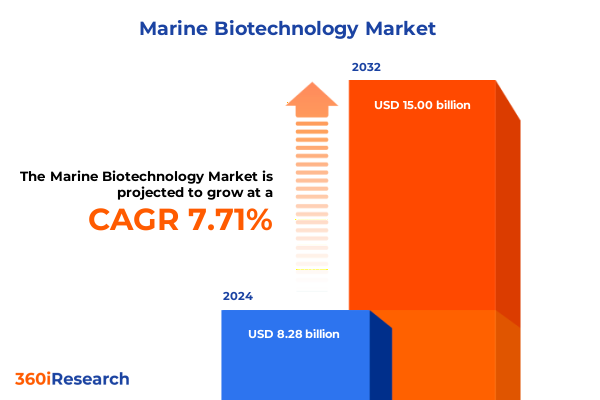

The Marine Biotechnology Market size was estimated at USD 8.88 billion in 2025 and expected to reach USD 9.53 billion in 2026, at a CAGR of 7.77% to reach USD 15.00 billion by 2032.

Unveiling the Ocean’s Potential: Introduction to the Expanding Horizons and Strategic Imperatives in Marine Biotechnology

Marine biotechnology harnesses the rich biodiversity of the world’s oceans to deliver innovative solutions across healthcare, environmental sustainability, and industrial applications. By exploring the molecular treasures of corals, algae, fungi, and marine viruses, researchers and companies are uncovering novel bioactive compounds and biomaterials that offer unique functional properties not found in terrestrial systems. This field has become a critical frontier for addressing global challenges such as antibiotic resistance, renewable energy, and climate-resilient food production.

Advances in high-throughput sequencing, bioinformatics, and synthetic biology have accelerated the pace of discovery, enabling the rapid identification of promising marine-derived molecules and pathways. As a result, collaborations between academic institutions, government agencies, and private enterprises have intensified, creating a vibrant innovation ecosystem. Despite this momentum, companies must navigate complex regulatory landscapes, environmental considerations, and evolving trade policies to translate scientific breakthroughs into viable products.

This executive summary presents a strategic overview of the marine biotechnology sector. It highlights the transformative shifts in research and development paradigms, examines the cumulative effects of recent United States tariff actions, provides segmentation and regional insights, profiles leading industry players, offers actionable recommendations for decision-makers, and details the rigorous research methodology employed. Together, these sections equip stakeholders with the clarity and foresight required to capitalize on the ocean’s untapped potential.

Navigating Radical Advances and Emerging Technologies That Are Propelling the Marine Biotechnology Landscape into a New Era of Innovation

Marine biotechnology has been reshaped by a confluence of groundbreaking scientific and technological developments that are redefining the scope of ocean-based research and commercialization. High-throughput sequencing platforms, machine learning–driven compound screening, and synthetic biology approaches have converged to create a fertile environment for discovery. These tools allow for rapid decryption of complex marine genomes, enable predictive modeling of bioactive molecule interactions, and facilitate the engineering of microbial cell factories optimized for industrial-scale production. This leap from labor-intensive natural product isolation to integrative omics and computational design marks a paradigm shift in how marine resources are harnessed.

In parallel, culture-independent techniques have emerged as essential instruments for exploring microbial dark matter. Metagenomic and metatranscriptomic analyses bypass the need to cultivate elusive marine microorganisms, capturing functional potential directly from environmental samples. Simultaneously, advances in isolation and cultivation protocols, such as microfluidic droplet systems and in situ incubation chambers, have substantially increased the recovery rate of previously unculturable strains. These complementary approaches expand the accessible chemical space, accelerating the identification of novel enzymes, antimicrobial agents, and biochemical pathways.

Furthermore, evolving regulatory frameworks and increased investment from governmental and philanthropic entities are catalyzing translational efforts. Adaptive policies that encourage bioprospecting while safeguarding biodiversity, combined with collaborative research consortia and open-access data repositories, have streamlined the path from discovery to market. Together, these transformative shifts underscore a rapidly evolving landscape wherein scientific ingenuity and strategic partnerships converge to unlock the vast potential of marine biotechnology.

Assessing the Comprehensive Effects of the 2025 United States Tariff Regime on Marine Biotechnology Supply Chains and Competitive Dynamics

In 2025, the United States implemented a revised tariff regime targeting a range of marine-derived raw materials and specialized bioproducts, reflecting broader trade policy shifts aimed at bolstering domestic manufacturing and safeguarding strategic supply chains. These measures increased duties on imports of algae biomass, coral- and sponge-derived extracts, specialized enzymes, and other intermediate goods essential to marine biotechnological processes. The immediate effect was a notable escalation in procurement costs for companies reliant on foreign-sourced feedstocks, prompting an urgent reevaluation of sourcing strategies.

