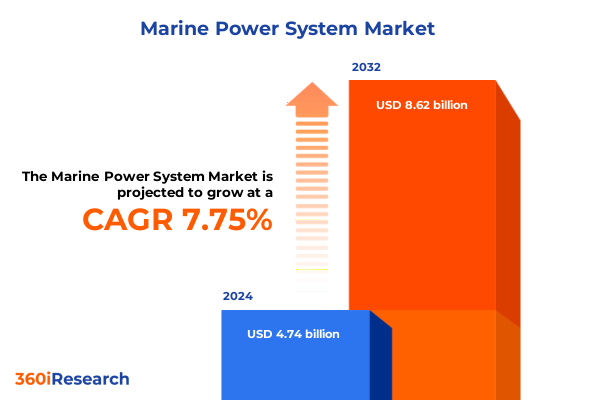

The Marine Power System Market size was estimated at USD 5.10 billion in 2025 and expected to reach USD 5.51 billion in 2026, at a CAGR of 7.77% to reach USD 8.62 billion by 2032.

Unveiling the Current State of Marine Power Systems Through the Lens of Technological Innovation, Environmental Pressures, Regulatory Shifts, and Market Drivers

Marine power systems today exist at the crossroads of accelerating environmental mandates, rapid technological innovation, and evolving global trade dynamics. As maritime operators pursue decarbonization pathways and enhanced operational efficiency, the industry is witnessing a proliferation of advanced propulsion solutions, digital control architectures, and alternative fuel integration. Simultaneously, tightening emissions regulations and mounting international pressure to lower greenhouse gas profiles are compelling vessel owners to reevaluate legacy power configurations and pursue zero-emission ambitions. In parallel, digitalization has ushered in predictive maintenance practices, enabling real-time performance optimization and remote diagnostics that reduce downtime and extend asset lifespans.

Against this dynamic backdrop, stakeholders must navigate a complex interplay of regulatory compliance, capital allocation, and technology adoption. Innovative players are forging partnerships across the value chain to accelerate next-generation marine power architectures, while financiers and insurers reassess risk profiles in light of new propulsion modalities and fuel innovations. As a result, a clear picture of the prevailing market drivers, technological imperatives, and strategic enablers is essential for executives charting growth pathways in the marine power sector.

Identifying the Transformative Shifts Reshaping Marine Propulsion Through Electrification, Digitalization, Decarbonization, and Emerging Business Models

The marine power landscape is undergoing transformative shifts driven by a confluence of factors that extend beyond conventional engine upgrades. Electrification is no longer confined to small coastal vessels; hybrid configurations and all-electric architectures are gaining traction on ferries and offshore support vessels, driven by both environmental commitments and lifecycle cost advantages. Simultaneously, the LNG supply chain has matured, with bunkering infrastructure expanding in key ports and enabling a broader fleet transition to lower-carbon fuel. The emergence of hydrogen and ammonia as next-phase fuels has prompted pilot projects in maritime power to validate safety protocols and operational feasibility, signaling a fundamental pivot in long-range shipping strategies.

Digitalization has further reshaped the strategic imperatives for marine power providers. Advanced monitoring systems, digital twins, and artificial intelligence-based analytics empower operators to extract actionable insights from engine performance data, propelling maintenance cycles from reactive to prescriptive. This data-driven evolution fosters tighter collaboration between technology providers, shipyards, and operators, crystallizing a more integrated ecosystem where intellectual property, software capabilities, and hardware reliability converge. In tandem, regulatory bodies are accelerating the rollout of emissions control mandates, compelling stakeholders to align retrofit programs, new-build specifications, and lifecycle strategies with phased decarbonization targets.

Assessing the Cumulative Impact of Newly Imposed United States Tariffs on Marine Power Equipment, Supply Chains, and Competitive Positioning in 2025

In 2025, the imposition of new United States tariffs on imported marine engines, propulsion components, and related equipment has introduced material cost pressures across the value chain. These duties, targeting key manufacturing hubs in Europe and Asia, have elevated landed costs for vessel new builds and retrofits alike. As a result, procurement strategies are migrating toward regional suppliers and vertically integrated OEMs to mitigate tariff exposure. Within the naval sector, accelerated modernization budgets have partly offset added import costs, whereas commercial operators are reevaluating capital expenditure timelines to balance immediate compliance needs against long-term operational savings.

