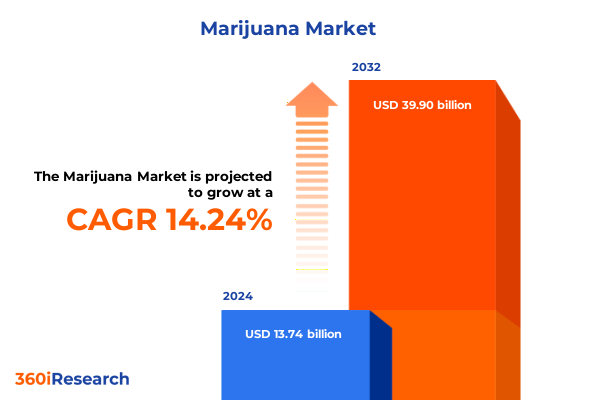

The Marijuana Market size was estimated at USD 15.68 billion in 2025 and expected to reach USD 17.88 billion in 2026, at a CAGR of 14.27% to reach USD 39.90 billion by 2032.

Unveiling the Critical Dynamics Shaping the Contemporary Marijuana Industry and Setting the Stage for Data-Driven Strategic Decision Making

The marijuana market is undergoing a period of profound change driven by policy reforms, technological innovation, and growing consumer sophistication. Across both medical and adult-use channels, stakeholders must navigate a complex regulatory mosaic while aligning product portfolios with diverse consumption preferences. These dynamics amplify the need for an authoritative executive summary that captures critical market forces, illuminates strategic inflection points, and equips leaders with clear direction.

In this context, an insightful introduction not only establishes foundational definitions and taxonomies but also frames the urgency of staying ahead in a fast-evolving space. By unpacking key industry drivers-ranging from legislative momentum to supply chain optimization-this section lays the groundwork for a cohesive narrative. It sets expectations for subsequent discussions on shifts in competitive dynamics, the implications of new tariff regimes, and the segmented value drivers that underpin differentiated growth strategies. Ultimately, a rigorous introduction creates shared understanding among executives, investors, and product innovators, enabling aligned decision-making that accelerates market leadership.

Charting the Transformative Shifts That Are Redefining Competitive Dynamics Technology Adoption and Consumer Preferences in the Marijuana Sector

Market participants are witnessing a series of transformative shifts reshaping competitive dynamics across cultivation, processing, and distribution. Regulatory liberalization in key jurisdictions continues to expand addressable audiences for both medical and recreational applications, while technology adoption-from automation in cultivation facilities to blockchain-enabled traceability-enhances operational transparency and consumer trust. As digital engagement accelerates, e-commerce platforms and direct-to-consumer strategies have moved to the forefront, driving omnichannel integration that blends physical retail with personalized online experiences.

Building on these foundational shifts, new extraction techniques and precision dosing innovations are enabling differentiated product formats, catering to sophisticated consumer demand for consistency, purity, and novel delivery experiences. Meanwhile, partnerships between cannabis operators and mainstream consumer packaged-goods leaders are forging cross-industry synergies, elevating branding standards and unlocking fresh capital pathways. These combined forces are remodeling traditional value chains and redefining competitive moats, calling for stakeholders to reassess resource allocation, accelerate R&D agendas, and cultivate strategic alliances.

Assessing the Comprehensive Consequences of Newly Imposed United States Tariffs in 2025 on Supply Chains Pricing Strategies and Market Accessibility

In early 2025, the United States introduced new tariff measures targeting imported cannabis-derived products, aiming to bolster domestic cultivation and processing industries. These tariff adjustments have introduced additional cost layers for hemp-extracts, concentrate imports, and select cannabinoid formulations. As a result, international suppliers face margin compression, compelling some to reconsider export volumes or explore tariff-mitigation strategies such as establishing local processing facilities or pursuing free-trade zone certifications.

The cumulative impact extends beyond immediate price inflation: supply chain flexibility has become paramount, with domestic producers scaling cultivation footprints and refining logistics to accommodate increased demand for locally sourced inputs. Concurrently, product innovation cycles are adapting to reflect input cost realities, driving a shift toward higher-margin formulations and premium branding. Firms that proactively recalibrate sourcing strategies, negotiate long-term supply agreements, and invest in vertical integration are emerging with strengthened resilience, while those reliant on imported bulk inputs must accelerate diversification or face competitive erosion.

Deriving Rich Insights from Consumption Method Product Type and Application Segmentation to Illuminate Key Value Drivers Across Diverse Marijuana Market Niches

A nuanced appreciation of market segmentation underscores how distinct consumption method categories, each with unique adoption patterns and value perceptions, drive portfolio prioritization. Inhalation formats encompass both smoking and vaping, with smoking retaining strong heritage appeal among long-standing adult-use enthusiasts and vaping capturing growth in discreet consumption preferences. Oral delivery spans beverages, capsules, edibles, and tinctures, offering versatile dosing and convenience for wellness-oriented users. Sublingual options-including lozenges and tinctures-cater to rapid onset demands, while topical offerings such as creams, oils, and transdermal patches address pain and skincare use cases with minimal psychoactive impact.

