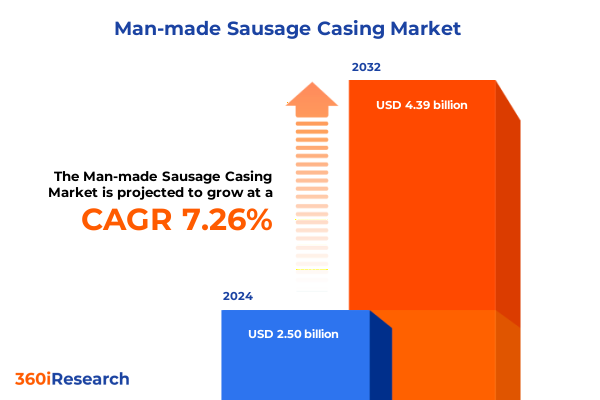

The Man-made Sausage Casing Market size was estimated at USD 2.68 billion in 2025 and expected to reach USD 2.89 billion in 2026, at a CAGR of 7.25% to reach USD 4.39 billion by 2032.

Unlocking the Core Dynamics of the Man-Made Sausage Casing Market: Foundational Context, Scope, and Strategic Imperatives Defined for Informed Decision-Making

The man-made sausage casing market has rapidly evolved, emerging as a critical component in modern meat processing and value-added protein products. From small-scale artisanal delis to large industrial producers, the choice of casing influences not only the final product’s appearance and texture, but also its shelf life, manufacturing efficiency, and regulatory compliance. With innovations spanning from cellulose alternatives to advanced collagen formulations, stakeholders must grasp the foundational dynamics shaping this essential industry segment.

This analysis delves into the critical factors that have made synthetic and semi-synthetic casings indispensable in contemporary meat processing. It highlights the interplay between raw material availability, manufacturing technologies, and evolving consumer preferences for both convenience and quality. Moreover, it outlines the scope of technological advancements that enable producers to tailor casings for optimized performance across diverse applications.

As regulatory frameworks tighten and sustainability considerations take center stage, manufacturers face growing pressure to balance cost, functionality, and environmental responsibility. Understanding these initial conditions is crucial for decision-makers tasked with steering production strategies, forging supplier partnerships, and meeting both commercial and household demand effectively.

By contextualizing the current market scenario and articulating the strategic imperatives at play, this introduction sets the stage for a comprehensive assessment of transformative shifts, tariff impacts, segmentation dynamics, regional variations, competitive landscapes, and targeted recommendations.

Revolutionary Industry Transformations Igniting Innovation, Transparency, and Sustainability in Sausage Casing Production

In recent years, the man-made sausage casing industry has witnessed several transformative shifts that are redefining production and consumption patterns. Initially driven by innovations in cellulose processing, the landscape has broadened to include advanced collagen and fibrous variants that offer enhanced mechanical strength and improved permeability. Concurrently, plastic-based film casings have gained traction for their uniformity and extended shelf life, appealing to high-volume processors seeking consistency.

Furthermore, the convergence of food safety regulations and consumer demand for traceability has accelerated the adoption of casings embedded with digital identifiers. These technologies enable real-time monitoring of product history and quality metrics, fostering greater transparency across the supply chain. Simultaneously, sustainability has emerged as a focal point, prompting manufacturers to pursue biodegradable and recyclable alternatives without compromising performance.

In parallel, shifting dietary trends, including a rise in specialty sausages and ethnic meat products, have spurred customization in casing formulations to accommodate unique flavor profiles, cooking methods, and presentation styles. This diversification underscores the importance of flexible manufacturing platforms capable of formulating casings with tailored properties, such as adjustable shrink rates, variable gas permeability, and enhanced smoke absorption.

Collectively, these shifts illustrate an industry in flux, where technological ingenuity, consumer expectations, and regulatory pressures coalesce to drive strategic realignments. Stakeholders who adapt to these emerging paradigms will unlock new avenues for product differentiation and operational resilience.

Navigating the Complex Economic Shifts Triggered by the 2025 United States Trade Tariffs on Sausage Casings

The imposition of elevated tariffs in 2025 has significantly influenced import dynamics and cost structures within the man-made sausage casing market. In response to protective duties on key raw materials and finished cellulose and collagen casings, manufacturers have recalibrated supply chains to mitigate upward pressure on input costs. This realignment has accelerated the shift toward domestic sourcing and localized production, thereby reducing reliance on imports vulnerable to regulatory volatility.

As a direct consequence of these measures, companies have intensified investments in domestic manufacturing assets, expanding capacity to produce both cellulose-based and collagen-based casings. This trend has catalyzed strategic partnerships between casing producers and raw material suppliers to secure consistent feedstock volumes. Additionally, the altered economic landscape has prompted a reexamination of pricing strategies, wherein manufacturers absorb marginal cost increases or pursue value-added differentiation to justify incremental price adjustments.

