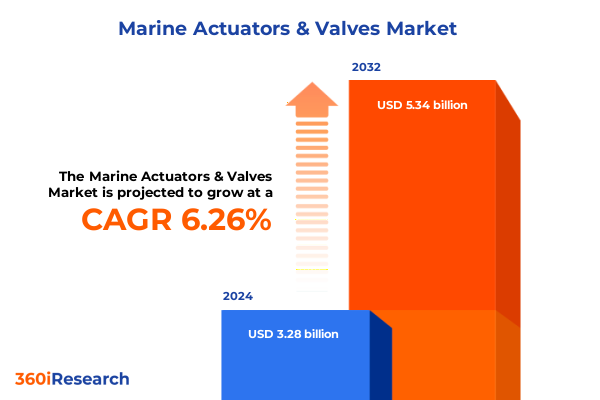

The Marine Actuators & Valves Market size was estimated at USD 3.49 billion in 2025 and expected to reach USD 3.68 billion in 2026, at a CAGR of 6.27% to reach USD 5.34 billion by 2032.

Setting the Course for Marine Actuators and Valves Market Understanding by Exploring Emerging Drivers, Challenges, and Strategic Imperatives

The global marine actuators and valves sector serves as the beating heart of ocean‐faring vessels, underpinning the safe and efficient control of fluid flow essential to propulsion, ballast management, and critical onboard systems. As engine designs evolve and environmental compliance becomes ever more stringent, the complexity and performance demands placed on valve assemblies and their actuation mechanisms have never been greater. This field is driven by a continuous push for enhanced corrosion resistance in saltwater conditions, real‐time monitoring capabilities, and ever‐tighter integration with ship automation platforms. Without a clear understanding of these forces, stakeholders risk falling behind in a market where reliability and precise control can make the difference between mission success and costly downtime.

Against this backdrop of technical innovation and regulatory pressure, it is critical for industry participants to align product roadmaps with emerging vessel architectures, digital ecosystems, and sustainable material choices. By framing both the long‐standing reliability requirements of the marine environment and the accelerating tempo of digital transformation, this overview sets the stage for a deeper exploration of pivotal trends and actionable insights that will follow. The following sections unpack how shifts in supply chains, policy frameworks, segmentation nuances, and regional dynamics coalesce to shape competitive advantage in one of the maritime sector’s most essential component markets.

Embracing Digitalization, Advanced Materials, and Regulatory Pressures to Reshape the Marine Valve and Actuator Ecosystem

In recent years, a wave of digitalization has swept through marine equipment design, enabling valves and actuators to be“smart” components that feed critical performance data into integrated ship control systems. This transition from purely mechanical devices to sensor‐equipped assemblies has redefined maintenance paradigms, shifting maintenance routines from fixed schedules to condition‐based protocols that increase uptime while reducing lifecycle expenditures. At the same time, manufacturers have explored alternative materials such as duplex stainless steels and composite alloys, aiming to balance weight reduction with enhanced resistance to chloride‐induced corrosion. These material advances enable valve bodies to operate flawlessly in deeper subsea applications, where pressure holds no mercy for suboptimal alloys.

Simultaneously, environmental regulations have prompted the introduction of low‐emission hydraulic fluids and non‐toxic coatings, prompting engineering teams to redesign actuator seals and valve interiors. This shift has been further compounded by Industry 4.0 initiatives, which tie centralized fleet management platforms to valve health indicators and remote diagnostics. In turn, this networked approach is sparking investments in secure data gateways and cyber‐hardened communication modules. With each of these transformative forces interacting, marine operators must navigate a terrain where mechanical reliability and digital security advance in lockstep toward next‐generation, high‐availability vessel architectures.

Understanding the Far-Reaching Repercussions of 2025 U.S. Tariffs on Sourcing Strategies and Supply Chain Resilience in Marine Valve Assemblies

The introduction of new United States tariff measures in early 2025 has reverberated through international supply chains for marine‐grade valves and actuators, particularly those sourced from key overseas manufacturing hubs. With increased duties imposed on finished valve assemblies and individual actuator modules, U.S. mariners and shipbuilders have encountered elevated landed costs, prompting a reassessment of procurement strategies and inventory buffers. In response, many maritime original equipment manufacturers have accelerated qualification programs for domestic suppliers, aiming to insulate themselves from further tariff volatility.

These protectionist measures have also catalyzed a more diversified approach to sourcing. Shipyards and retrofit specialists are now evaluating manufacturing partners in regions unaffected by U.S. trade policy, while investing in small‐batch trials to validate performance under saltwater stress tests. The cumulative impact goes beyond immediate cost pressures; it has triggered extended lead times for some imported components while boosting demand for North American fabrication capacity. Incentives to localize production have begun to emerge, with government grants and port authorities offering co‐investments in new machining centers. Consequently, industry participants face a dynamic landscape where trade policy, supply chain resilience, and strategic partnerships intersect to redefine sourcing blueprints for marine actuators and valves.

