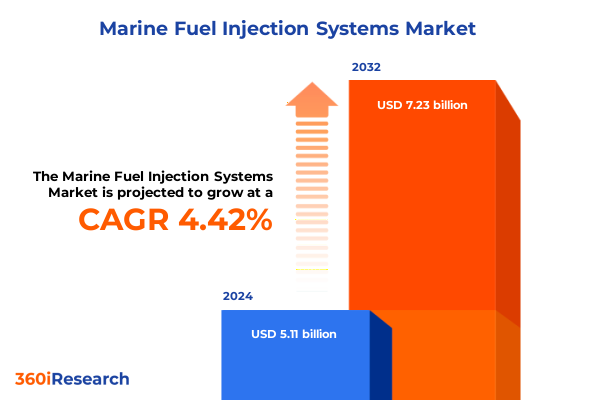

The Marine Fuel Injection Systems Market size was estimated at USD 5.33 billion in 2025 and expected to reach USD 5.55 billion in 2026, at a CAGR of 4.45% to reach USD 7.23 billion by 2032.

Navigating The Evolution Of Marine Fuel Injection Systems Amid Increasing Regulatory Demands Environmental Pressures And Technological Innovation

The landscape of marine propulsion is undergoing a profound transformation driven by evolving regulatory frameworks, intensifying environmental concerns, and the perpetual pursuit of operational excellence. Marine fuel injection systems occupy a central position within this narrative, serving as the nexus between raw energy sources and the dynamic power demands of vessels across commercial, leisure, and defense sectors. In recent years, regulatory bodies worldwide have imposed increasingly stringent emissions standards, prompting manufacturers to innovate beyond traditional mechanical injection architectures and embrace sophisticated electronic control mechanisms. Concurrently, the advent of digital connectivity has elevated fuel injection systems from mere mechanical assemblies to integrated platforms capable of real-time performance monitoring, predictive diagnostics, and adaptive tuning, thereby redefining the criteria for reliability and efficiency at sea.

As shipowners and operators navigate the dual imperatives of cost containment and environmental stewardship, the importance of advanced fuel injection technologies cannot be overstated. The industry stands at the confluence of ambitious carbon reduction targets and heightened scrutiny over particulate and NOx emissions, which have catalyzed the shift toward low-sulfur fuels, dual-fuel configurations, and hybrid powertrain solutions. Beyond emissions compliance, vessel operators are increasingly seeking solutions that optimize fuel consumption under diverse load profiles and sea conditions, minimize lifecycle maintenance expenditures, and deliver consistent performance during extended voyages. This introduction lays the groundwork for understanding how marine fuel injection systems are evolving in response to multifaceted pressures and why a deep dive into this domain is critical for stakeholders committed to future-proofing their fleets.

Embracing Next Generation Marine Fuel Injection Technologies To Drive Efficiency Sustainability Operational Agility And Unleash Unprecedented Performance

The transformative shifts reshaping marine fuel injection systems are underpinned by a rapid confluence of technological advancements and changing operational requirements. Manufacturers are embedding real-time data acquisition and analytics capabilities within injection modules, enabling dynamic adjustment of injection timing and pressure parameters in response to instantaneous load and environmental feedback. This level of integration is facilitated by the proliferation of advanced sensors and the maturation of maritime edge computing, which collectively unlock predictive maintenance paradigms that pre-empt component failures, reduce unscheduled downtime, and extend service intervals. Additionally, additive manufacturing techniques are being leveraged to produce complex injector geometries that optimize fuel atomization while reducing weight, leading to enhancements in combustion efficiency and emissions performance.

Concurrently, the industry is witnessing a concerted effort to broaden the spectrum of compatible fuel sources. The rise of dual-fuel engines, capable of seamlessly switching between conventional diesel and alternative fuels such as liquefied natural gas or bio-derived blends, reflects the sector’s pivot toward decarbonization pathways. Hybrid architectures are also gaining traction, wherein battery systems work in tandem with advanced injection engines to deliver peak load support and silent operation capabilities. Furthermore, digital twins of injection systems are becoming essential for virtual testing and validation, accelerating time-to-market for new designs and enabling rapid customization for niche vessel segments. Together, these transformative shifts illustrate how the intersection of advanced materials, digitalization, and fuel diversity is driving the next generation of marine propulsion solutions.

