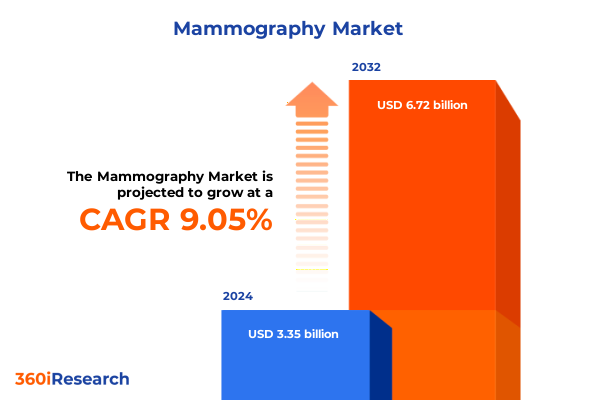

The Mammography Market size was estimated at USD 3.66 billion in 2025 and expected to reach USD 3.97 billion in 2026, at a CAGR of 9.04% to reach USD 6.72 billion by 2032.

Understanding the Foundations of Mammography Market Dynamics and Growth Drivers in a Rapidly Evolving Healthcare Ecosystem amid Technological Advancements and Shifting Regulatory Landscapes

The mammography market has emerged as a pillar of early breast cancer detection and patient outcomes, driven by both technological innovation and evolving clinical protocols. Fueled by a growing emphasis on preventive healthcare, providers and payers alike have prioritized investments in advanced imaging modalities to enhance diagnostic precision and streamline clinical pathways. Amid shifting demographic trends and an aging population, the critical importance of accurate, timely breast imaging has prompted healthcare organizations to reevaluate both legacy analog systems and cutting-edge digital solutions.

As healthcare stakeholders deepen their focus on value-based care models, mammography has assumed an even more prominent role in clinical decision-making frameworks. This shift has intensified demand for high-throughput screening capabilities, while simultaneously highlighting the need for sophisticated diagnostic tools that can differentiate between benign and malignant lesions with greater confidence. Regulatory advances and updated screening guidelines have underscored the imperative to expand access to high-quality imaging across diverse patient populations, particularly in underserved regions and rural settings.

Consequently, the market landscape is characterized by a dynamic interplay between established industry leaders and agile new entrants, each striving to deliver solutions that reduce recall rates and support personalized care. At the same time, healthcare systems are grappling with budgetary constraints and workforce shortages, creating a complex environment where strategic prioritization and investment in mammography technology can yield significant clinical and economic benefits.

Spotlighting Key Technological and Operational Transformations Redefining Mammography and Elevating Diagnostic Precision across Clinical Settings

The mammography sector is undergoing transformative shifts as digital platforms, artificial intelligence, and 3D imaging converge to redefine diagnostic pathways and patient experiences. Digital mammography’s evolution from two-dimensional screening to sophisticated three-dimensional tomosynthesis has delivered sharper lesion delineation and reduced the incidence of false positives, setting new benchmarks for image clarity. Simultaneously, portable and point-of-care devices are democratizing access to essential screening services, extending diagnostic capabilities beyond traditional radiology suites into outreach clinics and mobile health units.

Concurrently, the integration of AI-driven analytics has accelerated, empowering radiologists with decision support tools that flag subtle tissue anomalies and triage cases with unprecedented efficiency. As these software solutions become more deeply embedded in clinical workflows, they are driving improvements in accuracy, report turnaround times, and patient throughput. In parallel, maintenance and training services have expanded to accommodate the technical complexities of these advanced systems, ensuring that healthcare providers maintain optimal uptime and proficiency.

Moreover, the convergence of imaging and informatics platforms through PACS integration further streamlines data management and multidisciplinary collaboration. This holistic approach not only elevates diagnostic confidence but also facilitates longitudinal patient tracking and outcome measurement. Collectively, these technological and operational advancements are reshaping the mammography landscape, prompting providers and manufacturers to collaborate in new and innovative ways to meet the demands of precision medicine.