Consequently, many stakeholders have begun to internalize supply chain risks by investing in domestic cultivation and extraction capabilities. Larger firms have activated capital projects to establish inshore farms for marine algae and have repurposed coastal biorefineries to produce bioactive compounds locally. Meanwhile, smaller innovators have formed cooperative ventures with academic institutions and regional authorities to secure grant funding that offsets tariff-induced expense increases. This proactive adaptation highlights the agile nature of the sector but also underscores the financial strain faced by early-stage enterprises with limited access to capital.

On the downstream side, elevated input costs have reverberated through contract research and development budgets, compelling companies to prioritize high-value targets such as pharmaceutical leads and specialty biomaterials. The tariff-driven impetus for local production has the potential to foster greater vertical integration, yet it also raises questions about scalability, regulatory compliance, and environmental stewardship. In navigating these complex dynamics, decision-makers must balance short-term cost mitigation with long-term strategic positioning in the evolving global marine biotechnology arena.

Uncovering Deep Segmentation Perspectives Across Product Types, Source Organisms, Technological Platforms, Application Verticals, and End-User Destinations

A nuanced understanding of how marine biotechnology is partitioned across product types reveals two fundamental streams: bioactive compounds, which encompass diverse chemical entities harnessed for therapeutic, nutritional, and cosmetic applications, and biomaterials, which include structurally and functionally innovative polymers and scaffolds derived from marine organisms. This dichotomy underscores the dual focus of the industry on molecular discovery and material innovation.

Delving deeper into source organisms, the landscape is populated by corals & sponges that yield complex secondary metabolites with potent bioactivities, marine algae prized for their polysaccharides, lipids, and pigments, marine fungi offering a trove of unique enzymatic and antimicrobial agents, and marine viruses whose genetic elements inform novel gene editing and antiviral strategies. Each reservoir contributes distinct biochemical profiles and fosters targeted exploration.

On the technological front, culture-independent techniques such as metagenomic sequencing and bioinformatics-driven bioprospecting unlock the hidden genomic potential of uncultured microbial communities, while traditional isolation & cultivation of microorganisms, enhanced by automated and microfluidic approaches, remains indispensable for obtaining pure cultures and validating functional attributes. These complementary methodologies accelerate lead identification and product development cycles.

The spectrum of application verticals spans aquaculture & fishery innovations that improve yield and resilience, biofuels that support renewable energy initiatives, drug discovery pipelines targeting unmet medical needs, environmental health & human health interventions addressing ecological remediation and public health, food supply enhancements through novel nutritional ingredients, and industrial products & processes including biocatalysts and bioadhesives. This breadth of use cases reflects the versatility of marine-derived technologies.

In terms of end users, the chemical sector leverages marine-sourced catalysts and specialty reagents, the cosmetics industry incorporates marine extracts for skin and hair care, the energy domain explores algae-based fuels and bioenergy platforms, the food industry integrates novel proteins and nutraceuticals to meet evolving dietary trends, and the medical & pharmaceutical segment exploits marine molecules for drug development and medical devices. This multifaceted end-user engagement drives interdisciplinary collaboration and market diversification.

This comprehensive research report categorizes the Marine Biotechnology market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Source

- Technology

- Application

- End-User

Illuminating Regional Dynamics and Strategic Priorities Across the Americas, Europe Middle East & Africa, and Asia-Pacific Markets

In the Americas, the confluence of robust public funding initiatives, a sophisticated regulatory framework for bioprospecting, and established biotechnology infrastructure has positioned North America as a nexus for marine-derived drug discovery and advanced biomaterials research. Leading academic institutions and contract research organizations collaborate closely with innovative start-ups to translate ocean-derived discoveries into preclinical and clinical development programs. Simultaneously, Latin American nations leverage rich coastal biodiversity to develop regionally tailored aquaculture solutions, fostering local production of high-value bioactive extracts and supporting community-based commercial ventures. This dynamic interplay between established markets and emerging coastal economies augments the Americas’ strategic role in global marine biotechnology.

Europe, the Middle East & Africa present a distinctive mosaic of innovation hubs and sustainable practice initiatives. Western European countries capitalize on stringent environmental regulations and progressive policy incentives to drive sustainable extraction methods and circular bioeconomy models. In parallel, research consortia spanning the Middle East explore desert–sea interfaces for novel extremophiles, while African coastal nations engage in capacity-building programs aimed at harnessing indigenous marine resources for food security and public health solutions. The synergy among these regions fosters a collaborative ethos that balances commercial objectives with ecological stewardship.

