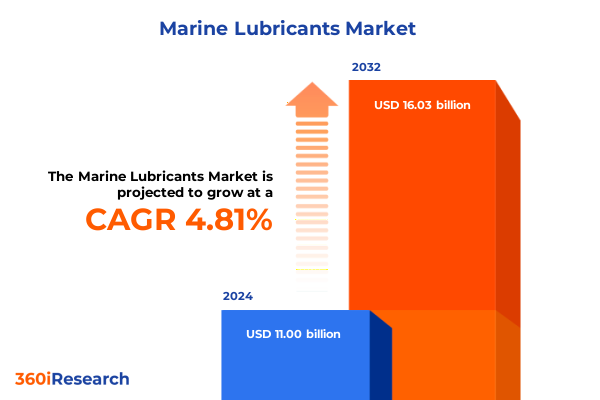

The Marine Lubricants Market size was estimated at USD 11.53 billion in 2025 and expected to reach USD 12.03 billion in 2026, at a CAGR of 4.80% to reach USD 16.03 billion by 2032.

Navigating the Complex Seas of Marine Lubricants with Environmental Pressures, Operational Demands, and Emerging Market Drivers in 2025

Marine lubricants are the often overlooked lifeblood of global maritime operations, providing essential protection and performance to a vast array of vessel systems. From the high-pressure environments of two-stroke diesel engines powering bulk carriers to the precision gearboxes in passenger ships, these specialized fluids mitigate wear, enhance efficiency, and contribute to engine longevity. Over the past decade, the marine lubricants sector has evolved in complexity, responding to tightening environmental controls, volatile feedstock costs, and the intricacies of a fragmented supply chain. At the same time, growing emphasis on operational uptime and total cost of ownership has propelled stakeholders to explore new formulations, additive technologies, and service models that deliver value beyond basic lubrication.

Navigating this intricate landscape requires an integrated understanding of regulatory frameworks, technological innovations, and market drivers. While regulatory mandates such as the IMO 2020 sulfur cap have reshaped fuel characteristics and oil formulations, digital tools and remote monitoring platforms have begun to redefine service delivery and predictive maintenance. Concurrently, the drive toward decarbonization and alternative fuels is transforming lubricant demand profiles and formulation priorities. This report offers a foundational overview of these intersecting forces, setting the stage for an exploration of transformative shifts, tariff impacts, segmentation priorities, and regional nuances vital for strategic decision-makers in the marine lubricants domain.

How Regulatory Reforms, Technological Innovations, and Decarbonization Goals Are Driving Unprecedented Shifts in the Marine Lubricants Landscape

Regulatory reforms and environmental imperatives are fundamentally altering the marine lubricants landscape, compelling industry participants to adapt at an unprecedented pace. The 2020 implementation of the IMO sulfur cap limited sulfur content in marine fuels to 0.50 percent globally and as low as 0.10 percent within designated emission control areas, reshaping lubricant specifications and driving a surge in high-base-number oils tailored to neutralize acidic byproducts. In response, synthetic and hybrid base oils have gained traction, offering compatibility with advanced exhaust aftertreatment systems, while biodegradable alternatives are emerging in ecologically sensitive regions under stringent emission regimes.

Technological advancements are also transforming product development and service delivery. Next-generation additive packages leveraging nanomaterials such as graphene and carbon nanotubes promise self-healing wear resistance, while dynamic, temperature-responsive formulations optimize performance under varying engine loads. Meanwhile, digital platforms and remote monitoring tools have enabled predictive maintenance, reducing the need for onboard expertise and lowering operating costs, a trend propelled by travel restrictions and port access constraints during global disruptions. The convergence of these regulatory and technological forces is fostering a more resilient, adaptable supply chain, equipping operators with the tools to improve asset utilization and environmental compliance concurrently.

Assessing the Cumulative Impact of 2025 United States Maritime Tariffs on Marine Lubricants Supply Chains and Operational Cost Structures

The United States’ Section 301 actions in 2025 have instituted targeted service fees on Chinese-operated and Chinese-built vessels, introducing a new layer of cost pressure for marine lubricants procurement and distribution channels servicing U.S. ports. Initially exempted for 180 days through October 13, 2025, vessels face fees beginning at USD 50 per net tonnage in October of that year, scaling to USD 140 per ton by April 2028, depending on vessel ownership and origin. Concurrently, LNG tankers will be subject to cargo requirements mandating increasing percentages of U.S.-built vessels over a 22-year transition, while proposed tariffs on ship-to-shore cranes and cargo handling equipment are under review.

