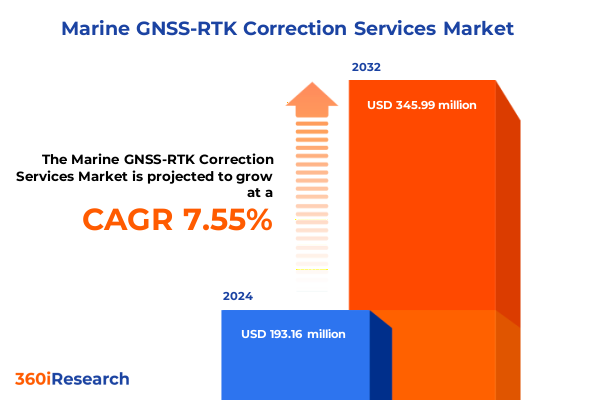

The Marine GNSS-RTK Correction Services Market size was estimated at USD 205.57 million in 2025 and expected to reach USD 222.44 million in 2026, at a CAGR of 7.72% to reach USD 345.99 million by 2032.

Setting the Stage for High-Precision Marine Navigation with GNSS-RTK Correction Services and Emerging Operational Drivers

As marine operations navigate increasingly complex environments, the demand for centimeter-level positioning accuracy has become critical for commercial, leisure, and offshore activities. GNSS-RTK correction services have emerged as the cornerstone technology enabling vessels to chart precise courses, optimize fuel consumption, and enhance safety at sea. These services leverage real-time differential corrections to standard satellite signals, transforming raw positioning data into exceptionally reliable and accurate coordinates essential for today’s advanced marine applications.

Against a backdrop of expanding global trade lanes, burgeoning offshore energy projects, and the growth of autonomous shipping trials, stakeholders across the maritime sector are placing heightened emphasis on high-precision navigation. Provider ecosystems are evolving rapidly, with innovations in network RTK architectures, cloud-based delivery models, and hybrid connectivity solutions reshaping service offerings. Meanwhile, end users are demanding integrated packages that combine hardware calibration, data integrity validation, and continuous support under flexible commercial terms.

This executive summary distills the key forces driving market dynamics, examines the implications of recent policy developments, and highlights actionable strategies for vendors and operators. By presenting a clear view of technological, regulatory, and competitive trends, this analysis equips decision-makers with the context needed to refine their navigation strategies and secure a competitive edge in high-precision marine positioning.

Revolutionizing Marine Positioning with Multi-Technique Correction Innovations, Flexible Commercial Models, and Hybrid Connectivity

The landscape for marine GNSS-RTK correction services is undergoing a fundamental transformation propelled by breakthroughs in positioning algorithms, the proliferation of cloud infrastructures, and the arrival of novel connectivity paradigms. Correction techniques have evolved beyond traditional network RTK offerings, with precise point positioning solutions and PPP-RTK hybrids enabling long-baseline support without dependence on local base stations. Single-base RTK remains relevant for localized deployments, yet its adoption is now being complemented by multi-technique approaches that deliver seamless handovers and ubiquitous coverage.

Service models are also shifting to accommodate diverse user preferences. Pay-as-you-go architectures allow occasional operators to access real-time corrections without upfront commitments, while subscription-based frameworks cater to frequent users seeking predictable OPEX profiles and value-added consultancy. This flexibility has broadened market reach, drawing in leisure boaters and specialty fishing fleets conventionally deterred by capital-intensive licensing.

Connectivity options have diversified in tandem, as cellular networks support cost-effective data streams in coastal zones, radio systems deliver low-latency links to offshore platforms, and satellite channels extend coverage to open ocean corridors. These advancements empower operators to tailor correction services to mission-critical performance benchmarks and environmental constraints. Consequently, vendors are forging partnerships across telecom providers, satellite operators, and cloud platforms to integrate multi-channel delivery and ensure uninterrupted service continuity, thereby redefining the expectations for reliability in marine navigation.