Parallel segmentation by product type reveals that concentrates drive premiumization through live resin, oil, shatter, and wax formats, whereas edible innovations leverage baked goods, beverages, chocolates, and gummies to tap health-and-wellness and lifestyle positioning. Traditional flower maintains a foundational role, providing a gateway for brand discovery, while topical formulations and vaping products like cartridges and vape pens reflect ongoing product diversification. Application-based analysis distinguishes the medical segment-focused on anxiety relief, pain management, and sleep disorders-from recreational channels oriented around creativity, relaxation, and social engagement. By overlaying these segmentation layers, stakeholders can pinpoint high-potential niches, calibrate R&D intensity, and optimize marketing narratives to resonate with specific user journeys.

This comprehensive research report categorizes the Marijuana market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Consumption Method

- Product Type

- Application

Uncovering Distinct Regional Nuances Across the Americas Europe Middle East Africa and Asia-Pacific to Inform Targeted Market Penetration and Expansion Strategies

Regional development trajectories reveal how localized regulatory frameworks and consumer cultures shape market maturity. In the Americas, particularly in the United States and Canada, progressive legalization has cultivated a robust ecosystem of licensed producers, vertically integrated operations, and vibrant retail networks. Consumer acceptance spans medical and adult-use contexts, supported by transparent packaging, rigorous testing standards, and well-established distribution channels. Market entrants benefit from clearly defined licensing protocols, though they must navigate varying state-level regulations that influence product portfolios and retail footprint strategies.

Across Europe, the Middle East & Africa, the landscape remains fragmented, with medical legalization driving primary market growth amid cautious recreational experiments. Europe’s regulatory alignment under centralized bodies coexists with divergent national policies, necessitating agile compliance approaches for cross-border trade. Meanwhile, several Middle East jurisdictions are piloting medicinal cannabis frameworks, and emerging African markets are exploring export-oriented cultivation to leverage favorable agronomic conditions. In Asia-Pacific, nascent medical programs in Australia and Japan, coupled with evolving CBD regulations in Southeast Asia, signal burgeoning opportunities. However, stakeholders must balance pioneering entry with robust regulatory engagement, educational campaigns, and distribution partnerships to build local trust and infrastructure.

This comprehensive research report examines key regions that drive the evolution of the Marijuana market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Leading Industry Players and Their Strategic Imperatives Including Product Innovation Partnership Models and Investment Approaches Shaping Market Leadership

Leading enterprises demonstrate a spectrum of strategic imperatives that illuminate pathways to market leadership. Major multi-state operators leverage vertically integrated models, aligning cultivation scale with in-house processing and branded retail chains to capture margin premia and ensure supply security. In contrast, nimble pure-play extract specialists prioritize product innovation, forging co-manufacturing partnerships and licensing agreements to expand geographic reach without incurring heavy fixed costs. Across these archetypes, strategic M&A activities have intensified, enabling firms to diversify portfolios, acquire proprietary extraction technologies, and gain footholds in emerging regulatory regimes.

Brand positioning also serves as a critical differentiator. Established players invest heavily in clinical research to validate medical claims, while lifestyle-oriented brands engage in experiential marketing and celebrity partnerships to amplify consumer resonance. Digital platforms and loyalty ecosystems are evolving into key engagement tools, facilitating data-driven personalization and retention efforts. Moreover, cross-sector collaborations with biotech firms and nutraceutical companies are expanding the frontier of cannabinoid research, underscoring the importance of strategic alliances and R&D synergies for sustained competitive advantage.

This comprehensive research report delivers an in-depth overview of the principal market players in the Marijuana market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 4Front Ventures Corp.

- Aphria Inc.

- Aurora Cannabis Inc.

- Ayr Wellness Inc.

- CanniMed Therapeutics Inc.

- Canopy Growth Corporation

- Charlotte’s Web Holdings, Inc.

- Cresco Labs, Inc.

- Cronos Group Inc.

- Curaleaf Holdings, Inc.

- Green Thumb Industries, Inc.

- GrowGeneration Corp.

- HEXO Corporation

- High Tide Inc.

- Innovative Industrial Properties, Inc.

- Jazz Pharmaceuticals plc

- Jushi Holdings Inc.

- Organigram Global Inc.

- Planet 13 Holdings Inc.

- Radient Technologies Inc.

- Scotts Miracle-Gro Company

- TerrAscend Corporation

- Tilray Brands, Inc.

