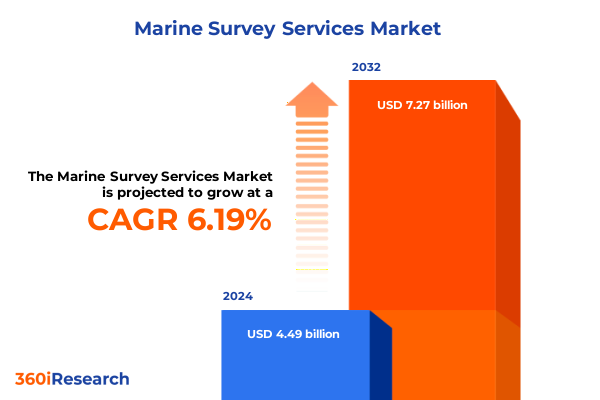

The Marine Survey Services Market size was estimated at USD 4.75 billion in 2025 and expected to reach USD 5.03 billion in 2026, at a CAGR of 6.26% to reach USD 7.27 billion by 2032.

An In-Depth Look at the Current Dynamics Shaping the Marine Survey Services Industry Amid Heightened Regulations and Evolving Stakeholder Demands

The marine survey services sector today operates at the intersection of stringent regulatory frameworks, evolving technological advancements, and increasingly complex stakeholder demands. Stakeholders from shipowners to offshore operators now expect not only the traditional due diligence in cargo, hull, and environmental assessments but also real-time data integration to support operational resilience. Against this backdrop, the introduction outlines the strategic drivers that are propelling the expansion of survey portfolios, the heightened emphasis on sustainability standards, and the shift toward digital-first methodologies.

In recent years, there has been an intensifying focus on decarbonization across the maritime industry, prompting survey providers to enhance energy-efficiency assessments and advise on alternative fuel adoption. Concurrently, geopolitical uncertainties and the specter of shifting trade policies have underscored the importance of comprehensive risk evaluations. Together, these factors underscore the critical role of marine survey services not only in certification and compliance but as strategic advisors in asset management.

This introduction sets the stage for a deeper examination of how transformative shifts, trade impacts, segmentation insights, and regional dynamics coalesce to shape the competitive landscape, guiding industry leaders toward informed, forward-looking decisions.

Examining the Key Technological and Operational Transformations Redefining Marine Survey Practices from Digitalization to Autonomous Inspection Capabilities

The landscape of marine survey services has undergone profound change, driven by a convergence of digital innovation and operational imperatives. Remote inspections leveraging high-definition live-streaming platforms and remotely operated vehicles have emerged as critical tools, enabling surveyors to collect data from vessels and offshore installations with minimal physical presence. This shift has not only accelerated inspection timelines but also enhanced safety by limiting exposure to hazardous environments.

Additionally, the integration of artificial intelligence and augmented reality within survey workflows is providing unprecedented precision in defect detection and structural analysis. AI-driven applications, such as Augmented Surveyor 3D, automatically identify anomalies on hull surfaces and subsea components, significantly reducing manual review cycles and improving the accuracy of maintenance planning. Equally important is the rise of digital twins, which furnish a dynamic, virtual representation of maritime assets, facilitating scenario planning and lifecycle management.

In parallel, there has been a surge in demand for high-value consulting services that address decarbonization pathways, regulatory compliance, and cybersecurity considerations for sensor networks and data transmission systems. This holistic approach to service delivery reflects a broader transformation from transaction-based survey models to advisory-driven partnerships, positioning survey firms as strategic collaborators in the maritime ecosystem.

Assessing How the Escalation of US Steel and Aluminum Tariffs in 2025 Has Reshaped Cost Structures and Supply Chain Dynamics for Marine Survey Operations

The imposition and subsequent escalation of U.S. steel and aluminum tariffs in 2025 have exerted multifaceted pressures on the cost structure and supply chains of marine survey operations. Initially set at 25% for both steel and aluminum imports effective March 12, 2025, the tariffs eliminated longstanding exemptions for major trading partners, compelling survey providers and vessel maintenance contractors to reassess sourcing strategies and material inventories.

On June 4, 2025, tariff rates doubled to 50% for steel and aluminum articles, intensifying cost escalations for the fabrication of sensor mounts, subsea tooling, and structural supports. As half of all U.S. aluminum consumption originates from imports-primarily from Canada-stakeholders in the marine sector have faced immediate price increases, prompting advanced purchasing and inventory build-up to mitigate tariff shocks.

In response, survey firms have recalibrated contract terms to incorporate pass-through clauses, while operators are exploring onshore production partnerships and alternative low-alloy composites where feasible. Although the tariffs aimed to bolster domestic manufacturing, the rapid policy shifts have introduced uncertainty and complexity, challenging survey service providers to balance cost containment with the delivery of high-quality, compliant inspections across offshore platforms, hull maintenance yards, and marine infrastructure projects.

