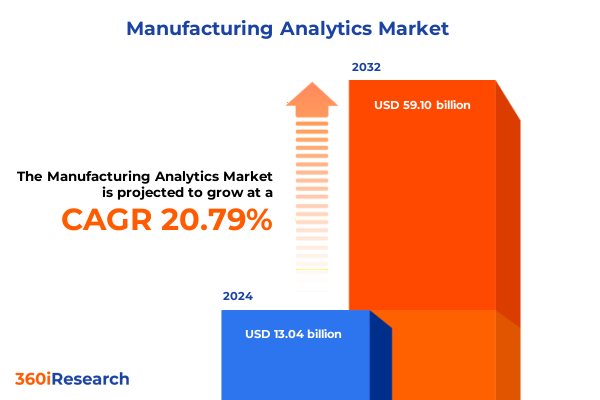

The Manufacturing Analytics Market size was estimated at USD 15.76 billion in 2025 and expected to reach USD 19.04 billion in 2026, at a CAGR of 21.07% to reach USD 60.10 billion by 2032.

Groundbreaking Overview Highlighting the Strategic Imperative of Manufacturing Analytics for Driving Operational Efficiency and Competitive Advantage in the Era of Digital Transformation

Manufacturing analytics has emerged as a critical enabler for operational excellence and strategic differentiation across modern production environments. As industries worldwide pivot toward data-driven decision-making, executives are increasingly recognizing analytics platforms as indispensable tools for optimizing resource utilization, streamlining processes, and driving innovation. This introduction lays the groundwork by articulating why manufacturing analytics represents more than just a technological trend; it is a strategic imperative that bridges traditional production paradigms with the possibilities afforded by digital transformation.

In the context of heightened global competition and rapidly evolving customer expectations, the integration of advanced analytics capabilities-from real-time monitoring to prescriptive insights-offers manufacturers a pathway to unlock latent efficiencies. This executive summary begins by framing the overarching landscape, illustrating how manufacturers are leveraging data to reduce downtime, predict equipment failures, and adapt to market fluctuations. By presenting a concise yet impactful overview of the critical drivers shaping this discipline, the introduction ensures that both operational leaders and C-suite executives share a unified understanding of the strategic stakes involved.

Moreover, this section sets the tone for the deeper exploration that follows, highlighting the fundamental role of analytics in fostering resilience, agility, and sustainable growth. Through this multilevel framing, decision-makers will appreciate the subsequent analysis not only as a compilation of insights but as a coherent guide for translating analytical potential into measurable performance improvements.

Unveiling Pioneering Shifts Shaping the Manufacturing Analytics Landscape Driven by AI Innovation, Data Democratization, Industry 4.0 Integration, and Edge Computing

Over the past several years, the manufacturing analytics landscape has undergone transformative shifts driven by breakthroughs in artificial intelligence, pervasive connectivity, and the democratization of data access. These shifts are not merely incremental; they represent a fundamental reconfiguration of how manufacturers collect, analyze, and act upon information. As traditional batch reporting gives way to continuous, real-time insights, organizations are reaping the benefits of accelerated decision loops and heightened operational responsiveness.

One of the most transformative drivers has been the integration of advanced machine learning algorithms that can unearth complex patterns within large, heterogeneous datasets. This development has enabled predictive maintenance strategies to dramatically reduce unplanned downtime while simultaneously optimizing maintenance spend. In parallel, the proliferation of edge computing architectures has brought advanced analytics capabilities closer to the point of production, minimizing latency and ensuring that insights can be applied instantaneously on the shop floor.

Furthermore, data democratization initiatives are empowering cross-functional teams with self-service analytics tools that require minimal coding expertise. This cultural shift towards broader data literacy and collaboration is breaking down traditional silos, allowing quality managers, supply chain analysts, and production planners to coalesce around a unified operational view. As a result, manufacturers are realizing synergistic gains in productivity, cost control, and product quality, establishing a new baseline for what it means to be competitive in the digital era.