Moreover, tariffs have prompted a broader evaluation of alternative casing types, with fibrous and plastic-based solutions emerging as substitutes in certain applications. Processors analyzing total cost of ownership have begun experimenting with hybrid casing systems and multilayer films to achieve desired functional attributes at competitive price points. This experimentation reflects a nuanced approach to balancing performance requirements with fiscal constraints amid ongoing trade uncertainties.

Overall, the 2025 tariff regime has reshaped strategic priorities, compelling stakeholders to enhance supply chain resilience, diversify material portfolios, and drive efficiency improvements across the production and distribution continuum.

Dissecting Intricate Segmentation Realities Highlighting Type, Application, and End-User Drivers Shaping Casing Deployment Strategies

Analysis of product categories reveals that cellulose remains the most widely adopted casing type, prized for its cost-effectiveness and reliable properties, while collagen formulations have carved out a significant niche due to their natural origin and superior bite. Fibrous casings continue to be preferred in applications requiring robust tensile strength, particularly in high-speed production lines, and plastic-based films are favored where uniform barrier performance is paramount.

Turning to end-use scenarios, the spectrum of processed meats highlights a strong correlation between casing selection and final product characteristics. Cooked sausage producers lean toward collagen variants for their consistent shrinkage and textural mouthfeel, whereas dried sausage manufacturers often rely on cellulose casings for ease of casing removal and efficient moisture regulation. Fresh sausage processors, facing strict hygiene and packaging demands, increasingly adopt plastic-based solutions to maintain product integrity during refrigerated distribution.

End-user segmentation underscores stark differences between commercial and household consumption channels. In commercial environments, large-scale processors prioritize high-throughput casing options that integrate seamlessly with automated filling and linking equipment. Conversely, the household segment is characterized by smaller package formats and premium offerings, where collagen and fibrous casings are employed to deliver artisanal appeal and authentic eating experiences.

These segmentation insights provide a nuanced understanding of how product type, application, and end-user requirements converge to shape demand patterns and inform strategic decision-making across the sausage casing value chain.

This comprehensive research report categorizes the Man-made Sausage Casing market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Application

- End User

Unearthing Regional Nuances in Infrastructure, Regulation, and Culinary Traditions That Propel Casing Demand Across Key Geographies

Regional analysis reveals that the Americas region continues to lead in large-scale consumption and domestic production infrastructure, where robust food processing industries and advanced logistics networks enable efficient distribution of both bulk and retail-ready casing products. Strong regulatory alignment and a mature supplier base support the availability of diverse casing formulations tailored to mainstream and specialty applications.

In the Europe, Middle East & Africa region, stringent food safety standards and evolving environmental policies have prompted casing manufacturers to innovate biodegradable and recyclable solutions. Growth in artisanal and gourmet meat products has also fueled demand for high-performance collagen and fibrous casings that deliver premium texture and visual appeal, while enabling producers to comply with rigorous regional guidelines.

Meanwhile, the Asia-Pacific region exhibits the most dynamic expansion potential, driven by rising per capita protein consumption and burgeoning meat-processing investments. Local dietary traditions favor a broad array of sausage types, leading to widespread adoption of customized casing formulations. As emerging markets in Southeast Asia and South Asia upgrade their processing capabilities, suppliers are collaborating closely with regional partners to establish production facilities and optimize supply chains.

Altogether, these regional insights underscore the importance of aligning product portfolios with local market conditions and regulatory frameworks to capitalize on growth opportunities in each geographies.

This comprehensive research report examines key regions that drive the evolution of the Man-made Sausage Casing market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Examining How Top Industry Players Are Leveraging Innovation, Strategic Alliances, and Digitalization to Fortify Competitive Positions

Leading enterprises in the man-made sausage casing industry have undertaken robust strategies to strengthen their market positions through innovation, capacity expansion, and strategic alliances. Major players have prioritized research and development investments to enhance casing performance attributes such as controlled shrinkage, gas permeability tuning, and surface texturization. This focus on functional differentiation enables companies to meet the exacting demands of both industrial producers and niche artisanal processors.

Strategic collaborations with raw material suppliers and contract manufacturers have been instrumental in securing consistent feedstock availability and optimizing cost efficiencies. In parallel, several firms have pursued targeted acquisitions to broaden their product portfolios and extend geographical reach. These moves have also facilitated entry into adjacent segments, such as flexible packaging and advanced barrier films, thereby diversifying revenue streams and mitigating market complexity.

In addition, digitalization initiatives are gaining momentum, as manufacturers integrate Industry 4.0 technologies into their production lines to achieve real-time process monitoring, predictive maintenance, and batch traceability. Early adopters have reported significant gains in operational agility and quality consistency, translating into stronger customer relationships and reduced risk of non-compliance.

By orchestrating these multifaceted strategies across innovation, partnerships, and digital transformation, leading companies are positioning themselves to capture emerging demand, navigate supply chain disruptions, and sustain long-term competitive advantage.

This comprehensive research report delivers an in-depth overview of the principal market players in the Man-made Sausage Casing market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Colpak Pty Ltd

- DAT-Schaub A/S.

- Devro plc

- FABIOS S.A.

