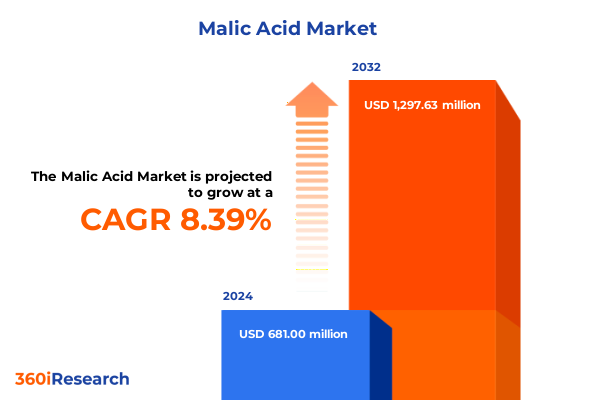

The Malic Acid Market size was estimated at USD 727.18 million in 2025 and expected to reach USD 777.03 million in 2026, at a CAGR of 8.62% to reach USD 1,297.62 million by 2032.

Setting the Stage for Malic Acid's Critical Role in Diverse Industries Amidst Growing Emphasis on Natural Ingredients and Functionality

Malic acid has garnered significant attention as a multifunctional organic compound that plays a pivotal role across an array of industries, driven by its naturally occurring status and versatile organoleptic and functional properties. In recent years, the compound’s presence has steadily expanded beyond traditional food and beverage arenas, finding heightened relevance in personal care formulations, pharmaceutical excipients, and industrial applications. As consumer preferences gravitate toward clean-label ingredients and regulatory bodies enforce increasingly stringent purity standards, malic acid’s profile as a GRAS-approved additive and pH-modifier has never been more pronounced. This convergence of demand signals underscores the necessity for industry participants to stay abreast of evolving production methods, application innovations, and regulatory landscapes to maintain competitive advantage.

The compound’s capacity to impart tartness, enhance flavor stability, and contribute to the chelation of metal ions positions it uniquely against competing organic acids. Concurrently, developments such as fermentation-based bioproduction, advanced downstream purification techniques, and green chemistry protocols are reshaping supply chains and cost structures alike. Against this backdrop, stakeholders must understand how supply, processing, and end-use trends are coalescing to redefine the role of malic acid in both legacy and emerging markets. The following analysis outlines critical shifts influencing the market, from tariff developments to segmentation insights across grades, forms, and applications, thereby equipping decision-makers with a robust strategic framework.

Innovations in Sustainable Sourcing, Advanced Processing, and Consumer Health Demands are Reshaping the Global Dynamics of the Malic Acid Industry

The malic acid landscape is undergoing a series of transformative shifts, propelled by advances in sustainable sourcing, process intensification, and heightened consumer health consciousness. Manufacturers are increasingly pivoting to fermentation routes that utilize renewable feedstocks, reducing reliance on petrochemical pathways and meeting ESG mandates. These innovations are complemented by refinements in crystallization and membrane separation technologies, which enhance product purity and lower energy consumption during production. As a result, cost efficiencies and reduced environmental footprints are becoming core differentiators among leading producers.

On the demand side, end-use industries are recalibrating their formulations to integrate multifunctional ingredients that satisfy both performance criteria and clean-label requirements. In personal care sectors, formulators are harnessing malic acid’s gentle exfoliation properties and pH-balancing capabilities to create differentiated skincare and haircare portfolios. Simultaneously, beverage and confectionery manufacturers are experimenting with naturally derived acidulants to replace synthetic counterparts, leveraging malic acid’s distinct tart profile and extended flavor release. This intersection of sustainability and functionality is fostering strategic collaborations across the value chain, where ingredient developers, brand owners, and regulatory experts co-innovate to unlock novel applications.

Assessing the Compounded Effects of 2025 United States Tariff Measures on Malic Acid Supply Chains, Pricing Dynamics, and Strategic Investments

The imposition of new United States tariff measures in early 2025 targeting select organic acids has introduced significant complexity into malic acid supply chains, fundamentally altering cost structures and procurement strategies. Imported volumes from key producing regions now face elevated duties, prompting buyers to reassess supplier portfolios and contemplate regional diversification. This tariff-induced recalibration has resulted in upward pressure on landed costs, particularly for end users reliant on high-purity grades for pharmaceutical and food applications.

