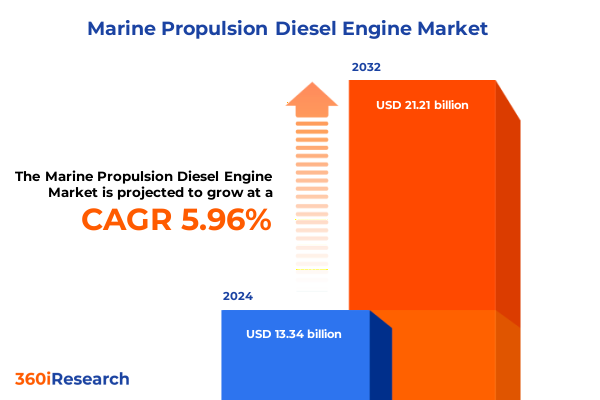

The Marine Propulsion Diesel Engine Market size was estimated at USD 13.34 billion in 2024 and expected to reach USD 14.10 billion in 2025, at a CAGR of 5.96% to reach USD 21.21 billion by 2032.

Strategic overview of the marine propulsion diesel engine sector as it adapts to decarbonization, digitalization, and operational reliability demands

Marine propulsion diesel engines remain the backbone of global seaborne trade and naval capability, moving the majority of the world’s cargo and supporting a wide spectrum of commercial, passenger, defense, and recreational vessels. Despite intensifying scrutiny over greenhouse gas and pollutant emissions, diesel technology continues to dominate deep-sea, offshore, and high-power applications because it offers proven reliability, energy density, and lifecycle economics under demanding operating conditions.

At the same time, the industry is undergoing profound change. Stricter regulations on sulfur oxides, nitrogen oxides, and carbon intensity from international and national authorities are reshaping engine design, fuel strategies, and vessel operations. Shipowners and operators are re-evaluating propulsion choices not only on the basis of power and efficiency, but also through the lens of lifecycle emissions, digital integration, and compatibility with future low- and zero-carbon fuels.

In this context, marine propulsion diesel engines are evolving rather than being abruptly displaced. Engine manufacturers are integrating advanced combustion strategies, exhaust aftertreatment, electronic control, and hybrid-electric architectures to reduce fuel consumption and emissions while preserving performance. Newbuild projects increasingly specify engines that are ready for alternative fuels such as methanol, ammonia, biofuels, or synthetic diesel, even when initial operation will be on conventional marine fuels.

Consequently, the market has shifted from a relatively mature, replacement-driven environment to one characterized by technology differentiation, regulatory risk management, and strategic fleet renewal. Understanding how these forces intersect across vessel types, speed classes, and regions is now essential for any stakeholder seeking to allocate capital effectively, protect asset values, and maintain competitive service offerings in global shipping and maritime services.

Transformative shifts redefining marine propulsion diesel engines through fuel flexibility, digital integration, hybridization, and intelligent vessel operations

The landscape for marine propulsion diesel engines is being transformed by converging structural shifts that extend well beyond incremental efficiency gains. Decarbonization has moved from a long-term aspiration to an immediate design and investment constraint, forcing shipowners to reconcile existing fleets with increasingly stringent greenhouse gas reduction trajectories. This is prompting widespread interest in engines that can operate on cleaner fuels, integrate seamlessly with hybrid systems, and provide transparent emissions data for compliance reporting.

One major shift lies in the emergence of fuel-flexible and dual-fuel diesel platforms. Large two-stroke and medium-speed four-stroke engines are now being specified as methanol-ready or ammonia-ready, with hardware and control systems designed to be upgraded as fuel supply chains mature. Smaller engines used in workboats, patrol craft, and recreational vessels are also seeing increased penetration of biofuel blends and synthetic drop-in fuels, which allow owners to reduce lifecycle emissions without replacing existing propulsion architectures.

In parallel, digitalization and connectivity are redefining the value proposition of marine diesel engines. Advanced engine management systems, sensor-rich components, and real-time data links enable continuous monitoring of performance, emissions, and component health. This, in turn, supports predictive maintenance, optimized voyage planning, and condition-based overhauls, which can extend service intervals and reduce total cost of ownership. Remote diagnostics and software upgrades are becoming as important as hardware robustness, particularly for global fleets operating in dispersed regions.

