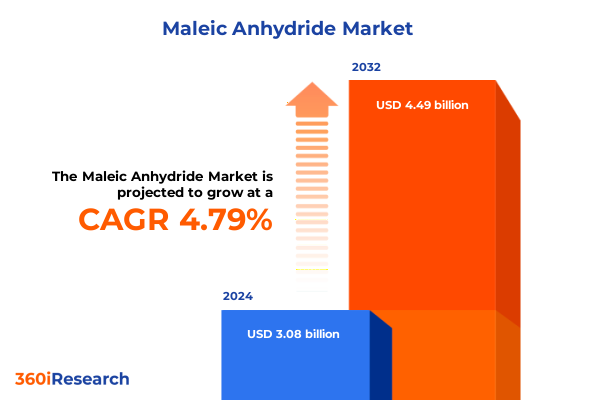

The Maleic Anhydride Market size was estimated at USD 3.23 billion in 2025 and expected to reach USD 3.39 billion in 2026, at a CAGR of 4.78% to reach USD 4.49 billion by 2032.

Unveiling the Integral Role and Emerging Opportunities of Maleic Anhydride Across Diverse Industrial Applications Driving Innovation and Sustainability

The global chemical industry’s reliance on versatile intermediates has never been more pronounced than in the case of maleic anhydride, a pivotal compound driving innovation across multiple downstream applications. Commonly produced through catalytic oxidation of feedstocks such as benzene and n-butane, this unsaturated cyclic anhydride forms the molecular backbone for unsaturated polyester resins, which serve as essential materials in the construction, automotive, and marine sectors. Beyond resin synthesis, its reactive double bonds facilitate esterification processes that yield plasticizers, lubricating oil additives, and agrochemical formulations, underscoring its role as an enabling platform for functional additives tailored to performance-critical markets.

Against an evolving backdrop of sustainability imperatives, industrial stakeholders are exploring greener production pathways and novel derivative chemistries to meet stringent environmental regulations. Concurrently, digitalization of process controls and real-time analytics is enhancing plant reliability and operational efficiency, generating cost savings while reducing carbon footprints. Thus, maleic anhydride emerges not only as a cornerstone feedstock but also as a focal point for strategic investment in advanced manufacturing technologies, hybrid supply chains, and circular economy initiatives. This introduction sets the stage for an in-depth exploration of recent technological shifts, regulatory influences, and market dynamics shaping the current landscape of the maleic anhydride sector.

Exploring Pivotal Technological Advancements and Sustainable Innovations Reshaping Maleic Anhydride Production and Market Dynamics Worldwide

Recent years have witnessed transformative shifts in the production landscape of maleic anhydride, propelled by breakthroughs in catalytic systems and reactor engineering. Innovations such as advanced metal oxide catalysts have significantly enhanced selectivity and yield in the benzene oxidation process, while membrane-based separation technologies are streamlining downstream purification. Furthermore, pilot-scale demonstrations of bio-based feedstock integration-leveraging maleic-derived intermediates from biomass fermentation-point to the potential for radical decarbonization, marking a departure from traditional petrochemical routes. These developments collectively redefine the efficiency frontier for maleic anhydride manufacturing, enabling more sustainable footprints without sacrificing throughput.

Beyond technical innovations, the industry is undergoing a paradigm shift in its operational philosophy. Integrated digital twins and predictive maintenance platforms are becoming ubiquitous, allowing plant operators to fine-tune reaction parameters in real time and preempt equipment failures. At the same time, circular economy principles are gaining traction, with research consortia exploring closed-loop recycling of maleic-anhydride-based resin scraps and end-of-life derivatives. Regulatory frameworks in key markets now incentivize lower emissions and resource conservation, catalyzing further investment in low-carbon technologies and greener chemistries. Consequently, the maleic anhydride sector is at the nexus of a broader industrial transformation, blending chemical engineering innovation with digital disruption and environmental stewardship.

Assessing the Broad Economic and Supply Chain Repercussions of the 2025 United States Tariffs on Maleic Anhydride and Allied Industries

In 2025, the introduction and adjustment of United States import tariffs on maleic anhydride and related derivatives have reverberated across global supply chains, altering procurement strategies and cost structures. Manufacturers reliant on foreign-sourced feedstocks faced immediate price uplifts, triggering a reevaluation of sourcing options and accelerated negotiations with domestic producers. As a result, several downstream resin and plasticizer formulators have pursued deeper partnerships with regional facilities to shield against further tariff volatility. Moreover, the ripple effects extended to logistics networks, as freight operators recalibrated shipping routes to optimize landed costs and transit times under the new duty regime.

Strategic responses to these policy shifts have manifested in diversified regional footprints, including greenfield expansions in low-tariff jurisdictions and capacity realignments favoring local production hubs. In addition, companies have invested in tariff engineering tactics-such as in-bond processing and tariff classification studies-to mitigate duty liabilities. These cumulative measures underscore the necessity for agile supply chain strategies and policy-informed decision-making frameworks. Consequently, the tariff landscape of 2025 has not only imposed immediate cost pressures but also spurred a more resilient and geographically balanced maleic anhydride ecosystem.