Assessing The Cumulative Impact Of Recent United States Tariffs On Marine Fuel Injection Components And Supply Chain Dynamics

The United States has implemented a series of tariff measures in recent years that have significantly influenced the cost structure and sourcing strategies within the marine fuel injection systems ecosystem. Initially imposed under broad Section 301 provisions targeting steel, aluminum, and selected automotive components, these duties have been progressively extended to encompass key injection system parts and raw materials imported from several major offshore manufacturing hubs. The cumulative effect has been a notable uptick in landed costs, prompting manufacturers and vessel owners to reevaluate their supplier networks and consider nearshoring or reshoring options. Many industry players have responded by diversifying procurement channels to mitigate dependency on high-tariff sources, balancing cost considerations with the imperative to secure reliable, high-quality components.

Moreover, the tariff environment has accelerated investment in domestic production capabilities, as stakeholders seek to insulate themselves from volatility in trade policy and currency fluctuations. Several component makers have established new facilities within port-adjacent industrial zones to streamline logistics and capitalize on available workforce expertise. While such developments have led to incremental improvements in supply chain resilience, they have also introduced challenges related to scale-up costs and lead times for new capacity. In response, collaboration between injection system OEMs and US-based suppliers has intensified, with joint ventures and strategic alliances emerging as preferred vehicles for sharing risk and fostering innovation. These dynamics underscore how trade policy shifts in 2025 have catalyzed a reconfiguration of the marine injection supply chain, with long-term implications for competitiveness and innovation capacity.

Deep Dive Into Critical Segmentation Insights Revealing Market Drivers Fuel Types Vessel Applications And Component Dynamics

A comprehensive examination of the marine fuel injection market through multiple segmentation lenses reveals nuanced drivers that underpin industry growth and innovation. When analyzed by fuel type, conventional diesel remains the bedrock of system design, though dual-fuel configurations are rapidly gaining traction as operators seek flexibility to navigate fluctuating bunker pricing. Gasoline-compatible injection architectures, while representing a smaller niche, are experiencing renewed interest in specialized leisure craft where noise and vibration reduction take precedence. Shifting focus to application segments, commercial vessels account for the lion’s share of overall demand due to the imperative for reliability and fuel economy on long-haul routes; leisure boats emphasize compactness and user-friendly interfaces; naval vessels prioritize hardened designs capable of operating under extreme conditions.

Engine type segmentation further illuminates market tendencies, with four-stroke systems dominating in power ranges up to medium horsepower due to their balance of efficiency and ease of maintenance. Two-stroke injection engines, on the other hand, prevail in large deep-water tonnage applications, where high-power density and adherence to stringent emissions regulations are critical. Injection technology analysis highlights a clear transition toward direct injection setups, which offer superior fuel control and lower particulate outputs compared to indirect configurations. Distribution channel breakdown shows aftermarket services flourishing as operators extend maintenance cycles, while original equipment manufacturer channels capitalize on integrated solutions during newbuild projects. Evaluating vessel size discloses that small DWT craft prioritize modular, scalable injection units for rapid retrofit, medium DWT vessels seek midrange systems balancing cost and performance, and large DWT segments demand high-capacity modules engineered for heavy-duty cycles.

Power output range segmentation underscores the differentiated requirements that influence system architecture, with high horsepower engines necessitating robust pump and injector assemblies that maintain precision under elevated pressures. Medium horsepower ranges emphasize versatility and fuel economy across variable load profiles, while low horsepower systems for auxiliary functions focus on compactness and simplified controls. Finally, dissecting component-level demand uncovers that control units and sensor modules are experiencing the fastest innovation cycle as digital integration intensifies, injector pump assemblies remain vital for delivering consistent fuel metering, and nozzle designs continue to evolve toward multi-hole geometries for optimal atomization. Sensor adoption is broadening from basic pressure and temperature monitoring toward multi-parametric diagnostics, forming the backbone of real-time performance management.

This comprehensive research report categorizes the Marine Fuel Injection Systems market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Fuel Type

- Component

- Engine Type

- Injection Technology

- Vessel Size

- Power Output Range

- Application

- Distribution Channel

Unveiling Regional Market Dynamics And Distinct Growth Opportunities Across Americas Europe Middle East Africa And Asia Pacific

The Americas region possesses a distinct blend of mature markets and emerging corridors that shape the marine fuel injection landscape. In North America, stringent environmental regulations and well-established refit markets drive demand for retrofittable electronic injection upgrades and sensor-enabled control systems. Fleet operators navigating coastal trade routes benefit from localized aftermarket networks and robust service infrastructures that facilitate rapid overhaul activities. Within Central and South America, growing offshore exploration and expanding commercial shipping lanes have catalyzed investment in tailored injection solutions, while evolving regulations are prompting gradual adoption of cleaner fuel technologies.

