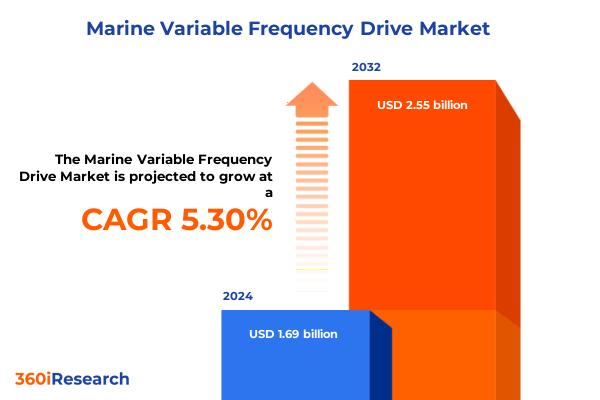

The Marine Variable Frequency Drive Market size was estimated at USD 1.78 billion in 2025 and expected to reach USD 1.87 billion in 2026, at a CAGR of 5.31% to reach USD 2.55 billion by 2032.

Exploring the Pivotal Role and Strategic Potential of Marine Variable Frequency Drives in Modern Naval and Commercial Fleets Amid Energy Transition

The adoption of variable frequency drives in marine applications is emerging as a strategic imperative for modern fleets seeking enhanced operational efficiency and reduced environmental impact. As propulsion systems evolve to meet stringent emissions regulations and rising fuel costs, marine drives have shifted from optional add-on components to core enablers of vessel performance. Stakeholders across commercial shipping, offshore support, cruise operations, and defense platforms are increasingly recognizing the value of advanced motor speed control in optimizing power consumption and minimizing wear on critical machinery. Consequently, decision-makers are positioning marine variable frequency drives at the forefront of technology roadmaps to drive long-term sustainability and competitiveness.

Against a backdrop of accelerating maritime electrification and digital transformation, the strategic potential of marine drives cannot be overstated. Their integration into retrofit projects and newbuild programs is unlocking significant gains in load management, torque precision, and vessel maneuverability. Moreover, the synergy between drive systems and condition-monitoring platforms is fostering predictive maintenance regimes that mitigate downtime and extend equipment lifecycles. As the industry enters a phase defined by decarbonization targets and operational transparency, variable frequency drives will play a pivotal role in orchestrating the next generation of smart, resilient, and eco-efficient vessels.

Unveiling the Disruptive Technological Advances Transforming the Marine Drives Landscape Through Digitalization and Emission Control Integration

Technological advancements are reshaping the marine drives landscape at an unprecedented pace, driven by the imperatives of energy efficiency, emission reduction, and digital integration. Power electronics have undergone significant miniaturization and ruggedization, enabling drives to withstand harsh marine environments while delivering higher switching frequencies and tighter control loops. Concurrently, the convergence of drive systems with onboard digital networks is facilitating real-time performance analytics, remote diagnostics, and seamless integration with energy management systems. These transformative capabilities are empowering ship operators to optimize vessel performance under varying load profiles and sea conditions more precisely than ever before.

In parallel, regulatory pressures to limit greenhouse gas emissions and sulfur oxide discharges are catalyzing shifts toward hybrid and all-electric propulsion architectures. Variable frequency drives are central to these new powertrain configurations, modulating motor inputs to balance load-sharing between diesel generators, battery banks, and energy storage devices. This evolution is not only improving fuel economy but also expanding operational flexibility in port and at sea. As these trends gain momentum, the marine drives market is pivoting toward holistic electric propulsion ecosystems that marry hardware innovation with software-driven intelligence, heralding a new era of environmentally conscious maritime operations.

Assessing the Far Reaching Consequences of New United States Import Tariffs on Marine Variable Frequency Drive Supply Chains and Strategic Sourcing

The recent imposition of increased United States tariffs on imported electrical and electronic components has introduced new complexities into marine drive supply chains and procurement strategies. Effective January 2025, additional duties on key subassemblies sourced from certain international markets have elevated landed costs and prompted shipyards to reassess sourcing partners. For manufacturers reliant on cross-border component flows, this development is translating into extended lead times and the need for strategic inventory buffering. In turn, vessel owners and operators are evaluating the total cost of ownership more rigorously, seeking greater transparency around component origins and tariff impacts.

These tariff adjustments have also prompted a regional diversification of manufacturing footprints. Stakeholders are exploring nearshore and domestic production options to mitigate exposure to duty fluctuations while ensuring compliance with trade regulations. Some marine drive suppliers are entering joint ventures with North American electronics fabricators to establish localized assembly facilities, thereby shielding end users from potential future tariff escalations. Moreover, the ongoing assessments of supply chain resilience underscore the importance of robust risk management frameworks that can absorb external policy shocks without disrupting shipbuilding or retrofit schedules.

