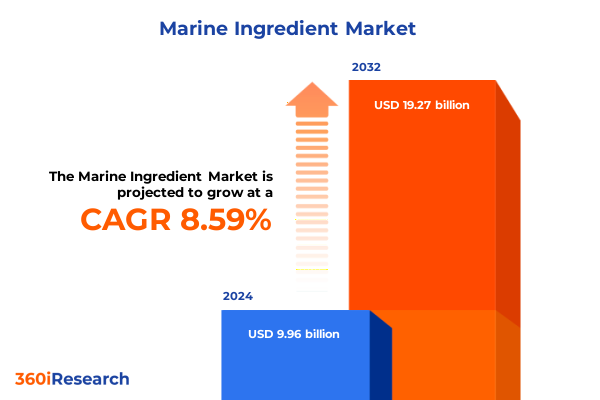

The Marine Ingredient Market size was estimated at USD 10.63 billion in 2025 and expected to reach USD 11.35 billion in 2026, at a CAGR of 8.86% to reach USD 19.27 billion by 2032.

Exploring the Strategic Role of Marine Ingredients in Shaping Innovations and Sustainability Across Diverse Global Industries

The marine ingredient sector stands at the intersection of sustainability imperatives and functional innovation, fueled by growing consumer awareness of health benefits and environmental stewardship. Over the past decade, the transition from conventionally sourced fish oils and meals toward novel algal and crustacean derivatives has accelerated, driven by technological advances in biotechnology and extraction science. Consequently, stakeholders across food, feed, pharmaceutical, and personal care industries are recalibrating their formulations to incorporate high-purity omega-3s, marine collagens, chitosan, and bioactive peptides that deliver targeted physiological benefits.

Meanwhile, regulatory frameworks are evolving to support traceability, quality assurance, and environmental accountability throughout the value chain. As governments worldwide tighten rules on overfishing and mandate eco-labels, companies are investing in digital traceability platforms and third-party certifications to demonstrate responsible sourcing. This alignment of consumer demand, regulatory pressure, and technological progress underpins the strategic importance of marine ingredients in creating differentiated products, supporting circular bioeconomy goals, and mitigating ecological impact.

Unveiling the Paradigm Shifts Driving Demand and Innovation Within the Marine Ingredient Industry Landscape Today

Significant paradigm shifts within the marine ingredient landscape reflect underlying transformations in supply, technology, and consumer priorities. First, the rapid expansion of fish oil and fishmeal production in key fishing nations underscores the sector’s response to demand surges for aquafeed and nutraceuticals. In the first quarter of 2025, global fish oil output rose by 34 percent year-on-year, driven by strong harvests in Chile, the United States, Spain, and several African nations, although European production experienced declines due to environmental constraints.

Second, the emergence of algal oil as a fish-free, sustainable source of eicosapentaenoic acid (EPA) and docosahexaenoic acid (DHA) has accelerated, fueled by innovations in fermentation and CO2 extraction to enhance bioavailability and stability. This trend aligns with a 2023 consumer survey reporting that 68 percent of U.S. buyers prioritize sustainability claims for algae-derived DHA/EPA products, a factor contributing to algae accounting for nearly a quarter of the global EPA/DHA market-up from 14 percent in 2018.

Moreover, heightened regulatory scrutiny around marine biodiversity and corporate environmental responsibility has propelled investments in green extraction processes and rigorous traceability protocols. Concurrently, demand for marine bioactives-particularly astaxanthin, marine collagen, and peptides-has surged in personal care and pharmaceutical formulations, driven by their antioxidant, anti-aging, and joint health properties. These converging forces underscore a transformative shift from commodity-focused marine products toward high-value, differentiated ingredients, fundamentally reshaping the competitive dynamics of the market.

Assessing the Cumulative Consequences of United States Tariffs Imposed in 2025 on Marine Ingredient Trade Dynamics

The cumulative impact of United States tariff measures introduced in 2025 has introduced new cost considerations and supply chain realignments for marine ingredient stakeholders. In April 2025, the Office of the U.S. Trade Representative instituted a blanket 10 percent tariff on nearly all seafood imports, with China-origin products targeted by a 30 percent surcharge. These duties have directly elevated costs for fish oil, fishmeal, and krill oil processors and downstream formulators, particularly given the United States’ annual $16 billion import dependency on seafood products.

Subsequent classification rulings by the U.S. Court of International Trade have further influenced tariff liability. Notably, a May 2025 decision determined that semi-synthetic fish oil ethyl ester concentrates maintain the essence of fish and qualify as “extracts of fish” under HTS heading 1603, preserving their higher duty treatment rather than falling under food preparation categories. This interpretation has narrowed opportunities for reclassification to lower-rate headings, effectively sustaining import duties on advanced marine oils.

As a result, companies have pursued strategic responses including diversification of sourcing to tariff-free regions, accelerated investment in domestic production capacities, and targeted advocacy for dietary ingredient exemptions. These measures reflect a broader recalibration of global procurement strategies, as industry leaders seek to mitigate tariff-induced margin pressures while maintaining supply continuity in a climate of evolving trade policy.

