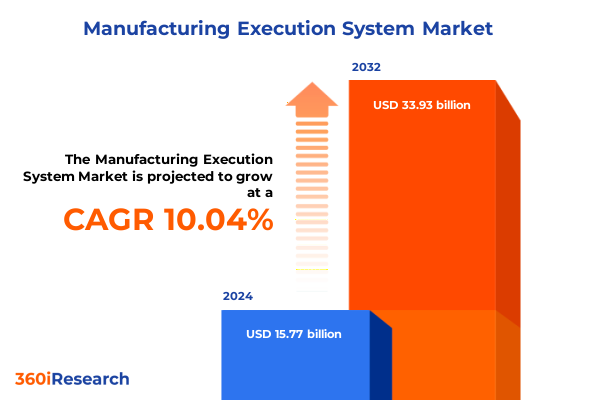

The Manufacturing Execution System Market size was estimated at USD 17.36 billion in 2025 and expected to reach USD 18.97 billion in 2026, at a CAGR of 10.04% to reach USD 33.93 billion by 2032.

Unveiling the Critical Role of Manufacturing Execution Systems in Driving Operational Excellence and Digital Transformation Across Modern Facilities

Manufacturing execution systems have emerged as the backbone of modern production facilities, serving as the critical link between enterprise resource planning layers and shop-floor operations. By orchestrating workflows, synchronizing data streams, and delivering real-time visibility, these systems enable manufacturers to achieve elevated levels of operational efficiency. As industries confront increasingly complex production environments marked by globalization and customization demands, the capacity to monitor performance metrics and adapt dynamically has become indispensable. Consequently, executives are viewing manufacturing execution platforms not merely as operational tools but as strategic assets that drive competitive differentiation.

In this context, the executive summary provides a concise roadmap for understanding how manufacturing execution systems are transforming enterprise operations. Beginning with an overview of pivotal technological shifts, the narrative progresses to examine the cumulative impact of recent tariff changes in the United States. It then delves into market segmentation, highlighting how distinct components, applications, industries, deployment models, and organization sizes shape adoption patterns. This foundation paves the way for regional analyses, competitive profiling, and strategic recommendations, culminating in a clear methodology and an actionable call to action. By following the insights presented here, decision-makers can navigate the complexities of digital transformation and harness the power of manufacturing execution systems to propel their operations forward.

Exploring the Emergence of Intelligent Automation and Real-Time Analytics as Pivotal Drivers Transforming Manufacturing Execution Systems Globally

The landscape of manufacturing execution is undergoing a fundamental metamorphosis, driven by the convergence of advanced automation, artificial intelligence, and ubiquitous connectivity. Intelligent automation initiatives are enabling machines to self-optimize production parameters, while real-time analytics platforms deliver granular insights into process bottlenecks, equipment utilization, and yield variability. Together, these advances are redefining how organizations manage quality, schedule production runs, and monitor resource consumption.

Moreover, the advent of edge computing architectures has empowered on-premise systems to process data locally, reducing latency and bolstering resilience in mission-critical environments. Cloud-native execution platforms complement this capability by offering scalable analytics and collaborative dashboards that facilitate cross-site benchmarking. As standards for interoperability-such as OPC UA and MQTT-gain wider acceptance, the seamless integration of discrete automation cells and enterprise applications becomes increasingly viable. These transformative shifts are elevating manufacturing execution systems from isolated control modules to holistic orchestration engines that underpin smart factory strategies.

Analyzing How Recent Tariff Policies Implemented in 2025 Have Reshaped Supply Chains and Production Strategies for Manufacturing Execution Systems

In 2025, the imposition of new tariff measures on intermediate goods and finished components in the United States has reverberated through global supply chains, compelling manufacturers to reassess sourcing and production strategies. These tariffs have elevated the cost of imported machinery parts, prompting some organizations to diversify procurement channels or accelerate nearshoring initiatives. Consequently, production planning modules within execution systems are being leveraged more extensively to model alternative scenarios that optimize lead times and minimize duty liabilities.

Transitioning through cascading effects, suppliers have begun absorbing portions of the additional costs, while end-users are demanding deeper transparency into material origins and cost structures. This shift has amplified the importance of traceability functions within quality management workflows, ensuring compliance with evolving regulatory requirements. As a result, manufacturing execution systems with robust analytics capabilities are indispensable for quantifying the financial implications of tariff fluctuations and enabling agile responses. In essence, the 2025 tariff environment has underscored the strategic value of execution platforms in safeguarding operational continuity amidst external policy pressures.