- Trulieve Cannabis Corporation

- Verano Holdings Corporation

Formulating Actionable Recommendations for Industry Leaders to Capitalize on Emerging Opportunities Optimize Operational Efficiency and Navigate Regulatory Complexities

To thrive amid dynamic market forces, industry leaders should prioritize several strategic actions. First, diversifying supply chains through a mix of domestic sourcing and selective offshore partnerships will mitigate tariff exposure and ensure consistent raw material flows. Firms that integrate advanced cultivation technologies and predictive analytics can optimize yields while maintaining quality standards, creating cost efficiencies that bolster pricing flexibility. Second, investing in modular processing capabilities-such as on-site extraction units and micro-formulation labs-enables rapid product iteration and localized customization, enhancing responsiveness to shifting consumer preferences.

Additionally, forging proactive regulatory engagement strategies will accelerate market access in new jurisdictions. By collaborating with policymakers, conducting real-world evidence studies, and participating in industry consortia, companies can shape favorable legislative outcomes and standard-setting initiatives. Finally, cultivating compelling brand narratives that align with health-and-wellness trends, social responsibility commitments, and transparency in sourcing will deepen consumer loyalty. By weaving these elements into a cohesive growth blueprint, organizations can navigate complexity, capitalize on emerging opportunities, and reinforce their strategic positioning in the evolving marijuana market.

Detailing the Rigorous Mixed-Method Research Methodology Integrating Primary Interviews Secondary Analysis and Robust Segmentation Framework to Ensure Data Integrity

This research adopted a rigorous mixed-methodology approach to ensure comprehensive coverage and data integrity. Primary research comprised in-depth interviews with C-suite executives, cultivation directors, and retail operators across leading markets. These qualitative insights were complemented by structured consumer focus groups segmented by usage patterns and demographic cohorts. Proprietary surveys captured evolving purchase motivators and brand perceptions, providing foundational inputs for segmentation analysis.

Secondary research integrated a wide array of sources, including regulatory filings, scientific publications on cannabinoid efficacy, and industry association reports. A triangulation protocol validated findings across data streams, while a multi-stage peer review process ensured methodological rigor. The segmentation framework was crafted to align consumption method, product type, and application categories, enabling precise cross-segment comparisons. Finally, expert validation sessions and stakeholder workshops furnished practical feedback, reinforcing the applicability of insights for strategic planning and investment decision-making.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Marijuana market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Marijuana Market, by Consumption Method

- Marijuana Market, by Product Type

- Marijuana Market, by Application

- Marijuana Market, by Region

- Marijuana Market, by Group

- Marijuana Market, by Country

- United States Marijuana Market

- China Marijuana Market

- Competitive Landscape

- List of Figures [Total: 15]

- List of Tables [Total: 2067 ]

Concluding Key Takeaways That Synthesize Market Dynamics Strategic Insights and Best Practices for Stakeholders Operating in the Contemporary Marijuana Landscape

In summary, the marijuana market stands at a pivotal juncture defined by evolving regulation, sophisticated consumer expectations, and technological breakthroughs. Transformative shifts in cultivation automation, extraction science, and digital retail have recalibrated competitive dynamics, while new United States tariff policies have underscored the importance of supply chain agility. A layered segmentation analysis across consumption method, product type, and application channels reveals differentiated growth pockets and informs targeted innovation pathways.

Regional insights highlight the maturity of the Americas, the regulatory complexity of Europe, the Middle East & Africa, and the emergent promise of Asia-Pacific markets, guiding entry strategies. Leading companies exemplify diverse strategic archetypes-from vertically integrated operators to product innovation-driven pure plays-demonstrating the critical role of partnerships, M&A, and brand differentiation. By implementing the actionable recommendations outlined herein and adhering to a robust research methodology, stakeholders are well-positioned to harness market momentum and sustain competitive advantage in the dynamic marijuana landscape.

Driving Immediate Engagement with a Compelling Call to Action to Connect with Ketan Rohom for Exclusive Access to In-Depth Marijuana Market Intelligence and Strategic Guidance

For industry professionals seeking unparalleled depth and clarity in marijuana market intelligence, an exclusive opportunity awaits. Engage directly with Ketan Rohom, Associate Director of Sales & Marketing, who brings a proven track record of translating complex market data into actionable commercial strategies. Leveraging his expertise in guiding decision-makers through regulatory challenges, consumer behavior shifts, and competitive positioning, Ketan can facilitate customized access to the full research report that aligns precisely with your organization’s objectives.

By partnering with Ketan Rohom, you gain privileged insights into emerging product innovations, tariff impact analyses, and granular segmentation breakdowns that drive competitive advantage. He offers tailored consultations to help you interpret findings, benchmark performance, and craft go-to-market roadmaps. This is your moment to secure a decisive informational edge in the evolving marijuana landscape-reach out today to explore subscription options, enterprise licensing, or bespoke white-label deliverables that empower your team to act confidently and decisively.

- How big is the Marijuana Market?

- What is the Marijuana Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?