Mitigating Cost Pressures and Strengthening Supply Chains Amid 2025 US Tariff Adjustments for High-Precision Marine GNSS-RTK

The cumulative impact of United States tariffs implemented in early 2025 has introduced both challenges and strategic opportunities for marine GNSS-RTK service providers and their end users. Heightened import duties on specialized hardware components-ranging from high-precision antennas to dedicated correction servers-have escalated equipment acquisition costs and pressured vendor margins. In response, many manufacturers have restructured supply chains by localizing assembly in tariff-exempt jurisdictions or by qualifying alternative chipset suppliers from unaffected markets to preserve competitive pricing.

Service providers have adopted a mix of cost absorption and pricing optimization tactics. Rather than passing the full brunt of increased hardware expenses onto customers, providers have rebalanced subscription models and revised pay-as-you-go fees with moderate adjustments. Bundled offerings that combine correction data, remote diagnostics, and proactive system maintenance have gained traction as value-preserving strategies, enabling operators to achieve budget certainty while enjoying high-precision performance.

Looking ahead, stakeholders are prioritizing supply chain resilience and contractual flexibility to mitigate future tariff volatility. Multi-vendor partnerships, nearshore production agreements, and proactive inventory stocking have emerged as key tactics to minimize operational disruptions. Furthermore, ongoing trade negotiations and potential tariff waivers for maritime safety equipment offer potential reprieves, underscoring the importance of diligent policy monitoring and agile procurement planning.

Unveiling Complex Market Dynamics Through Technique, Business Model, Connectivity, and End-Use Segmentation Insights

The marine GNSS-RTK correction services market can be deconstructed through multiple analytical lenses, each yielding unique insights into service adoption drivers and technology preferences. Examining the suite of correction techniques reveals that network RTK continues to dominate sectors requiring established infrastructure and high update rates, while PPP-RTK and precise point positioning are gaining momentum in remote and transoceanic applications due to their minimal ground station dependency. Single-base RTK remains the pragmatic choice for coastal operations with limited station density, providing a cost-effective solution for smaller fleets.

Parallel perspectives emerge when considering service models, where the pay-as-you-go approach lowers entry barriers for infrequent users and leisure enthusiasts, whereas subscription frameworks deliver enhanced support, volume discounts, and strategic consulting services attractive to commercial shipping and offshore oil and gas operators. Connectivity segmentation further underscores this dichotomy: cellular networks satisfy nearshore data throughput requirements, radio links serve mid-range offshore installations, and satellite connectivity underpins global coverage for expeditionary vessels and autonomous test platforms.

End-use analyses illuminate demand stratification across commercial shipping-comprising cargo liners and passenger ferries-specialized fishing fleets, sport boating and yachting aficionados, and offshore energy enterprises. Cargo carriers prioritize seamless corridor coverage and integration with voyage planning systems, passenger lines emphasize safety and passenger experience enhancement, while offshore oil and gas operators demand ruggedized, redundant correction links to support drilling precision and platform positioning. Leisure segments value user-friendly interfaces and cost predictability, driving tailored packaging alongside professional-grade systems in the sport boating and yachting communities.

This comprehensive research report categorizes the Marine GNSS-RTK Correction Services market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Correction Technique

- Service Model

- Connectivity

- End Use

Tailored Adoption Patterns and Strategic Imperatives Across the Americas, EMEA, and Asia-Pacific Maritime Corridors

Regional examination of marine GNSS-RTK correction services reveals differentiated adoption rhythms and strategic imperatives across the Americas, Europe Middle East & Africa, and Asia-Pacific. In the Americas, waterways teeming with commercial and leisure traffic have catalyzed early uptake of subscription-based network RTK, supported by extensive coastal cellular coverage and emerging satellite-augmented services. Commercial shipping corridors from North America to Latin America are also witnessing integration of PPP-RTK solutions for transoceanic voyages, underpinned by cooperative agreements with regional service hubs.