Understanding Market Segmentation Through Component, Application, Industry, Deployment, and Organization Size to Unlock Targeted Opportunities in MES

Insight into the manufacturing execution market is enriched by examining the diverse dimensions through which stakeholders engage with solutions. From the perspective of components, organizations weigh the merits of service engagements-where expert consultancies facilitate system implementation and optimization-against the inherent capabilities of software licenses that deliver core functionality. Application-level analysis reveals a spectrum of use cases, from performance analysis dashboards that pinpoint efficiency gaps to production scheduling engines orchestrating complex workflows, all the way through quality management shifts that embed compliance controls and resource monitoring routines that track asset health.

Industry-specific dynamics further nuance this landscape, as automotive manufacturers demand just-in-time synchronization, electronics producers require micro-level traceability, and food and beverage processors prioritize hygiene and safety protocols. Metal and machinery firms focus on heavy asset uptime, while pharmaceutical entities emphasize validation and audit trails. Deployment strategies introduce another layer of choice, where cloud-based platforms promise rapid scalability and remote access, whereas on-premise systems guarantee data sovereignty and low-latency operations. Finally, organization size dictates implementation complexity and ROI expectations, with large enterprises driving global rollouts and small to medium enterprises opting for modular deployments that align with budgetary constraints. By understanding these segmentation insights, stakeholders can tailor their MES strategy to align with specific operational imperatives.

This comprehensive research report categorizes the Manufacturing Execution System market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component

- Application

- Industry

- Deployment

- Organization Size

Comparative Regional Dynamics Highlighting Distinct Adoption Patterns and Growth Catalysts Across Americas, EMEA, and Asia-Pacific Manufacturing Hubs

Regional characteristics play a decisive role in shaping how manufacturing execution systems are adopted and scaled. The Americas market is characterized by a blend of established industrial powerhouses and burgeoning mid-market innovators, driving demand for solutions that address both legacy integration challenges and digital upskilling initiatives. Meanwhile, Europe, the Middle East and Africa exhibit a dual narrative: Western European facilities lead in Industry 4.0 pilot programs, whereas Middle Eastern and African operations emphasize modular architectures to leapfrog infrastructure constraints.

In Asia-Pacific, the scale and diversity of production ecosystems-from automotive hubs in Japan and Korea to high-volume electronics clusters in China and Southeast Asia-fuel a voracious appetite for both cloud-native and on-premise execution deployments. Regional regulatory landscapes, such as data protection laws in the European Union and local content requirements in select Asia-Pacific countries, further influence deployment models and feature prioritization. Transitioning seamlessly between soil-and-cloud architectures, manufacturers in these regions are leveraging execution systems to reconcile global best practices with localized operational nuances, ensuring that regional growth trajectories align with technological capabilities.

This comprehensive research report examines key regions that drive the evolution of the Manufacturing Execution System market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading and Emerging Manufacturing Execution System Providers to Assess Strategic Initiatives, Collaborations, and Technology Innovations

A cadre of leading technology vendors and emerging challengers populate the manufacturing execution space, each differentiating through unique value propositions. Established enterprise software providers are enhancing their portfolios by infusing machine learning capabilities into quality management modules and embedding digital twin constructs into performance analysis workflows. Simultaneously, specialist MES firms are forging partnerships with automation OEMs to deliver tightly integrated hardware–software packages that expedite deployment timelines.

Strategic collaborations between technology providers and professional services firms are accelerating best-practice adoption across industries, while acquisitions of analytics startups by major players underscore the premium placed on advanced forecasting and anomaly detection. Meanwhile, open-source initiatives are fostering developer communities that contribute plugins and extensions, expanding the functional reach of core platforms. This competitive tapestry compels manufacturers to evaluate providers not only on feature breadth and scalability but also on partner ecosystems, support frameworks, and long-term innovation roadmaps. By profiling these key players, stakeholders can identify the optimal fit for their specific operational and strategic objectives.

This comprehensive research report delivers an in-depth overview of the principal market players in the Manufacturing Execution System market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ABB Ltd.

- Accenture PLC

- Apriso Corporation

- AVEVA Group PLC

- Camstar Systems Inc.

- Critical Manufacturing SA

- Dassault Systèmes SE

- DELMIAworks

- Emerson Electric Co.

- Epicor Software Corporation

- Eyelit Inc.

- Forcam GmbH

- General Electric Company

- Honeywell International Inc.

- iBASEt

- Lighthouse Systems Ltd.

- MPDV Mikrolab GmbH

- Oracle Corporation

- PTC Inc.

- Rockwell Automation Inc.