Assessing the Comprehensive Consequences of Recent United States Tariff Implementations on Mammography Equipment and Supply Chains through 2025

The imposition of new United States tariffs in early 2025 on select mammography components and finished imaging devices has introduced multi-layered challenges across the supply chain. Manufacturers reliant on imported detectors, specialized X-ray tubes, and core imaging modules have experienced elevated input costs, leading to adjusted pricing structures for both equipment and maintenance services. These cost pressures have reverberated through procurement cycles, compelling healthcare providers to reassess capital expenditure plans and explore financing alternatives to offset the impact of higher upfront investment requirements.

In turn, some regional distributors have responded by increasing inventory holdings of analog and digital mammography units to hedge against further tariff escalations, while others have sought to renegotiate contractual terms with original equipment manufacturers. For many stakeholders, the necessity to diversify sourcing strategies has accelerated partnerships with domestic component producers and assembly facilities. As a result, supply chain resilience has emerged as a strategic imperative, with organizations prioritizing dual-sourcing agreements and near-shoring initiatives to balance cost containment with market continuity.

While the tariff-driven cost escalation poses short-term challenges, it has also catalyzed innovation in service models, such as outcome-based pricing and performance guarantees, to maintain competitive positioning. Furthermore, some vendors are intensifying investment in software-driven upgrades to existing fleets, offering algorithmic enhancements rather than full equipment replacements as a cost-effective alternative. Through these dynamic adaptations, the market continues to navigate the tariff landscape while preserving access to state-of-the-art mammography solutions.

Unveiling Critical Insights from Technology, Deployment, Product Type, Application, and End User Segmentation Driving Mammography Market Diversification

Delving into the market’s segmentation reveals distinct performance and adoption patterns across technology, deployment, product type, application, and end user categories. Analog mammography systems continue to maintain a presence in legacy clinical settings, but they are ceding ground to digital modalities, including both two-dimensional digital imaging and advanced three-dimensional tomosynthesis, as providers seek to reduce recall rates and enhance lesion detection. Fixed installations remain the backbone of high-volume diagnostic centers, while portable units gain traction in outreach programs, mobile screening vehicles, and regions with limited infrastructure.

Examining product types exposes the critical role of equipment vendors, whose investments in hardware innovation are complemented by service providers delivering maintenance and specialized training. At the same time, software solutions such as AI-driven analytics and picture archiving and communication systems are becoming integral to comprehensive mammography offerings, enabling streamlined workflows and retrospective data analysis. In clinical applications, screening services prioritize rapid throughput to maximize participation in population health programs, whereas diagnostic procedures leverage biopsy guidance and advanced lesion evaluation tools to inform personalized treatment plans.

Finally, the landscape of end users underscores diverse operational models: breast-focused clinics and outpatient centers emphasize patient comfort and operational efficiency, diagnostic imaging centers deploy multi-specialty and standalone facilities to serve broader referral networks, and both private and public hospitals integrate mammography into comprehensive oncology services. These segmentation insights illuminate pathways for targeted innovation and resource allocation within the mammography ecosystem.

This comprehensive research report categorizes the Mammography market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Technology

- Deployment

- Product Type

- Application

- End User

Mapping Regional Variances in Mammography Adoption and Infrastructure across the Americas, EMEA, and Asia-Pacific Healthcare Environments

Regional dynamics in mammography adoption and infrastructure investment showcase marked variations across the Americas, Europe Middle East & Africa, and Asia-Pacific landscapes. In the Americas, a dense network of private and public hospitals, outpatient clinics, and dedicated breast centers underscores a mature screening environment. Here, digital mammography and tomosynthesis installations account for the majority of new equipment purchases as providers enhance early detection programs and align with stringent reimbursement frameworks.

In the Europe Middle East & Africa region, diverse healthcare systems and funding models have led to heterogeneous deployment patterns. Western European countries exhibit high penetration of advanced 3D imaging and AI-enabled software, supported by centralized breast cancer screening initiatives. Conversely, emerging markets within the Middle East and Africa are characterized by gradual adoption of portable and fixed digital units, often facilitated through public-private partnerships and donor-funded outreach programs.