Extracting Actionable Intelligence from End Use, Product Type, Distribution Channels, and Production Process Segmentation of the Maleic Anhydride Market

A granular examination of market segmentation reveals differentiated growth trajectories and risk profiles that industry participants must navigate. The Agrochemical segment, which encompasses applications such as herbicide emulsifier and insecticide dispersant, demands consistent purity and reactivity to ensure formulation stability. Meanwhile, the Coating sector-spanning architectural and industrial finishes-relies on maleic anhydride’s capacity to confer adhesion and UV resistance, driving innovation in waterborne and high-solids resins. In parallel, Lubricating Oil Additives, including friction modifiers and viscosity index improvers, harness the anhydride’s functional groups to enhance engine efficiency and longevity. Similarly, Plasticizer formulations bifurcate into non-phthalate and phthalate-based derivatives, reflecting regulatory shifts toward safer, greener plasticizing agents. Lastly, the Unsaturated Polyester Resin category-subdivided into isophthalic, orthophthalic, and terephthalic variants-continues to underpin robust demand in composites and advanced materials.

Beyond end use, product type distinctions between high purity grade and standard grade underscore the importance of tailored quality thresholds for specialized versus commodity applications. Distribution channel dynamics further accentuate market nuances, as direct supply agreements enable cost optimization and technical collaboration, whereas distributor networks facilitate regional reach and agility. The production process split-between benzene oxidation and n-butane oxidation routes-fosters competitive positioning based on feedstock availability, cost considerations, and environmental impact. By integrating these segmentation pillars into strategic planning, companies can align capacity expansions, R&D investments, and marketing efforts to targeted industry verticals and customer requirements.

This comprehensive research report categorizes the Maleic Anhydride market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Production Process

- End Use Industry

- Distribution Channel

Deriving Strategic Perspectives from Regional Trends and Demand Patterns in the Americas, Europe Middle East Africa, and Asia Pacific

Regional dynamics continue to shape the maleic anhydride market through distinct demand catalysts and regulatory environments. In the Americas, a resurgence in infrastructure projects and automotive production has bolstered demand for unsaturated polyester resins, while stringent environmental regulations incentivize the adoption of high-efficiency production technologies. Conversely, the Europe, Middle East & Africa region is characterized by a diverse regulatory tapestry that balances sustainability mandates against industrial competitiveness. Here, players are forging public–private partnerships to pilot bio-derived feedstocks and circular recycling platforms, aligning with the European Green Deal’s objectives.

Meanwhile, Asia-Pacific remains the dominant consumption hub, driven by rapid urbanization, expanding manufacturing bases, and robust growth in construction and automotive end-uses. China’s ongoing transition toward cleaner energy sources and Japan’s emphasis on specialty resin applications underscore the region’s dual focus on scale and sophistication. Moreover, emerging Southeast Asian markets are investing in greenfield facilities to service rising domestic demand and export opportunities. Collectively, these regional trends highlight the importance of localized market strategies, adaptive regulatory compliance, and targeted capital deployment to capitalize on differentiated regional growth vectors.

This comprehensive research report examines key regions that drive the evolution of the Maleic Anhydride market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Uncovering Competitive Strategies and Innovative Developments Among Leading Global Producers of Maleic Anhydride

Industry leaders are actively pursuing a blend of capacity expansions, technological partnerships, and portfolio diversification to maintain their competitive edge. Key global producers have initiated joint ventures to secure feedstock integration and enhance downstream value capture. Strategic acquisitions of specialty resin firms are also underway, reinforcing capabilities in high-performance composites and co-polymer innovations. In parallel, companies are directing R&D resources toward next-generation catalyst formulations and process intensification techniques to reduce energy intensity and carbon emissions.

Collaboration between chemical producers and end-use manufacturers is facilitating co-development of application-specific grades, particularly in sectors such as automotive coatings and advanced lubrication systems. These partnerships are complemented by digital transformation initiatives that leverage machine learning to optimize reaction kinetics and yield predictive maintenance insights. Collectively, these strategies underscore a proactive stance on innovation, operational resilience, and sustainability, positioning leading producers to meet evolving customer demands and regulatory expectations.

This comprehensive research report delivers an in-depth overview of the principal market players in the Maleic Anhydride market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Aditya Birla Chemicals (India) Limited

- Arkema S.A.

- Ashland Inc.

- Bartek Ingredients Inc.

- BASF SE

- Borealis AG

- Changzhou Yabang Chemical Co., Ltd.

- China National Bluestar (Group) Co., Ltd.

- Clariant AG

- Eastman Chemical Company

- Evonik Industries AG

- Exxon Mobil Corporation

- Godavari Biorefineries Limited

- Gulf Advanced Chemical Industries Co., Ltd.

- Huntsman Corporation

- IG Petrochemicals Ltd.

- INEOS AG

- Jiangyin Shunfei Chemical Co., Ltd.

- Kanto Chemical Co., Inc.

- LANXESS AG

- Mitsubishi Chemical Corporation

- Nan Ya Plastics Corporation

- Ningbo Jiangning Chemical Co., Ltd.