- Fibran Group

- Kalle GmbH

- LEM Products, Inc.

- NIPPI, Incorporated

- Nitta Casings Inc.

- Oversea Casing Company, LLC

- SELO B.V.

- Shenguan Holdings Group Co., Ltd.

- Viscofan, S.A.

- Viskase Companies, Inc.

- ViskoTeepak Holding Ab Ltd

Strategically Positioning Your Organization Through Sustainable, Resilient, and Digitally Enabled Supply Chain Initiatives

Industry leaders should prioritize investments in sustainable casing alternatives that align with evolving regulatory and consumer expectations. By collaborating with material scientists and eco-focused startups, companies can accelerate the development of biodegradable and recycled-content casings that maintain core performance metrics.

Moreover, executives are advised to diversify supply chains by establishing dual sourcing strategies for cellulose and collagen feedstocks. Cultivating relationships with multiple suppliers reduces exposure to trade policy fluctuations and raw material shortages. At the same time, exploring localized production partnerships in high-growth regions can minimize logistics costs and enhance responsiveness to market shifts.

Embracing digital traceability solutions will strengthen quality control and foster transparency across the value chain. Deploying IoT-enabled sensors and blockchain-based recordkeeping allows processors to substantiate compliance claims and deliver traceable product narratives valued by discerning consumers.

Finally, it is crucial to integrate application-specific expertise into product development workflows. Engaging directly with end users in cooked, dried, and fresh sausage segments ensures that novel casing formulations are validated against real-world production challenges, thereby accelerating time-to-market and maximizing adoption rates.

Employing a Robust Multi-Phase Research Framework Integrating Expert Interviews, Data Triangulation, and Rigorous Validation Procedures

This study was underpinned by a multi-tiered research approach combining primary and secondary data sources with rigorous validation processes. In the initial phase, subject-matter experts in food science, process engineering, and regulatory affairs were interviewed to identify critical trends, technical milestones, and market drivers shaping casing adoption.

Concurrently, an exhaustive review of public and proprietary literature-including academic journals, patent filings, industry white papers, and regulatory publications-provided historical context and quantitative benchmarks. Data triangulation techniques ensured that disparate information streams converged to deliver robust insights, reducing potential biases and data discrepancies.

Key industry stakeholders, including casing manufacturers, meat processors, and material suppliers, participated in detailed questionnaire surveys and follow-up consultations. These interactions facilitated a deeper understanding of operational constraints, technological needs, and strategic priorities across the value chain.

Finally, all findings underwent a comprehensive validation process led by cross-functional experts to confirm accuracy, consistency, and relevance. This structured methodology guarantees that the analysis offers a reliable foundation for decision-making and long-term strategic planning.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Man-made Sausage Casing market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Man-made Sausage Casing Market, by Type

- Man-made Sausage Casing Market, by Application

- Man-made Sausage Casing Market, by End User

- Man-made Sausage Casing Market, by Region

- Man-made Sausage Casing Market, by Group

- Man-made Sausage Casing Market, by Country

- United States Man-made Sausage Casing Market

- China Man-made Sausage Casing Market

- Competitive Landscape

- List of Figures [Total: 15]

- List of Tables [Total: 636 ]

Summarizing Critical Market Drivers, Regional Distinctions, and Strategic Pathways Shaping the Future of Synthetic Sausage Casings

In conclusion, the man-made sausage casing market stands at an inflection point defined by technological innovation, evolving dietary preferences, and shifting trade dynamics. Stakeholders who leverage advanced materials, digital traceability, and flexible manufacturing platforms will be best positioned to meet the nuanced demands of both industrial and artisanal meat processors.

Protective tariffs have underscored the need for supply chain diversification and domestic production enhancements, prompting a reevaluation of sourcing strategies and pricing models. At the same time, segmentation insights demonstrate clear linkages between casing type, application requirements, and end-user preferences, guiding product development and targeted marketing efforts.

Regional nuances across the Americas, Europe, Middle East & Africa, and Asia-Pacific highlight distinct growth trajectories rooted in regulatory frameworks, culinary traditions, and infrastructure maturity. By aligning product portfolios with these local realities, manufacturers can unlock new revenue streams and reinforce competitive differentiation.

Ultimately, a proactive stance-underpinned by sustainability, digital integration, and strategic partnerships-will enable industry participants to navigate uncertainties, capitalize on emerging opportunities, and drive sustained growth in this vital segment.

Transform Your Strategic Vision with Expert Guidance to Secure the Definitive Man-Made Sausage Casing Market Intelligence

For an in-depth exploration of the man-made sausage casing landscape, secure access to the full report to uncover strategic intelligence and actionable insights. Ketan Rohom, Associate Director, Sales & Marketing, is available to guide you through the findings, answer any questions, and facilitate your purchase. Leverage this opportunity to equip your organization with proprietary analysis and expert recommendations designed to drive competitive advantage and accelerate growth.

- How big is the Man-made Sausage Casing Market?

- What is the Man-made Sausage Casing Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?