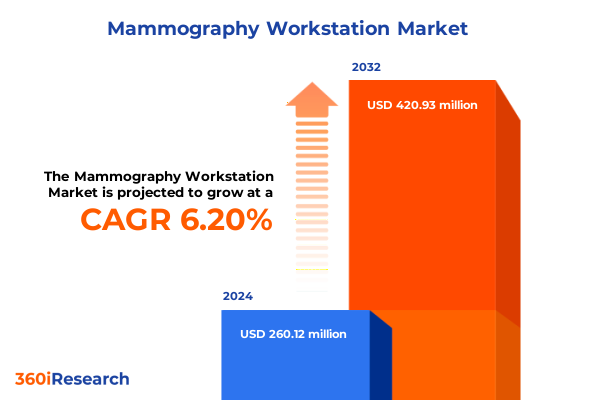

The Mammography Workstation Market size was estimated at USD 274.46 million in 2025 and expected to reach USD 293.62 million in 2026, at a CAGR of 6.29% to reach USD 420.93 million by 2032.

Revolutionizing Breast Imaging Workflows with Advanced Mammography Workstations Designed to Enhance Precision, Efficiency, and Patient Care

The mammography workstation segment has emerged as a pivotal component in modern breast imaging workflows, bridging advances in diagnostic precision with the increasing demand for streamlined radiology processes. As digital transformation continues to permeate healthcare, the integration of advanced displays, workstation systems, and intelligent software solutions has redefined how radiologists interact with image data, interpret findings, and collaborate across multidisciplinary teams. In this rapidly evolving environment, understanding the core capabilities, interoperability standards, and user experience considerations of workstation platforms becomes essential for healthcare providers aiming to enhance diagnostic accuracy and operational efficiency.

Amid heightened global awareness of breast cancer screening programs and a growing emphasis on early detection, mammography workstations have transcended their traditional role. They now serve not only as image review stations but also as hubs for advanced visualization, AI-driven analytics, and secure teleradiology communications. These shifts have amplified the importance of flexible, scalable solutions that can adapt to varying clinical settings, regulatory requirements, and budgetary constraints. Consequently, decision-makers require clear, actionable insights into the technological landscape and market dynamics shaping the next generation of mammography workstations.

Emerging Technological Innovations and Regulatory Dynamics Reshaping Mammography Workstation Capabilities and Radiology Service Delivery Paradigms

The mammography workstation landscape is undergoing transformative shifts driven by the convergence of artificial intelligence, cloud computing, and regulatory evolution. Innovations in AI algorithms are now seamlessly embedded within software platforms to automate lesion detection, prioritize worklists, and optimize image post-processing. These capabilities not only reduce the cognitive load on radiologists but also shorten turnaround times for diagnostic reports. Simultaneously, cloud-based teleradiology services have become more robust, offering secure reading environments that facilitate real-time collaboration among specialists across geographic boundaries.

In parallel, the adoption of tomosynthesis and digital detectors has elevated the complexity and volume of image data, necessitating high-performance hardware configurations and ultra-high-resolution displays capable of rendering three-dimensional reconstructions with exceptional clarity. Regulatory bodies have also responded to these technological advancements by updating quality standards and accreditation protocols, compelling vendors to fortify cyber-security measures, ensure DICOM compatibility, and maintain HIPAA compliance. As a result, the market is tilting toward integrated platforms that harmonize hardware, software, and service components into cohesive solutions that can scale with clinical demand.

Assessing the Far-reaching Effects of 2025 U.S. Trade Tariffs on Mammography Workstation Supply Chains, Costs, and Radiology Infrastructure Investments

The imposition of new U.S. tariffs in early 2025 has introduced a series of cost pressures and supply chain recalibrations for manufacturers and end users of mammography workstations. These measures, targeting imported electronic components, medical-grade displays, and specialized semiconductor chips, have prompted many vendors to reconsider their sourcing strategies. To mitigate the impact of increased duties, several providers have accelerated near-shoring initiatives, relocating key assembly operations to North American facilities or diversifying procurement across non-subject countries.

Consequently, healthcare organizations are grappling with incremental price adjustments on workstation hardware and extended lead times for critical system upgrades. Many radiology departments are reevaluating capital expenditure plans or entering into multi-year service agreements to lock in current pricing and secure maintenance support. Despite these challenges, some suppliers have opted to absorb a portion of the tariff increases to preserve market share, underscoring the competitive intensity within the sector. Ultimately, the 2025 tariff environment has reinforced the imperative for transparent total-cost-of-ownership analyses and proactive supply chain risk management among both vendors and healthcare providers.