Supply chain resilience has emerged as a critical focus in light of these trade measures. Shipyards and integrators are diversifying sourcing footprints, preferring alloy suppliers and component fabricators within tariff-exempt jurisdictions. Nevertheless, the transition entails higher logistical complexity and inventory carrying costs. To protect margins, many firms have instituted strategic alliances with domestic engine manufacturers, fostering joint development agreements that leverage localized production incentives. Through these shifts, market participants aim to maintain competitive positioning, secure lead times, and preserve the integrity of technology roadmaps amid an increasingly protectionist trade environment.

Deriving Key Insights from Market Segmentation Across Engine Types, Vessel Categories, Propulsion, Fuel Choices, Power Ranges, and Installation Options

Dissecting the marine power system market through segmentation reveals nuanced trends that inform product development and go-to-market strategies. Engine type dynamics show that while diesel remains ubiquitous in heavy-duty applications, electric motors and hybrid systems are rapidly scaling in both coastal shipping and specialty vessel markets, spurred by advancements in energy storage and power electronics. Gas turbines continue to find niche use in high-speed patrol vessels and naval craft requiring rapid power ramp-up, whereas integration of hybrid architectures has unlocked operational flexibility across vessel classes.

Vessel typology further underscores shifting demand patterns. Bulk carriers and container ships dominate merchant fleet installations, yet growing interest in emissions reduction has elevated the cruise ship segment’s uptake of hybrid and LNG-powered configurations. In naval applications, destroyers and frigates are driving investment in integrated electric propulsion, and offshore support fleets favor anchor handling and platform supply vessels equipped with battery-augmented power units to comply with stringent regional emissions rules. On the recreational side, yachts and powerboats are embracing plug-in hybrids and advanced waterjet propulsion to deliver enhanced performance with reduced environmental impact.

Propulsion type segmentation highlights the growing penetration of pod propulsion systems, which deliver improved maneuverability and fuel savings, particularly in passenger vessels and offshore support craft. Conventional shaft lines remain predominant in large cargo vessels, while waterjet solutions are preferred for high-speed patrol boats and ferries. Fuel choice segmentation reflects an industry in transition: heavy fuel oil is being progressively supplanted by LNG, with biofuel trials underway in short-sea shipping. Meanwhile, diesel persists in smaller craft and backup generator sets, and operators are monitoring ammonia and hydrogen experimentation as zero-carbon long-haul alternatives.

Analysis of power output ranges indicates that systems below one megawatt are chiefly employed in recreational and small commercial vessels, whereas the one to five megawatt category underpins offshore support and medium-size passenger ships. Above five megawatts, integrated power plants serve as the backbone for large cargo, cruise, and naval vessels. Finally, installation type segmentation demonstrates robust aftermarket activity, as fleet owners retrofit existing hulls to meet evolving regulatory and performance standards, alongside continued demand for new-build systems and selective retrofit projects to bridge the gap until next-generation vessels enter service.

This comprehensive research report categorizes the Marine Power System market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Engine Type

- Vessel Type

- Fuel Type

- Propulsion Type

- Power Output Range

- Installation Type

Unlocking Growth Potential Through Regional Dynamics and Opportunities Spanning the Americas, Europe Middle East Africa, and Asia-Pacific Landscapes

Regional dynamics exert a profound influence on marine power system adoption, each geography characterized by distinct regulatory frameworks, fuel availability, and fleet composition. In the Americas, the Gulf of Mexico’s offshore drilling resurgence and the robust cruise ship industry in Florida drive demand for integrated LNG and hybrid power configurations. Concurrently, the U.S. Navy’s multi-year modernization program accelerates the deployment of integrated electric propulsion across destroyer and littoral combat vessel classes, fostering synergies between military and commercial technology platforms.

