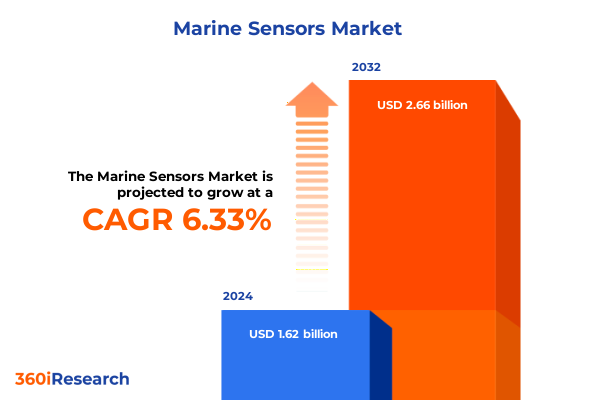

The Marine Sensors Market size was estimated at USD 1.72 billion in 2025 and expected to reach USD 1.83 billion in 2026, at a CAGR of 6.38% to reach USD 2.66 billion by 2032.

Unveiling the Critical Importance and Technological Advances of Marine Sensor Solutions Shaping the Future of Ocean Exploration and Monitoring

The marine sensor industry forms the backbone of modern oceanic exploration, enabling accurate data collection for navigation, environmental monitoring, and subsea infrastructure integrity. As vessels traverse the globe’s waters and autonomous platforms become more prevalent, reliable sensing technologies have evolved to deliver critical insights in real time. From the detection of acoustic signals that reveal undersea activity to the measurement of salinity gradients that inform climate science, these devices underpin both commercial and scientific endeavors. In essence, marine sensors serve as the eyes and ears of the maritime world, translating complex underwater phenomena into actionable intelligence.

Over the past decade, growing demand for sustainable fisheries management, offshore energy development, and national security operations has accelerated investment in high-performance sensing solutions. The drive toward digitalization and connectivity has given rise to sophisticated sensor arrays capable of multi-parameter monitoring and long-range data transmission. Meanwhile, advances in materials science have improved sensor durability and reduced maintenance requirements under harsh oceanic conditions. The convergence of miniaturization, low-power electronics, and edge-computing capabilities is redefining how sensor systems are designed and deployed.

Consequently, industry stakeholders now face an ever-shifting landscape, shaped by tightening regulatory frameworks, supply chain complexities, and evolving end-user expectations. As technological frontiers expand, companies must remain agile in aligning product roadmaps with emerging use cases ranging from subsea robotics to global surveillance networks. This introduction sets the stage for a comprehensive examination of the trends, policies, and strategic imperatives shaping the marine sensor market.

Revolutionary Technological and Regulatory Transformations Driving a New Era of Connectivity, Intelligence, and Sustainability in Marine Sensor Ecosystems

The marine sensor landscape is experiencing a paradigm shift driven by breakthroughs in connectivity, data analytics, and sustainability imperatives. Innovative wireless communication protocols now enable sensor networks to transmit high-frequency acoustic, optical, and environmental data across unprecedented ranges, reducing reliance on legacy cabling infrastructure. Simultaneously, the integration of edge computing has empowered sensor nodes to perform in-situ processing, filtering raw measurements and forwarding only actionable alerts, thus optimizing bandwidth usage and extending operational lifespans.

At the same time, machine learning algorithms have been embedded into sensor platforms to automate anomaly detection and predictive maintenance models. These capabilities allow system operators to receive early warnings on structural fatigue in subsea pipelines or ecological disturbances in marine habitats. Additionally, the deployment of multi-utility sensors capable of recording temperature, salinity, and pressure within a single housing has streamlined installation processes and cut logistical costs. Stakeholders are now prioritizing modular designs that accommodate swift sensor upgrades and rapid calibration across diverse applications.

Furthermore, mounting regulatory pressures related to marine conservation, carbon emissions reduction, and maritime security are compelling manufacturers to innovate around energy harvesting and biofouling-resistant coatings. These advances not only extend sensor longevity but also enhance accuracy under bioactive conditions that historically limited measurement fidelity. Taken together, these transformative shifts are redefining competitive dynamics, pushing industry participants to forge strategic partnerships and embrace open standards to stay ahead in a rapidly evolving market.

