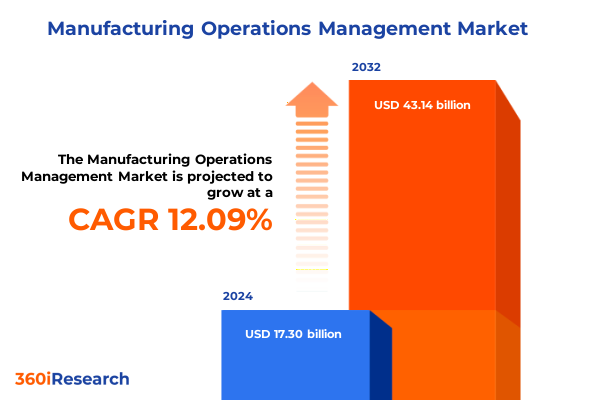

The Manufacturing Operations Management Market size was estimated at USD 19.27 billion in 2025 and expected to reach USD 21.46 billion in 2026, at a CAGR of 12.20% to reach USD 43.14 billion by 2032.

Shaping the Future of Production Excellence Through Integrated Manufacturing Operations Management Strategies and Industry Best Practices

In an era defined by unprecedented technological breakthroughs and shifting global dynamics, manufacturing operations management has emerged as a cornerstone for organizational success. This report provides a distilled overview of the pivotal forces reshaping production environments, highlighting the synergy between operational excellence and strategic innovation. At its core, the narrative underscores how manufacturers are transitioning from legacy, siloed systems to integrated platforms that deliver real-time visibility, enhanced control, and data-driven decision making across the value chain.

Throughout this executive summary, readers will encounter a balanced examination of market drivers and constraints, the ripple effects of policy adjustments, and actionable intelligence designed to inform high-level strategic decisions. By weaving together analyses of technological trends, tariff implications, segmentation insights, and regional nuances, the report paints a comprehensive portrait of the manufacturing operations management terrain. This introduction lays the groundwork for deeper exploration, setting the stage for subsequent discussions around transformative shifts, end-user needs, and competitive positioning in a landscape where agility and resilience are paramount.

With a clear nexus between operational efficiency and broader business objectives, the sections that follow will equip industry leaders with the context and perspective needed to navigate an environment characterized by rapid change and intensifying competition. Transitioning from broad context to specific insights, this summary aims to catalyze informed action and foster a strategic mindset geared toward long-term value creation.

Navigating the Era of Digital Transformation and Industry 4.0 Innovations Redefining Manufacturing Operations Management Paradigms

The manufacturing ecosystem is undergoing a fundamental metamorphosis as digital transformation, artificial intelligence, and connected technologies converge to redefine traditional production paradigms. Solutions once confined to standalone functions have evolved into interconnected platforms capable of orchestrating assets, people, and processes with unprecedented precision. In this era of Industry 4.0, the advent of predictive analytics and machine learning models has elevated maintenance strategies from reactive interventions to proactive asset performance planning, ultimately minimizing downtime and optimizing throughput.

Concurrently, cloud-based deployments have gained momentum, enabling manufacturers to scale operations seamlessly and foster collaboration across geographically dispersed sites. This shift toward hybrid architectures-where on-premise systems integrate natively with cloud environments-addresses data sovereignty concerns while unlocking the flexibility needed to adapt to volatile demand patterns. Furthermore, the proliferation of edge computing devices has extended real-time monitoring capabilities to the plant floor, empowering decentralized decision making and reducing latency for time-sensitive operations.

Beyond technology, the workforce has emerged as both a beneficiary and a driver of these transformative shifts. Digital upskilling initiatives are equipping technicians and engineers with the competencies required to harness sophisticated management systems effectively. As a result, organizations are converging technical talent development with process optimization, creating a virtuous cycle that enhances operational resilience and prepares the workforce for next-generation manufacturing challenges.