Unveiling Critical Segment-Level Observations That Illuminate Market Participation Across Service Types Data Modalities Vessel Categories and End-User Verticals

Across the marine survey services domain, type-based differentiation highlights the breadth of specialized offerings. Cargo surveys focus on the integrity of stowage and container handling systems, while environmental surveys emphasize ballast water management and pollution monitoring. Hull and machinery surveys verify structural soundness and propulsion efficiency, whereas hydrographic surveys, encompassing bathymetric and oceanographic assessments, ensure safe navigation and subsea mapping. Offshore survey capabilities extend to pipeline inspections, platform installation evaluations, and subsea equipment audits, reflecting the sector’s diversification in support of energy and infrastructure operations.

Data modalities further segment the market by the nature of gathered information. Environmental data underpins compliance reporting and ecological impact studies, geospatial data supports precise charting and spatial analytics, and resource data informs subsea asset development and resource exploration.

Vessel-specific survey demands vary by operational profile. Cargo ships require frequent inspections of hull coatings and cargo holds, fishing vessels depend on winch and deck gear verifications, passenger ships mandate stringent safety audits, and tankers necessitate corrosion assessments within cargo pipelines and tanks. Meanwhile, end-user segmentation delineates engagement models among government agencies prioritizing regulatory enforcement, insurance companies assessing risk exposures, offshore operators commissioning specialized asset integrity surveys, and shipping companies seeking turnkey inspection and certification services.

This comprehensive research report categorizes the Marine Survey Services market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Data Type

- Technology

- Vessel Type

- End-user

Highlighting Regional Nuances That Drive Demand and Innovation in Marine Survey Services Across the Americas Europe Middle East Africa and Asia-Pacific Markets

Regional distinctions in marine survey services are pronounced, reflecting variations in maritime infrastructure, regulatory regimes, and investment priorities. In the Americas, robust port modernization programs and the expansion of offshore energy projects have fueled demand for detailed hydrographic and environmental assessments, supported by public-private collaborations and government-led resilience initiatives.

Europe, the Middle East, and Africa feature a dual focus on offshore wind installation surveys and stringent environmental mandates arising from the European Green Deal. This has elevated the prominence of resource data analysis and geospatial intelligence in both shallow-water and deep-water contexts, while North Sea decommissioning projects intensify requirements for pipeline integrity and platform removal evaluations.

Asia-Pacific markets are experiencing rapid growth driven by burgeoning cargo volumes, expanding ferry networks, and ongoing offshore oil and gas exploration. Survey providers in this region are leveraging advanced remote inspection technologies and digital classification services to accommodate high-frequency vessel traffic and support national decarbonization targets. Together, these regional dynamics illustrate how local economic drivers, regulatory priorities, and technological adoption rates shape the strategic focus of marine survey service firms across the globe.

This comprehensive research report examines key regions that drive the evolution of the Marine Survey Services market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Industry Players and Their Strategic Initiatives That Are Accelerating Adoption of Advanced Survey Solutions and Sustainability Practices

Industry leaders have exhibited diverse strategic approaches to capture growth opportunities within the marine survey sector. Bureau Veritas has accelerated its digital transformation agenda by launching the Augmented Surveyor 3D tool, an AI-driven platform that automates the detection and geolocation of structural anomalies during remote inspections, bolstering efficiency and safety across marine and offshore engagements.

DNV GL has underscored its role as a class society innovator, championing the integration of cyber-physical systems and high-speed connectivity to transform vessels into sensor-rich data hubs, thereby enabling remote monitoring and shore-based decision support centers. At the same time, regional specialists and niche consultancies are forging partnerships with technology providers to deliver tailored environmental data analytics and geospatial mapping solutions for port authorities and resource developers.

Collectively, these strategic initiatives reflect a competitive landscape in which digitalization, sustainability consulting, and bespoke service offerings serve as critical differentiators. Firms that have invested in advanced analytics and remote inspection capabilities are capturing higher-value engagements and reinforcing long-term client relationships through end-to-end advisory services.

This comprehensive research report delivers an in-depth overview of the principal market players in the Marine Survey Services market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Fugro Group

- DNV AS

- DOF Group ASA

- Royal Boskalis Westminster N.V

- TÜV Rheinland AG

- Bureau Veritas Marine & Offshore, SAS

- Lloyd's Register Group Services Limited.

- RINA Group

- ABL Group

- Schlumberger Limited

- Altrad Sparrows

- Apave group

- ASI Group Ltd

- Coastal marine survey

- DLS Marine

- Exail Technologies

- GEO.XYZ bv

- Global Maritime Group AS

- GUJMAR Group

- Hempel A/S

- International Marine Survey Limited

- Intertek Group plc

- Kongsberg Gruppen ASA

- Marine Geodesy Group

- Marine Surveyor Group

- Polaris Maritime Inc.

- Royal Marine Group

- Sabine Surveyors Ltd.

- SEATECH MARINE SURVEYORS & CONSULTANTS PVT. LTD.