Meanwhile, the Asia-Pacific region is experiencing robust expansion, driven by rising healthcare expenditure and growing awareness of breast cancer screening. High-density urban centers in East Asia spearhead the adoption of state-of-the-art mammography suites and integrated image management solutions, while South and Southeast Asian markets focus on scalable, cost-effective equipment models and training services to expand coverage in underserved rural areas. These regional insights highlight the importance of localized strategies to address unique infrastructure, funding, and regulatory landscapes.

This comprehensive research report examines key regions that drive the evolution of the Mammography market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Industry Leaders and Innovators Catalyzing Breakthroughs in Mammography through Strategic Partnerships and Advanced Solutions

Key industry players are actively shaping the mammography landscape through strategic alliances, continuous product innovation, and service portfolio expansion. Leading equipment manufacturers leverage global R&D networks to introduce next-generation detectors and X-ray tubes that deliver higher resolution images at lower radiation doses. These hardware advancements are frequently paired with proprietary AI algorithms, enabling real-time lesion detection and risk stratification during screening workflows.

Collaborative partnerships between technology firms and healthcare providers are also driving market momentum. Joint ventures focusing on clinical validation of AI solutions and interoperability with existing hospital information systems are crafting new pathways for adoption. In parallel, service organizations specializing in equipment maintenance and radiologist training are extending their footprints by offering remote monitoring, virtual simulation modules, and on-site skill enhancement workshops, catering to the complex needs of diverse end users.

Software vendors are capitalizing on demand for integrated diagnostic ecosystems by refining PACS platforms with cloud-native architectures and modular add-on analytics. These enhancements facilitate seamless data exchange across multi-specialty imaging centers and hospital networks, bolstering collaborative care models. Through these concerted efforts, market leaders are not only advancing technological frontiers but also elevating the overall standard of mammography practice.

This comprehensive research report delivers an in-depth overview of the principal market players in the Mammography market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Analogic Corporation

- Canon Medical Systems Corporation

- Carestream Health, Inc.

- Delphinus Medical Technologies, Inc.

- Digirad Corporation

- Dilon Technologies, Inc.

- Fujifilm Holdings Corporation

- GE HealthCare Technologies Inc.

- General Medical Merate S.p.A.

- Hitachi, Ltd.

- Hologic, Inc.

- iCAD, Inc.

- IMS s.r.l.

- Konica Minolta, Inc.

- Koninklijke Philips N.V.

- Metaltronica S.p.A.

- Planmed Oy

- Sectra AB

- Siemens Healthineers AG

- Varex Imaging Corporation

Translating Market Intelligence into Strategic Action: Recommended Tactical Initiatives for Mammography Industry Stakeholders to Seize Emerging Opportunities

Industry leaders can translate market intelligence into actionable strategies by prioritizing investments in dual-sourcing and near-shoring initiatives to enhance supply chain resilience against tariff fluctuations. By combining hardware excellence with modular software upgrades, organizations can offer tiered solutions that meet both cost-sensitive and premium customer segments. Strengthening service networks through virtual and on-site training programs will ensure optimal utilization of advanced imaging modalities, reducing downtime and improving diagnostic throughput.

Moreover, forging alliances with academic institutions and clinical centers can accelerate real-world validation of AI algorithms, bolstering confidence among radiologists and regulatory bodies. Collaborative research programs can also yield proprietary data sets that refine machine learning models, enhancing accuracy in biopsy guidance and lesion evaluation. Simultaneously, engaging in public-private partnerships and donor-driven initiatives can unlock new markets in underserved regions, leveraging portable mammography platforms to expand screening outreach.