- SAP SE

- Siemens AG

- Tata Consultancy Services Limited

- Werum IT Solutions GmbH

Strategic Imperatives for Manufacturers to Harness MES Capabilities, Drive Competitive Advantage, and Achieve Operational Resilience in Turbulent Markets

Industry leaders must adopt a proactive stance to harness the full spectrum of manufacturing execution capabilities and secure competitive advantage. First, aligning executive sponsorship with cross-functional teams ensures that deployment projects have the strategic support and resource allocation necessary to succeed. Leadership should mandate clear performance metrics and milestones, intertwining operational objectives with business outcomes to measure the tangible impact of execution systems. Additionally, organizations should cultivate a culture of continuous improvement by embedding user feedback loops and regularly reviewing process KPIs to refine system configurations.

Next, integrating execution platforms with enterprise data lakes and ERP systems enhances end-to-end visibility, enabling predictive maintenance decisions and dynamic scheduling adjustments. Emphasizing modular architectures will allow scalable expansion, accommodating future technology add-ons without extensive rework. Collaborating closely with technology partners to co-develop custom analytics models can unlock novel insights, particularly when addressing unique manufacturing recipes or regulatory workflows. Finally, investing in upskilling programs ensures that operations teams can leverage advanced features-such as AI-driven anomaly detection-maximizing return on technology investments. By following these strategic imperatives, industry leaders can fortify operational resilience and foster agile, data-driven cultures.

Comprehensive Methodology Integrating Primary Interviews, Secondary Data Analysis, and Expert Validation to Ensure Rigorous Insights into MES Markets

This research integrates a multi-phased approach to guarantee robust and reliable insights into the manufacturing execution ecosystem. The foundation rests on primary interviews conducted with senior executives and technology architects across diverse industries, ensuring firsthand perspectives on adoption challenges, feature priorities, and implementation roadmaps. Complementing these discussions, secondary data analysis encompasses a review of industry white papers, regulatory filings, and domain-specific publications to contextualize technological trends and policy influences.

Quantitative validation is achieved through surveys targeting operations managers and IT directors, providing statistical rigor to the qualitative findings. We triangulate this data with case studies drawn from live deployments, revealing tangible outcomes and lessons learned. Expert panels convened at key milestones critique preliminary conclusions, offering real-time feedback and ensuring alignment with evolving industry best practices. Throughout the process, rigorous data governance and confidentiality protocols safeguard the integrity of proprietary information. This methodological rigor underpins the credibility of the insights presented in this report.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Manufacturing Execution System market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Manufacturing Execution System Market, by Component

- Manufacturing Execution System Market, by Application

- Manufacturing Execution System Market, by Industry

- Manufacturing Execution System Market, by Deployment

- Manufacturing Execution System Market, by Organization Size

- Manufacturing Execution System Market, by Region

- Manufacturing Execution System Market, by Group

- Manufacturing Execution System Market, by Country

- United States Manufacturing Execution System Market

- China Manufacturing Execution System Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 954 ]

Synthesizing Key Insights to Illuminate the Path Forward for Manufacturing Execution Systems Amidst Digital Evolution and Market Complexities

In synthesizing the multifaceted insights covered in this report, it becomes clear that manufacturing execution systems are no longer ancillary productivity tools but central pillars of digital transformation. Organizations that embrace real-time analytics, intelligent automation, and interoperable architectures are positioned to navigate geopolitical uncertainties and shifting regulatory landscapes with greater agility. Regional nuances underscore the need for flexible deployment models, while segmentation insights reveal how tailored solutions can address the distinct needs of various industries and enterprise scales.

Competitive dynamics highlight the importance of evaluating providers on both technological innovation and ecosystem partnerships, ensuring that platform choices align with long-term strategic roadmaps. The actionable recommendations outlined serve as a blueprint for aligning MES initiatives with overarching business goals, from executive sponsorship and cultural change to data integration and continuous improvement. Ultimately, this report illuminates the path forward for manufacturers seeking to harness the full potential of MES technologies, equipping decision-makers with the clarity and confidence to drive sustainable operational excellence.

Connect with Ketan Rohom for Tailored Market Intelligence and Expert Guidance to Secure Your MES Investment and Drive Future Growth

To unlock the full potential of your manufacturing operations and capitalize on emerging digital trends, reach out to Ketan Rohom (Associate Director, Sales & Marketing) to access the comprehensive research report on Manufacturing Execution Systems. Engaging directly with Ketan will provide you with a personalized consultation, ensuring you obtain insights tailored to your unique operational challenges and strategic goals. This report is designed to equip decision-makers with the intelligence needed to optimize processes, mitigate supply chain disruptions, and position their organizations for sustained competitiveness. Don’t miss the opportunity to transform your production landscape with data-driven strategies and expert guidance that will shape your success in today’s rapidly evolving manufacturing environment

- How big is the Manufacturing Execution System Market?

- What is the Manufacturing Execution System Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?