Electrification is also altering how diesel engines are integrated into propulsion systems. Hybrid configurations that combine diesel engines with battery energy storage are spreading from passenger ferries and harbor craft into offshore support vessels and certain coastal cargo segments. In these architectures, diesel engines often operate closer to optimal load points while batteries handle peak shaving, low-speed maneuvering, and hotel loads, yielding measurable gains in fuel efficiency and emissions reduction.

Moreover, emerging concepts such as autonomous and highly automated vessels rely on propulsion systems that are tightly integrated with navigation, control, and safety systems. For diesel engine suppliers, this means designing propulsion packages that are not only mechanically reliable but also cyber-secure, interoperable with third-party software, and capable of delivering high-quality data streams. Taken together, these shifts signify a transition from standalone power units to intelligent, networked propulsion ecosystems in which the diesel engine remains central but no longer operates in isolation.

Cumulative impact of 2025 United States maritime trade actions on sourcing, cost structures, and risk management in marine diesel propulsion

Trade policy developments in the United States during 2025 have layered a new dimension of complexity onto the marine propulsion diesel engine landscape. Building on earlier rounds of Section 301 tariffs, the U.S. Trade Representative concluded that China’s state-supported strategy to dominate maritime, logistics, and shipbuilding sectors was actionable under U.S. trade law, citing its impact on market-oriented competition and domestic industrial capability. This determination set the stage for targeted actions aimed at reducing dependence on Chinese-built vessels and related maritime equipment.

In April 2025, U.S. authorities outlined a phased framework of fees and restrictions focused on Chinese vessel operators, Chinese-built ships, and key port equipment such as ship-to-shore cranes. These measures were explicitly designed to disincentivize the use of Chinese shipping assets calling at U.S. ports and to send a demand signal for vessels built in U.S. yards or allied countries. For an industry in which marine propulsion diesel engines are deeply embedded in long-lived assets, these actions altered the relative attractiveness of sourcing hulls and propulsion packages from different shipbuilding clusters.

However, by late 2025 the geopolitical and economic calculus had shifted again. Following high-level negotiations between the U.S. and China, both sides agreed to pause their respective port fees and certain associated tariffs, including those on Chinese-made port cranes, for a twelve-month period starting in November 2025. This suspension temporarily eased pressure on global shipping costs and reduced immediate cost escalation risks for shipowners whose fleets rely heavily on Chinese-built hulls equipped with diesel propulsion systems.

The cumulative effect of these tariff actions and subsequent suspensions in 2025 has not been neutral, even with the temporary truce. Shipowners, shipyards, and engine manufacturers have been compelled to revisit sourcing strategies, contractual structures, and risk allocations. Long-term newbuild programs are increasingly stress-tested against scenarios in which tariffs or fees could be reactivated or expanded, particularly for vessels constructed in or operated by entities based in countries subject to U.S. trade actions. As a result, many stakeholders are placing greater emphasis on diversification of shipbuilding partners, including in South Korea, Japan, Europe, and emerging yards in Southeast Asia.

For the marine propulsion diesel engine market specifically, these developments influence not only where engines are built and installed but also how inventories of critical components, spare parts, and subassemblies are managed. Some engine manufacturers are reinforcing regional assembly, testing, and service capabilities in the Americas and Europe to limit exposure to cross-border disruptions. Others are renegotiating long-term supply contracts for castings, turbochargers, control electronics, and fuel equipment to ensure redundancy and price stability. Even if the near-term financial impact of suspended tariffs is muted, the underlying policy volatility encourages a strategic shift toward more resilient, regionally balanced supply chains.

Looking ahead, the uncertainty surrounding future tariff structures and enforcement timelines is likely to remain a strategic variable in propulsion-related investment decisions. Fleet operators evaluating major refits or new propulsion concepts must now weigh not only fuel price trajectories and emissions regulations, but also the potential for trade actions to alter the lifecycle economics of engines and vessels sourced from specific jurisdictions. This reinforces the importance of flexible contracting, diversified partnerships, and scenario-based planning for capital-intensive propulsion assets.