Uncovering Segmentation Insights Across Product Types, Applications, Technologies, Deployment Models, and End User Categories for Mammography Workstations

An in-depth examination of segmentation dimensions reveals distinct drivers and adoption patterns across the mammography workstation market. Within the product type segment, hardware solutions comprised of diagnostic-grade displays and high-throughput workstation systems remain foundational, while professional services in consulting and maintenance are increasingly valued for optimizing ROI and uptime. Software offerings have bifurcated into computer-aided detection (CAD) modules for routine mammography interpretation and AI-enabled suites that extend beyond detection to workflow automation and advanced analytics.

Exploring applications, the screening and diagnostic use cases represent the lion’s share of volume, yet growth in teleradiology is notable as cloud reading platforms and remote radiology services expand access to subspecialty expertise. Tomosynthesis applications continue to gain momentum as clinical guidelines endorse three-dimensional imaging for dense breast tissue assessment. From a technology standpoint, there is clear convergence: digital mammography remains ubiquitous, CAD tools are standard in many systems, tomosynthesis hardware is growing, and advanced AI models are integrated for both diagnostics and workflow augmentation.

Deployment mode preferences exhibit a split between cloud-centric models-offering public or private cloud environments for centralized image storage and collaborative reading-and on-premise implementations, where tightly controlled in-house servers ensure data sovereignty. End-user segments vary in priorities: general and specialty clinics often prioritize cost-effective turnkey solutions, diagnostic centers require rapid throughput and robust maintenance contracts, hospitals balance large-scale system integration with regulatory mandates for private and public institutions, and high-volume imaging centers demand scalable, high-performance architectures.

This comprehensive research report categorizes the Mammography Workstation market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Technology

- Deployment Mode

- End User

- Application

Analyzing Regional Dynamics and Growth Catalysts Across Americas, Europe Middle East & Africa, and Asia-Pacific Markets in Mammography Workstations

Regional analyses underscore divergent growth trajectories and investment priorities. In the Americas, widespread government funding for mammography screening programs, coupled with extensive reimbursement frameworks, has fostered the rapid uptake of digital and tomosynthesis-enabled workstations. Radiology networks in the United States and Canada are leveraging shared cloud platforms to streamline workflows and extend specialist coverage to rural communities.

Across Europe Middle East & Africa, established markets in Western Europe are bolstering compliance with updated medical device regulations, leading to demand for upgraded hardware and interoperable software certified under the new EU MDR. Meanwhile, emerging markets in the Middle East are channeling investment into regional teleradiology hubs, and select African nations are piloting tele-imaging initiatives to address screening disparities in remote areas.

In the Asia-Pacific region, government-led breast cancer screening drives in China and Japan have catalyzed procurement of advanced mammography workstations, while India’s private healthcare sector focuses on cost-effective digital platforms for high-volume clinics. Australia and New Zealand continue to emphasize integration with national health networks, reinforcing data security and cross-institutional sharing of mammography studies.

This comprehensive research report examines key regions that drive the evolution of the Mammography Workstation market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Leading Vendors’ Strategic Initiatives, Partnerships, and Technological Developments Driving Competitiveness in Mammography Workstation Market

Leading vendors are deploying multifaceted strategies to strengthen their positions in the mammography workstation ecosystem. Global incumbents have forged partnerships with cloud service providers to deliver secure, scalable reading environments, while also acquiring niche AI technology firms to embed advanced analytics into their flagship software suites. Competitive differentiation is increasingly achieved through modular product architectures that allow customers to selectively upgrade displays, add AI plugins, or expand service agreements based on evolving clinical needs.

At the same time, several mid-tier and emerging players are capitalizing on specialized offerings-such as zero-footprint viewers optimized for remote radiology, or subscription-based licensing models that minimize upfront investment. These vendors often focus on accelerated product certification and rapid deployment to underserved markets, creating pressure on established brands to respond with localized support centers and streamlined onboarding processes. Overall, strategic initiatives by key companies emphasize a balance between technological innovation, customer experience, and operational agility.

This comprehensive research report delivers an in-depth overview of the principal market players in the Mammography Workstation market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Agfa-Gevaert N.V.

- Fujifilm Holdings Corporation

- GE HealthCare Technologies Inc.

- Hologic, Inc.

- iCAD, Inc.

- Koninklijke Philips N.V.

- MeVis Medical Solutions AG

- Sectra AB

- Siemens Healthineers AG

- Volpara Solutions Limited

Strategic Roadmap for Industry Leaders to Capitalize on Emerging Opportunities and Mitigate Risks in the Evolving Mammography Workstation Landscape

Healthcare providers and technology suppliers must adopt a proactive stance to harness emerging opportunities in the mammography workstation space. First, investing in AI-driven diagnostic and workflow tools will be critical to differentiate service offerings and enhance radiologist productivity. Organizations should conduct pilot deployments with vendor-agnostic validation to assess performance across diverse case mixes and imaging modalities.