Assessing the Strategic Repercussions of 2025 United States Tariffs on Production Costs, Supply Chain Resilience, and Sourcing Models

In 2025, a series of tariff adjustments by the United States government introduced new import duties on critical components and industrial machinery, creating a cascade of implications for domestic manufacturers and global supply chains alike. The immediate effect was an uptick in input costs, prompting organizations to reevaluate sourcing strategies and, in many cases, accelerate diversification of their supplier base. Faced with higher landed costs, several companies sought regional production alternatives to mitigate exposure to escalating trade tensions.

The tariff environment also catalyzed investments in local content production, as manufacturers recognized the strategic importance of reducing reliance on overseas components. This trend dovetailed with broader reshoring initiatives, where government incentives further incentivized domestic capacity expansion. However, while onshoring delivered long-term supply security, it often entailed higher capital expenditures and a steeper learning curve for integrating advanced manufacturing operations management systems into greenfield facilities.

Moreover, the uncertainty surrounding future trade policies spurred organizations to adopt scenario planning tools embedded within enterprise manufacturing intelligence solutions. By simulating various tariff rate and exchange rate scenarios, executives gained the ability to forecast financial impacts under multiple trade landscapes. Ultimately, the cumulative impact of 2025 tariffs underscored the critical need for agile operational strategies, robust risk mitigation frameworks, and comprehensive visibility from supplier management through final product delivery.

Unveiling Critical Insights Across Component, Organizational, Deployment, and Industry Vertical Segmentation to Drive Tailored Operational Excellence

The multifaceted nature of manufacturing operations management underscores the importance of examining solutions through a component lens where consulting, implementation, and training services complement an array of software capabilities ranging from asset performance management to quality management systems. This layered analysis reveals that while consulting services drive strategic alignment and change management, training programs ensure workforce readiness, and software modules deliver targeted functionality for production planning, scheduling, and compliance management.

Assessing organizations by size further illuminates divergent priorities: large enterprises often emphasize scalability, system interoperability, and global governance to support complex, multi-site operations, whereas small and medium enterprises seek cost-effective, modular solutions that deliver rapid ROI without extensive IT overhead. These distinctions highlight the necessity for vendors to tailor their value propositions, offering both robust, feature-rich platforms for large operations and streamlined, purpose-built deployments for smaller manufacturers.

Similarly, deployment mode reveals trade-offs between cloud-based and on-premise implementations. Cloud environments appeal to organizations seeking flexibility, lower upfront costs, and continuous updates, while on-premise solutions offer enhanced control over data security and customization. Finally, when viewed through an end-user perspective, sectors such as automotive and aerospace emphasize asset utilization and regulatory compliance, whereas food and beverage and pharmaceuticals prioritize traceability and quality assurance. In metals, mining, and oil & gas, the focus often centers on harsh-environment resilience, inventory management, and labor productivity, underscoring the diverse functional requirements that must be addressed through tailored manufacturing operations management strategies.

This comprehensive research report categorizes the Manufacturing Operations Management market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component

- Technology

- Integration

- Deployment Mode

- Organization Size

- End-User

Exploring How Regional Market Dynamics in the Americas, EMEA, and Asia-Pacific Shape Adoption and Innovation in Manufacturing Operations Management

A regional lens reveals distinct drivers shaping the adoption and evolution of manufacturing operations management solutions. In the Americas, the combination of onshoring incentives and a robust aftermarket services ecosystem has accelerated demand for integrated solutions that support localized production while enabling global visibility. Organizations in North America are particularly keen on leveraging cloud-native platforms to achieve rapid deployment cycles and continuous innovation.

Europe, the Middle East, and Africa present a converging dichotomy of regulatory rigor and digital innovation. Stringent regulations around safety, sustainability, and data privacy have prompted manufacturers to adopt comprehensive quality management and compliance systems, while burgeoning investment in smart factories positions the region as a hotbed for advanced process automation and digital twins.