Assessing the Compounding Effects of 2025 United States Tariffs on Supply Chains, Costs, and Global Competitiveness of Marine Sensor Manufacturers

Recent policy measures implemented in 2025 have reshaped cost structures and supply chain strategies for marine sensor providers worldwide. The new tariff regime introduced broader duties on electronic components, specialty alloys, and precision instruments entering the United States, resulting in recalibrated sourcing decisions. Companies heavily reliant on imported pressure transducers and acoustic modules have encountered higher landed costs, necessitating adjustments to procurement portfolios and consideration of alternative manufacturing hubs.

These tariff-driven dynamics have led to extended lead times as organizations evaluate domestic suppliers and renegotiate long-term contracts. In response, some market players have initiated vertically integrated supply programs, while others have pursued joint ventures in markets offering favorable trade concessions. As component costs rise, engineering teams are challenged to optimize design architectures, leveraging consolidated multi-utility sensor platforms that reduce the overall bill of materials and assembly complexity.

In parallel, the ripple effect of elevated duties has stimulated onshore investment in sensor production capabilities, particularly in North America. Government incentives aimed at strategic industry resilience have further bolstered capital allocation toward advanced manufacturing lines. Meanwhile, end users in defense and environmental monitoring applications are revising capital expenditure cycles to account for tariff-induced budgetary shifts. Ultimately, these cumulative tariff impacts are fostering a new equilibrium in supply chain resilience, cost management, and innovation prioritization across the marine sensor domain.

Illuminating Segmentation Trends Driving Product, Connectivity, Functionality, Application, End User, and Sales Channel Strategies in Marine Sensors

A nuanced understanding of the marine sensor market emerges when exploring segmentation across product types, connectivity modes, functionality, applications, end-user profiles, and distribution channels. In terms of product offerings, acoustic sensors, GPS sensors, motion, position & speed sensors, optical sensors, pressure sensors, salinity sensors, smoke detection sensors, and temperature sensors each present unique design requirements and performance criteria. This diversity drives differentiated R&D focus, with acoustic and optical modules often commanding higher complexity and integration costs.

Connectivity trends further delineate market pathways: wired systems retain leadership where bandwidth and power stability are paramount, while wireless solutions gain traction for agile deployments in remote oceanographic missions. Functionality segmentation underscores demand for both multi-utility sensors capable of capturing environmental and operational metrics concurrently, and single-utility sensors optimized for specialized tasks. Multi-utility platforms frequently appeal to research institutes and environmental monitoring programs seeking consolidated datasets with lower deployment footprints.

When examining applications, communication & navigation use cases often prioritize GPS and speed measurement devices, whereas defense & security applications demand ruggedized, high-resolution acoustic and pressure sensors. Environmental monitoring and ocean exploration initiatives leverage salinity and temperature sensing to model ecological changes, while underwater research platforms require precise optical and motion detection arrays. End users range from commercial shipping operators and service providers to government defense agencies and academic research institutes. Finally, market participants tailor sales strategies to direct sales channels for high-touch integration services, while distributors serve broader customer bases requiring rapid fulfillment and technical support.

This comprehensive research report categorizes the Marine Sensors market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Connectivity

- Functionality

- Applications

- End-User

- Sales Channel

Examining Regional Dynamics Across the Americas, Europe Middle East & Africa, and Asia-Pacific to Uncover Strategic Opportunities in the Marine Sensor Industry

The marine sensor landscape exhibits distinct regional characteristics across the Americas, Europe, Middle East & Africa, and Asia-Pacific, each presenting tailored opportunities and challenges. In the Americas, strong demand in offshore energy exploration and coastal surveillance has spurred advancements in pressure and acoustic sensing technologies. Partnerships between sensor manufacturers and national oceanographic institutions have accelerated the deployment of integrated systems along critical shipping routes and environmental monitoring networks.

In the Europe, Middle East & Africa region, stringent environmental regulations and renewable energy initiatives have driven growth in optical and salinity sensor applications. European subsea infrastructure projects benefit from robust research funding and cross-border collaborations, while Middle Eastern desalination plants increasingly incorporate advanced temperature and pressure sensing to optimize water purification processes. African coastal nations are beginning to adopt modular wireless sensor arrays to monitor marine biodiversity and respond to climate-driven shifts in fisheries management.

