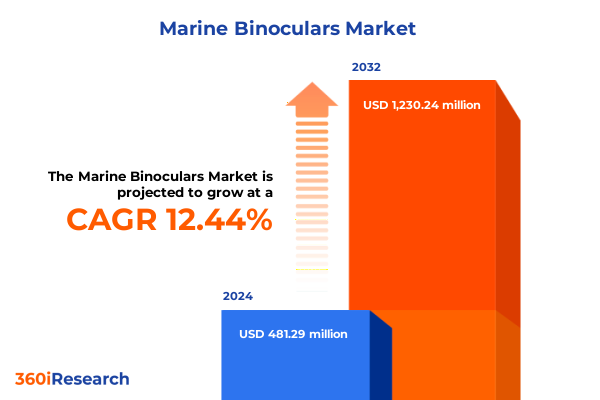

The Marine Binoculars Market size was estimated at USD 540.76 million in 2025 and expected to reach USD 599.37 million in 2026, at a CAGR of 12.45% to reach USD 1,230.24 million by 2032.

Exploring the Marine Binoculars Market Context Technological Drivers and Regulatory Forces Shaping Future Industry Directions

The marine binoculars market is at a transformative crossroads, driven by technological breakthroughs, evolving end user demands, and heightened regulatory pressures. In recent years, advancements in optics, coatings, and digital integration have elevated product performance to new heights, while shifting consumer expectations have created demand for greater durability, ease of use, and connectivity features. Regulatory developments addressing maritime safety and environmental sustainability have further shaped the landscape, compelling manufacturers and end users alike to adapt their strategies and investments in high-performance visual equipment.

Against this backdrop, our executive summary establishes the purpose and scope of this market research report, outlining the core themes and structure that will guide readers through in-depth analysis. We begin by examining key transformative shifts redefining industry dynamics, before diving into the cumulative impact of United States tariff measures on supply chains, cost structures, and strategic planning in 2025. Subsequent sections unpack nuanced segmentation insights across end user, product type, sales channel, and magnification categories, followed by a regional breakdown that highlights growth pockets and risk factors in the Americas, Europe, Middle East & Africa, and Asia-Pacific regions. We conclude with an overview of leading companies, actionable recommendations for industry leaders, our research methodology, and a compelling call-to-action to engage with our full report.

Uncovering Major Technological Innovations Changing Performance Standards While End Users Demand Greater Durability and Environmental Responsibility

In recent years, transformative shifts in the marine binoculars landscape have emerged as pivotal forces redefining product design, manufacturing, and market adoption. Technological advancements such as the incorporation of phase-corrected roof prisms, hydrophobic and oleophobic coatings, and integrated digital compasses have enhanced optical clarity, water resistance, and navigational functionality. These features not only improve user experience during recreational and professional maritime activities but also set new performance benchmarks that redefine quality expectations across all end-user categories.

Simultaneously, changing end user behaviors and preferences have exerted significant influence on manufacturers’ strategic roadmaps. Recreational sailors and wildlife enthusiasts, for instance, now demand lightweight, ergonomically optimized devices that deliver uncompromised image quality. Commercial operators within marine tourism and offshore energy sectors seek ruggedized equipment capable of withstanding corrosive environments and heavy usage. In defense applications, demand centers on advanced thermal imaging compatibility and low-light performance, underscoring the importance of specialized optical innovations. As a result, companies are accelerating R&D investments and forming strategic partnerships to keep pace with this diverse spectrum of market expectations.

Regulatory trends have contributed another layer of complexity to the transformation. Stricter maritime safety standards and environmental regulations mandate higher durability and reduced ecological footprint, driving the adoption of sustainable materials and eco-friendly manufacturing processes. Initiatives aimed at minimizing plastic waste and promoting recyclable components have gained traction, influencing supplier selection and product lifecycle management. Together with heightened supply chain transparency requirements, these regulatory influences compel stakeholders across the value chain to embrace greater accountability and innovation, further accelerating the market’s evolution.