Segmentation insights reveal how engine placement, installation type, speed class, vessel mission, and end user shape diesel propulsion choices

Understanding the marine propulsion diesel engine market requires careful examination of how demand and technology choices vary by engine placement. Inboard configurations remain central to deep-sea cargo vessels, tankers, large passenger ships, naval platforms, and many workboats, where direct connection to the propulsion shaftline or gearbox delivers high power density and robust reliability. Outboard engines, by contrast, are more prominent in smaller recreational craft, fast-response vessels, and certain coastal service boats, where modularity, ease of replacement, and maneuverability are critical. Sterndrive or inboard–outboard solutions bridge these categories by combining inboard-mounted engines with steerable drives, appealing to owners seeking compact layouts and good handling. Jet drive systems, also typically inboard, are favored in shallow-water, high-speed, or debris-prone environments, such as riverine patrol, high-speed passenger services, and specialized workboats, where reduced risk of damage to exposed propellers is a significant advantage.

Installation type further shapes demand patterns. Newbuild projects tend to prioritize the latest emissions-compliant engines, digital control systems, and fuel-flexible or hybrid-ready architectures because design choices can be optimized from the keel up. In this context, shipyards and owners are increasingly specifying engines that can transition to alternative fuels or integrate with battery systems, even if initial operation remains conventional. Retrofit and repower projects, on the other hand, are driven by the need to extend asset life, achieve regulatory compliance, and improve fuel efficiency without replacing the entire vessel. These projects often involve replacing legacy engines with modern, electronically controlled units, upgrading turbocharging and fuel systems, and integrating aftertreatment or hybrid modules within the constraints of existing engine rooms and weight envelopes.

Engine speed class is another critical lens for understanding technology and application choices. Low-speed engines operating below 750 RPM, typically in large two-stroke configurations, dominate the main propulsion of very large commercial cargo and tanker vessels that require high thermal efficiency and the ability to burn a range of heavy fuels or fuel blends. Within this class, power spans from below 1000 kilowatts for smaller hulls to well above 6000 kilowatts for the largest ocean-going ships, with intermediate ranges between 1000 and 6000 kilowatts tailored to specific hull designs and service profiles. Medium-speed engines between 750 and 1200 RPM, generally four-stroke units, serve as both main propulsion and auxiliary power sources on a wide variety of ships, from offshore support and passenger vessels to workboats and naval auxiliaries, across a similar spread of power ratings.

High-speed engines form two broad clusters. The first, running between 1201 and 1800 RPM, is widely used in fast ferries, patrol craft, crew boats, larger recreational yachts, and certain coastal cargo or offshore support vessels where rapid acceleration and high power-to-weight ratios are essential. Within this band, power ratings progress from below 1000 kilowatts for smaller craft through intermediate ranges of 1000 to 2000 kilowatts and 2001 to 3000 kilowatts, up to configurations that exceed 3000 kilowatts and can reach beyond 6000 kilowatts in multi-engine installations. The second cluster, operating above 1800 RPM, caters to even lighter and faster vessels, including high-performance patrol boats, specialized workboats, and premium recreational craft. Similar power sub-ranges apply, with the highest ratings often achieved through multiple high-speed engines working in concert, sometimes coupled with waterjets or surface drives.

Vessel type introduces further nuance in propulsion preferences. Commercial cargo vessels, including bulk carriers, container ships, general cargo vessels, and roll-on/roll-off units, rely heavily on low-speed and medium-speed inboard engines designed for continuous operation on long voyages. Tankers transporting crude oil, products, chemicals, or liquefied gases also favor robust low-speed and medium-speed solutions, with a growing emphasis on fuel flexibility and redundancy to manage operational and regulatory risks. Offshore support vessels such as anchor-handling tug supply units, platform supply vessels, construction and crane ships, crew boats, and sea trucks typically deploy medium- or high-speed engines to balance maneuverability, dynamic positioning performance, and efficiency in demanding sea states.