Europe Middle East and Africa collectively present a heterogeneous panorama of regulatory regimes and vessel requirements. European Union initiatives targeting carbon neutrality by mid-century have accelerated uptake of dual-fuel and hybrid powertrains, fueling demand for versatile injection modules that accommodate LNG, hydrogen-blend fuels, and traditional marine diesel oil. In the Middle East, large-scale shipbuilding and offshore energy projects underscore the need for high-power injection systems engineered for desert and maritime interfaces, with collaborative ventures between regional shipyards and global OEMs facilitating technology transfer. African maritime operators, contending with aging fleets and limited refit infrastructure, are increasingly exploring partnerships to modernize injection systems as part of broader fleet renewal strategies.

Asia Pacific emerges as the fastest-growing zone for marine propulsion innovation, driven by rapidly expanding intra-regional trade, burgeoning leisure yacht markets, and substantial naval modernization programs. East Asian shipyards integrate advanced direct injection platforms into newly launched container carriers and bulk carriers, leveraging economies of scale to push down per-unit costs. Southeast Asia’s archipelagic geography propels demand for dual-fuel ferries and fishing fleets outfitted with injection technologies optimized for variable fuel qualities. Across Australasia, stringent emission benchmarks and proactive decarbonization roadmaps inspire early adoption of advanced sensor networks and digital twins to simulate system performance under local sea state conditions.

This comprehensive research report examines key regions that drive the evolution of the Marine Fuel Injection Systems market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Marine Fuel Injection System Providers Driving Strategic Innovation Partnerships And Competitive Differentiation

Industry incumbents and new entrants alike are intensifying their focus on innovation to secure leadership positions in the marine fuel injection sector. Legacy automotive suppliers have leveraged core competencies in high-pressure injection to transition into marine applications, capitalizing on existing research capabilities and component manufacturing expertise. These firms are competing directly with traditional marine engine producers that possess deep domain knowledge of vessel operating environments and robust service networks. Collaboration between these entities often manifests through co-development agreements that marry high-pressure pump design know-how with specialized injector tip geometries tailored for maritime fuels.

In parallel, emerging technology providers are carving niches by offering turnkey digital solutions that augment mechanical injection modules with data-driven advisory services. These companies embed advanced analytics, machine learning algorithms, and remote monitoring dashboards to help vessel operators extract actionable insights from operational data. Strategic partnerships between digital innovators and established OEMs are co-creating new value propositions, such as subscription-based performance enhancements and condition-based maintenance offerings. This convergence of mechanical and digital competencies is redefining traditional competitive boundaries, compelling all participants to evolve business models toward integrated hardware-software-service platforms.

This comprehensive research report delivers an in-depth overview of the principal market players in the Marine Fuel Injection Systems market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- BorgWarner Inc.

- Caterpillar Inc.

- Central Diesel Inc.

- Continental AG

- Cummins Inc.

- Denso Corporation

- DUAP AG

- Edelbrock, LLC

- FiTech Fuel Injection

- MAN Energy Solutions SE

- Robert Bosch GmbH

- Rolls-Royce Power Systems AG

- Wärtsilä Corporation

- Yanmar Co., Ltd.

Implementing Forward Looking Strategic Initiatives To Optimize Performance Mitigate Risks And Accelerate Value Creation In Marine Fuel Injection Systems

Industry leaders should prioritize the integration of advanced digital controls with legacy mechanical systems to deliver differentiated performance gains and predictive maintenance capabilities. By investing in modular injection architectures that support seamless upgrades of electronic control units and sensor suites, companies can extend the operational lifespan of installed fleets while unlocking new revenue streams through data monetization. Simultaneously, cultivating strategic alliances with regional component manufacturers and service providers will be vital to mitigate the effects of tariff volatility and expedite aftermarket support across critical maritime corridors.

In terms of technology roadmaps, stakeholders are advised to channel research and development budgets toward adaptive fuel injection systems capable of accommodating emerging low-carbon fuels without compromising engine longevity or reliability. Establishing pilot programs in collaboration with vessel operators and regulatory bodies will accelerate certification processes and foster market acceptance. Finally, embedding sustainability metrics into product development criteria-not merely emissions compliance-will resonate with charterers and insurers that increasingly demand demonstrable decarbonization outcomes. Through these strategic initiatives, industry players can solidify their position and capture incremental value in the rapidly evolving marine propulsion landscape.