Assessing the Comprehensive Impacts of United States Tariff Measures on Supply Chains Cost Structures and Strategic Planning in 2025

The imposition of new United States tariffs in early 2025 has introduced significant shifts in cost structures, procurement strategies, and supplier networks within the marine binoculars market. Applied to key optical components and finished products originating from major manufacturing hubs, these tariff measures have heightened landed costs, squeezing margins for original equipment manufacturers (OEMs) and distributors. In response, many companies have re-evaluated existing sourcing strategies, exploring alternative procurement from tariff-free or lower-rate regions to preserve competitive pricing and protect profitability.

Cost pressures have also accelerated conversations around supply chain resilience and nearshoring. Firms with high-volume requirements have sought to diversify their supplier base by partnering with manufacturers in countries with more favorable trade terms and robust optical component capabilities. Such realignments, while mitigating tariff exposure, introduce new logistical considerations, including quality control protocols, lead-time variability, and regulatory compliance in target regions. These evolving dynamics underscore the strategic importance of proactive supply chain management and flexible procurement frameworks.

Beyond immediate cost impacts, the long-term repercussions of the 2025 tariffs extend to market entry decisions, R&D investments, and pricing strategies. Companies that previously relied on low-cost imports are reevaluating manufacturing footprints, evaluating contract manufacturing or joint ventures in tariff-advantaged locations. Meanwhile, premium-positioned brands are leveraging product differentiation and enhanced features to justify value-based pricing, absorbing a portion of tariff-driven cost increases. As a result, the 2025 tariff environment serves as both a challenge and catalyst for innovation, prompting companies to revisit their global strategies and prioritize agility in an increasingly complex trade ecosystem.

Delivering Precise Market Perspectives through End User Product Type Sales Channel and Magnification-Based Segmentation

In analyzing the marine binoculars market through four critical segmentation lenses, differentiated insights emerge that inform targeted growth strategies. Based on end user, the market encompasses three primary categories: Commercial, Defense, and Recreational. Within Commercial use, distinct sub-domains such as marine tourism, offshore energy, and shipping reveal unique performance and regulatory requirements, from high-precision optical navigation in offshore oil platforms to durable, high-contrast imaging for charter boat excursions.

Product type segmentation further refines the competitive environment, with offerings divided into Porro prism and Roof prism configurations. Porro prism models maintain relevance among users seeking robust, cost-efficient solutions suited to recreational and certain commercial applications, while Roof prism variants dominate professional and defense sectors where compactness, weight savings, and phase-corrected clarity are paramount. This differentiation shapes R&D priorities, marketing narratives, and channel strategies across the market.

Examining sales channels highlights the coexistence of offline and online routes to market. Traditional brick-and-mortar outlets remain critical for hands-on demonstrations and immediate post-sale support, whereas digital channels are rapidly gaining ground. Within online distribution, brand websites and third-party e-commerce platforms serve distinct roles: brand websites foster direct engagement and higher margin capture, and third-party platforms deliver broader reach and volume opportunities. Successful players orchestrate a seamless omnichannel experience to cater to evolving customer behaviors.

The magnification-based segmentation categorizes products into three tiers: options offering magnification levels up to 7X, the core segment spanning 8X to 10X, and high-power models exceeding 10X. Each tier addresses varying user needs, from wide-field, stable viewing near harbors and docks to high-zoom observation for distant navigational markers or surveillance tasks. Manufacturers calibrate their product portfolios across these magnification segments to align with application-specific performance demands and margin profiles.

This comprehensive research report categorizes the Marine Binoculars market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Magnification

- Sales Channel

- End User

Revealing Distinct Demand Profiles and Competitive Drivers across the Americas Europe Middle East Africa and Asia-Pacific Regions

A nuanced regional analysis of the marine binoculars market unveils differentiated dynamics across the Americas, Europe Middle East & Africa, and Asia-Pacific. In the Americas, robust marine tourism, well-established naval operations, and a growing appetite for recreational water sports drive sustained demand. The United States and Canada represent mature demand centers for premium-feature roof prism devices, while emerging markets in Latin America are increasingly embracing entry-level and mid-range Porro prism models to support expanding coastal tourism and commercial fishing activities.