Passenger segments, including cruise ships, conventional ferries, and high-speed ferry services, increasingly prioritize engines that can integrate with electric propulsion, energy storage, and advanced emissions control to meet stringent port and coastal regulations. Recreational vessels, spanning personal watercraft, small craft, and large yachts or superyachts, are important users of high-speed inboard, sterndrive, jet drive, and outboard engines, with strong demand for quiet operation, low vibration, and premium onboard experience. Naval and coast guard fleets deploy a mix of low-, medium-, and high-speed engines across patrol boats, landing craft, utility vessels, frigates, and corvettes, with requirements that emphasize rapid acceleration, survivability, and compatibility with advanced combat and power systems. Inland and riverine craft, as well as workboats and tugs including dredgers, pilot and patrol boats, and harbor tugboats, rely on propulsion packages optimized for frequent starts and stops, bollard pull, and reliable performance in confined waterways.

End user categories help link these technical and application characteristics to procurement behavior. Commercial operators seek propulsion solutions that optimize lifecycle cost, uptime, and regulatory compliance across cargo, passenger, offshore, and service fleets. Defense customers emphasize mission readiness, interoperability, and secure, long-term support arrangements, often driving demand for engines that satisfy stringent military standards and can be integrated into complex combat and electrical architectures. Recreational users, while more sensitive to initial cost and brand perception, are increasingly attentive to fuel efficiency, noise, and environmental footprint. Across all end user groups, the interplay between engine placement, installation type, speed class, and vessel mission profile defines a diverse but interconnected set of propulsion opportunities for diesel engine manufacturers and service providers.

This comprehensive research report categorizes the Marine Propulsion Diesel Engine market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Engine Placement

- Installation Type

- Engine Speed Class

- Vessel Type

- End User

Regional insights across the Americas, Europe–Middle East–Africa, and Asia-Pacific highlight divergent pathways for marine diesel propulsion

Regional dynamics introduce another layer of differentiation in the marine propulsion diesel engine market, as regulatory frameworks, shipbuilding capabilities, trade patterns, and fleet compositions vary significantly. In the Americas, demand is anchored by commercial and naval fleets operating along extensive coastlines, inland waterways, and offshore energy basins. The United States and Canada maintain sizable tug and workboat fleets for harbor services and inland barge operations, which rely on medium- and high-speed diesel engines that prioritize durability, ease of maintenance, and compliance with local emissions rules. Offshore oil and gas activity in the Gulf of Mexico and off the coasts of Brazil continues to support demand for propulsion packages tailored to anchor-handling, platform supply, and construction vessels, many of which now incorporate hybrid power or advanced automation.

In parallel, environmental regulations in North American emission control areas push engine suppliers and fleet owners to adopt cleaner combustion strategies, exhaust aftertreatment, and alternative fuel readiness for coastal and short-sea shipping. Passenger ferries, cruise ships, and certain cargo services serving ports in the Americas are at the forefront of specifying engines compatible with low-sulfur fuels, biofuels, and hybrid-electric architectures. Regional naval programs, including recapitalization of patrol and support vessels, also influence demand patterns by favoring propulsion systems that combine robust performance with improved fuel economy and reduced acoustic signatures.

Across Europe, the Middle East, and Africa, conditions are highly diverse but share common themes of stringent regulation in European waters and growing maritime investment elsewhere. European countries host advanced shipyards and technology suppliers that specialize in sophisticated diesel and hybrid propulsion systems for cruise vessels, offshore wind service craft, high-speed ferries, naval ships, and specialized workboats. The presence of multiple emission control areas and ambitious regional decarbonization targets drives early adoption of cutting-edge engines, alternative fuels, and integrated power systems. In the Middle East, large-scale port developments, tanker and offshore support operations, and emerging naval programs create demand for a wide spectrum of engine sizes and configurations. African markets, while more fragmented, are investing gradually in port infrastructure, coastal security, and offshore resource development, which in turn stimulates need for reliable commercial, patrol, and service vessels powered predominantly by diesel engines.