These maritime levies compound broader trade tariffs that impose a 25 percent surcharge on most imports from Canada and a 10 percent energy-specific levy, affecting base oil imports critical to marine lubricant formulation. While domestic production of Group II and Group II+ base oils meets much of U.S. demand, reliance on imported Group III feedstocks from Canada, South Korea, and the Middle East subjects suppliers to tariff-induced cost fluctuations. As a result, lubricant blending operations have experienced margin compression and supply chain realignments, prompting strategic shifts toward securing long-term supplier agreements and exploring local feedstock diversification to alleviate tariff exposure and maintain competitive pricing.

Unveiling Core Segment Dynamics Across Product, Vessel, Engine, Base Oil, Application, and Sales Channels Shaping Marine Lubricant Strategies

Market participants are navigating a multifaceted segmentation landscape in which performance requirements and purchasing behaviors vary significantly across product types, vessel classes, engine architectures, base oil chemistries, functional applications, and distribution channels. Cylinder oils, engineered for two-stroke diesel engines prevalent on tanker and bulk carrier routes, demand elevated base numbers and tailored detergency profiles to manage the acidic byproducts of low-sulfur fuels. Conversely, gear oils and hydraulic fluids for passenger ships and offshore platforms emphasize anti-wear and oxidation resistance under high-speed, cyclic load conditions.

Engine type further refines lubricant needs, with two-stroke designs relying on specialized cylinder oils, while four-stroke diesel and gas engines in military and commercial vessels utilize synthetic or ester-based engine oils optimized for thermal stability. Within base oil chemistries, Group I stocks persist in low-load applications, while ester and polyalphaolefin blends now dominate high-performance formulations, offering superior viscosity control and environmental compatibility. Functional segmentation across auxiliary systems, main engines, gear trains, hydraulic circuits, and turbines underscores the diversity of requirements and the need for targeted lubricant portfolios.

Sales channel dynamics illustrate a market in transition: while traditional offline distribution through marine supply hubs remains the backbone of procurement, digital platforms and e-commerce portals are gaining momentum. These online channels offer operators rapid access to product information, real-time inventory visibility, and streamlined ordering, creating pressure on suppliers to integrate digital touchpoints within their go-to-market strategies. This intricate segmentation framework dictates that successful market actors refine their offerings to align with the nuanced demands of each segment, fostering deeper customer engagement and differentiated value propositions.

This comprehensive research report categorizes the Marine Lubricants market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Vessel Type

- Engine Type

- Base Oil Type

- Application

- Sales Channel

Exploring Regional Disparities and Growth Drivers in the Marine Lubricants Market Across the Americas, EMEA, and Asia-Pacific Theaters

Regional markets exhibit distinct growth drivers and operational challenges, with the Americas leveraging robust domestic base oil capacity and a strong legal framework to support maritime commerce. The United States’ extensive coastline and leadership in LNG exports have driven demand for specialized marine lubricants capable of withstanding cold ambient conditions and aggressive cargo regimes, while port infrastructure modernization programs in North America emphasize environmental compliance and cleaner shipping fuels.

In Europe, the Middle East, and Africa, stringent environmental regulations, including the Mediterranean’s designation as a Sulphur Oxide Emission Control Area in May 2025, have accelerated the adoption of very low sulfur fuel oils and scrubber technologies. This has increased demand for cylinder oils with high base numbers and low-ash synthetic blends, while green corridor initiatives in the North Sea and Baltic regions incentivize the use of bio-based lubricants through tax advantages and reduced port fees. Port expansions in the Gulf Cooperation Council states are also catalyzing demand for lubricants tailored to extreme temperature and high-humidity environments.