Across Europe, Middle East & Africa, regulatory alignment with stringent maritime safety directives and heightened environmental standards have heightened demand for sustainable and high-durability optical equipment. Western Europe’s advanced yacht charter industry and North Sea offshore energy platforms sustain a preference for top-tier professional binoculars, while Mediterranean leisure boating stimulates demand for mid-range solutions that balance performance and cost. In the Middle East and select African coastal hubs, investments in port infrastructure and naval modernization underpin growth opportunities, though political volatility and per-unit cost sensitivities require tailored market entry approaches.

Asia-Pacific emerges as a pivotal growth frontier, driven by expansive commercial shipping volumes, increasingly affluent recreational segments, and government-led maritime security initiatives. Key markets such as China, Japan, and South Korea prioritize high-magnification, digitally integrated models for both defense and commercial surveillance applications. At the same time, Southeast Asian archipelagos present dual demand streams: cost-sensitive solutions for local fisheries and high-performance variants for luxury cruise operators. Regional supply chain clustering and rising domestic manufacturing capabilities further influence competitive positioning and pricing strategies.

This comprehensive research report examines key regions that drive the evolution of the Marine Binoculars market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Analyzing the Competitive Landscape through Established Optical Leaders Embracing Digital Disruption and Strategic Partnerships

The competitive arena of marine binoculars is defined by a blend of legacy optical specialists and agile new entrants that collectively shape market direction. Established optics manufacturers leverage deep technical expertise, proprietary prism technologies, and global distribution networks to maintain brand prestige and customer trust. These incumbents continue to expand their portfolios with premium coatings, digital integration modules, and customizable accessories that reinforce traditional strengths in clarity and durability.

Conversely, emerging players and electronics-focused firms are entering the fray with value-engineered offerings that emphasize digital connectivity, augmented reality overlays, and mobile app integration. These newcomers leverage software development capabilities and cost-effective manufacturing partnerships to challenge incumbents on both functionality and price. Strategic partnerships between optics companies and electronics innovators have become increasingly common, as evidenced by modular attachment systems that deliver real-time data overlays on traditional binocular platforms.

Mergers, acquisitions, and cross-sector collaborations represent another dimension of competitive activity. Industry leaders seek to bolster product breadth and geographical reach by assimilating specialized optics workshops or investing in regional manufacturing hubs. Simultaneously, joint ventures with maritime technology providers enable integrated solutions that combine advanced imaging with autonomous vessel navigation systems. This flurry of activity underscores a broader trend toward convergence, where optics excellence and digital innovation coalesce to meet evolving market expectations.

This comprehensive research report delivers an in-depth overview of the principal market players in the Marine Binoculars market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ATN Corporation

- Bresser GmbH

- Bushnell Corporation

- Canon Inc.

- Carson Optical Inc.

- Celestron LLC

- Fujinon Corporation

- Kowa Company Ltd.

- Leica Camera AG

- Leupold & Stevens Inc.

- Meade Instruments Corporation

- Minox GmbH

- Nikon Corporation

- Olympus Corporation

- Orion Telescopes & Binoculars

- Pentax Ricoh Imaging Company Ltd.

- Simmons Optics

- Steiner GmbH

- Swarovski Optik KG

- Tasco Worldwide

- Vixen Co. Ltd.

- Vortex Optics

- Zeiss International

Enabling Sustainable Growth through Innovation Diversified Sourcing and an Integrated Omnichannel Market Approach

To navigate the evolving marine binoculars market and secure competitive advantage, industry leaders must adopt a multi-pronged approach that melds innovation with operational resilience. Prioritizing R&D investments in advanced prism technologies and eco-friendly materials will position companies at the forefront of regulatory compliance and performance differentiation. Collaborative research programs with academic institutions and optics research labs can accelerate the development of next-generation coatings, lens formulations, and miniaturized electronic components.