Delving into the Multifaceted Segmentation Landscape Revealing Unique Marine Drive Demand Patterns Across Vessel Types Voltage Classes and Propulsion Systems

The marine drive market exhibits a rich tapestry of demand behaviors when dissected across vessel type, voltage class, power rating, propulsion type, and sales channel. Among vessel categories, merchant fleets spanning bulk carriers, container ships, and tankers have demonstrated early adoption of high-power drive solutions to facilitate energy savings on transoceanic voyages. Naval platforms such as aircraft carriers and destroyers prioritize rugged, shock-resistant designs to maintain operational readiness under extreme conditions, whereas offshore support vessels increasingly rely on drives for dynamic positioning and safe station keeping. Passenger vessels continue to integrate mid-range power ratings in hybrid propulsion schemes that balance guest comfort with green credentials.

Voltage classification further differentiates drive applications, with megawatt-scale high-voltage systems favored for large-scale propulsion installations and low-voltage drives embedded in auxiliary equipment such as pumps and winches. Medium-voltage variants are carving out a niche in balanced power distribution architectures that need both capacity and flexibility. Propulsion type exerts its own influence; all-electric vessels capitalize on drive-driven electric thrusters for zero-emission maneuvering, while diesel-electric and hybrid systems utilize drive modulation to enhance generator efficiency and battery charge control. Within sales channels, original equipment manufacturers continue to bundle drives into turnkey propulsion packages for newbuilds, even as aftermarket providers expand retrofit offerings that enable legacy fleets to modernize their power control infrastructure without full system replacements.

This comprehensive research report categorizes the Marine Variable Frequency Drive market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Vessel Type

- Voltage Class

- Power Rating

- Propulsion Type

- Sales Channel

Illuminating Regional Variations in Marine Drive Adoption Trends Highlighting Strategic Opportunities Across Americas EMEA and Asia Pacific Markets

Regional market dynamics underscore the importance of geographic strategy in marine drive deployment and service support. In the Americas, retrofit initiatives among commercial fleets in the Gulf of Mexico and Great Lakes shipping lanes are driving heightened interest in medium-power drive solutions, spurred by inland waterways regulations and aging vessel stock. EMEA customers, particularly in Northern Europe and the Middle East, are motivated by stringent emission control areas and offshore energy projects, leading to a surge in high-voltage drive installations aboard drill ships and floating production platforms. Asia Pacific emerges as the shipbuilding powerhouse, where new construction of container ships, tankers, and LNG carriers demands integrated drive systems aligned with regional classification society standards.

These regional nuances are shaping supplier strategies around service infrastructure and aftermarket support networks. Suppliers are establishing local engineering centers in key ports and shipyard hubs to deliver rapid commissioning, spare parts provisioning, and condition-based maintenance analytics. Meanwhile, collaboration with local electrical grid operators in developed markets is facilitating dual-use charging capabilities for vessels equipped with battery-backed drive systems. This localized approach not only reduces downtime but also strengthens customer relationships by embedding support capabilities within each market’s unique regulatory and operational context.

This comprehensive research report examines key regions that drive the evolution of the Marine Variable Frequency Drive market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting the Competitive Strategies and Technological Innovations of Leading Global Marine Variable Frequency Drive Manufacturers Driving Industry Evolution

Market leadership in marine variable frequency drives is characterized by a blend of technological prowess, global service reach, and strategic partnerships. Key players are differentiating through modular drive architectures that streamline integration into diverse vessel platforms, enabling scalable power ratings without compromising reliability. Investments in power semiconductor innovations and advanced cooling systems have further enhanced the robustness of product portfolios for harsh marine environments. These companies are also forging alliances with digital platform providers to deliver predictive maintenance solutions, leveraging cloud-based analytics to anticipate drive system faults and optimize maintenance schedules.

Beyond technology, successful manufacturers are expanding their footprints through targeted acquisitions and joint ventures, particularly in regions where local certification and in-country manufacturing confer competitive advantages. These strategic initiatives are complemented by dedicated R&D centers focused on next-generation marine electrification, including AI-driven energy management algorithms and bidirectional drive functionalities for regenerative power harvesting. As the market consolidates, companies that marry technical innovation with comprehensive lifecycle services are positioned to capture value across the drive ecosystem, from component supply through long-term operational support.

This comprehensive research report delivers an in-depth overview of the principal market players in the Marine Variable Frequency Drive market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ABB Ltd.

- Berg Propulsion AB

- CG Drives & Automation AB

- Danfoss A/S

- Emerson Electric Co.

- Fuji Electric Co., Ltd.

- Mitsubishi Electric Corporation

- Rockwell Automation, Inc.

- Schneider Electric SE

- Siemens AG

- WEG S.A.