In the Asia-Pacific, rapid industrialization and government-led digitalization initiatives have fueled adoption across tiers of manufacturers, from global conglomerates to emerging enterprises. Investment in workforce upskilling and government subsidies for Industry 4.0 technology have created a fertile landscape for both cloud-based and on-premise implementations, with an emphasis on operational scalability and cost efficiency.

This comprehensive research report examines key regions that drive the evolution of the Manufacturing Operations Management market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Analyzing Market-Leading Players’ Strategic Alliances, Innovation Focus, and Services Ecosystem to Understand Competitive Differentiation

Leading solution providers continue to differentiate through strategic partnerships, M&A activity, and comprehensive portfolios that blend software, services, and ecosystem capabilities. Established multinational corporations have forged alliances with cloud infrastructure vendors to deliver scalable, secure platforms while integrating advanced analytics and AI capabilities into their asset performance and production planning offerings. Such collaborations have broadened the appeal of their solutions across diverse industry verticals.

At the same time, agile technology players are focusing on niche innovation, investing heavily in edge computing, digital twin frameworks, and low-code development environments. These moves enable faster time-to-value and more seamless customization, appealing to manufacturers seeking to pilot Industry 4.0 initiatives with minimal disruption. The competitive landscape is further intensified by regional specialists that leverage deep domain expertise and localized support models, reinforcing the importance of tailoring solutions to specific market contexts.

Across the board, leading companies are elevating customer success programs and investing in training academies to ensure organizations can maximize the value of their deployments. By combining preconfigured best practices, industry content libraries, and collaborative communities, these providers are reducing implementation risk and fostering continuous improvement through peer benchmarking and shared knowledge.

This comprehensive research report delivers an in-depth overview of the principal market players in the Manufacturing Operations Management market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ABB Ltd.

- Aegis Industrial Software Corporation

- ANASOFT APR, spol. s r.o

- Binmile Technologies Pvt. Ltd.

- Bosch Rexroth AG

- Critical Manufacturing S.A. by ASM Pacific Technology Limited

- Dassault Systèmes SE

- Emerson Electric Co.

- Epicor Software Corporation

- EpsilonSys Software inc.

- General Electric Company

- Honeywell International Inc.

- iBASEt

- Infor

- International Business Machines Corporation

- Katana Technologies OÜ

- Leading2Lean, LLC

- MasterControl, Inc.

- Microsoft Corporation

- Oracle Corporation

- Procuzy by Moraabh Ventures Private Limited

- Rockwell Automation, Inc.

- SAP SE

- Schneider Electric SE

- Siemens AG

- SYSPRO Proprietary Limited

- TRooTech Business Solutions

Implementing a Phased Digital Transformation Strategy with Pilot Digital Twins, Workforce Upskilling, and Scenario Planning for Resilient Manufacturing

To navigate the complexities and opportunities within manufacturing operations management, industry leaders should prioritize a holistic digital transformation roadmap that aligns technology investments with broader business objectives. Embarking on pilot deployments of digital twins can validate use cases for predictive maintenance, enabling organizations to fine-tune integration approaches before full-scale rollouts. Concurrently, investing in workforce development ensures that employees possess the necessary skills to operate advanced systems effectively, thereby accelerating adoption and realizing faster returns.

Furthermore, adopting a modular, phased implementation strategy mitigates risk and allows for iterative improvements. By starting with high-impact areas such as quality management or production planning, organizations can establish quick wins that build executive support for subsequent phases. Engaging cross-functional stakeholders in governance councils fosters collaboration and ensures solutions are configured to support end-to-end processes rather than isolated departmental needs.

Finally, manufacturing executives should leverage scenario planning tools embedded within enterprise manufacturing intelligence platforms to stress-test strategic plans against potential tariff changes, demand fluctuations, and supply chain disruptions. This proactive approach to risk management enhances organizational resilience and positions manufacturers to capitalize on emerging opportunities in an unpredictable global environment.