Asia-Pacific stands out as both a center of shipbuilding and a rapidly evolving arena for propulsion technology adoption. Major shipbuilding nations in the region construct a significant share of the world’s commercial cargo, tanker, and large passenger vessels, embedding low-speed and medium-speed diesel engines at the heart of global trade capacity. At the same time, coastal states across East, Southeast, and South Asia maintain very large fishing, coastal cargo, inland, and passenger fleets, which collectively represent substantial demand for small and medium diesel engines, many in outboard, inboard, or jet drive configurations. Growing regulatory attention to air quality in port cities and to greenhouse gas emissions from regional shipping lanes is prompting gradual adoption of cleaner engines, hybrid systems, and alternative fuels.

Moreover, Asia-Pacific markets are central to the emerging supply chain for advanced engine components, electronics, and alternative fuel infrastructure. Collaboration between regional shipyards, classification societies, and global engine manufacturers is accelerating the deployment of fuel-flexible and digitally enabled propulsion platforms. Consequently, while the Americas and Europe, Middle East, and Africa regions often lead in early regulatory-driven adoption, Asia-Pacific plays a pivotal role in scaling production, driving cost efficiencies, and shaping the long-term trajectory of marine propulsion diesel engine technologies worldwide.

This comprehensive research report examines key regions that drive the evolution of the Marine Propulsion Diesel Engine market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Key company strategies center on fuel-ready platforms, integrated propulsion systems, digital services, and collaborative innovation in marine diesel

The competitive landscape for marine propulsion diesel engines is characterized by a mix of large multinational manufacturers and specialized regional players, each pursuing differentiated strategies to align with evolving regulatory, technological, and customer requirements. Major engine companies with global footprints are investing heavily in modular engine platforms that can be adapted across a wide range of vessel types, speed classes, and power ratings. These platforms increasingly feature common core designs that can be configured for conventional operation, dual-fuel capability, or future conversion to alternative fuels such as methanol or ammonia, reducing technical risk for shipowners.

A strong emphasis on research and development is evident in the race to deliver lower-emission combustion concepts, advanced fuel injection systems, and integrated exhaust aftertreatment. Engine designers are deploying high-efficiency turbocharging, optimized charge air management, and precise electronic control to minimize fuel consumption and emissions without sacrificing reliability. For high-speed engines used in fast ferries, patrol craft, and recreational vessels, manufacturers are focusing on weight reduction, noise and vibration control, and compact packaging. In medium- and low-speed segments that power large commercial cargo and tanker vessels, companies are refining large-bore engine architectures to support alternative fuels and to interface seamlessly with waste heat recovery and hybrid propulsion modules.

Beyond the engine block itself, leading firms are transforming into full-system providers. They offer integrated propulsion packages that encompass main engines, auxiliary gensets, gearboxes, propellers or waterjets, shaftline solutions, and power management systems, all orchestrated by unified control and monitoring platforms. Digital services, including predictive maintenance analytics, remote diagnostics, and performance optimization tools, are becoming central to customer value propositions. These offerings allow shipowners to optimize fuel use, extend overhaul intervals, and manage emissions compliance more effectively, while deepening long-term service relationships.

Partnerships and ecosystems are also reshaping competition. Engine manufacturers collaborate closely with shipyards, classification societies, fuel suppliers, and technology firms specializing in batteries, automation, and connectivity. Such collaborations accelerate the certification and deployment of new propulsion concepts, particularly in pilot projects for low- and zero-carbon fuels or autonomous vessel operations. At the same time, consolidation and portfolio realignment within the industry reflect a strategic focus on core competencies, with some companies divesting non-core activities to concentrate on marine and power segments, while others expand into adjacent services such as energy storage or integrated power solutions.

In this environment, differentiation increasingly hinges on the ability to offer engines that are not only efficient and reliable but also future-ready, digitally enabled, and backed by comprehensive life-cycle support. Companies that can combine technological innovation with global service networks and strong project execution capabilities are well positioned to shape the next generation of marine propulsion solutions.

