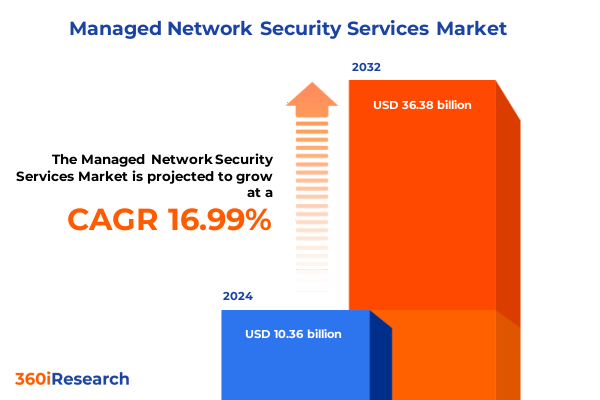

The Managed Network Security Services Market size was estimated at USD 11.97 billion in 2025 and expected to reach USD 13.82 billion in 2026, at a CAGR of 17.20% to reach USD 36.38 billion by 2032.

Navigating the Complexities of Modern Cyber Threats with Advanced Managed Network Security Services to Drive Resilience and Growth

Managed network security services are no longer optional in an era defined by sophisticated cyber threats, proliferating network perimeters, and hybrid IT environments. As organizations contend with escalating attacks that span distributed denial-of-service campaigns, advanced persistent threats, and supply-chain exploits, the value of outsourcing security operations to specialized managed service providers has surged. This comprehensive executive summary delves into the critical factors shaping this dynamic market, offering a foundation for strategic decision-making and investment.

In this introduction, we contextualize the accelerating adoption of managed network security services against a backdrop of digital transformation initiatives. Whether driven by remote workforce imperatives, multi-cloud deployments, or stringent regulatory mandates, enterprises require resilient security frameworks that can scale on demand and adapt proactively to novel attack vectors. The shift from reactive defenses to continuous monitoring and predictive threat intelligence underscores the maturation of the managed security model.

By establishing the current state of the landscape, this section sets the stage for deeper analysis of transformative trends, tariff implications, segmentation insights, regional variations, and vendor strategies. The insights presented here highlight both the challenges and opportunities inherent in selecting, integrating, and optimizing managed network security solutions. Through a balanced lens of technological innovation and market pragmatism, readers will gain clarity on how to align security investments with overarching business objectives.

Embracing Cloud Native Architectures and AI-Driven Threat Detection as Foundational Shifts in the Managed Network Security Landscape

The managed network security landscape has undergone transformative shifts driven by rapid cloud adoption, the integration of artificial intelligence and machine learning for threat detection, and the emergence of zero trust security frameworks. Cloud native architectures have redefined perimeter boundaries, enabling service providers to deliver security functions as scalable, elastic services that align with fluctuating traffic patterns and enterprise workloads. At the same time, AI-powered analytics have transitioned from experimental tools to core components of threat intelligence, automating anomaly detection, reducing false positives, and accelerating incident response cycles.

The zero trust paradigm, predicated on the principle of never trusting any access request by default, has further propelled managed service providers to incorporate granular identity and access management capabilities. This approach acknowledges that modern enterprises operate beyond traditional network perimeters, requiring continuous verification and adaptive policy enforcement across on premises, cloud, and edge environments. Concurrently, the proliferation of remote and hybrid work models has expanded attack surfaces, compelling organizations to leverage managed services for unified threat management that integrates firewall, intrusion prevention, virtual private network, and endpoint protection services.

These foundational shifts have not only elevated security efficacy but also optimized operational resilience and cost efficiency. As enterprises navigate these advancements, the role of managed network security services evolves from tactical support to strategic enabler, empowering organizations to pursue digital initiatives with confidence.

Assessing the Impact of 2025 United States Tariff Measures on Global Supply Chains and Cost Structures in Managed Network Security Services

In 2025, the United States implemented tariff measures targeting network infrastructure hardware and certain security appliances, marking a strategic effort to bolster domestic manufacturing and reduce reliance on overseas supply chains. These duties have reverberated across the managed network security services ecosystem, affecting equipment sourcing costs, vendor pricing strategies, and overall service delivery economics. Providers reliant on imported firewalls, intrusion detection systems, and VPN gateways faced immediate pressure to recalibrate operating expenses and renegotiate vendor contracts.