The Asia-Pacific market is characterized by rapid fleet expansion and evolving regulatory landscapes. Major shipping hubs in China and South Korea are investing heavily in dual-fuel vessels and LNG bunkering infrastructure, necessitating engine oils compatible with gas-fueled propulsion systems. India’s coastal shipping growth and emerging maritime corridors are creating new lubricants distribution networks, while Southeast Asian nations focus on cost-effective syntheses that meet compliance without significantly increasing operating expenses. Across the region, the blend of inexpensive heavy fuel oils and growing environmental mandates presents a dual challenge, driving suppliers to innovate formulations that balance performance with affordability.

This comprehensive research report examines key regions that drive the evolution of the Marine Lubricants market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Marine Lubricant Players and Their Strategic Initiatives in Innovation, Sustainability, and Global Market Expansion

The competitive landscape in marine lubricants is anchored by a cadre of global energy majors and specialized additives formulators. Exxon Mobil and Shell maintain extensive blending and distribution footprints, leveraging decades of R&D and optimized supply chains to deliver high-performance synthetic and hybrid formulations tailored to diverse vessel classes. Chevron, BP, and TotalEnergies similarly emphasize integrated portfolio development, forging partnerships and executing targeted acquisitions to expand their base oil production capabilities and specialty lubricant offerings.

Specialty chemical joint ventures such as Infineum, the ExxonMobil–Shell cooperation, have emerged as key drivers of additive innovation, focusing on advanced ashless dispersants and viscosity modifiers to meet evolving exhaust emission standards. Companies like Fuchs and Castrol complement the supermajors with regional expertise and agile service models, deploying digital monitoring solutions and remote diagnostic platforms to enhance asset reliability. Recent collaborations, such as AD Ports Group’s alliance with ADNOC Distribution to expand marine lubricant distribution in the UAE, underscore the strategic importance of integrated logistics networks and localized supply in meeting emerging market demand.

Across the board, leading firms are investing in next-generation bio-based and environmentally acceptable lubricants, aligning product roadmaps with decarbonization targets and green shipping corridors. Their competitive advantage derives from scale-enabled R&D, diversified feedstock sourcing, and digital service ecosystems that deliver predictive maintenance insights. As the industry transitions toward cleaner fuels and stricter emission regimes, these established players are positioned to capitalize on the growing demand for specialty formulations and integrated service offerings.

This comprehensive research report delivers an in-depth overview of the principal market players in the Marine Lubricants market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Blaser Swisslube Inc.

- BP plc

- Chevron Corporation

- Croda International Plc

- ExxonMobil Corporation

- FUCHS Petrolub SE

- Gulf Oil Marine Ltd.

- Idemitsu Kosan Co. Ltd.

- Indian Oil Corporation Ltd.

- JXTG Nippon Oil & Energy Corporation

- Klüber Lubrication München SE & Co. KG

- Lukoil Marine Lubricants

- Morris Lubricants Ltd.

- Motul S.A.

- Petronas Lubricants International

- Phillips 66 Company

- Quepet Marine Lubricants

- Repsol S.A.

- Rymax Lubricants

- Shell plc

- Sinopec Group

- Total Marine Solutions

- TotalEnergies SE

- Valvoline Inc.

Actionable Recommendations for Industry Leaders to Bolster Innovation, Supply Chain Resilience, and Sustainable Growth in Marine Lubricants Domain

To secure market leadership and sustain profitability, marine lubricant suppliers should prioritize the development of next-generation formulations that address both environmental mandates and operational exigencies. Investing in bio-based and synthetic base oils, coupled with ashless additive chemistries, will enable compliance with sulfur and particulate emission regulations while delivering superior wear protection. Establishing research collaborations with marine engine OEMs can accelerate product validation cycles and ensure compatibility with emerging fuel technologies.

Diversification of base oil sourcing is critical to mitigate tariff exposure and feedstock volatility. Suppliers should pursue dual-sourcing strategies, including investments in domestic Group II+ capacity and partnerships with international producers of Group III and ester base oils. Simultaneously, integrating digital platforms for remote condition monitoring and predictive maintenance services will strengthen customer loyalty and create new value streams beyond commodity sales. Enhanced data analytics can also inform bespoke service contracts, aligning lubricant management with each fleet’s unique operating profile.