- Nippon Shokubai Co., Ltd.

- Petronas Chemicals Group Berhad

- Polynt S.p.A.

- Shandong Huifeng Petroleum Chemical Co., Ltd.

- Thirumalai Chemicals Ltd.

- UBE Industries, Ltd.

- Wanhua Chemical Group Co., Ltd.

- Yongsan Chemical Co., Ltd.

- Zibo Qixiang Tengda Chemical Co., Ltd.

Delivering Actionable Strategic Recommendations to Propel Growth, Enhance Sustainability, and Strengthen Resilience in the Maleic Anhydride Sector

To navigate the complexities of today’s market, industry leaders should undertake a multifaceted strategic approach that balances near-term risk mitigation with long-term growth imperatives. Prioritizing investment in low-carbon production pathways and circular end-use solutions will align corporate objectives with global sustainability frameworks and unlock green financing opportunities. Moreover, forging strategic alliances with feedstock suppliers and logistics partners can diversify supply sources, enhance supply chain visibility, and reduce exposure to tariff fluctuations.

In parallel, companies should scale digital transformation efforts by integrating advanced analytics and industry 4.0 systems throughout their manufacturing footprint, enabling real-time process optimization and predictive asset management. Emphasizing customer co-innovation programs will foster deeper collaboration, accelerate product development cycles, and differentiate offerings in competitive end-use markets. By adopting this holistic strategy-anchored in sustainability, digitalization, and partnership-industry leaders can engineer resilient business models that capitalize on emerging market trends and deliver superior value to stakeholders.

Illuminating the Rigorous Multi-Stage Research Methodology and Analytical Framework Underpinning the Maleic Anhydride Market Study

This study’s insights are grounded in a rigorous research methodology that synthesizes primary and secondary intelligence through a multi-phase analytical framework. Initial desk research encompassed comprehensive review of academic publications, regulatory filings, patent databases, and industry white papers to map technological trends and policy influences. Subsequently, primary interviews were conducted with senior R&D executives, process engineers, procurement managers, and sustainability officers across key global markets to capture real-time perspectives on operational challenges and innovation roadmaps.

Quantitative data points were validated and triangulated through multiple channels, including trade association reports, customs data analyses, and expert consensus panels. An iterative peer-review process ensured methodological rigor, with cross-functional subject matter experts vetting assumptions and thematic interpretations. Advanced statistical techniques and scenario analysis tools underpinned the segmentation logic, enabling robust extrapolation of supply–demand dynamics without reliance on speculative forecasting. This methodological integrity ensures that the resulting conclusions and recommendations reflect a balanced, evidence-based view of the maleic anhydride landscape.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Maleic Anhydride market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Maleic Anhydride Market, by Product Type

- Maleic Anhydride Market, by Production Process

- Maleic Anhydride Market, by End Use Industry

- Maleic Anhydride Market, by Distribution Channel

- Maleic Anhydride Market, by Region

- Maleic Anhydride Market, by Group

- Maleic Anhydride Market, by Country

- United States Maleic Anhydride Market

- China Maleic Anhydride Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1590 ]

Synthesizing Core Insights to Reveal Overarching Trends and Strategic Imperatives in the Maleic Anhydride Industry

Drawing together the core insights, it is evident that the maleic anhydride sector stands at a strategic inflection point where innovation, regulation, and sustainability converge. Technological breakthroughs in catalyst design and bio-integration are reshaping production paradigms, while evolving tariff landscapes underscore the importance of agile supply-chain architectures. Segmentation analysis reveals nuanced demand drivers across end-use industries, product grades, distribution strategies, and production routes, highlighting opportunities for targeted investment and portfolio optimization.

Regionally differentiated growth patterns-from the infrastructure-led expansion in the Americas to the scale-driven dynamics of Asia-Pacific and the policy-driven innovation in Europe, Middle East & Africa-underscore the necessity for localized market strategies. Furthermore, leading companies’ emphasis on strategic alliances, capacity expansions, and digital transformation initiatives demonstrates a proactive approach to capturing emerging opportunities and mitigating operational risks. Together, these strategic imperatives furnish a clear blueprint for stakeholders seeking to navigate the complexities of the maleic anhydride ecosystem and secure sustainable competitive advantage.

Seize the Opportunity to Engage with Associate Director Ketan Rohom for Customized Maleic Anhydride Insights and Exclusive Market Report Purchase

To discover how this comprehensive market research report can empower your strategic decision-making and unlock new avenues for growth, seize the opportunity to connect directly with Associate Director, Sales & Marketing, Ketan Rohom. Drawing on deep industry expertise and an extensive network of global stakeholders, Ketan provides tailored consultation to align the study’s actionable insights with your unique organizational objectives. Engaging with this report through Ketan ensures you gain prioritized access to exclusive data sets, thematic analyses, and scenario planning tools that will sharpen your competitive edge. Reach out today to arrange a personalized walkthrough of the findings, discuss bespoke deliverables, and secure your copy of the definitive Maleic Anhydride market research report to inform investment strategies, supply chain optimizations, and product development roadmaps.

- How big is the Maleic Anhydride Market?

- What is the Maleic Anhydride Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?