Across the Asia-Pacific, the confluence of expanding naval fleets, deep-sea mining explorations, and aquaculture development has heightened the need for versatile sensor platforms. Producers in this zone leverage cost-efficient manufacturing ecosystems to offer competitively priced modules, while regional governments invest in sensor networks to safeguard maritime borders and optimize port operations. Collectively, these regional dynamics inform how market players calibrate product roadmaps, establish localized support centers, and engage in cross-region partnerships to capture growth trajectories.

This comprehensive research report examines key regions that drive the evolution of the Marine Sensors market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Identifying Leading Innovators and Strategic Player Insights Driving Competitive Advantage and Technological Leadership in the Global Marine Sensor Market

Leading companies in the marine sensor arena continuously drive innovation, form strategic alliances, and refine product portfolios to secure competitive advantage. Notable industry pioneers have invested in advanced materials and proprietary signal-processing algorithms to enhance sensor accuracy under high-pressure and low-light conditions. These efforts underscore the critical role of R&D intensity in maintaining technological leadership.

Several market participants have diversified their offerings through acquisitions of specialized sensor startups, enabling rapid entry into emerging niches such as underwater robotics and autonomous vehicle navigation. Others have expanded global service footprints by establishing calibration centers and technical support hubs in proximity to major shipping ports and offshore platforms. Collaboration with technology integrators has become a cornerstone strategy, allowing companies to embed their sensors into turnkey solutions tailored for energy, defense, and environmental sectors.

In addition, partnerships with academic and research institutions facilitate real-world testing and validation of next-generation sensors. These insight-driven alliances not only improve product reliability but also generate credible use cases that accelerate adoption across conservative end-user segments. Together, these company-level initiatives reveal how strategic positioning, technology partnerships, and service excellence define success in the competitive marine sensor marketplace.

This comprehensive research report delivers an in-depth overview of the principal market players in the Marine Sensors market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Amphenol Corporation

- BAE Systems PLC

- Baumer Holding AG

- CODAR Ocean Sensors, Ltd.

- Curtiss-Wright Corporation

- Cyclops Marine Limited

- Danfoss A/S

- Dartmouth Ocean Technologies Inc.

- Endress+Hauser AG

- Furuno Electric Co., Ltd

- Garmin Ltd.

- Gems Sensors, Inc

- Gill Sensors & Controls Limited

- Hansford Sensors Ltd.

- Honeywell International Inc.

- In-Situ Inc. by The Boeing Company

- Kongsberg Gruppen ASA

- L3Harris Technologies, Inc.

- Lockheed Martin Corporation

- Micro-Air, LLC by Innovative Motion Technologies Company

- Miros by Aircontact Group AS

- Nantong Saiyang Electronics Co.,Ltd

- NKE Marine Electronics

- Nortek Group

- NORTHROP GRUMMAN CORPORATION

- RTX Corporation

- SBG Systems

- Sea-Bird Scientific by Veralto

- Senmatic A/S

- Signet Marine Inc.

- Siren Marine, LLC by Yamaha Motor Co., Ltd.

- Sonardyne International Ltd

- TE Connectivity Corporation

- Teledyne Technologies Incorporated

- Trensor, LLC

- Xylem Inc.

Targeted Strategic Recommendations to Empower Industry Leaders to Navigate Market Challenges and Seize Emerging Opportunities in Marine Sensor Technology

Industry leaders must adopt targeted strategies to navigate cost pressures, accelerate innovation, and expand market reach. First, developing flexible manufacturing models that incorporate modular sensor architectures will enable faster time-to-market and cost optimization amid fluctuating tariffs and component availability. By designing platforms with interchangeable modules, organizations can simplify upgrades and reduce inventory complexity.

Second, forging cross-industry partnerships with telecom providers, research laboratories, and defense integrators will unlock new revenue streams. Collaborative proposals for joint pilot projects in autonomous maritime surveillance or renewable energy monitoring can demonstrate system value and secure early adopter commitments. These alliances also support knowledge sharing on emerging use cases and regulatory compliance requirements.

Third, focusing on software-enabled services such as predictive analytics subscriptions and remote calibration offerings can shift business models from transactional sales to recurring revenue. Sensor data monetization through cloud-based dashboards and proprietary analytics tools enhances customer stickiness and justifies premium pricing. Finally, investing in localized technical support and training programs across key regions will strengthen customer relationships and facilitate rapid deployment cycles. By executing these recommendations, industry leaders can position their organizations for sustained growth amid evolving market dynamics.