In Europe, Middle East & Africa, stringent European Union emissions directives incentivize early adoption of zero-emission fuels and carbon capture trials in North Sea offshore vessels. The Middle East has emerged as a strategic LNG bunkering hub, with sovereign wealth funds partnering on infrastructure build-out to support regional and international shipping lines. African coastal nations, meanwhile, represent a growth frontier for smaller coastal trade and offshore support operations, presenting opportunities for lower-power hybrid retrofits.

Asia-Pacific remains the world’s largest shipbuilding and repair basin, anchored by China, Japan, and South Korea. This region’s focus on export-oriented production of container ships and bulk carriers stimulates demand for conventional shaft, waterjet, and pod propulsion solutions, while domestic emissions targets accelerate electric ferry trials on major riverine and coastal routes in China. Additionally, Australia and Southeast Asia are expanding LNG import terminals, enabling broader access to cleaner fuels and reinforcing the region’s pivotal role in the marine power ecosystem.

This comprehensive research report examines key regions that drive the evolution of the Marine Power System market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Companies Driving Technological Breakthroughs, Strategic Partnerships, and Competitive Momentum Across the Marine Power System Ecosystem

Leading organizations in the marine power sector are distinguished by their integrated technology portfolios, global service networks, and strategic joint ventures that extend beyond equipment supply to encompass digital services and lifecycle support. Companies with century-old legacies in engine manufacturing have pivoted toward energy management platforms and advanced analytics, leveraging decades of performance data to refine predictive maintenance algorithms and remote monitoring capabilities. Partnerships between engine OEMs and software specialists are yielding holistic solutions that optimize fuel consumption while preempting component failures through real-time diagnostics.

Concurrently, trailblazers in electric and hybrid propulsion are forging alliances with battery manufacturers and power electronics firms to address thermal management and safety certification challenges inherent in maritime environments. Collaboration between traditional marine power providers and automotive-grade battery suppliers has accelerated the certification of energy storage systems for marine use, setting new benchmarks for system integration and fire suppression protocols. As regulatory pressures intensify, industry leaders are also investing in hydrogen fuel cell research, joining consortia to pilot zero-emission corridors and validate bunkering logistics. This convergence of hardware, software, and ecosystem partnerships is redefining competitive advantage and establishing a blueprint for future innovation.

This comprehensive research report delivers an in-depth overview of the principal market players in the Marine Power System market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ABB Ltd

- Brunvoll AS

- Caterpillar Inc.

- Corvus Energy Inc.

- Cummins Inc.

- Doosan Enerbility Co., Ltd.

- Hyundai Heavy Industries Co., Ltd.

- Kawasaki Heavy Industries, Ltd.

- Kongsberg Gruppen ASA

- Leclanché SA

- MAN Energy Solutions SE

- Mitsubishi Heavy Industries, Ltd.

- MTU Friedrichshafen GmbH

- Rolls-Royce Power Systems AG

- Scania CV AB

- Schottel GmbH

- Siemens Energy AG

- Volvo Penta AB

- Wärtsilä Corporation

- Yanmar Co., Ltd.

Recommending Actionable Strategic Imperatives for Marine Power Leaders to Capitalize on Technological Advances, Regulatory Changes, and Market Dynamics

To thrive amidst evolving market demands and regulatory imperatives, marine power industry leaders should prioritize the acceleration of hybrid and electric powertrain R&D while deepening engagement with fuel cell and hydrogen supply chains. By dedicating resources to modular system architectures and open digital interfaces, organizations can streamline integration across vessel types and retrofit applications. In parallel, forging collaborative partnerships with port authorities, fuel suppliers, and classification societies will expedite the rollout of alternative fuel infrastructure and harmonize safety standards.

Risk mitigation requires diversifying component sourcing networks to circumvent tariff-induced cost volatility and bolster supply chain resilience. Establishing dual-sourcing agreements and localized assembly hubs can reduce lead times and ensure continuity amid trade uncertainties. Moreover, investing in workforce upskilling programs focused on digital maintenance, cybersecurity, and alternative fuel handling will secure the talent pipeline necessary to support next-generation propulsion systems. Finally, engaging proactively with regulatory agencies to shape emissions policy and certification protocols will position industry leaders as preferred collaborators, granting early insight into regulatory trajectories and unlocking incentives for low-carbon vessel adoption.