Comprehensive Examination of the Cumulative Impact of United States Tariffs Enacted in 2025 on Manufacturing Analytics Supply Chains and Investment Strategies

The cumulative impact of United States tariffs enacted in 2025 has introduced new complexities for manufacturers and analytics providers, particularly in sectors reliant on imported machinery, sensors, and data infrastructure. As tariffs on key components and industrial automation equipment took effect, organizations were compelled to reassess their sourcing strategies and reevaluate supply chain resilience. These levies have not only increased the cost base for capital expenditures but have also accelerated the adoption of analytics-driven risk mitigation frameworks.

In response to heightened duties, many manufacturers are now leveraging predictive analytics models to simulate the financial implications of tariff adjustments under various trade scenarios. By integrating scenario-based forecasting with real-time procurement data, procurement and finance teams can quantify the budgetary impact of alternative supplier relationships. Moreover, advanced analytics platforms have become vital in identifying cost leakage across global supply networks, enabling companies to prioritize nearshoring or dual sourcing to circumvent tariff-induced expenses.

Beyond cost containment, the tariffs have spurred increased investment in domestic manufacturing analytics capabilities, as organizations seek to localize critical operations and maintain data sovereignty. This strategic pivot has strengthened partnerships between original equipment manufacturers and software providers, fostering co-developed analytics solutions tailored to U.S.-based production environments. Consequently, the new tariff landscape has catalyzed a wave of innovation in manufacturing analytics, empowering companies to transform trade challenges into opportunities for competitive differentiation.

In-Depth Analysis of Key Segmentation Dimensions Revealing How End Use Industry, Application, Analytics Type, and Organization Size Are Reshaping Market Dynamics

In evaluating the manufacturing analytics market through a segmentation lens, distinct patterns emerge across end use industries, applications, analytics types, and organization sizes. When considering end use industries, aerospace and defense manufacturers often prioritize high-fidelity quality management systems to ensure compliance with stringent safety standards, whereas automotive companies balance predictive maintenance and production planning to optimize uptime across commercial and passenger vehicle lines. Electronics producers, spanning consumer, industrial, and semiconductor domains, rely on analytics to forecast component lifespan and manage yield variability. Food and beverages organizations, by contrast, focus on supply chain optimization to adhere to regulatory requirements and minimize waste, while oil and gas operators integrate real-time monitoring analytics to secure operational continuity in remote environments.

Turning to application-focused segmentation, predictive maintenance holds particular sway in industries with high-capital equipment and critical uptime requirements, enabling preemptive interventions before machine failures occur. In parallel, production planning and scheduling analytics are reshaping throughput optimization in fast-paced manufacturing settings, while quality management platforms leverage defect detection algorithms to ensure product consistency. Supply chain optimization tools incorporate demand sensing and inventory balancing models, addressing volatility and enhancing agility across global networks.

Across analytics types, descriptive analytics remains foundational for performance reporting, yet organizations are increasingly deploying predictive analytics frameworks to anticipate disruptions and algorithmic prescriptive analytics to recommend corrective actions. Meanwhile, large enterprises typically command extensive analytics deployments integrated with enterprise resource planning and manufacturing execution systems, whereas small and medium enterprises embrace cloud-native analytics services to gain cost-effective access to advanced insights. These segmentation-driven distinctions illuminate the nuanced requirements that analytics providers must address to deliver tailored solutions and maximize value for diverse manufacturing stakeholders.

This comprehensive research report categorizes the Manufacturing Analytics market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component

- Analytics Type

- Application

- End Use Industry

- Organization Size

Strategic Regional Intelligence Highlighting How Americas, Europe Middle East and Africa, and Asia Pacific Markets Are Diverging in Analytics Adoption Patterns

Regional dynamics in manufacturing analytics adoption reveal marked contrasts among the Americas, Europe Middle East and Africa, and the Asia Pacific. In the Americas, particularly the United States, there is a strong emphasis on integrating analytics with legacy equipment through edge-enabled architectures. This approach reflects the region’s extensive installed base of older machinery, driving demand for retrofit solutions that can deliver real-time performance monitoring without significant capital investment. Moreover, North American manufacturers are investing heavily in workforce analytics to upskill technicians and bridge the gap between traditional manufacturing know-how and data science competencies.