Finally, industry leaders must cultivate supply chain resilience through strategic alliances with port authorities, shipping consortia, and equipment manufacturers. Proactive engagement in regulatory consultations and green corridor initiatives will position companies as preferred technology partners in low-emission maritime projects. By blending proactive regulatory compliance, digital innovation, and supply chain diversification, marine lubricant providers can navigate evolving market conditions and secure sustainable growth.

Research Methodology Underpinning This Marine Lubricants Analysis Through Rigorous Data Collection, Expert Validation, and Quantitative Triangulation

This analysis synthesizes insights drawn from a multi-tiered research approach encompassing both primary and secondary data streams. Secondary research involved an exhaustive review of regulatory frameworks, industry white papers, technical bulletins, and corporate disclosures, ensuring comprehensive coverage of environmental mandates, trade actions, and technological advancements. Peer-reviewed journals, industry association reports, and maritime regulatory publications were scrutinized to validate key trends and emerging best practices.

Primary research entailed structured interviews and consultations with subject-matter experts, including lubricant formulators, marine engine OEMs, port authority representatives, and procurement executives from leading shipping companies. These engagements provided granular perspectives on segment-specific requirements, operational challenges, and service expectations. Quantitative data collected through these interactions were triangulated against secondary sources to enhance reliability and detect variances in regional adoption rates and supplier performance metrics.

Analytical models were then applied to map segmentation demand drivers, regional growth trajectories, and the financial implications of tariff implementations. Continuous validation of findings through expert workshops and peer reviews ensured the integrity of the insights. This rigorous methodology underpins the strategic recommendations and conclusions presented, providing stakeholders with a robust evidence base for informed decision-making.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Marine Lubricants market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Marine Lubricants Market, by Product Type

- Marine Lubricants Market, by Vessel Type

- Marine Lubricants Market, by Engine Type

- Marine Lubricants Market, by Base Oil Type

- Marine Lubricants Market, by Application

- Marine Lubricants Market, by Sales Channel

- Marine Lubricants Market, by Region

- Marine Lubricants Market, by Group

- Marine Lubricants Market, by Country

- United States Marine Lubricants Market

- China Marine Lubricants Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1431 ]

Conclusion Drawing Together Strategic Insights and Imperatives to Navigate the Future Course of the Marine Lubricants Industry

The marine lubricants industry stands at a pivotal juncture, shaped by the simultaneous forces of regulatory exigency, technological innovation, and geopolitical realignment. Environmental mandates continue to drive demand for advanced synthetic and bio-based formulations, while digital platforms redefine service delivery and customer engagement. At the same time, trade actions and tariff regimes have underscored the importance of supply chain agility and diversified feedstock sourcing. Together, these dynamics are redrawing competitive boundaries and creating new avenues for differentiation.

As operators grapple with the dual imperatives of cost efficiency and environmental stewardship, marine lubricant providers must harness deep domain expertise, agile R&D frameworks, and integrated digital offerings to deliver compelling value. Strategic alignment with emerging propulsion technologies, from LNG and methanol to hybrid-electric configurations, will be crucial in sustaining relevance. Meanwhile, regional growth patterns-from North America’s infrastructure modernization to EMEA’s emission control areas and Asia-Pacific’s fleet expansion-present tailored opportunities for targeted market entry and localization.

Ultimately, success in this evolving market requires a holistic approach that balances technical innovation, operational reliability, and proactive regulatory engagement. By leveraging the insights and recommendations outlined herein, stakeholders can navigate the complex currents of the marine lubricants arena and chart a course toward sustainable, profitable growth.

Connect with Ketan Rohom Associate Director Sales and Marketing to Unlock Comprehensive Marine Lubricants Market Insights and Gain Strategic Advantage

To access the full spectrum of strategic insights and data-driven analysis on the marine lubricants market, connect directly with Ketan Rohom, Associate Director, Sales & Marketing. He can guide you through the report’s comprehensive breakdown of emerging trends, regulatory impacts, segmentation deep dives, and actionable recommendations. Engage with Ketan to tailor the report to your organization’s specific needs, ensuring you leverage the latest intelligence to strengthen competitive positioning and drive sustainable growth. Don’t miss the opportunity to secure this critical resource and empower your decision-making with expert support and bespoke research deliverables.

- How big is the Marine Lubricants Market?

- What is the Marine Lubricants Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?