Detailing the Robust Research Methodology Underpinning Insights Through Rigorous Data Collection, Expert Consultations, and Analytical Rigor

The insights presented herein are grounded in a rigorous research methodology combining comprehensive secondary research, targeted primary interviews, and robust data validation protocols. Industry reports, white papers, and regulatory filings provided the foundation for mapping technology trends and policy developments, while peer-reviewed journals and patent databases illuminated emerging innovations. Complementing this desk research, structured interviews with senior executives, naval architects, and port authorities yielded first-hand perspectives on operational challenges and investment priorities.

Data triangulation ensured consistency across disparate sources, with quantitative findings cross-checked against historical performance benchmarks and expert forecasts. Segmentation analysis was validated through in-depth case studies, enabling a nuanced understanding of market drivers by engine type, vessel class, propulsion mode, fuel category, power rating, and installation approach. Finally, the entire research process underwent iterative peer review to guarantee analytical rigor, unbiased interpretation, and strategic relevance for stakeholders navigating the complex marine power ecosystem.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Marine Power System market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Marine Power System Market, by Engine Type

- Marine Power System Market, by Vessel Type

- Marine Power System Market, by Fuel Type

- Marine Power System Market, by Propulsion Type

- Marine Power System Market, by Power Output Range

- Marine Power System Market, by Installation Type

- Marine Power System Market, by Region

- Marine Power System Market, by Group

- Marine Power System Market, by Country

- United States Marine Power System Market

- China Marine Power System Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1908 ]

Summarizing Core Takeaways and Strategic Considerations That Define the Future Trajectory of the Marine Power System Landscape

In summary, the marine power system sector stands at a pivotal juncture defined by the imperative to decarbonize, digitalize, and fortify supply chains against geopolitical headwinds. Technological breakthroughs in hybrid powertrains, battery storage, and alternative fuels are accompanied by digital solutions that optimize performance and reduce operational risk. Trade policies, such as the recent U.S. tariff measures, introduce near-term cost considerations but also catalyze localized production and strategic alliances. Regional insights underscore heterogeneous adoption patterns driven by regulatory frameworks, fuel accessibility, and vessel demand profiles.

For industry and government stakeholders, balancing immediate retrofit needs with longer-term zero-emission objectives will require integrated planning, cross-sector collaboration, and targeted investment in workforce capabilities. By aligning R&D priorities with emerging fuel infrastructure and leveraging digital ecosystems, organizations can achieve sustainable growth while meeting evolving environmental standards. Ultimately, charting a resilient course through these transformative dynamics will define the competitive landscape of marine power systems for decades to come.

Securing Comprehensive Marine Power System Market Intelligence through a Direct Consultation with Ketan Rohom to Propel Informed Strategic Decisions

For decision-makers seeking to secure a comprehensive understanding of the marine power system landscape, a direct consultation with Ketan Rohom, Associate Director of Sales & Marketing, offers unparalleled access to proprietary insights and in-depth market intelligence that underpin strategic planning and competitive differentiation. By engaging one-on-one, stakeholders can explore tailored data sets and bespoke analysis that align with their technology roadmaps, supply chain strategies, and investment priorities. This personalized dialogue ensures that emerging trends, regulatory developments, and regional dynamics are contextualized to each organization’s unique positioning, enabling leaders to anticipate market shifts and capitalize on growth vectors.

Our dedicated engagement model not only clarifies complex tariff structures, segmentation nuances, and regional variances but also equips teams with actionable recommendations grounded in rigorous research methodology. To transform these insights into measurable outcomes, schedule your exclusive briefing with Ketan Rohom-gain the foresight and confidence required to navigate today’s evolving marine power environment and secure your competitive advantage through a definitive purchase of the full market research report.

- How big is the Marine Power System Market?

- What is the Marine Power System Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?