In response, domestic producers are evaluating options to scale fermentation-based operations, while multinational suppliers are exploring tariff engineering solutions, such as reclassification strategies and tariff suspensions, to mitigate duty burdens. These maneuvers, however, require extensive documentation and regulatory scrutiny, thereby elongating lead times and increasing compliance overheads. To offset these challenges, stakeholders are engaging in long-term supply agreements, exploring toll manufacturing partnerships within the United States, and optimizing inventory management to cushion against volatility. The cumulative impact of these tariffs underscores the importance of agility and foresight in navigating evolving trade policies.

Revealing Critical Segmentation Perspectives Across Grades, Forms, Applications, and Distribution Channels in the Malic Acid Market

A nuanced understanding of market segmentation reveals critical levers that shape competitive positioning and growth trajectories within the malic acid sector. When evaluating grade differentiation, the market spans food grade, industrial grade, and pharmaceutical grade, each with distinct purity specifications, regulatory requirements, and cost profiles. Food-grade malic acid remains the workhorse in flavor and acidity modulation, while industrial-grade materials serve non-food applications such as metal cleaning, leather processing, and textile finishing. Meanwhile, pharmaceutical grade products command premium pricing and stringent quality controls, driving investments in advanced purification.

Form-based segmentation further delineates market behavior, with liquid malic acid solutions favored for ease of incorporation and reduced handling risks, and powder forms prized for extended shelf life and stability. In applications, the industry extends across cosmetics, food and beverage, industrial, and pharmaceutical sectors: in cosmetics, the molecule contributes to haircare formulations, makeup stabilizers, and skincare exfoliants; food and beverage manufacturers deploy it in bakery, confectionery, dairy, and soft drinks to impart tartness and enhance flavor fusion; industrial uses include leather processing and textile treatments, where its chelating properties facilitate metal ion control; and in pharmaceuticals, malic acid features prominently in injectables, syrups, and tablet formulations to adjust pH and improve palatability.

Distribution channel dynamics add another layer of insight, as offline channels incorporate direct sales, retail networks, and wholesalers and distributors to serve varied purchase volumes and technical service needs, while online channels-comprising company websites and e-commerce platforms-are carving out a fast-growing avenue for smaller batch orders and digital customer engagement. Recognizing how these segmentation parameters interplay enables suppliers and users to tailor offerings, optimize supply models, and pinpoint high-value niches.

This comprehensive research report categorizes the Malic Acid market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Grade

- Form

- Application

- Distribution Channel

Understanding Regional Dynamics and Demand Drivers Across the Americas, EMEA, and Asia-Pacific Markets for Malic Acid Products

Regional dynamics exert a profound influence on malic acid demand patterns and competitive landscapes. In the Americas, robust consumption in the food and beverage segment, spurred by a strong beverage innovation pipeline and premium confectionery launches, underpins the need for consistent, high-purity supply. Domestic producers are leveraging proximity to key end markets and integrating vertically to capture value across fermentation, purification, and distribution.

Across Europe, Middle East & Africa, stringent regulatory frameworks and a heightened focus on sustainability drive adoption of bio-based malic acid. European Union labeling requirements and green procurement scores incentivize manufacturers to source from certified renewable pathways, while the Middle East is emerging as a strategic logistics hub for global distribution. Africa’s evolving chemical industry is exploring tolling agreements to build local capacity, positioning the region as an upcoming growth frontier.

The Asia-Pacific region commands significant market share thanks to expansive cosmetics and pharmaceutical sectors in nations such as China, India, and Japan, which embrace malic acid for texture enhancement, pH control, and skin-beneficial attributes. Rapid expansion of contract manufacturing and co-development facilities, alongside government support for bio-industrial parks, has accelerated local production capabilities. Consequently, Asia-Pacific stakeholders are not only meeting domestic demand but are also emerging as net exporters of competitively priced grades to international markets.

This comprehensive research report examines key regions that drive the evolution of the Malic Acid market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Leading Industry Players, Strategic Partnerships, and Competitive Innovations Shaping the Global Malic Acid Value Chain

The competitive landscape of the malic acid market is marked by a mix of chemical giants, specialty ingredient producers, and agile biotech disruptors. Established companies with global footprints are investing in capacity expansions and strategic acquisitions to secure feedstock supply and broaden downstream capabilities. They are also forging partnerships with technology providers to integrate process-intensification solutions and bolster sustainability credentials. Conversely, niche manufacturers are carving out leadership positions by focusing on high-purity pharmaceutical grade production and rapid-response customer service models.