Simultaneously, diversification of procurement and manufacturing footprints is critical to mitigate trade-related headwinds and supply disruptions. Establishing dual-sourcing agreements in complementary geographies with tariff-favorable conditions can help maintain cost stability and shorten lead times. Companies should also consider nearshoring select production activities to improve supply chain transparency, lower transportation risk, and enhance responsiveness to fluctuating market demands.

On the go-to-market side, cultivating an integrated omnichannel ecosystem that harnesses the strengths of offline retail and targeted digital platforms will be key. By optimizing brand websites for direct engagement and employing data analytics to personalize online shopping experiences, companies can capture higher margins while expanding reach through third-party e-commerce partners. Finally, pursuing strategic alliances with maritime service providers, defense contractors, and tourism operators can unlock new distribution channels and co-branding opportunities, further solidifying market positions.

Ensuring Analytical Rigor through Integrated Primary Interviews Secondary Research Data Triangulation and Quality Control

This report’s findings are grounded in a rigorous multi-phase research methodology designed to ensure comprehensive coverage and analytical precision. Our primary research phase involved in-depth interviews with key stakeholders across the value chain, including OEM executives, raw material suppliers, distributors, and end users spanning commercial, defense, and recreational segments. These candid discussions provided nuanced perspectives on emerging trends, unmet customer needs, and strategic priorities driving investment decisions.

Complementing primary inputs, extensive secondary research encompassed reviews of industry journals, technical whitepapers, regulatory filings, trade association reports, and patent databases. This rich information corpus was systematically examined to validate primary insights, identify technological breakthroughs, and track competitive developments. Data triangulation techniques were employed to reconcile discrepancies, ensuring that conclusions rest on verifiable and convergent evidence.

Quantitative analysis focused on mapping segmentation trends, channel performance, and regional demand patterns, leveraging both historical shipment data and current industry indicators. Our expert panel also conducted cross-verification exercises with independent market analysts and maritime equipment consultants to confirm interpretation and relevance. Throughout the process, stringent quality control measures-including peer reviews, editorial audits, and consistency checks-were applied to uphold the highest standards of accuracy and objectivity.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Marine Binoculars market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Marine Binoculars Market, by Product Type

- Marine Binoculars Market, by Magnification

- Marine Binoculars Market, by Sales Channel

- Marine Binoculars Market, by End User

- Marine Binoculars Market, by Region

- Marine Binoculars Market, by Group

- Marine Binoculars Market, by Country

- United States Marine Binoculars Market

- China Marine Binoculars Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1113 ]

Synthesizing Key Findings and Strategic Imperatives for Navigating a Rapidly Evolving Marine Binoculars Market Landscape

In conclusion, the marine binoculars market is poised at an inflection point where technological innovation, shifting end user requirements, and evolving geopolitical factors converge to redefine competitive advantage. Advanced optical designs, sustainable manufacturing practices, and digital feature integration will serve as primary differentiators as companies strive to capture diverse commercial, defense, and recreational demand streams. Meanwhile, regional nuances and tariff dynamics will continue to influence supply chain strategies and go-to-market execution.

As industry leaders contemplate the road ahead, the imperative to balance performance, cost efficiency, and regulatory compliance grows ever more complex. Those that proactively invest in R&D, cultivate flexible sourcing networks, and orchestrate seamless omnichannel experiences will be best positioned to thrive in a landscape characterized by rapid change and escalating customer expectations. By leveraging the insights and recommendations presented in this report, stakeholders can chart a course toward sustainable growth and enduring market leadership.

Unlock Exclusive Marine Binoculars Market Intelligence and Secure Your Strategic Advantage with Expert Guidance from an Industry Leader

To learn more about the comprehensive marine binoculars market research and secure your organization’s competitive edge, please reach out to Ketan Rohom, Associate Director of Sales & Marketing. Ketan will guide you through the detailed findings, answer your specific questions, and facilitate the purchase of the full report so that your team can leverage actionable insights and strategic intelligence without delay.

- How big is the Marine Binoculars Market?

- What is the Marine Binoculars Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?