The cumulative impact of these tariffs has manifested in diversified sourcing approaches, including the exploration of alternative OEMs, domestic component partnerships, and in some cases, incremental cost pass-through to end users. Managed security vendors have responded by optimizing inventory management, adopting modular hardware designs, and accelerating software-defined security functions to mitigate hardware dependency. This strategic pivot to software-centric delivery models helps absorb tariff-induced cost fluctuations, maintains service-level commitments, and preserves competitiveness in pricing structures.

Moreover, the tariff landscape has catalyzed consolidation among niche hardware manufacturers, driving select vendors to pursue mergers or alliances that enhance scale and cost synergies. For enterprises, understanding how these policy shifts influence vendor roadmaps, support SLAs, and long-term cost of ownership is essential for informed procurement and contract negotiation. As the ecosystem adapts, managed network security services continue to evolve, balancing regulatory imperatives with the imperative of robust, scalable protection.

Unveiling Critical Service Driven, Deployment Based, Vertical Specific and Organization Size Focused Segmentation Insights in Network Security Management

A nuanced view of the managed network security services market emerges when evaluating segmentation across service types, deployment modes, vertical markets, and organization sizes. Based on service type, the field encompasses distributed denial-of-service protection, firewall solutions-with distinctions between next generation firewall and unified threat management-intrusion detection and prevention offerings categorized into host-based and network-based systems, and virtual private network services that span IPsec VPN and SSL VPN implementations. Each of these service categories commands unique technical requirements and integration complexity, influencing both buyer decision criteria and provider delivery models.

When examining deployment modes, contrasting cloud-based services with on premises solutions reveals divergent value propositions. Cloud-based managed security provides rapid scalability, minimal upfront capital expenditure, and continuous updates delivered via a subscription model. Conversely, on premises deployments deliver direct control over security infrastructure, tailored customization, and alignment with existing data sovereignty mandates.

The market’s vertical segmentation spans banking, financial services, and insurance; government and defense; healthcare; information technology and telecommunications; manufacturing; and retail and e-commerce. Regulatory compliance, threat sophistication, and uptime requirements vary significantly across these verticals, driving specialized managed service offerings. Organizational size further delineates demand characteristics, as large enterprises often require tailored service-level agreements and integration with complex IT environments, while small and medium-sized enterprises prioritize ease of deployment, cost efficiency, and managed security bundles that deliver essential protections without extensive in-house resources.

Interpreting these four segmentation dimensions in tandem equips stakeholders with a multifaceted understanding of market dynamics, enabling targeted service design, precise go-to-market strategies, and optimized resource allocation.

This comprehensive research report categorizes the Managed Network Security Services market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Service Type

- Deployment Mode

- Industry Vertical

- Organization Size

Analyzing Distinct Regional Dynamics Across the Americas, Europe Middle East Africa, and Asia-Pacific to Inform Strategic Network Security Decisions

Regional variations in managed network security services reveal distinct dynamics in the Americas, Europe Middle East Africa, and Asia-Pacific, each shaped by regulatory frameworks, technology adoption rates, and local threat landscapes. In the Americas, particularly the United States and Canada, stringent data privacy regulations and high cyber threat volumes drive demand for advanced services, including managed detection and response, continuous monitoring, and compliance support. The maturity of service provider ecosystems in North America also fosters innovation, enabling rapid integration of AI-driven analytics and threat intelligence feeds.

Across Europe, Middle East, and Africa, data sovereignty and GDPR-inspired regulatory mandates shape deployment preferences, often favoring on premises or private cloud solutions to maintain jurisdictional control. In the Middle East and Africa, emerging digital transformation initiatives and infrastructure investments present growth opportunities, but uneven threat awareness and budget constraints can challenge adoption. Across this region, multilingual support and culturally adapted service models enhance provider differentiation and market penetration.

