation levitation solutions that drive sustained growth. Take this opportunity to secure a deeper understanding of evolving industry trends, validate your strategic roadmaps, and position your organization at the forefront of magnetic levitation innovation. Connect with Ketan Rohom today to unlock the insights that will define tomorrow’s industry leaders and enhance your competitive advantage.

- How big is the Magnetic Levitation Rotation System Market?

- What is the Magnetic Levitation Rotation System Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?