Asia-Pacific stands out for its rapid adoption of industrial-scale cultivation technologies and biorefinery platforms. Countries such as China, Japan, Australia, and South Korea have invested heavily in large-scale algae farms and marine microbial fermentation facilities, supporting both biofuel generation and commodity biochemicals production. Additionally, emerging markets in Southeast Asia explore traditional knowledge systems to discover bioactive compounds, integrating ethnobotanical insights with modern screening workflows. This blend of scale, innovation, and cultural heritage sustains Asia-Pacific’s leadership in diverse application areas.

Together, these regional dynamics highlight the importance of tailored strategies that align technological capabilities, policy frameworks, and resource endowments. Stakeholders seeking to expand their global footprint in marine biotechnology must account for region-specific regulatory landscapes, funding ecosystems, and collaborative networks to optimize research outcomes and commercial success.

This comprehensive research report examines key regions that drive the evolution of the Marine Biotechnology market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Marine Biotechnology Enterprises Demonstrating Pioneering Research, Strategic Alliances, and Market-Driving Innovations

The competitive landscape of marine biotechnology features a cadre of enterprises that have distinguished themselves through rigorous scientific portfolios and strategic collaborations. Major enzyme manufacturers have been at the forefront, integrating marine-derived catalysts into industrial processes to enhance reaction efficiencies and reduce environmental footprints. These firms have established dedicated research centers focused on mining deep-sea microbes and synthetic biology platforms, resulting in streamlined pipelines for new enzyme variants with tailored properties. Strategic alliances with academic institutions and technology platforms underpin their efforts to maintain a competitive edge.

Meanwhile, companies specializing in marine algal bioactives and biomaterials have transformed niche research into scalable operations. Through investments in automated photobioreactor systems and biorefinery technologies, these innovators steadily increase throughput of polysaccharides, lipids, and high-value peptides. Partnerships with cosmetic and pharmaceutical brands have expedited the transition from lab-scale discovery to consumer-facing products, signaling the maturing commercialization model within the sector.

A third segment comprises contract research and manufacturing organizations that offer end-to-end capabilities in marine-derived molecule discovery, process optimization, and regulatory support. By providing access to high-capacity screening libraries, advanced fermentation infrastructure, and bioassay platforms, these service providers enable emerging biotechnology ventures to accelerate development timelines while managing capital requirements. Their role as enablers has become increasingly vital in a landscape shaped by complex supply chains and evolving tariff structures.

Collectively, these diverse corporate profiles illustrate a shifting paradigm in which integrated R&D investments, strategic partnerships, and scalable manufacturing capabilities drive sustained innovation. As the sector continues to mature, the interplay between specialized technology developers and service-oriented enterprises will define the competitive contours of the marine biotechnology landscape.

This comprehensive research report delivers an in-depth overview of the principal market players in the Marine Biotechnology market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Aker BioMarine ASA

- BASF SE

- Benchmark Holdings plc

- Biolchim Group by J.M. Huber Corporation

- BioLume, Inc.

- BlueBioTech GmbH

- Cellana Inc.

- Corbion N.V.

- DSM-Firmenich AG

- Earthrise Nutritionals LLC

- GeoMarine Biotechnologies (P) LTD

- GlycoMar Ltd.

- Marine Biopolymers Ltd.

- Marinova Pty Ltd

- Marshall Marine Products

- Nofima

- oceanBASIS GmbH

- Pharma Mar, S.A.

- PROLUME, LTD

- Seppic S.A.

- The GELITA Group

- Veramaris V.O.F.

- Xanthella Ltd.

- ZIVO Bioscience, Inc.

Actionable Strategic Recommendations for Industry Leaders to Harness Marine Biotechnologies, Navigate Trade Barriers, and Drive Sustainable Growth

To capitalize on emerging opportunities and mitigate evolving risks, industry leaders should prioritize integrated technology portfolios that combine culture-independent discovery with advanced cultivation platforms. By allocating resources to metagenomic and bioinformatics capacities alongside investments in next-generation microfluidics and in situ incubation systems, organizations can accelerate the identification of novel bioactive targets and streamline scale-up pathways. This dual focus ensures that both high-throughput screening and downstream production capabilities are optimized for efficiency and resilience.

Simultaneously, companies must diversify supply chains by fostering domestic cultivation initiatives and robust strategic alliances. Establishing inshore algae farms, supporting coastal biorefineries, and partnering with local research institutions can reduce dependence on imported raw materials and attenuate exposure to tariff pressures. Cooperative frameworks that leverage grant funding and government incentives will further strengthen regional production networks and secure critical feedstock accessibility.

Engagement with policymakers and regulatory bodies is also essential. Proactive collaboration to develop science-driven, adaptive regulatory frameworks will expedite bioprospecting approvals, facilitate cross-border material transfers, and ensure equitable access to genetic resources. By participating in industry consortiums and public–private dialogues, stakeholders can help shape policies that balance innovation, biodiversity conservation, and economic competitiveness.