- Yaskawa Electric Corporation

Charting Actionable Strategies for Industry Stakeholders to Navigate Regulatory Challenges and Capitalize on Emerging Opportunities in Marine Drive Markets

Industry stakeholders can fortify their market positions by embracing an innovation-led product roadmap that prioritizes energy efficiency enhancements and digital service offerings. By integrating advanced motor control algorithms and remote monitoring capabilities into drive systems, suppliers can deliver measurable operational benefits that resonate with fleet owners focused on cost containment and regulatory compliance. Furthermore, establishing localized assembly and service facilities will mitigate tariff risks and shorten lead times, bolstering supply chain resilience in the face of geopolitical uncertainties.

Collaborative partnerships between drive manufacturers, shipyards, and software developers are equally crucial. Co-developing retrofit packages that simplify installation and commissioning on existing vessels can accelerate technology adoption and unlock aftermarket revenue streams. Simultaneously, engaging with classification societies early in the design process ensures that novel drive architectures meet evolving safety and performance standards. By executing these strategies in concert, industry leaders will be well positioned to capitalize on the accelerating shift toward electrified propulsion and digital operations within the marine sector.

Detailing Rigorous Research Approaches Combining Primary Expert Insights and In Depth Secondary Analysis for Robust Marine Drive Market Intelligence

The research underpinning this analysis is grounded in a rigorous methodology that integrates primary expert interviews with comprehensive secondary data evaluation. Leading marine drive designers, shipyard executives, propulsion system integrators, and end users were consulted to gain nuanced perspectives on technical requirements and market drivers. These qualitative insights were complemented by an exhaustive review of public regulatory filings, patent databases, and industry white papers to ensure that the technological outlook reflects the most current advancements.

Quantitative validation was achieved through triangulation of multiple data sources, including manufacturer disclosures, trade association statistics, and port authority reports. A bottom-up approach was employed to map drive adoption patterns across vessel classes and propulsion systems, while scenario analysis assessed the potential impacts of policy shifts such as tariff changes and emissions regulations. The combined methodological framework ensures that the findings presented here offer robust, actionable intelligence for stakeholders seeking to navigate the marine variable frequency drive landscape with confidence.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Marine Variable Frequency Drive market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Marine Variable Frequency Drive Market, by Vessel Type

- Marine Variable Frequency Drive Market, by Voltage Class

- Marine Variable Frequency Drive Market, by Power Rating

- Marine Variable Frequency Drive Market, by Propulsion Type

- Marine Variable Frequency Drive Market, by Sales Channel

- Marine Variable Frequency Drive Market, by Region

- Marine Variable Frequency Drive Market, by Group

- Marine Variable Frequency Drive Market, by Country

- United States Marine Variable Frequency Drive Market

- China Marine Variable Frequency Drive Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 2067 ]

Summarizing Key Insights on Marine Drive Market Dynamics Emphasizing Strategic Imperatives for Energy Efficiency and Digital Transformation Initiatives

In summary, variable frequency drives are poised to become the linchpin of modern marine propulsion strategies, offering a pathway to enhanced efficiency, reduced emissions, and advanced digital capabilities. The interplay of technological innovation, regulatory impetus, and shifting procurement landscapes is driving a transition toward integrated electric and hybrid powertrain architectures across all vessel segments. Industry players that anticipate and respond to these dynamics by investing in modular drive technologies, strategic regional presence, and digital service ecosystems will secure a sustainable competitive edge.

Looking ahead, the convergence of energy storage solutions, bidirectional power conversion, and AI-enabled analytics will further elevate the strategic value of drive systems. As marine operators and shipbuilders embrace decarbonization goals, variable frequency drives will remain central to achieving operational resilience and environmental stewardship. The insights and recommendations detailed in this executive summary lay a solid foundation for informed decision-making, equipping stakeholders to chart a successful course through the rapidly evolving marine drives domain.

Inspiring Engagement with Expert Associate Director to Secure Comprehensive Marine Drive Market Research for Strategic Decision Making and Growth Enablement

To explore deeper insights tailored to your strategic priorities and to secure access to the full comprehensive marine variable frequency drive market research report, please reach out directly to Ketan Rohom, Associate Director, Sales & Marketing at 360iResearch. Ketan brings extensive expertise in maritime electrification technologies and can guide you through the report’s detailed findings, ensuring you leverage the most pertinent data for your organization. Engaging with Ketan will enable you to obtain customized research packages, exclusive executive summaries, and priority briefing sessions that align with your operational and investment objectives. Don’t miss the opportunity to equip your leadership team with the actionable intelligence required to navigate the dynamic marine drives landscape successfully and to gain a competitive edge in the evolving global marketplace.

- How big is the Marine Variable Frequency Drive Market?

- What is the Marine Variable Frequency Drive Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?