Within Europe Middle East & Africa, regulatory mandates emphasizing maritime safety and emissions reduction have driven broad adoption of hybrid connectivity solutions, blending terrestrial radio networks with satellite fallback. Offshore energy developments in the North Sea and Gulf of Guinea demand ultra-reliable high-precision corrections, prompting service providers to deploy redundant multi-station architectures. Leisure yachting in the Mediterranean similarly benefits from value-added geo-fencing and anchorage-assistance services layered on core RTK offerings.

Asia-Pacific presents a landscape of rapid growth, fueled by expanding port infrastructure, offshore resource exploration, and a vibrant yachting culture in Southeast Asia. Cellular networks are progressively enabling real-time correction access in coastal zones, while emerging low-Earth-orbit satellite constellations offer opportunities for ubiquitous global coverage. Together, these regional dynamics underscore the need for tailored go-to-market strategies and agile service delivery footprints that align with local regulatory, infrastructural, and environmental conditions.

This comprehensive research report examines key regions that drive the evolution of the Marine GNSS-RTK Correction Services market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Navigating Competitive Currents with Strategic Alliances, Cloud-Native Platforms, and AI-Driven Correction Accuracy

Competitive intensity in marine GNSS-RTK correction services is punctuated by established geospatial giants and agile new entrants each vying for technological distinction and service excellence. Incumbent providers leverage decades of expertise in terrestrial RTK networks, expansive correction server footprints, and integrated support offerings to anchor long-term subscription contracts with major commercial shipping consortia and offshore operators. Conversely, emerging players are differentiating through cloud-native platforms, AI-enhanced accuracy algorithms, and modular connectivity frameworks that streamline deployments for mid-size fleets and specialized leisure markets.

Strategic alliances have become a hallmark of competitive positioning, as companies partner with satellite operators to embed correction payloads within advanced communication constellations, or collaborate with cellular carriers to ensure priority data throughput in congested coastal corridors. Technological innovation pipelines focus on automating network integrity monitoring, predictive system health diagnostics, and seamless multi-technique handovers that maintain centimetrical accuracy under challenging sea conditions.

In this vibrant ecosystem, leadership is defined by the ability to preempt evolving customer demands-whether through turnkey integration of RTK corrections with voyage optimization tools, the introduction of usage-based billing models that align cost with performance, or the deployment of self-service portals that empower end users to manage correction subscriptions and connectivity profiles with minimal friction.

This comprehensive research report delivers an in-depth overview of the principal market players in the Marine GNSS-RTK Correction Services market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- CHC Navigation Co Ltd

- Consat AS

- Fugro NV

- Geo++ GmbH

- Hemisphere GNSS Inc

- Hexagon AB

- Leica Geosystems AG

- Mobile Satellite Ventures LLC

- NavCom Technology Inc

- NavNet Systems Inc

- NovAtel Inc

- Oceaneering International Inc

- RTKdata GmbH

- Septentrio NV

- SwissGNSS AG

- Tersus GNSS Inc

- Topcon Positioning Systems Inc

- Trimble Inc

- Veripos Ltd

Expanding Market Reach and Resilience through Technique Diversification, Hybrid Connectivity, and Supply Chain Agility

Industry leaders must adopt a multifaceted approach to maintain growth and fortify their market positions within the evolving landscape of marine GNSS-RTK correction services. First, diversifying correction techniques by integrating PPP-RTK and precise point positioning alongside network RTK can expand addressable markets and reduce reliance on fixed infrastructure. Coupled with this, offering tiered service models enables providers to capture value across the spectrum-from casual leisure users to heavy operational fleets-while smoothing revenue streams.

Second, investing in robust, hybrid connectivity solutions that leverage cellular, radio, and satellite channels will safeguard service continuity and performance SLAs, particularly in remote or congested waterways. Collaborating with telecom operators and satellite constellations supports scalable global coverage, ensuring clients can maintain uninterrupted high-precision corrections regardless of location.