- SGS Société Générale de Surveillance SA

- SOUTH COAST MARINE SURVEYORS

- Underwater Survey Technology 21, Inc.

Presenting a Strategic Roadmap of Actionable Steps for Marine Survey Service Providers to Capitalize on Emerging Technologies and Mitigate Trade-Related Risks

To thrive in a landscape defined by rapid technological evolution and trade uncertainties, marine survey service providers should prioritize a multifaceted strategy. First, integrating advanced remote inspection platforms with AI-driven analytics will reduce turnaround times and enhance data reliability, fostering greater client confidence and operational scalability.

Second, providers must cultivate flexible supply chain arrangements by diversifying material sourcing and establishing strategic alliances with domestic fabricators. This approach will mitigate the financial and logistical challenges posed by tariff fluctuations on steel and aluminum.

Third, expanding consulting services to encompass decarbonization roadmaps, environmental impact assessments, and cybersecurity risk management will position firms as indispensable strategic partners rather than transactional vendors. In parallel, strengthening regional partnerships-particularly within emerging Asia-Pacific and Middle Eastern markets-can unlock new project pipelines and support localized compliance expertise.

Finally, consistent investment in talent development and cross-functional collaboration will be paramount. By equipping surveyors with digital skills and fostering interdisciplinary teams, organizations will ensure seamless delivery of complex projects while adapting to evolving regulatory demands and environmental imperatives.

Detailing the Rigorous Research Framework Employed to Gather Insightful Data Through Primary Interviews Secondary Analysis and Data Triangulation Techniques

The insights presented in this executive summary are grounded in a robust research framework combining primary and secondary methodologies. Qualitative depth was achieved through interviews with senior executives at classification societies, offshore operators, shipowners, and regulatory agencies, ensuring a nuanced understanding of current operational challenges and strategic priorities.

Quantitative rigor was provided by an extensive secondary research process, encompassing regulatory filings, industry association reports, and verified customs data on trade policy impacts. Data triangulation techniques were applied to reconcile conflicting sources and to validate emerging trends, while a peer review process with subject-matter experts bolstered the credibility of the findings.

Furthermore, case studies focusing on pilot implementations of remote inspection technologies and AI-driven defect detection were analyzed to illustrate practical applications and outcomes. This methodological blend of stakeholder perspectives, empirical data, and field-level observations underpins the strategic recommendations and ensures that the conclusions reflect both market realities and forward-looking possibilities.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Marine Survey Services market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Marine Survey Services Market, by Type

- Marine Survey Services Market, by Data Type

- Marine Survey Services Market, by Technology

- Marine Survey Services Market, by Vessel Type

- Marine Survey Services Market, by End-user

- Marine Survey Services Market, by Region

- Marine Survey Services Market, by Group

- Marine Survey Services Market, by Country

- United States Marine Survey Services Market

- China Marine Survey Services Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1908 ]

Synthesizing the Main Findings and Implications to Reinforce the Strategic Importance of Adaptive Survey Capabilities in a Rapidly Evolving Maritime Environment

In summary, the marine survey services industry is undergoing a paradigm shift toward digital-enabled, advisory-driven service models, driven by technological breakthroughs, regulatory pressures, and trade policy dynamics. The adoption of remote inspection platforms, AI-powered analytics, and digital twins is redefining operational efficiency, safety, and data transparency.

Meanwhile, the 2025 escalation of steel and aluminum tariffs has introduced new cost considerations, compelling survey providers to reimagine material sourcing strategies and contract structures. Simultaneously, segmentation analysis underscores the importance of tailoring service portfolios to address diverse needs across cargo integrity, environmental compliance, geospatial intelligence, and offshore asset integrity.

Geographic variations in regulatory frameworks and infrastructure investments further shape regional demand profiles, while leading industry players differentiate themselves through innovation in digital services and sustainability consulting. By adopting the recommended actionable strategies and leveraging the comprehensive research methodology, survey service providers can navigate the complexities of the evolving landscape and reinforce their position as strategic advisors in support of a more resilient and efficient maritime sector.

Engage with Ketan Rohom to Unlock Comprehensive Insights and Obtain the Full Marine Survey Services Market Research Report Tailored for Informed Decision-Making

For decision-makers looking to deepen their understanding of marine survey services and secure a competitive edge, personalized engagement offers the fastest path to actionable intelligence. Ketan Rohom, with extensive experience in sales and marketing strategy for complex maritime research initiatives and a proven track record of guiding organizations through technical procurement challenges, is prepared to lead a tailored discussion on how this comprehensive report can address your unique business priorities. By reaching out to Ketan, stakeholders gain direct access to deeper insights on market dynamics, segmentation nuances, and regional forecasts, along with guidance on leveraging transformative trends and navigating the impact of trade policies. Connect with him to arrange a consultation or secure your copy of the marine survey services market research report and equip your team with the decisive intelligence required to steer future strategy and operational investments

- How big is the Marine Survey Services Market?

- What is the Marine Survey Services Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?