This comprehensive research report delivers an in-depth overview of the principal market players in the Marine Propulsion Diesel Engine market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

Actionable strategies for industry leaders emphasize fuel flexibility, digital performance management, supply resilience, collaboration, and capabilities

Industry leaders in the marine propulsion diesel engine value chain face a strategic inflection point where early, proactive moves can secure long-term advantage. First and foremost, organizations should prioritize propulsion decisions that preserve optionality in the face of regulatory and fuel uncertainty. Selecting engines and associated systems that can transition to cleaner fuels, incorporate hybrid modules, or upgrade emissions control hardware allows fleets to adapt as regulations tighten and alternative fuel supply chains mature, without premature asset obsolescence.

In parallel, investment in data and digital capabilities should be treated as a core strategic initiative rather than an incremental add-on. Engine and vessel performance data, when collected and analyzed systematically, can reveal opportunities to optimize operating profiles, reduce fuel consumption, and identify emerging maintenance issues before they result in unplanned downtime. Leaders should establish governance structures and partnerships that ensure secure data flows between ships, shore-based operations centers, and engine manufacturers, enabling continuous improvement and evidence-based decision-making across the fleet.

Supply chain resilience is another critical priority, particularly in light of the tariff and trade policy volatility observed in recent years. Companies should map their dependence on specific shipyards, component suppliers, and manufacturing locations, then develop diversification strategies that include alternative sourcing arrangements, regional assembly hubs, and strategic stockholding of critical spares. Contractual frameworks for newbuild and retrofit projects can be shaped to share or mitigate tariff and logistics risks, protecting project economics even if trade measures shift during construction or early operation.

Collaboration across the ecosystem offers powerful leverage for addressing complex challenges such as decarbonization and safety. Fleet operators can engage early with engine suppliers, classification societies, and fuel providers to co-develop pilot projects for new fuels or propulsion concepts, ensuring that operational realities inform design choices. Financial institutions and insurers can be brought into these discussions to align financing structures and risk assessments with technical pathways that reduce emissions and enhance resilience. By working collaboratively, stakeholders can accelerate learning curves, reduce duplication of effort, and create standardized solutions that scale more readily.

Finally, leaders should invest in people and organizational capabilities that support this transformation. Engineering teams need skills in digital tools, systems integration, and alternative fuel technologies in addition to traditional marine engineering expertise. Operational staff and seafarers must be trained to manage more complex propulsion systems safely and efficiently, including hybrid architectures and advanced automation. Establishing clear internal roadmaps that link propulsion strategy to broader corporate sustainability, safety, and financial objectives ensures that technical initiatives receive sustained executive attention and adequate resources.

Robust research methodology integrating secondary intelligence, stakeholder interviews, and multidimensional segmentation underpins propulsion market insights

The findings and insights presented in this report are grounded in a structured research methodology designed to capture both the technical depth and commercial realities of the marine propulsion diesel engine ecosystem. The analytical process begins with comprehensive secondary research, drawing on regulatory documents, standards, industry association publications, company disclosures, technical papers, and conference proceedings. This desk-based review establishes the context for propulsion technologies, regulatory trajectories, fuel developments, and regional maritime activity, while also mapping the key players and value chain linkages from engine design through vessel operation and maintenance.

Building on this foundation, targeted primary research is conducted with stakeholders across the ecosystem, including engine manufacturers, shipyards, naval architects, fleet operators, classification societies, component suppliers, and port authorities. Structured and semi-structured interviews are used to probe real-world decision criteria, technical constraints, investment priorities, and operational experiences with diesel propulsion systems, hybrid configurations, and alternative fuels. These conversations provide critical validation of assumptions derived from secondary sources and illuminate emerging practices that may not yet be widely documented.

The next stage involves detailed segmentation and comparative analysis. The market is examined through the lenses of engine placement, installation type, speed class, vessel type, end user category, and geographic region. For each dimension, the research assesses how technical requirements, regulatory exposure, and commercial drivers shape propulsion choices and technology adoption. Cross-segmentation analysis identifies where multiple trends intersect, such as the combination of high-speed engines, hybrid architectures, and stringent emission regulations in passenger ferries, or the interplay between low-speed engines, alternative fuels, and long-haul trade routes in large cargo and tanker fleets.