Detailing Comprehensive Research Methodology Combining Multisource Data Collection Rigorous Analysis And Expert Validation For Robust Insights

This research employs a multi-layered methodology designed to deliver robust and actionable insights into the marine fuel injection ecosystem. Primary data collection forms the cornerstone of analysis, incorporating structured interviews with senior executives at engine manufacturers, component suppliers, shipyards, and regulatory agencies. These engagements are supplemented by detailed surveys administered to fleet operators representing commercial, leisure, and defense segments, capturing firsthand perspectives on technology adoption barriers, performance expectations, and procurement criteria.

Secondary research involved rigorous examination of industry publications, patent filings, technical standards documentation, and white papers issued by leading maritime organizations. Data triangulation techniques were applied to reconcile divergent sources and ensure reliability, while peer benchmarking provided a comparative framework for assessing competitive positioning. Quantitative analysis leveraged time-series data on import-export flows, production volumes, and maintenance cycles, all contextualized within prevailing trade policies and environmental mandates. Finally, the findings underwent expert validation sessions with a panel of veteran marine engineers, naval architects, and emissions specialists to refine interpretation and align recommendations with practical feasibility.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Marine Fuel Injection Systems market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Marine Fuel Injection Systems Market, by Fuel Type

- Marine Fuel Injection Systems Market, by Component

- Marine Fuel Injection Systems Market, by Engine Type

- Marine Fuel Injection Systems Market, by Injection Technology

- Marine Fuel Injection Systems Market, by Vessel Size

- Marine Fuel Injection Systems Market, by Power Output Range

- Marine Fuel Injection Systems Market, by Application

- Marine Fuel Injection Systems Market, by Distribution Channel

- Marine Fuel Injection Systems Market, by Region

- Marine Fuel Injection Systems Market, by Group

- Marine Fuel Injection Systems Market, by Country

- United States Marine Fuel Injection Systems Market

- China Marine Fuel Injection Systems Market

- Competitive Landscape

- List of Figures [Total: 20]

- List of Tables [Total: 1431 ]

Concluding Perspectives On The Critical Role Of Advanced Marine Fuel Injection Systems In Shaping Sustainable Maritime Operations

The interplay of regulatory imperatives, technological innovation, and shifting trade dynamics underscores the strategic importance of advanced marine fuel injection systems in modern maritime operations. As the push toward decarbonization intensifies, stakeholders must navigate a complex matrix of emissions targets, fuel diversity requirements, and digital transformation pathways. The pieces of this puzzle-from sensor-enabled direct injection modules to adaptive control algorithms-are rapidly coming together to form holistic propulsion solutions that deliver superior efficiency, reduced environmental impact, and enhanced operational resilience.

Looking ahead, the industry will confront new challenges and opportunities as alternative fuels such as hydrogen blends and synthetic e-methanol enter mainstream consideration. Integration of digital twins, augmented by artificial intelligence, promises to revolutionize system design and lifecycle management, while escalating geopolitical tensions and trade policy shifts will continue to shape sourcing strategies. In this dynamic context, organizations that proactively invest in modular, upgradable injection architectures and cultivate diversified supplier networks will be best positioned to thrive. Ultimately, the advanced marine fuel injection systems of tomorrow will not merely power vessels-they will power the sustainable evolution of global maritime trade.

Take The Next Step Toward Enhanced Maritime Performance And Secure Your Exclusive Comprehensive Market Intelligence Report Today

Achieving timely access to the full market intelligence report is essential for maintaining a competitive edge in today’s fast-evolving maritime environment. By partnering with Ketan Rohom, Associate Director of Sales & Marketing, you can secure personalized guidance and unlock exclusive insights tailored to your organization’s strategic objectives. Engaging with Ketan Rohom ensures that you receive a detailed walkthrough of the report’s findings, a clear understanding of how the data applies to your operational and expansion plans, and bespoke support for leveraging the report across decision-making forums. Connecting with Ketan Rohom opens the door to value-added services, including custom data visualizations, executive briefings, and targeted workshops designed to translate complex analysis into actionable roadmaps. Don’t delay in capitalizing on this opportunity: reach out to Ketan Rohom today to arrange a consultation, obtain immediate access to the comprehensive marine fuel injection systems study, and position your company for lasting success in the global marketplace.

- How big is the Marine Fuel Injection Systems Market?

- What is the Marine Fuel Injection Systems Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?