Innovation is a key differentiator, as leading players introduce novel formulations tailored for specific industry requirements, while simultaneously upgrading analytical and quality assurance protocols to meet evolving regulatory demands. Cross-licensing agreements and joint ventures are increasingly prevalent, facilitating access to proprietary strains for fermentation and enabling shared investment in next-generation separation technologies. This collaborative ethos is expanding the industry’s collective capability to develop specialized derivatives and application-specific blends, thus driving value across the entire supply chain.

This comprehensive research report delivers an in-depth overview of the principal market players in the Malic Acid market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Bartek Ingredients Inc.

- Fuso Chemical Co., Ltd.

- Ingreland Limited

- ISEGEN South Africa (Pty) Ltd.

- Junsei Chemical Co., Ltd.

- Kanto Chemical Co., Inc.

- Lonza Group Ltd.

- Muby Chemicals

- Nacalai Tesque, Inc.

- Polynt S.p.A.

- The Chemical Company

- Thirumalai Chemicals Ltd.

Delivering Pragmatic Strategic Recommendations for Industry Leaders to Enhance Resilience, Profitability, and Sustainability in Malic Acid Operations

To thrive amid evolving market dynamics and tariff pressures, industry leaders should prioritize securing diversified, sustainable feedstock sources, including partnerships with agricultural producers and biorefinery operators. Simultaneously, investments in modular fermentation platforms and advanced purification units can deliver the flexibility required to adjust to shifts in demand across grades and forms. By establishing strategic toll manufacturing arrangements in key consuming regions, organizations can mitigate trade-related cost variances and enhance service levels.

On the demand side, co-innovation initiatives with end-users can accelerate the development of differentiated malic acid derivatives and application-specific blends, unlocking new revenue streams in high-growth segments such as scalp care, functional beverages, and specialty pharmaceuticals. Embracing digital sales and customer care platforms will further streamline order processing, technical support, and market insights gathering, strengthening client ties. Finally, a robust regulatory intelligence framework, combined with proactive advocacy on trade policies, will empower companies to anticipate market shifts and steer investment decisions with confidence.

Outlining Rigorous Research Methodologies Employed to Ensure Data Integrity, Comprehensive Analysis, and Actionable Insights for Stakeholders

This analysis is grounded in a rigorous research methodology combining extensive secondary research and targeted primary engagements. The process began with a thorough review of patent filings, regulatory publications, and peer-reviewed literature to map technological advancements and process innovations. Secondary data sources included public financial filings, import-export databases, and industry association reports to validate market dynamics without reliance on proprietary estimation figures.

Primary research involved structured interviews with C-level executives, R&D leaders, and procurement specialists across the value chain to capture on-the-ground perspectives and emerging demand patterns. Data triangulation was applied to cross-verify findings, and thematic analysis techniques were used to distill strategic insights and thematic narratives. Rigorous quality checks ensured consistency and accuracy, while stakeholder workshops provided validation of key assumptions and market observations.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Malic Acid market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Malic Acid Market, by Grade

- Malic Acid Market, by Form

- Malic Acid Market, by Application

- Malic Acid Market, by Distribution Channel

- Malic Acid Market, by Region

- Malic Acid Market, by Group

- Malic Acid Market, by Country

- United States Malic Acid Market

- China Malic Acid Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1749 ]

Synthesizing Core Trends, Strategic Implications, and Forward-Looking Perspectives to Conclude the Comprehensive Malic Acid Industry Analysis

The malic acid market is poised at the intersection of sustainability, innovation, and regulatory evolution, with each trend reinforcing the compound’s strategic importance. Supply-side transformations, from bio-based production to tariff adaptations, are reshaping competitive dynamics, while segmentation nuances across grade, form, application, and channel offer pathways for targeted value creation. Regional distinctions underscore that geography remains a key determinant of cost, convenience, and compliance.

Against this backdrop, industry participants who align investments with sustainability imperatives, form deep collaborative networks, and adopt agile commercialization models will be best positioned to capitalize on malic acid’s expanding utility. As consumers and regulators continue to champion transparency and performance, malic acid’s favorable safety profile and functional versatility will drive further adoption across legacy and emerging applications, ensuring its role as a cornerstone ingredient for years to come.

Contact Ketan Rohom to Secure Your Customized Malic Acid Market Research Report and Gain Exclusive Strategic Intelligence Today

To explore how your organization can leverage in-depth market intelligence on malic acid and unlock strategic advantages, connect with Ketan Rohom, Associate Director of Sales & Marketing, to discuss tailored research solutions and the comprehensive report offerings designed to address your specific challenges and objectives

- How big is the Malic Acid Market?

- What is the Malic Acid Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?