To amplify market penetration, stakeholders should harness digital marketing channels and data-driven outreach campaigns that target distinct end users, including specialized breast clinics and multi-specialty imaging centers. Tailored value propositions that address operational efficiency, diagnostic accuracy, and regulatory compliance will resonate with both public and private healthcare purchasers. Ultimately, a balanced portfolio that integrates equipment, services, and software will position organizations to capitalize on emerging opportunities and fortify their competitive standing.

Detailing Rigorous Research Methodology Employed to Ensure Data Integrity, Analytical Precision, and Comprehensive Coverage of the Mammography Sector

The insights presented in this report derive from a rigorous, multi-stage research framework encompassing primary interviews, secondary data analysis, and expert validation. Initially, a comprehensive review of peer-reviewed literature, regulatory filings, and industry publications established the foundational understanding of technological trends and market drivers. This was complemented by an in-depth analysis of tariff schedules, trade data, and supply chain benchmarks to assess the impact of United States trade policies through 2025.

Subsequently, primary research efforts included structured interviews with C-level executives, radiology department heads, procurement managers, and service providers across key geographies. These discussions captured nuanced perspectives on adoption barriers, financing strategies, and maintenance requirements. Quantitative insights from surveys and proprietary databases provided a cross-sectional view of segmentation performance across technology, deployment, product type, application, and end user categories.

Finally, iterative validation sessions with technical advisors and industry veterans ensured the accuracy and relevance of analytical findings. The report’s strategic recommendations were stress-tested through scenario modeling and sensitivity analysis, reinforcing their applicability under varying market conditions. This multi-source methodology ensures that the report delivers holistic, actionable intelligence for decision-makers in the mammography sector.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Mammography market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Mammography Market, by Technology

- Mammography Market, by Deployment

- Mammography Market, by Product Type

- Mammography Market, by Application

- Mammography Market, by End User

- Mammography Market, by Region

- Mammography Market, by Group

- Mammography Market, by Country

- United States Mammography Market

- China Mammography Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 2067 ]

Synthesizing Core Findings and Forward-Looking Perspectives to Reinforce Strategic Positioning in an Evolving Mammography Market Landscape

The convergence of technological breakthroughs, shifting regulatory frameworks, and emerging tariff considerations has jointly sculpted a mammography market that is both dynamic and complex. Throughout this report, we have explored how digital imaging modalities, AI-powered analytics, and portable deployment models are expanding diagnostic capabilities and broadening access to life-saving screening services. The segmentation lens has illuminated where equipment innovation intersects with service excellence, and where alignment with clinical application drives differentiated value.

Regional analyses have underscored the importance of tailoring market strategies to distinct infrastructure and funding landscapes, whether in mature North American systems, heterogeneous Europe Middle East & Africa environments, or rapidly expanding Asia-Pacific markets. Simultaneously, the cumulative effects of United States tariff measures have highlighted the need for adaptive supply chain strategies and collaborative manufacturing partnerships.

Ultimately, the market’s future trajectory will hinge on stakeholders’ ability to integrate hardware, software, and service solutions into cohesive offerings that address both clinical imperatives and economic constraints. By embracing data-driven decision-making, strengthening collaborative networks, and fostering patient-centric innovation, industry participants can secure a leadership position in the next chapter of mammography evolution.

Engaging with Ketan Rohom to Unlock Exclusive Market Intelligence and Drive Informed Decision-Making in the Mammography Sector

To access the full market research report and gain a competitive edge in the mammography sector, reach out directly to Ketan Rohom, our Associate Director of Sales & Marketing. Engage today to secure exclusive insights into evolving market trends, regulatory shifts, and emerging growth opportunities. Connect with Ketan to discuss how tailored data and strategic recommendations can inform procurement decisions, optimize product portfolios, and drive sustainable growth. Procurement professionals and executive stakeholders will benefit from one-on-one consultations, customized briefings, and priority access to the comprehensive analysis. Don’t miss the opportunity to transform your strategic planning and capture new market share with confidence; contact Ketan Rohom now to procure the definitive guide to the mammography market’s future.

- How big is the Mammography Market?

- What is the Mammography Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?