The Asia-Pacific region encompasses a diverse spectrum of market maturity. Developed economies such as Japan, South Korea, and Australia exhibit advanced managed security adoption, underpinned by robust regulatory compliance requirements and high rates of cloud migration. In contrast, emerging markets across Southeast Asia and India are characterized by accelerated digitalization efforts, often outpacing security investment. Providers that deliver turnkey cloud-based services, bundled compliance frameworks, and localized threat intelligence stand to capture significant market share in these growth corridors.

Understanding these three regional dynamics and their intersection with vendor capabilities is critical for crafting effective regional go-to-market strategies and aligning service offerings with local enterprise needs.

This comprehensive research report examines key regions that drive the evolution of the Managed Network Security Services market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Exploring Key Vendor Strategies and Innovations from Leading Security Providers Shaping the Future of Managed Networking Security Solutions Worldwide

Leading providers in the managed network security sector continually refine service portfolios through strategic partnerships, technology acquisitions, and innovation investments. Established network infrastructure vendors have extended their offerings by integrating advanced threat intelligence platforms and security orchestration capabilities, enabling seamless incident response workflows and automated remediation. These players leverage global footprints to deliver localized support and managed compliance services, while bolstering out-of-the-box integrations with popular cloud platforms.

Pure-play managed security providers differentiate themselves through specialized expertise in emerging threat vectors, such as ransomware mitigation, API security, and IoT network protection. By investing in proprietary AI and machine learning engines, they enhance behavioral analytics and predictive threat modeling. Strategic alliances with cybersecurity research institutes and threat intelligence consortiums further augment their detection capabilities.

Innovative disruptors focus on software-defined perimeter models, zero trust access controls, and edge security functions optimized for hybrid IoT environments. Their modular architectures allow enterprises to select discrete security functions, deploying them as fully managed services or integrating them with existing on premises tools. This modularity fosters flexibility and cost efficiency, particularly for organizations undergoing phased digital transformations.

In addition, several emerging players specialize in compliance-driven managed services tailored to specific verticals, offering frameworks that address regulations such as HIPAA, PCI DSS, and NIST guidelines. By aligning technical delivery with regulatory requirements, they streamline audit processes and reduce organizational risk, enhancing their value proposition in regulated industries.

This comprehensive research report delivers an in-depth overview of the principal market players in the Managed Network Security Services market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Accenture plc

- AT&T, Inc.

- BAE Systems plc

- BT Group

- Check Point Software Technologies, Inc.

- Cisco Systems, Inc.

- CrowdStrike

- Darktrace

- Deloitte

- Ernst & Young

- Fortinet

- HCLTech

- IBM Corporation

- Infosys

- KPMG

- Lumen Technologies

- McAfee

- Microsoft

- NTT Security Holdings

- Palo Alto Networks

- Secureworks

- Sophos

- Symantec

- Tata Communications

- Verizon Communications

- Wipro

- Zscaler

Actionable Strategic Recommendations for Network Security Leaders to Enhance Resilience Drive Innovation and Secure Emerging Digital Ecosystems

To stay ahead of escalating threats and capital constraints, industry leaders should prioritize the integration of AI and machine learning technologies into their managed security offerings. By automating threat detection and response processes, providers can enhance operational efficiency and reduce mean time to detection. Cultivating strategic alliances with threat intelligence networks and research institutions will further enrich detection capabilities and foster collaborative defense mechanisms across the ecosystem.

Enterprises should adopt a zero trust framework as a guiding principle for network design, ensuring that every access request is continuously verified. This shift demands close collaboration with managed service providers to implement identity-based microsegmentation, adaptive authentication, and context-aware policy enforcement. Simultaneously, investing in software-defined security architectures will mitigate hardware supply chain dependencies highlighted by recent tariff measures, enabling rapid feature deployment and cost predictability.

Expanding service portfolios to include specialized compliance modules tailored to industry-specific regulations can unlock new revenue streams and strengthen customer retention. Providers should also develop flexible deployment options that cater to varying risk appetites, offering seamless interoperability between on premises and cloud environments. Building strong local partnerships, particularly in emerging Asia-Pacific and Middle East markets, will accelerate market entry and foster trust with regional enterprises.