Employing a Robust Research Framework Combining Secondary Intelligence, Executive Interviews, Quantitative Surveys, and Triangulation for Unparalleled Insight

This research effort was grounded in a rigorous methodology designed to ensure the accuracy and relevance of findings across multiple dimensions. Initially, an extensive secondary research phase synthesized insights from publicly available corporate filings, industry technical papers, regulatory databases, and trade publications to map the competitive and technological landscape. This groundwork provided the foundation for developing hypotheses and identifying key players, trends, and regional nuances.

Building upon this, primary research involved structured interviews with over one hundred senior executives, operations managers, technology specialists, and end-users across diverse industry verticals. These conversations yielded qualitative insights into procurement criteria, deployment challenges, and evolving priorities that quantitative data alone may overlook. Concurrently, a detailed survey of decision-makers captured quantitative metrics on adoption rates, technology preferences, and strategic drivers to validate and triangulate the qualitative findings.

Finally, all data points were cross-validated through a data triangulation process, ensuring consistency and reliability. Where discrepancies emerged, follow-up inquiries and targeted desk research were conducted to reconcile differing viewpoints. This multilayered approach underpins the robustness of the report, enabling stakeholders to make confident, evidence-based strategic decisions in the realm of manufacturing operations management.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Manufacturing Operations Management market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Manufacturing Operations Management Market, by Component

- Manufacturing Operations Management Market, by Technology

- Manufacturing Operations Management Market, by Integration

- Manufacturing Operations Management Market, by Deployment Mode

- Manufacturing Operations Management Market, by Organization Size

- Manufacturing Operations Management Market, by End-User

- Manufacturing Operations Management Market, by Region

- Manufacturing Operations Management Market, by Group

- Manufacturing Operations Management Market, by Country

- United States Manufacturing Operations Management Market

- China Manufacturing Operations Management Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1431 ]

Summarizing Strategic Imperatives and Multifaceted Influences That Define Manufacturing Operations Management Excellence in a Dynamic Global Environment

The manufacturing operations management landscape stands at a pivotal juncture where rapid technological innovation converges with evolving regulatory and trade dynamics. Organizations that embrace integrated platforms, leverage data-driven insights, and cultivate a digitally adept workforce are best positioned to thrive amidst uncertainty. This summary has illuminated how component, organizational, deployment, and industry-specific factors drive solution requirements, while regional nuances and competitive strategies shape market trajectories.

Moreover, the cumulative impact of U.S. tariff adjustments in 2025 has underscored the importance of flexible sourcing strategies, scenario planning capabilities, and local production initiatives. By appreciating these multifaceted influences, industry leaders can prioritize investments in areas that yield the greatest strategic advantage, whether through predictive maintenance, compliance management, or advanced analytics.

Ultimately, the path forward demands a balanced approach that integrates pilot testing, modular deployment, and continuous workforce development. Armed with the insights outlined in this report, decision-makers can craft resilient roadmaps that align operational excellence with broader business goals, driving sustainable growth in an ever-evolving manufacturing ecosystem.

Unlock Exclusive Insights Through a Personalized Consultation with Our Associate Director of Sales & Marketing to Propel Your Manufacturing Strategy Forward

As the manufacturing industry hurtles toward increasingly complex challenges and rapid technological advancements, securing a comprehensive understanding of trends and strategies is more critical than ever. Engaging directly with an expert like Ketan Rohom, Associate Director of Sales & Marketing, opens the door to unlocking the full depth of insights contained within this market research report. Through a personalized consultation, prospective buyers can explore tailored analyses, clarify methodological nuances, and gain clarity on how the findings specifically align with their organizational objectives. By initiating a discussion, decision-makers position themselves to leverage granular data on technological adoption, tariff impacts, segmentation patterns, regional performance, and competitive strategies. This direct engagement not only accelerates strategic planning but also ensures that investments in manufacturing operations management solutions are grounded in the most current and comprehensive intelligence available. Reach out today to schedule a one-on-one briefing with Ketan Rohom and take the decisive step toward driving operational excellence and sustained growth across your manufacturing footprint.

- How big is the Manufacturing Operations Management Market?

- What is the Manufacturing Operations Management Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?