Second, cloud maturity should be elevated through the deployment of hybrid models that combine public or private cloud services with on-premise fallback capabilities, ensuring continuity of operations and compliance with data governance requirements. Concurrently, establishing long-term maintenance and consulting partnerships will mitigate the risk of unplanned downtime and enable adaptive scaling of hardware and software resources.

Finally, stakeholders should continuously monitor policy and tariff developments to anticipate cost fluctuations and adjust procurement strategies accordingly. Collaboration between C-suite decision-makers, radiology directors, and IT leads will be paramount to align investment roadmaps with both clinical imperatives and fiscal constraints.

Comprehensive Research Framework Outlining Methodological Approaches, Data Collection Techniques, and Analytical Processes for Mammography Workstation Analysis

This research study follows a rigorous, multi-tiered approach encompassing both primary and secondary data collection. Initially, in-depth interviews were conducted with senior radiologists, IT administrators, and procurement managers across major hospitals, diagnostic centers, and specialist clinics to gather qualitative insights into deployment preferences, workflow challenges, and performance expectations.

Secondary research involved the systematic review of regulatory filings, accreditation standards, vendor white papers, and peer-reviewed publications to map the competitive environment and track recent technological breakthroughs. Data triangulation techniques were applied to reconcile potential inconsistencies between primary interviews and published sources, ensuring the reliability of key findings.

Quantitative analyses leveraged a detailed segmentation framework, categorizing the market by product type, application, technology, deployment mode, and end-user group. Regional market dynamics were further scrutinized through country-specific examination of policy frameworks, reimbursement schemes, and infrastructure investments. The final report synthesizes these insights into cohesive narratives and actionable charts, providing stakeholders with a comprehensive decision-support tool.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Mammography Workstation market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Mammography Workstation Market, by Product Type

- Mammography Workstation Market, by Technology

- Mammography Workstation Market, by Deployment Mode

- Mammography Workstation Market, by End User

- Mammography Workstation Market, by Application

- Mammography Workstation Market, by Region

- Mammography Workstation Market, by Group

- Mammography Workstation Market, by Country

- United States Mammography Workstation Market

- China Mammography Workstation Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 2226 ]

Synthesis of Key Findings and Strategic Imperatives Highlighting Future Trajectories for Mammography Workstation Adoption and Innovation

The evolution of mammography workstations is characterized by rapid technological innovation, shifting regulatory landscapes, and the imperative to deliver high-fidelity imaging across diverse clinical settings. Advanced AI integrations are streamlining the detection process, while cloud-based solutions are democratizing access to subspecialty expertise and bolstering collaborative care models. At the same time, tariff pressures underscore the importance of strategic supply chain planning and cost-management frameworks.

Segmentation analysis highlights the differentiated needs of hardware, software, and service offerings, with each category demanding tailored deployment and support strategies. Regional perspectives reveal that growth is far from uniform, driven by local policy incentives, healthcare funding mechanisms, and varying maturity levels in digital health infrastructure. Company initiatives demonstrate a clear trend toward modular, partnership-driven development roadmaps that balance innovation with scalability.

Taken together, these insights form a roadmap for stakeholders seeking to optimize their adoption and procurement strategies. By aligning technological investments with end-user requirements and fostering cross-functional collaboration, organizations can capitalize on the next wave of advancements in mammography workstations and deliver more precise, efficient, and patient-centric breast imaging services.

Engage with Ketan Rohom to Unlock Specialized Mammography Workstation Market Insights and Propel Your Radiology Practice Forward

To gain unrivaled visibility into the evolving mammography workstation market and obtain a full suite of insights tailored to your strategic objectives, reach out directly to Ketan Rohom, Associate Director of Sales & Marketing at our organization. Ketan brings a wealth of expertise in mediating between market intelligence and end-user requirements, ensuring that your team acquires the precise data, analyses, and support needed to inform critical investment and technology decisions. By engaging with Ketan, you will unlock exclusive access to comprehensive market research deliverables, including custom deep-dive analyses, comparative vendor profiles, and actionable outlooks on emerging trends. Don’t miss the opportunity to equip your stakeholders with the foresight required to outpace competitors and drive superior patient outcomes. Contact Ketan today to secure your copy of the full report and chart a course for innovation and growth in the mammography workstation landscape.

- How big is the Mammography Workstation Market?

- What is the Mammography Workstation Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?