Finally, continuous training and certification programs for managed security operations center analysts will ensure skill alignment with evolving threat tactics and technologies. By embedding a culture of innovation and proactive threat hunting, both providers and users of managed services can maintain resilience in the face of ever-evolving digital risks.

Detailing Robust Research Methodology Integrating Primary Interviews Secondary Data Triangulation and Qualitative Quantitative Analysis for Precision

This report’s methodology combines robust primary research with comprehensive secondary data analysis to ensure precision and reliability. The primary research phase involved in-depth interviews with senior security architects, CIOs, and managed service executives from diverse industry verticals to capture firsthand insights on adoption drivers, technology preferences, and operational challenges. These qualitative engagements were complemented by structured surveys administered to IT decision-makers across small, medium, and large enterprises to quantify trends in deployment models and service preferences.

Secondary research encompassed a rigorous review of regulatory documents, vendor white papers, cybersecurity incident reports, and technology roadmaps to contextualize primary findings within broader industry developments. Publicly available financial statements and investor presentations provided additional transparency on vendor strategies and market movements. Triangulating data from these multiple sources enabled cross-validation of key themes and reinforced the robustness of our conclusions.

Analytical frameworks employed include SWOT analysis to evaluate vendor strengths and weaknesses, Porter’s Five Forces to assess competitive dynamics, and PESTEL analysis to understand macroeconomic, regulatory, and technological drivers. A qualitative scoring model was applied to benchmark major service providers across criteria such as service breadth, innovation pipeline, geographic coverage, and client satisfaction metrics. Data collection and validation were overseen by seasoned analysts with deep expertise in cybersecurity and network management, ensuring methodological rigor throughout the research lifecycle.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Managed Network Security Services market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Managed Network Security Services Market, by Service Type

- Managed Network Security Services Market, by Deployment Mode

- Managed Network Security Services Market, by Industry Vertical

- Managed Network Security Services Market, by Organization Size

- Managed Network Security Services Market, by Region

- Managed Network Security Services Market, by Group

- Managed Network Security Services Market, by Country

- United States Managed Network Security Services Market

- China Managed Network Security Services Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1272 ]

Concluding Insights Reinforcing the Pivotal Role of Managed Network Security Services in Safeguarding Digital Infrastructure and Enabling Strategic Growth

The managed network security services landscape stands at the confluence of technological innovation, evolving threat paradigms, and regulatory shifts. Enterprises seeking to fortify digital infrastructures must navigate cloud transformations, zero trust adoption, and hardware supply chain disruptions with strategic clarity. Segmentation insights reveal that service type, deployment mode, industry vertical, and organizational scale all profoundly influence solution requirements and procurement patterns.

Regional dynamics underscore the importance of tailoring service delivery to local regulatory frameworks and threat environments, while leading vendors continue to differentiate through AI-driven analytics, modular architectures, and compliance-focused offerings. By internalizing the actionable recommendations and aligning them with corporate risk management frameworks, both service providers and end users can drive resilience and secure long-term competitive advantage.

Ultimately, the ability to adapt to shifting tariffs, integrate emerging technologies, and engage in collaborative threat intelligence will define success in this dynamic sector. As the threat landscape grows more sophisticated, managed network security services will evolve from support functions to strategic enablers of digital transformation. This conclusion encapsulates the imperative for continuous innovation, data-driven decision-making, and proactive defense strategies to navigate an ever-changing security terrain.

Encouraging Immediate Engagement to Acquire Comprehensive Managed Network Security Market Research Insights through Direct Outreach with Ketan Rohom

For decision-makers seeking unparalleled depth and actionable intelligence in the managed network security domain, this report offers a comprehensive, data-driven roadmap tailored to evolving threat landscapes and technological innovations. Our research encapsulates strategic insights across service types, deployment modes, industry verticals, regional dynamics, and vendor capabilities, empowering enterprises and solution providers to formulate resilient strategies. For personalized guidance on leveraging these findings to achieve competitive advantage, connect directly with Ketan Rohom, Associate Director, Sales & Marketing at 360iResearch. Engage today to secure access to the full suite of analysis, methodology details, and strategic recommendations essential for informed investment, partnership, and growth decisions in managed network security services

- How big is the Managed Network Security Services Market?

- What is the Managed Network Security Services Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?