Finally, fostering cross-sector partnerships that integrate environmental sustainability and circular economy principles will enhance long-term viability. Initiatives such as byproduct valorization, waste-to-resource conversion, and transparent supply chain certification will demonstrate corporate stewardship and meet growing consumer and investor expectations. Together, these recommendations offer a strategic roadmap for navigating complexity and achieving sustainable growth in marine biotechnology.

Detailing the Robust Research Methodology Employed to Ensure Comprehensive, Objective, and High-Quality Insights in Marine Biotechnology Analysis

The foundational quality and reliability of this marine biotechnology analysis stem from a rigorous mixed-methods research approach that integrates primary and secondary data sources. Extensive primary research included structured interviews and workshops with leading industry executives, academic researchers, regulatory authorities, and technology providers. Input from these stakeholders offered nuanced perspectives on strategic priorities, technological bottlenecks, and market adaptation strategies, ensuring that insights are grounded in real-world operational contexts.

Complementing this, secondary research efforts encompassed a thorough review of peer-reviewed journal articles, patent databases, industry white papers, and conference proceedings. Publicly available government reports and policy documents were analyzed to map the evolving regulatory environment and tariff frameworks. This holistic synthesis of scientific literature and trade data provided a comprehensive backdrop against which emerging trends were identified and validated.

Quantitative and qualitative data were subjected to meticulous triangulation processes. Comparative analysis of interview findings, publication trends, and policy developments ensured consistency and robustness. Discrepancies were addressed through follow-up inquiries and cross-referencing with reputable data repositories. Advanced analytical tools, including thematic coding software and statistical modeling, were employed to discern patterns, correlations, and strategic inflection points.

A stringent quality assurance protocol underpinned the entire research lifecycle. Peer review by external subject-matter experts verified methodological integrity and interpretation accuracy. Ethical considerations, such as the responsible handling of proprietary information and adherence to biodiversity conservation guidelines, were rigorously maintained. This disciplined research framework underlies the credibility and actionable value of the insights presented herein.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Marine Biotechnology market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Marine Biotechnology Market, by Product Type

- Marine Biotechnology Market, by Source

- Marine Biotechnology Market, by Technology

- Marine Biotechnology Market, by Application

- Marine Biotechnology Market, by End-User

- Marine Biotechnology Market, by Region

- Marine Biotechnology Market, by Group

- Marine Biotechnology Market, by Country

- United States Marine Biotechnology Market

- China Marine Biotechnology Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 954 ]

Synthesizing Key Findings and Strategic Imperatives That Shape the Future Trajectory of Marine Biotechnology Innovations

This analysis has illuminated the dynamic evolution of marine biotechnology, characterized by transformational advances in sequencing and cultivation technologies, the pronounced effects of recent United States tariff adjustments on supply chain strategies, and the multifaceted segmentation across product types, source organisms, technological platforms, applications, and end-user domains. Regional insights reveal distinct innovation ecosystems in the Americas, Europe Middle East & Africa, and Asia-Pacific, while leading enterprises exemplify the integration of R&D prowess and strategic partnerships that drive market innovation. Practical recommendations emphasize the importance of dual-technology investments, supply chain diversification, regulatory engagement, and sustainability-driven collaborations.

Looking ahead, stakeholders who effectively integrate these insights will be best positioned to navigate an increasingly complex global landscape. By aligning technological capabilities with strategic policy engagement and sustainable operational practices, industry leaders can unlock the vast potential of marine-derived solutions while fostering resilience against external trade and environmental pressures. The future trajectory of marine biotechnology will be shaped by those who blend scientific rigor with proactive strategy, securing competitive advantage and delivering transformative benefits across health, energy, environmental, and industrial sectors.

Connect Directly with Ketan Rohom to Secure Customized Marine Biotechnology Market Intelligence and Purchase the Comprehensive Research Report

For organizations seeking in-depth intelligence and actionable recommendations tailored to the nuances of marine biotechnology, a comprehensive report is available to guide strategic decision-making.

To obtain this authoritative research document, stakeholders are invited to connect directly with Ketan Rohom, Associate Director, Sales & Marketing at 360iResearch. Mr. Rohom can provide detailed information on report contents, customization options, and enterprise licensing arrangements, ensuring that your team has the precise market intelligence needed to stay ahead of regulatory developments, supply chain shifts, and technological advancements. Reach out today to secure access to the full analysis and position your organization for success in the rapidly evolving marine biotechnology arena.

- How big is the Marine Biotechnology Market?

- What is the Marine Biotechnology Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?