Third, strengthening supply chain resilience through strategic nearshoring, multi-vendor contracts, and proactive inventory management will mitigate tariff and component shortage risks. Providers should also embed transparency in commercial agreements, offering customers clear clauses on price adjustments linked to external cost drivers. By executing these recommendations, industry stakeholders can enhance operational agility, deepen customer relationships, and secure a sustainable competitive edge.

Combining Secondary Intelligence, Stakeholder Interviews, Proprietary Data, and Expert Workshops for Robust Market Insights

This analysis employs a rigorous, multi-stage research methodology designed to uncover both granularity and strategic clarity within the marine GNSS-RTK correction services market. The process began with a comprehensive review of secondary data sources, including patent filings, regulatory publications, and industry whitepapers, to map the evolving technology landscape and identify key service providers.

Primary research formed the backbone of insights, comprising in-depth interviews with senior stakeholders across vessel operations, offshore energy, and leisure boating enterprises, as well as executives from leading technology vendors. These interviews furnished nuanced perspectives on adoption drivers, integration challenges, and emerging service requirements. Quantitative validation ensued through the analysis of proprietary usage datasets, correction network performance metrics, and public domain connectivity coverage reports.

Subsequent triangulation reconciled qualitative narratives and quantitative findings, ensuring consistency and mitigating bias. Finally, expert workshops brought together cross-functional teams-including maritime navigators, network engineers, and policy analysts-to stress-test preliminary conclusions and refine strategic recommendations. This iterative, stakeholder-centric approach guarantees a balanced, actionable view of the market dynamics shaping marine GNSS-RTK correction services.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Marine GNSS-RTK Correction Services market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Marine GNSS-RTK Correction Services Market, by Correction Technique

- Marine GNSS-RTK Correction Services Market, by Service Model

- Marine GNSS-RTK Correction Services Market, by Connectivity

- Marine GNSS-RTK Correction Services Market, by End Use

- Marine GNSS-RTK Correction Services Market, by Region

- Marine GNSS-RTK Correction Services Market, by Group

- Marine GNSS-RTK Correction Services Market, by Country

- United States Marine GNSS-RTK Correction Services Market

- China Marine GNSS-RTK Correction Services Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1113 ]

Charting a Future of Enhanced Accuracy and Operational Excellence through Strategic Innovation and Resilient Market Approaches

The imperative for precise and dependable marine navigation has never been more pronounced, as operators across commercial shipping, offshore energy, and leisure sectors seek to elevate safety, efficiency, and environmental compliance. GNSS-RTK correction services stand at the nexus of these objectives, offering centimeter-level positioning that underpins autonomous navigation trials, dynamic course optimization, and geo-fencing applications. Technological innovations in correction techniques, service delivery models, and connectivity options are broadening the addressable market and reshaping competitive dynamics.

At the same time, policy shifts-such as the 2025 United States tariffs-have underscored the importance of supply chain resilience and strategic procurement planning. Segmentation analysis reveals that both high-value industrial operators and cost-sensitive leisure users are embracing differentiated offerings, while regional patterns highlight the need for localized go-to-market strategies. Against this backdrop, companies that execute on diversified technique portfolios, hybrid connectivity architectures, and transparent commercial frameworks will be best positioned to capture growth and sustain leadership.

Ultimately, the path forward demands a balance of innovation, operational agility, and customer-centric service design. By aligning strategic investments with the evolving demands of maritime stakeholders, organizations can chart a course toward enhanced navigation accuracy, operational excellence, and long-term commercial success.

Accelerate Your Precision Navigation Strategy with a Personalized Briefing from Our Associate Director of Sales & Marketing

Transform your strategic planning today by securing the comprehensive marine GNSS-RTK correction services report. Connect with Ketan Rohom, Associate Director of Sales & Marketing, to unlock the insights that will drive precision, resilience, and growth for your organization. Reach out now to arrange a personalized briefing, discover tailored recommendations, and gain immediate access to the full analysis that will position you at the forefront of the marine navigation industry.

- How big is the Marine GNSS-RTK Correction Services Market?

- What is the Marine GNSS-RTK Correction Services Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?