Unveiling the Multifaceted Impact of Valve, Actuator, Application, Material, Size, and Pressure Segmentation on Market Dynamics

A nuanced view of the market emerges when analyzing product segmentation through multiple technical lenses. Based on valve type, the competitive arena extends across ball valves that provide tight shut-off performance, butterfly valves prized for their compact footprint, check valves that prevent reverse flow, gate valves valued for minimal pressure drop, and globe valves distinguished by precise flow metering. Meanwhile, actuator type segmentation reveals a spectrum of control mechanisms, with electric actuators delivering precise positioning and programmability, hydraulic actuators offering robust force in high-torque scenarios, manual actuators retaining essential fail-safe simplicity, and pneumatic actuators securing rapid response times in critical safety circuits.

Diving deeper, application segmentation illuminates how end-use demands vary. Chemical and petrochemical operators prioritize valve assemblies resistant to corrosive process streams, whereas oil and gas deploy actuators engineered to withstand extreme temperatures and pressures. Power generation facilities lean on components engineered for cyclical thermal stresses, while shipbuilding and marine professionals require stringent certifications for fire resistance and offshore safety standards. In water and wastewater contexts, valves and actuators must accommodate abrasive particulates and biocorrosion challenges.

Equally important is material segmentation, which differentiates product offerings based on carbon steel’s cost-effectiveness, cast iron’s durability in low-pressure systems, and stainless steel’s superior corrosion resistance for demanding marine environments. Size segmentation further clarifies market dynamics, spanning up to two-inch valves used in instrumentation loops, two-to-six-inch valves common in auxiliary circuits, six-to-twelve-inch assemblies deployed in main water ballast lines, and above-twelve-inch valves reserved for primary seawater intake systems. Finally, pressure rating segmentation codifies operational envelopes from low-pressure fittings suited for freshwater distribution to medium-pressure valves for general service and high-pressure assemblies that safeguard subsea and emergency shutdown applications.

This comprehensive research report categorizes the Marine Actuators & Valves market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Valve Type

- Actuator Type

- Application

- Material

- Size

- Pressure Rating

Examining How Regional Regulations, Port Modernization Initiatives, and Shipyard Trends Shape Demand Across Principal Global Markets

Regional distinctions play a decisive role in how companies approach product development and go-to-market tactics. The Americas region, anchored by major shipbuilding hubs along the Gulf Coast and West Coast, continues to favor localized manufacturing to support stringent U.S. Coast Guard regulations and domestic content requirements. Here, operators exhibit a strong preference for electric and pneumatic actuation in ballast and fire-suppression systems, reflecting a broader push toward electrification and automation.

In the Europe, Middle East, and Africa cluster, a mix of advanced offshore exploration initiatives in the North Sea and burgeoning LNG terminals in the Middle East drives demand for high-pressure valves with specialized alloy construction. Regulatory harmonization under the European Marine Equipment Directive has catalyzed broad adoption of performance‐verified products, while emerging port modernization projects in African nations present greenfield opportunities for corrosion‐resistant valve systems.

Across Asia-Pacific, dynamic shipbuilding centers in South Korea, China, and Japan underpin a flourishing retrofit market fueled by fuel-efficiency mandates and emission-control legislation. Demand for hybrid actuator solutions and integrated sensor arrays is particularly pronounced, as regional operators seek to extend the service life of existing fleets through digital upgrades. Each of these regional ecosystems exhibits unique procurement drivers and industry standards, underscoring the need for tailored product roadmaps and strategic alliances.

This comprehensive research report examines key regions that drive the evolution of the Marine Actuators & Valves market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Collaborative Innovation, Modular Designs, and Strategic Alliances Driving Competitiveness Among Leading Suppliers

Leading the pack in product innovation, several established manufacturers have unveiled modular valve architectures that streamline field servicing and part interchangeability. Strategic partnerships between actuator specialists and sensor providers are accelerating the introduction of smart valve platforms capable of self-diagnostics and predictive maintenance alerts. In parallel, a wave of mid-tier firms is capitalizing on niche applications, offering bespoke materials and coatings for ultra-deepwater operations at competitive price points.

Collaboration between ship operators and technology start-ups has also emerged as a potent force. These alliances are piloting digital twin simulations of valve assemblies under varied hydrodynamic loads and corrosion scenarios, thereby compressing development cycles and validating designs in virtual seafaring environments. At the same time, joint ventures between component suppliers and system integrators are shaping turnkey valve-and-actuator packages that reduce installation complexity and commissioning time. Such concerted efforts underscore a shared industry imperative: to deliver next-generation marine control systems that combine rugged reliability with advanced data analytics.