Detailing a Robust Multi-Method Research Framework Incorporating Qualitative, Quantitative, Expert Consultations, and Rigorous Data Triangulation Techniques

The research methodology underpinning this executive summary combined multiple research streams to ensure depth, accuracy, and actionable insights. Initially, comprehensive secondary research was conducted, drawing upon industry white papers, regulatory publications, and open-source technical journals to build a foundational understanding of marine sensor technologies and market drivers. This secondary analysis informed the design of primary research instruments and guided the selection of subject matter experts.

Subsequently, expert consultations were conducted with leading marine scientists, sensor engineers, and procurement specialists across commercial, government, and academic sectors. These interviews provided qualitative perspectives on technology adoption barriers, operational challenges, and emerging application areas. Insights from expert dialogues were systematically coded and triangulated against quantitative data to validate observed trends and reconcile conflicting viewpoints.

In parallel, quantitative data was gathered through proprietary surveys targeting supply chain managers, R&D leaders, and end users, capturing metrics on technology preferences, procurement lead times, and budget allocation shifts. Data triangulation techniques ensured consistency across multiple sources, enhancing the robustness of the findings. Finally, iterative validation sessions were held with key stakeholders to review preliminary conclusions and refine the analysis. This rigorous, multi-method approach underpins the credibility and strategic relevance of the insights presented throughout this report.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Marine Sensors market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Marine Sensors Market, by Product Type

- Marine Sensors Market, by Connectivity

- Marine Sensors Market, by Functionality

- Marine Sensors Market, by Applications

- Marine Sensors Market, by End-User

- Marine Sensors Market, by Sales Channel

- Marine Sensors Market, by Region

- Marine Sensors Market, by Group

- Marine Sensors Market, by Country

- United States Marine Sensors Market

- China Marine Sensors Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1113 ]

Synthesizing Key Findings to Illuminate the Strategic Imperatives and Future Outlook for Stakeholders Engaged in the Marine Sensor Landscape

In synthesizing the analysis of marine sensor market trends, it is evident that technological innovation, policy shifts, and strategic collaborations collectively define the path forward. Advances in wireless connectivity, edge computing, and multi-parameter sensing are converging to deliver smarter, more resilient sensor networks tailored to a diverse set of marine applications. Concurrently, evolving regulatory landscapes and tariff environments necessitate agile supply chain strategies and proactive cost-management measures.

Segmentation analysis reveals the importance of aligning product roadmaps with the unique requirements of acoustic, optical, pressure, salinity, and temperature sensing applications. Differentiated connectivity approaches, whether wired or wireless, and tailored functionality platforms can drive competitive advantage in both defense and commercial markets. Regional insights highlight the imperative to customize offerings to localized demand drivers, regulatory frameworks, and partnership ecosystems across the Americas, Europe, Middle East & Africa, and Asia-Pacific.

Ultimately, companies that integrate robust R&D pipelines, forge strategic alliances, and embrace service-oriented business models will be best positioned to capitalize on emerging opportunities. The research methodology employed ensures these conclusions rest on a solid foundation of data triangulation and stakeholder validation. By leveraging these strategic imperatives, organizations can confidently navigate the evolving marine sensor landscape and chart a course toward sustainable growth.

Take the Next Step to Secure Competitive Advantage: Connect with Ketan Rohom to Acquire Comprehensive Marine Sensor Market Research Report

If you are ready to transform your strategic outlook and harness the full potential of the marine sensor market landscape, you are invited to connect directly with Ketan Rohom, who serves as Associate Director of Sales & Marketing. His guidance and tailored expertise will help you secure the detailed market research report that contains actionable insights, in-depth analysis, and customized data essential for making well-informed investment and product development decisions. By partnering with Ketan, you will gain access to the latest trends and nuanced perspectives necessary to differentiate your offerings and outpace competitors. Reach out without delay to ensure your organization capitalizes on emerging opportunities in acoustic, optical, pressure, and temperature sensing technologies. Engage with Ketan to discuss how this comprehensive report can be integrated into your strategic planning process, and take confident steps toward market leadership.

- How big is the Marine Sensors Market?

- What is the Marine Sensors Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?