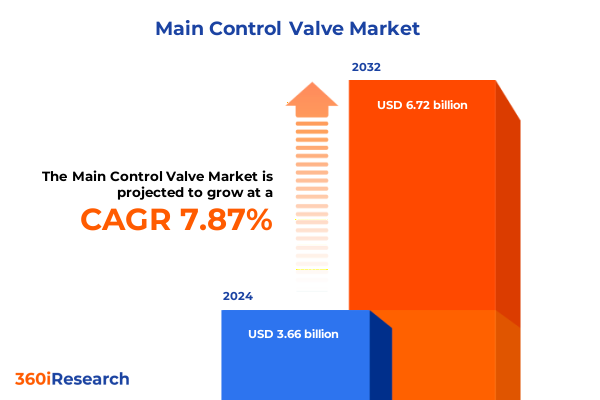

The Main Control Valve Market size was estimated at USD 3.87 billion in 2025 and expected to reach USD 4.20 billion in 2026, at a CAGR of 8.17% to reach USD 6.72 billion by 2032.

Setting the Stage for Main Control Valve Market Evolution Through Technological Innovation and Industrial Transformation

In a rapidly evolving industrial environment, main control valves stand at the core of fluid handling and process automation systems across diverse sectors. Emerging digital innovations, tightening regulatory requirements, and shifting supply chain paradigms have collectively heightened the strategic importance of these components. As industries strive to achieve greater operational efficiency, sustainability, and reliability, selecting and deploying the right control valve solutions has become critical to maintaining competitive advantage.

This executive summary offers a concise yet robust narrative outlining the primary market forces influencing the main control valve landscape. It begins by illuminating the foundational drivers of value, proceeds to explore transformative shifts in technology and trade, and then unpacks the complex layers of segmentation and regional dynamics. Complementing these insights, the summary examines competitive positioning, recommends strategic actions for industry leaders, and delineates the research framework underpinning the analysis. Ultimately, this introduction sets the stage for a comprehensive exploration, ensuring stakeholders can navigate challenges and capitalize on the manifold opportunities presented by the main control valve market.

Uncovering the Disruptive Shifts Reshaping Control Valve Dynamics From Digital Integration to Sustainability Imperatives Across Industries

The main control valve sector has undergone profound transformations as industrial processes embrace enhanced digitalization and sustainability benchmarks. Smart actuators, integrated sensors, and cloud-based performance monitoring platforms now deliver real‐time diagnostics, enabling predictive maintenance and reducing unplanned downtime more effectively than ever before. Concurrently, additive manufacturing has begun to reshape production methodologies, offering greater design flexibility and accelerated prototyping cycles for customized valve geometries.

Moreover, environmental imperatives and energy optimization goals have propelled the adoption of valves designed for minimal leakage and precise flow modulation. Materials innovation has introduced advanced alloys and composites that resist corrosion under harsh chemical conditions, further extending service life and reducing total cost of ownership. The growing emphasis on lifecycle management has driven collaboration between end users and valve manufacturers, fostering co‐development of modular architectures that simplify maintenance and upgrade pathways. As these disruptive forces converge, the market’s competitive landscape continues to evolve, demanding greater agility and cross‐functional expertise from both suppliers and operators.

Analyzing the Far-Reaching Consequences of US Tariff Revisions in 2025 on Main Control Valve Supply Chains and Competitive Positioning

In 2025, the United States government enacted targeted tariff revisions impacting key valve components and raw materials crucial to main control valve manufacturing. These adjustments, aimed at balancing domestic production incentives with strategic trade relationships, have reverberated through global supply chains. Consequently, manufacturers have been compelled to reevaluate sourcing strategies for critical alloys and electronic subcomponents, often shifting procurement toward alternative trade partners in Asia and Europe.