This comprehensive research report delivers an in-depth overview of the principal market players in the Marine Actuators & Valves market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Alfa Laval AB

- AUMA Riester GmbH & Co. KG

- Bray International, Inc.

- Bürkert GmbH & Co. KG

- Curtiss-Wright Corporation

- Emerson Electric Co.

- Flowserve Corporation

- Honeywell International Inc.

- IMI plc

- KITZ Corporation

- KSB SE & Co. KGaA

- Moog Inc.

- Rotork plc

- SAMSON AG

- Schneider Electric SE

- SPX Flow, Inc.

- Valmet Oyj

- Velan Inc.

- Watts Water Technologies, Inc.

- Wärtsilä Corporation

Driving Competitive Resilience by Focusing on Digital Integration, Flexible Manufacturing, and Strategic Supplier Diversification

To navigate this evolving landscape, industry leaders must prioritize digital integration by embedding sensor hardware and secure communication pathways into new valve product lines. Investing in flexible manufacturing that can pivot between small custom runs and high-volume production will mitigate risks associated with tariff shifts and shifting regional demand patterns. Forging joint development agreements with technology firms can accelerate the rollout of digital twins and remote monitoring platforms, unlocking insights into asset health and optimizing maintenance cycles.

Furthermore, establishing multi-tiered supplier networks that include both domestic fabricators and vetted international partners will guard against future trade disruptions. Embracing sustainable materials and low-toxicity fluids will not only satisfy tightening environmental regulations but also differentiate offerings in a market increasingly attentive to decarbonization goals. Lastly, upskilling engineering and service teams to interpret real-time data streams and perform rapid in-field diagnostics will translate strategic investments in digital hardware into tangible performance outcomes.

Utilizing a Dual-Phase Primary and Secondary Research Framework with Data Triangulation and Expert Peer Validation to Ensure Robust Insights

Our research methodology combines robust secondary analysis of industry publications, regulatory filings, and technical white papers with a rigorous primary interview program involving senior engineers, procurement directors, and shipyard project managers. We employed a data triangulation process to cross-verify insights, leveraging equipment certification databases and vessel registry reports to ensure accuracy.

Quantitative metrics were gathered from manufacturer disclosures and trade associations, and we conducted qualitative in-depth interviews to capture emerging use cases and procurement rationales. All findings underwent a multi-stage validation process, including peer reviews by independent maritime subject matter experts. By synthesizing diverse data streams and stakeholder perspectives, this methodology yields a holistic view of current market dynamics and strategic imperatives for the marine actuators and valves sector.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Marine Actuators & Valves market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Marine Actuators & Valves Market, by Valve Type

- Marine Actuators & Valves Market, by Actuator Type

- Marine Actuators & Valves Market, by Application

- Marine Actuators & Valves Market, by Material

- Marine Actuators & Valves Market, by Size

- Marine Actuators & Valves Market, by Pressure Rating

- Marine Actuators & Valves Market, by Region

- Marine Actuators & Valves Market, by Group

- Marine Actuators & Valves Market, by Country

- United States Marine Actuators & Valves Market

- China Marine Actuators & Valves Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1113 ]

Bringing Together Segmentation Excellence, Regional Adaptability, and Collaborative Innovation to Define Leadership in Maritime Control Systems

In sum, the marine actuators and valves market stands at the nexus of mechanical tradition and digital transformation, challenged by evolving trade policies, demanding regulatory frameworks, and the relentless pursuit of operational efficiency. Recognizing the intricate segmentation factors-ranging from valve and actuator types to application, material, size, and pressure classifications-is crucial for aligning product strategies with end-user needs.

Moreover, regional market nuances in the Americas, Europe, Middle East & Africa, and Asia-Pacific underscore the necessity of tailored approaches in design, compliance, and supply chain structuring. Industry players who capitalize on modular designs, forge strategic partnerships, and embed digital intelligence into their product portfolios are poised to set the benchmark for reliability and innovation. As the sector continues to navigate tariff headwinds and environmental imperatives, the companies that adapt most proactively will secure a competitive advantage in this critical maritime component landscape.

Seize Strategic Advantage Now by Engaging Directly with Our Associate Director of Sales & Marketing for Customized Access and Expert Guidance

To unlock the full potential of this comprehensive analysis and gain exclusive strategic insights tailored to your organization’s needs, we invite you to connect with Ketan Rohom, Associate Director of Sales & Marketing, to secure a complete copy of the report and explore bespoke consultancy options

- How big is the Marine Actuators & Valves Market?

- What is the Marine Actuators & Valves Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?