Across Europe, the Middle East, and Africa, stringent regulatory frameworks and sustainability directives have accelerated analytics-driven energy management and compliance reporting. European original equipment manufacturers are embedding analytics modules into new machinery to meet EcoDesign and REACH regulations, while Middle Eastern petrochemical producers are focusing on data-driven predictive maintenance to safeguard critical infrastructure. In Africa, selective greenfield investments in digitalized manufacturing hubs are creating opportunities for cloud-based analytics adoption among emerging industrial players.

In the Asia Pacific region, the convergence of smart manufacturing initiatives and government-backed Industry 4.0 programs is catalyzing widespread analytics deployment. Major economies such as China, Japan, and South Korea are supporting analytics innovation through public-private collaborations, funding advanced research in AI-driven quality management and supply chain resilience. Meanwhile, emerging markets in Southeast Asia are leapfrogging legacy constraints by adopting turnkey analytics platforms that can be rapidly configured for localized production scenarios. Collectively, this regional mosaic underscores the importance of context-specific analytics strategies that align with distinct regulatory, infrastructural, and technological landscapes.

This comprehensive research report examines key regions that drive the evolution of the Manufacturing Analytics market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Critical Competitive Landscape Insights Spotlighting Prominent Players and Their Strategic Initiatives Driving Innovation within the Manufacturing Analytics Sector

The manufacturing analytics sector is characterized by a vibrant ecosystem of established technology providers, specialized startups, and progressive original equipment manufacturers that are embedding analytics capabilities directly into their hardware offerings. Leading industrial automation companies have intensified their focus on analytics by augmenting control systems with integrated machine learning toolkits, thus enabling seamless data aggregation and advanced diagnostic functionalities. Concurrently, cloud-based software vendors are differentiating through modular, industry-agnostic analytics suites that can be tailored to specific production processes, minimizing deployment complexity and accelerating time to value.

Innovation has also been driven by nimble startups that concentrate on niche applications, including anomaly detection in high-speed production lines and AI-enabled image recognition for quality assurance. These agile entrants often partner with larger system integrators, leveraging broader distribution channels to scale their solutions across multiple geographies. In parallel, leading original equipment manufacturers have formed strategic alliances with analytics platform companies to co-develop next-generation equipment embedded with real-time performance monitoring and closed-loop optimization features.

Furthermore, strategic partnerships between sensor manufacturers and analytics vendors are yielding hardware-software bundles designed to simplify the data pipeline, from edge acquisition through cloud-based analytics and visualization. These collaborations reflect an industry trend toward converged offerings that lower technical barriers for manufacturers. As competition intensifies, companies that effectively integrate domain expertise with data science capabilities are best positioned to capture value within this dynamic ecosystem.

This comprehensive research report delivers an in-depth overview of the principal market players in the Manufacturing Analytics market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ABB Ltd.

- Alteryx, Inc.

- AVEVA Group plc

- General Electric Company

- Honeywell International Inc.

- International Business Machines Corporation

- Microsoft Corporation

- Oracle Corporation

- PTC Inc.

- Qlik Technologies Inc.

- Rockwell Automation, Inc.

- SAP SE

- SAS Institute Inc.

- Siemens AG

- Tableau Software, LLC

Actionable Strategic Recommendations Empowering Industry Leaders to Harness Manufacturing Analytics for Transformational Growth and Operational Excellence

To capitalize on the evolving manufacturing analytics landscape, industry leaders must adopt a multifaceted strategy that bridges technological innovation with organizational readiness. First, executives should prioritize the establishment of cross-functional analytics centers of excellence that serve as hubs for best practices, data governance, and skills development. By institutionalizing a disciplined approach to data management and fostering collaboration among IT, operations, and business units, manufacturers can accelerate the adoption of analytics across the enterprise.

In addition, companies should evaluate their existing technology stack through the lens of interoperability, ensuring seamless integration between analytics platforms, enterprise resource planning systems, and shop-floor control networks. This may involve modernizing legacy equipment with edge gateways or adopting open-architecture solutions that facilitate plug-and-play data exchange. Complementing this effort with targeted investments in upskilling programs will equip frontline technicians and engineers with the analytical acumen necessary to interpret insights and implement data-driven interventions.