Furthermore, the tariffs have intensified competitive pressures by altering cost structures for imported valves and drive mechanisms. Domestic producers have seized the moment to promote locally manufactured solutions, marketing enhanced lead times and lower exposure to geopolitical risk. In parallel, multinational suppliers have restructured distribution frameworks, integrating regional assembly hubs to mitigate tariff impacts while preserving global service coverage.

These developments have driven end users in energy, chemical processing, and water treatment to revisit inventory policies, favoring buffer stocks of high‐impact valves and spare parts to maintain uninterrupted operations. Ultimately, the 2025 tariff landscape has underscored the need for agile strategic planning, transparent cost modeling, and diversified supplier networks to safeguard resilience in an increasingly complex trade environment.

Deciphering Key Segmentation Dimensions Illuminating Diverse Valve Types Applications End User Industries Materials Sizes and Pressure Ratings

A nuanced segmentation framework reveals that valve typologies cater to distinct operational requirements. Ball valves excel in rapid shutoff scenarios with their quarter-turn mechanism, while butterfly valves offer compact form factors ideal for large-diameter applications. Diaphragm valves, with their flexible sealing element, serve sanitary environments in pharmaceutical and food processing plants, whereas gate valves commonly regulate high-pressure flow in oil and gas pipelines. Globe valves provide fine throttling control in power generation and refined chemical processes, just as plug valves deliver robust performance where frequent cycling occurs.

Application-based insights further differentiate usage across sectors. Petrochemical facilities demand valves resistant to aggressive solvents, while specialty chemical plants prioritize precise flow control to manage intermittent reactions. Food and beverage operations seek hygienic designs with minimal dead space, contrasting with HVAC systems that focus on corrosion-resistant materials and compatibility with water and glycol mixtures. In oil and gas, onshore installations emphasize rugged mechanical integrity, whereas offshore platforms rely on subsea-rated valves. Power generation segments from hydro to thermal plants require variations in pressure handling and temperature resilience, and water treatment facilities distinguish between drinking water purity standards and sewage corrosive environments.

End user industry nuances also shape procurement. Municipal authorities invest in sewage treatment valves designed for abrasive slurries, rationalizing longevity over initial cost, while residential building owners prioritize compact, low-maintenance valves within HVAC loops. Commercial complexes balance performance with lifecycle cost metrics, and heavy industrial sites in mining and metal processing seek valves engineered for abrasive slurries and high solids content.

Material selection remains a core factor as alloy steel and stainless steel dominate high-pressure, high-temperature services, while brass and bronze find favor in potable water and low-pressure systems. Cast iron retains a presence in conventional water distribution pipelines. Size and pressure rating decisions-from small, low-pressure valves in laboratory setups to large, high-pressure assemblies in petrochemical plants-underscore the need to precisely match valve specifications to process demands.

Finally, distribution channel preferences influence market access and service support. Direct sales arrangements enable bespoke configuration, distributors supply standardized inventories with authorized and independent options, OEM partnerships integrate valves into larger equipment packages, and online platforms offer rapid procurement for emergency replacements. Together, these seven segmentation pillars illuminate the multifaceted decision criteria guiding stakeholders in valve selection and deployment.

This comprehensive research report categorizes the Main Control Valve market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- End User Industry

- Material

- Size

- Pressure Rating

- Application

- Distribution Channel

Exploring Regional Variances in Main Control Valve Demand Across The Americas Europe Middle East Africa and Asia-Pacific Growth Drivers

Regional analysis highlights divergent growth drivers and market expectations. In the Americas, energy infrastructure modernization and stringent environmental regulations have elevated demand for control valves with advanced emission control capabilities and digital monitoring. The region’s mature manufacturing base also fosters collaboration on retrofit projects, where legacy plants integrate smart valves to enhance operational intelligence.

Conversely, Europe, Middle East, and Africa present a tapestry of requirements. In Western Europe, decarbonization targets are catalyzing investments in green hydrogen plants, necessitating valves that can handle varying flow rates and corrosive atmospheres. The Middle East’s ongoing petrochemical expansions demand high-capacity, high-pressure valves for massive downstream installations, while North African water scarcity initiatives are driving valve adoption in desalination and sewage recycling facilities. These disparate conditions compel suppliers to maintain flexible design platforms and localized service networks.