Revealing Critical Insights into Marine Ingredient Market Segmentation by Product Type Source Form and Application

An analysis of marine ingredient demand through the lens of product typology reveals a nuanced landscape in which specialized oils, polymers, and bioactive compounds each chart distinct growth trajectories. Algal oil distinguishes itself with subsegments of DHA oil, EPA oil, and mixed oil catering to infant nutrition, cognitive health formulations, and premium functional foods. Within polysaccharide derivatives, chitosan formulations appear in bead, film, and powder configurations, enabling innovative wound-healing dressings, food preservation coatings, and biodegradable packaging solutions. The fishmeal sector, structured around flakes, pellets, and powder, remains pivotal for aquafeed and animal nutrition, driving protein supply in aquaculture and livestock. Fish oil derivatives, from concentrated fish oil through deodorized and refined grades, support nutraceutical and pharmaceutical applications, while krill oil concentrates, oil powders, and phospholipid fractions serve high-purity omega-3 markets. Meanwhile, the marine collagen category spans hydrolyzed collagen and Type I and II frameworks supporting skin health and joint support, and peptide portfolios-including collagen peptides, fish protein hydrolysates, and marine peptides-address muscle recovery, sports nutrition, and immunomodulation.

When examined by source, algae resource bases divide into macroalgae and microalgae proven for high-yield fatty acid and bioactive extraction processes. Crustacean sources, comprising krill and shrimp shell, feed phospholipid-rich and chitosan production lines respectively. Fish sources such as anchovy, menhaden, and sardine underlie traditional meal and oil products, whereas mussel, oyster, and squid from the mollusk category inform collagen and specialty peptidic ingredient development.

Form preferences encompass capsules, oils, pellets, powders, and tablets, reflecting formulation requirements, bioavailability considerations, and end-user convenience. Capsules and tablets predominate in consumer healthcare, oils integrate seamlessly into functional foods and beverages, while pellets and powders serve industrial processes for feed and cosmetics. Furthermore, application segmentation across animal feed, cosmetics, dietary supplements, food & beverages, and pharmaceuticals highlights the breadth of marine ingredient utility. Within animal feed, aquaculture leads consumption, complemented by emerging pet food, poultry nutrition, and ruminant feed applications. This multidimensional segmentation framework provides clarity on evolving demand pockets and substantiates targeted innovation opportunities.

This comprehensive research report categorizes the Marine Ingredient market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Source

- Form

- Application

Delineating Regional Market Dynamics and Growth Drivers Across Americas Europe Middle East Africa and Asia Pacific

Regional landscapes for marine ingredients exhibit distinct drivers that shape supply, demand, and strategic initiatives. In the Americas, robust aquaculture expansion in Chile and the United States underpins surging fishmeal and fish oil output, supported by improved fisheries management and large-scale harvests. For instance, Chile’s 2025 anchovy quota and heightened Peruvian fleet activity have propelled early-year production increases, catalyzing downstream protein and lipid availability. Against this backdrop, U.S. companies continue stable domestic white fishmeal supply, benefitting from increased Alaska pollock quotas and diversified species utilization.

Across Europe, the Middle East, and Africa, the regulatory focus on sustainability and traceable sourcing drives premium positioning for marine bioactives. Markets in Northern Europe emphasize certification through programs such as MarinTrust and fishery improvement projects, reinforcing consumer confidence and commanding higher margins. Concurrently, personal care and nutraceutical sectors in Western Europe stimulate demand for marine collagen, chitosan, and astaxanthin derivatives, leveraging advanced extraction technologies. Emerging markets in the Middle East and Africa increasingly integrate marine peptides and algae-based oils into dietary supplement formulations, supported by expanding retail networks and rising health awareness.

The Asia-Pacific region continues as the dominant global shareholder in aquaculture production and feed consumption, accounting for over 70 percent of farmed fish supply in 2020 and driving sustained fishmeal demand. Investments in aquaculture expansion across China, India, and ASEAN nations amplify requirements for high-quality protein sources, while government initiatives bolster domestic processing capacity. Notably, Asia Pacific’s aquafeed sector secured 63.5 percent of global market share in 2022, underscoring the region’s critical role in marine ingredient uptake across feed, functional foods, and emerging personal care segments.

This comprehensive research report examines key regions that drive the evolution of the Marine Ingredient market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Global Companies Driving Innovation Competitive Strategies and Growth in the Marine Ingredient Sector

A cadre of leading global companies shapes the marine ingredient sector through strategic investments, capacity expansions, and research collaborations. Omega Protein, a primary fishmeal and fish oil producer in North America, leverages vertically integrated operations from harvest to processing, enabling cost efficiencies and product consistency. Croda International harnesses biotechnology expertise to advance algal oil and chitosan innovations, partnering with biotech firms to scale microalgae fermentation for high-purity omega-3. BASF’s fish oil ethyl ester concentrate classification victory illustrates the importance of legal acumen in managing tariff exposures and ingredient positioning. Meanwhile, Argent Chemical Laboratories and Prinova focus on custom marine collagen and peptide solutions, responding to personalized nutrition and skin health demands. GC Rieber’s diversified marine portfolio spans krill oil phospholipids and marine algae extracts, emphasizing sustainability through FSC-certified feedstocks and carbon-neutral processing. These and other players, including Kewpie and Balchem, continue refining their competitive strategies through targeted acquisitions, joint ventures, and dedicated R&D centers, reinforcing their leadership within targeted market niches.