Moreover, leaders must adopt a portfolio approach to analytics initiatives, balancing quick-win projects-such as predictive maintenance pilots for critical assets-with more ambitious, enterprise-wide deployments that deliver transformative outcomes. By combining rapid prototyping with scalable rollouts, organizations can demonstrate early value while building the organizational momentum required for broader analytics adoption. Finally, forging strategic partnerships with technology innovators and academic institutions will allow manufacturers to stay at the forefront of emerging analytics methodologies and foster a continuous cycle of innovation.

Rigorous Research Methodology Detailing Multimodal Data Collection, Qualitative and Quantitative Analyses, and Validation Protocols Ensuring Robust Findings

This market research report was developed through a rigorous methodology combining both qualitative and quantitative research techniques to ensure the validity and reliability of findings. Primary research included in-depth interviews with manufacturing executives, plant managers, and data scientists across key industry verticals. These discussions provided firsthand insights into adoption drivers, technology preferences, and organizational challenges, effectively grounding the analysis in real-world operational contexts.

Secondary research involved the systematic examination of industry publications, regulatory frameworks, patent filings, and academic studies. This desk research established a comprehensive understanding of market trends, technology trajectories, and competitive dynamics. Data synthesis and triangulation processes were employed to reconcile information from primary and secondary sources, ensuring that conclusions were supported by multiple lines of evidence.

Quantitative modeling techniques, such as descriptive statistical analysis and comparative benchmarking, were applied to evaluate market segmentation, pricing models, and deployment scenarios. Validation workshops with domain experts were convened to review key assumptions and refine the analytical framework. Finally, ongoing market monitoring during the research period ensured that emerging developments-such as tariff changes, regulatory updates, and technology breakthroughs-were incorporated into the final report.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Manufacturing Analytics market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Manufacturing Analytics Market, by Component

- Manufacturing Analytics Market, by Analytics Type

- Manufacturing Analytics Market, by Application

- Manufacturing Analytics Market, by End Use Industry

- Manufacturing Analytics Market, by Organization Size

- Manufacturing Analytics Market, by Region

- Manufacturing Analytics Market, by Group

- Manufacturing Analytics Market, by Country

- United States Manufacturing Analytics Market

- China Manufacturing Analytics Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1590 ]

Compelling Synthesis Underlining Key Takeaways and Strategic Imperatives Emerging from the Manufacturing Analytics Executive Summary

The manufacturing analytics landscape is characterized by rapid innovation, evolving trade dynamics, and a diverse ecosystem of solutions that cater to specific industry requirements. This executive summary has highlighted how strategic integration of analytics platforms can drive operational efficiency, enhance product quality, and fortify supply chain resilience. The transformative shifts occurring in AI, edge computing, and data democratization underscore the imperative for manufacturers to adopt data-centric strategies if they seek to maintain a competitive edge.

Insight into the implications of the 2025 United States tariffs reveals the critical role of analytics in risk mitigation, supply network adaptation, and localization efforts. Segmentation analysis further emphasizes that end use industries, applications, analytics types, and organization sizes each present unique challenges and opportunities that demand tailored solutions. Regional intelligence points to divergent adoption patterns across the Americas, Europe Middle East and Africa, and the Asia Pacific, while competitive landscape insights underscore the importance of strategic partnerships and converged hardware-software offerings.

Ultimately, the actionable recommendations and methodological rigor presented herein offer a roadmap for executives to navigate an increasingly complex and dynamic environment. By synthesizing the core findings of this report, decision-makers can prioritize high-impact initiatives, allocate resources effectively, and foster a culture that embraces continuous analytics-driven improvement.

Engaging Call to Action Inviting Collaboration with Ketan Rohom to Secure Comprehensive Manufacturing Analytics Market Research Insights

To learn more about this comprehensive manufacturing analytics market research report, please reach out directly to Ketan Rohom, Associate Director of Sales & Marketing at 360iResearch. Ketan can provide you with customized insights, detailed findings, and personalized guidance to align the report’s key takeaways with your organization’s unique requirements. By engaging with Ketan, you will gain early access to executive summaries, in-depth case studies, and priority support for any data needs or clarification requests. Take the next step to equip your leadership team with data-driven strategies that will position you at the forefront of manufacturing innovation by contacting Ketan today to purchase the full market research report and secure a competitive advantage.

- How big is the Manufacturing Analytics Market?

- What is the Manufacturing Analytics Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?