In the Asia-Pacific region, rapid urbanization in Southeast Asia and infrastructure overhauls in China and India underpin robust valve consumption across water treatment, power generation, and oil and gas sectors. Market participants must navigate complex regulatory landscapes and diverse supplier ecosystems, balancing cost efficiency with quality assurance. As regional supply chains evolve, partnerships with local fabricators and engineering firms become essential to meet project timelines and maintain competitive pricing. Collectively, these regional insights underscore the importance of tailored go-to-market strategies that reflect local requirements, regulatory frameworks, and end user priorities.

This comprehensive research report examines key regions that drive the evolution of the Main Control Valve market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Identifying Leading Players Trailblazing Technological Advancements Strategic Collaborations and Market Expansion in Main Control Valve Industry

Several companies have emerged as front-runners by blending technological prowess with strategic market positioning. Manufacturers investing heavily in digital platforms have introduced smart valve suites that integrate seamlessly with distributed control systems, providing end users with actionable data on valve health, flow dynamics, and predictive maintenance schedules. Strategic alliances between valve producers and automation leaders have accelerated time to market for turnkey solutions, enabling customers to deploy fully integrated packages rather than piecemeal components.

Concurrently, targeted acquisitions have allowed key players to fortify their geographic reach and product portfolios. By assimilating regional specialists with core competencies in niche applications-such as subsea valves or cryogenic service designs-leading vendors have broadened their capability set and optimized cost structures. Collaborative R&D efforts with universities and research institutes have further driven materials innovation, resulting in alloys that withstand higher pressures and more aggressive chemical media.

These strategic moves have been complemented by a sharpened focus on sustainability. Top-tier companies now report on valve lifecycle carbon footprints, championing circular economy principles by offering valve refurbishment and remanufacturing services. Collectively, these initiatives demonstrate how industry champions leverage cross-sector partnerships, digital enablement, and sustainable practices to cement their leadership positions in the main control valve arena.

This comprehensive research report delivers an in-depth overview of the principal market players in the Main Control Valve market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ABB Ltd

- AVK Holding A/S

- Baker Hughes Company

- Bray International, Inc.

- Christian Bürkert GmbH & Co. KG

- CIRCOR International, Inc.

- Crane Co.

- Curtiss-Wright Corporation

- Emerson Electric Co.

- Flowserve Corporation

- Honeywell International Inc.

- IMI plc

- KITZ Corporation

- KSB SE & Co. KGaA

- Metso Corporation

- Samson AG

- Schlumberger Limited

- Spirax-Sarco Engineering plc

- Valmet Oyj

- Velan Inc.

Formulating Actionable Strategies for Industry Champions to Navigate Market Complexities Optimize Investments and Accelerate Innovation Adoption

Industry leaders should prioritize digitization of valve operations to unlock predictive maintenance and performance optimization. By integrating Internet of Things–enabled sensors directly into valve assemblies, organizations can shift from reactive repairs to condition-based servicing, ultimately reducing downtime and maintenance costs. In parallel, decision-makers need to cultivate flexible procurement frameworks that incorporate dual-sourcing strategies, thereby diluting geopolitical and tariff-driven supply chain risks.

Moreover, forging strategic partnerships with materials science innovators can yield valves engineered for next-generation process demands, such as biofuels, hydrogen, and carbon capture. Collaborating on joint development agreements accelerates time to market and ensures alignment between design specifications and functional requirements. To bolster sustainability credentials, companies must adopt circular economy models, offering asset life extension through refurbishment programs and remanufacturing services.

Finally, to maintain competitive differentiation, organizations should establish dedicated centers of excellence for valve analytics, enabling cross-functional teams to harness data-driven insights for continuous improvement. By championing these actionable strategies, industry leaders will not only navigate the complexities of the current market but also position themselves at the forefront of innovation and operational excellence.