This comprehensive research report delivers an in-depth overview of the principal market players in the Marine Ingredient market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Aker BioMarine ASA

- Austral Group S.A.

- BASF SE

- Cargill, Incorporated

- COPEINCA S.A.

- Croda International plc

- KD Pharma Group

- Omega Protein Corporation

- Pesquera Diamante S.A.

- Royal DSM N.V.

Formulating Strategic Actionable Recommendations to Enhance Competitiveness Resilience and Growth in Marine Ingredients

Industry leaders can strengthen their market position by embracing sustainability-driven innovation and supply chain resilience. Companies should prioritize strategic partnerships with algal biotechnology firms to accelerate development of high-yield DHA and EPA strains, thereby diversifying reliance on fish-based sources. In parallel, expanding domestic production capacity for fishmeal and fish oil can mitigate tariff-induced cost pressures while ensuring supply continuity in key markets. Engaging proactively with regulatory bodies to clarify tariff classifications and secure dietary ingredient exemptions will reduce legal uncertainties and protect margins.

Furthermore, integrating digital traceability solutions across procurement, processing, and distribution will enhance transparency, reinforce sustainability credentials, and meet growing consumer demand for ethical sourcing. To capture emerging applications, firms should allocate R&D budgets to advanced marine collagen and peptide research, exploring novel formulations for skin health, joint support, and immunomodulation. Finally, pursuing targeted M&A or joint ventures in high-growth regions-particularly Asia-Pacific and the Middle East-will unlock new channels and amplify market access, ensuring robust growth amid evolving trade dynamics.

Outlining a Comprehensive Multimethod Research Methodology Ensuring Accuracy Reliability and Depth in Market Insights

This research employed a multimethod approach to ensure comprehensive and accurate market insights. Secondary research involved systematic review of trade press, regulatory filings, court rulings, and statistical data from organizations such as UNCTAD, IFFO, and FAO. Key sources included quarterly production data, tariff schedules, and fisheries quota reports. Primary research incorporated in-depth interviews with senior executives and technical experts spanning ingredient producers, formulators, and end-use sector representatives.

Quantitative analysis triangulated production volumes, trade flows, and application trends to validate segmental performance. Price indices were cross-referenced with import duty data and classification rulings to assess cost impacts. Qualitative validation workshops with industry stakeholders refined demand forecasts and substantiated strategic recommendations. The combined methodology ensured data integrity, minimized bias, and produced actionable intelligence across product types, sources, forms, applications, and regions.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Marine Ingredient market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Marine Ingredient Market, by Product Type

- Marine Ingredient Market, by Source

- Marine Ingredient Market, by Form

- Marine Ingredient Market, by Application

- Marine Ingredient Market, by Region

- Marine Ingredient Market, by Group

- Marine Ingredient Market, by Country

- United States Marine Ingredient Market

- China Marine Ingredient Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 2703 ]

Synthesizing Key Findings to Illuminate Future Trajectories and Opportunities Within the Marine Ingredient Ecosystem

In summary, the marine ingredient market is undergoing a profound evolution powered by sustainability imperatives, advanced biotechnology, and shifting trade policies. Transformative supply dynamics-from surging fish oil production to rising algal oil adoption-reflect the industry’s drive for resource efficiency and functional differentiation. United States tariff actions in 2025 have reshaped procurement strategies, reinforcing the need for diversified sourcing and regulatory engagement.

Segmentation analysis reveals targeted growth zones in high-purity algal oils, chitosan derivatives, and marine peptides, while regional insights highlight the Americas, EMEA, and Asia-Pacific as distinct arenas for strategic investment. Leading companies are leveraging innovative R&D, legal frameworks, and vertical integration to maintain competitive advantage. Collectively, these insights chart a roadmap for stakeholders to navigate market complexities, capitalize on emerging applications, and foster sustainable growth within the global marine ingredient ecosystem.

Engage With Our Expert to Purchase the Marine Ingredient Market Research Report and Unlock Proprietary Insights

Contact Ketan Rohom, Associate Director of Sales & Marketing at 360iResearch, to secure your comprehensive marine ingredient market research report today. Engage with an expert to discuss your specific industry needs and gain tailored insights on supply chain shifts, tariff impacts, emerging product innovations, and regional growth drivers. Leverage our in-depth analysis to inform strategic decisions, strengthen competitive positioning, and accelerate your business growth within the dynamic marine ingredient ecosystem. Reach out now to access proprietary data and actionable intelligence that will empower your organization to navigate evolving market opportunities with confidence.

- How big is the Marine Ingredient Market?

- What is the Marine Ingredient Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?