Throughout the process, qualitative insights are integrated with quantitative indicators of fleet composition, shipbuilding activity, and technology deployment, while avoiding speculative extrapolations unsupported by evidence. Scenario thinking is employed to explore how changes in regulation, fuel availability, trade policy, or technological breakthroughs could alter propulsion strategies over time. Finally, findings are synthesized into a coherent narrative aimed at informing strategic choices by technical and non-technical decision-makers alike, with emphasis on clarity, transparency of assumptions, and practical relevance to capital planning and risk management.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Marine Propulsion Diesel Engine market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Marine Propulsion Diesel Engine Market, by Engine Placement

- Marine Propulsion Diesel Engine Market, by Installation Type

- Marine Propulsion Diesel Engine Market, by Engine Speed Class

- Marine Propulsion Diesel Engine Market, by Vessel Type

- Marine Propulsion Diesel Engine Market, by End User

- Marine Propulsion Diesel Engine Market, by Region

- Marine Propulsion Diesel Engine Market, by Group

- Marine Propulsion Diesel Engine Market, by Country

- Indonesia Marine Propulsion Diesel Engine Market

- Competitive Landscape

- List of Figures [Total: 31]

- List of Tables [Total: 1441 ]

Conclusion underscores diesel’s enduring role while highlighting adaptation to regulation, technology shifts, and evolving maritime trade conditions

Marine propulsion diesel engines are entering a decisive phase in their evolution, shaped simultaneously by decarbonization imperatives, digital transformation, and shifting trade dynamics. While alternative fuels and new propulsion concepts are gaining momentum, diesel technology remains central to global shipping, offshore services, naval operations, and a wide variety of commercial and recreational vessels. Rather than a simple transition from one dominant technology to another, the industry is moving toward a more diverse and adaptable propulsion landscape.

Across engine placements, speed classes, vessel types, and regions, owners and manufacturers are rethinking propulsion choices with an eye toward fuel flexibility, emissions compliance, operational efficiency, and supply chain resilience. Regulatory frameworks and trade policies, including the tariff measures and suspensions seen in 2025, reinforce the need for strategies that can accommodate uncertainty without compromising safety or reliability. Against this backdrop, those who harness detailed segmentation insights, invest in future-ready technologies, and cultivate collaborative partnerships will be best placed to maintain competitiveness, safeguard asset value, and contribute meaningfully to a lower-emission maritime sector.

Engage with Ketan Rohom to unlock tailored access to in-depth marine propulsion diesel engine insights and secure strategic advantage

Marine propulsion stakeholders who recognize the urgency of acting on these insights will benefit from structured, data-backed decision support. The full marine propulsion diesel engine market report has been designed to translate complex regulatory, technological, and trade dynamics into clear strategic options for fleets, yards, equipment manufacturers, investors, and policymakers.

To move from high-level understanding to concrete planning, decision-makers are encouraged to engage directly with Ketan Rohom, Associate Director, Sales & Marketing, to explore purchase options for the complete report and associated deliverables. A direct dialogue enables alignment between the report’s coverage and the organization’s specific fleet profile, regional exposure, and investment horizon. In addition, Ketan can outline opportunities for tailored analytical support that builds on the core research to address unique questions around engine technology choices, retrofit sequencing, or regional compliance pathways.

By initiating this conversation, organizations secure timely access to detailed segmentation, competitive benchmarking, regulatory mapping, and scenario analysis that are not available in the public domain. This access, in turn, empowers leadership teams to de-risk major capital decisions, strengthen negotiating positions with suppliers and financiers, and prioritize projects that deliver measurable gains in efficiency, resilience, and environmental performance. Taking this step now positions marine enterprises to navigate the next decade of propulsion transition from a position of confidence rather than constraint.

- How big is the Marine Propulsion Diesel Engine Market?

- What is the Marine Propulsion Diesel Engine Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?