Outlining Rigorous Research Methodology Integrating Multisource Data Collection Validation Techniques and Analytical Frameworks for Robust Insights

This research integrates a comprehensive blend of primary and secondary methods to ensure analytical rigor and data integrity. Primary insights derive from structured interviews with plant engineers, procurement specialists, and technology vendors, enriching the study with firsthand perspectives on application drivers, performance benchmarks, and emerging challenges. Secondary sources include peer-reviewed journals, industry conference proceedings, and white papers published by standards bodies, providing context on regulatory shifts, materials science advancements, and automation trends.

Data validation occurs through triangulation of multiple independent sources, verifying consistency across divergent viewpoints. Quantitative analyses employ comparative assessments of valve specifications, supplier capabilities, and operational outcomes, while qualitative evaluations explore case studies of retrofit projects and new facility deployments. A peer review process, involving subject matter experts from mechanical engineering, process automation, and sustainability disciplines, further underpins the study’s credibility.

Ultimately, the methodology balances depth and breadth, offering stakeholders a robust framework to inform strategic planning, procurement decisions, and future product development in the main control valve market.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Main Control Valve market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Main Control Valve Market, by Type

- Main Control Valve Market, by End User Industry

- Main Control Valve Market, by Material

- Main Control Valve Market, by Size

- Main Control Valve Market, by Pressure Rating

- Main Control Valve Market, by Application

- Main Control Valve Market, by Distribution Channel

- Main Control Valve Market, by Region

- Main Control Valve Market, by Group

- Main Control Valve Market, by Country

- United States Main Control Valve Market

- China Main Control Valve Market

- Competitive Landscape

- List of Figures [Total: 19]

- List of Tables [Total: 2226 ]

Synthesizing Core Takeaways Highlighting Critical Market Dynamics Innovative Trends and Strategic Imperatives for Main Control Valve Stakeholders

This summary has underscored the pivotal role of technological innovation and sustainability in redefining main control valve applications across sectors. Key segmentation insights reveal that valve selection depends on a complex interplay of type characteristics, application environments, end user requirements, materials compatibility, size constraints, pressure ratings, and distribution preferences. Regional analyses highlight how growth trajectories vary from environmental retrofits in the Americas to petrochemical expansions in the Middle East and infrastructure modernization in Asia-Pacific.

Leading companies have leveraged digital integration, strategic partnerships, and sustainability initiatives to differentiate their offerings and fortify market positions. In response to evolving trade policies, particularly the 2025 US tariff revisions, agile supply chain reconfiguration and dual-sourcing strategies have become essential. Collectively, these insights converge toward a set of actionable imperatives: embrace predictive maintenance through digitization, collaborate on advanced materials development, and adopt circular economy models to extend asset lifecycles.

By synthesizing these core takeaways, stakeholders are equipped to make informed decisions that align with emerging trends and operational imperatives, ensuring resilient and innovative growth in the control valve landscape.

Empowering Decision Makers With Tailored Intelligence and Expert Support to Secure Access to Comprehensive Main Control Valve Market Research Findings

To gain a comprehensive understanding of the main control valve market’s nuances and unlock competitive advantages, reach out to Ketan Rohom, the Associate Director of Sales & Marketing at our firm. Ketan will guide you through a tailored exploration of the full report’s depth and methodology, ensuring you acquire the precise intelligence needed to inform your strategic decisions. Engaging with him not only grants you exclusive access to detailed insights but also provides a dedicated point of contact for any customized analysis or further clarification. Leverage his expertise to align the study’s findings with your organization’s objectives, whether you seek to refine sourcing strategies, evaluate potential partnerships, or assess emerging technology adoption. Connect with Ketan today to transform high‐level market intelligence into actionable business outcomes, staying ahead of your competitors and capitalizing on every growth opportunity within the dynamic control valve landscape.

- How big is the Main Control Valve Market?

- What is the Main Control Valve Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?