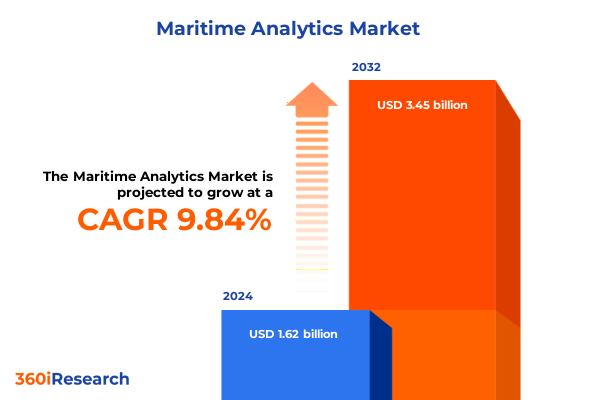

The Maritime Analytics Market size was estimated at USD 1.78 billion in 2025 and expected to reach USD 1.95 billion in 2026, at a CAGR of 9.90% to reach USD 3.45 billion by 2032.

Unlocking the Power of Data-Driven Decision Making for Enhanced Efficiency, Safety, and Sustainability in Maritime Operations

The maritime industry stands at the intersection of rapid digital transformation and escalating geopolitical complexity, making data-driven insights indispensable for decision-makers. Advanced analytics solutions have moved beyond mere reporting tools to become strategic assets that unlock real-time visibility across vessel performance, supply chain flows, and environmental compliance. As shipping companies grapple with tighter regulatory mandates and volatile trade environments, maritime analytics offers a cohesive framework for integrating multisource data-from onboard sensors to port logistics systems-into a unified platform for actionable intelligence.

Against this backdrop, industry leaders are prioritizing digital initiatives that enhance operational resilience and optimize resource allocation. By harnessing predictive maintenance algorithms, companies can anticipate equipment failures before they occur, significantly reducing unplanned downtime and maintenance expenditures. Simultaneously, route optimization engines leverage machine learning models to identify the most fuel-efficient navigation corridors, thereby supporting carbon intensity reduction goals established by the International Maritime Organization in 2023, which require all vessels above 400 gross tonnage to report and improve their Energy Efficiency Existing Ship Index and annual Carbon Intensity Indicator starting January 1, 2023. These converging trends underscore the critical role of maritime analytics as both a compliance enabler and a driver of competitive differentiation in an increasingly data-centric shipping ecosystem.

Embracing Technological Innovations That Are Redefining How Maritime Data Is Captured, Analyzed, and Leveraged for Competitive Advantage

Technological advancements are fundamentally reshaping how data is collected, processed, and applied across maritime operations. Edge computing solutions now capture high-frequency telemetry from propulsion systems and hull-integrity sensors, enabling near-instant anomaly detection that was previously impossible with periodic manual inspections. Moreover, digital twin platforms are gaining traction as they create accurate virtual replicas of vessels and port facilities, facilitating scenario analysis for asset lifecycle management and sustainability planning. This trend is complemented by the integration of blockchain frameworks, which enhance supply chain transparency by providing immutable shipment records, reducing fraud, and ensuring regulatory traceability.

Meanwhile, artificial intelligence and machine learning capabilities are maturing at pace, powering autonomous vessel navigation systems and adaptive scheduling algorithms that recalibrate in response to dynamic port congestion and weather forecasts. The Internet of Things (IoT) continues to proliferate, with smart buoy networks and portside analytics hubs delivering real-time environmental and security data to centralized dashboards. Through these transformative technologies, maritime stakeholders are unlocking actionable insights that drive operational efficiencies, cost reductions, and environmental benefits across the shipping value chain.

Assessing the Far-Reaching Consequences of United States Trade and Tariff Policies on Maritime Operations, Vessel Economics, and Global Supply Chains

In early 2025, the United States expanded its Section 232 trade measures to impose a 25% tariff on all steel and aluminum imports, impacting both raw materials used in shipbuilding and components critical for vessel maintenance. While designed to protect domestic industries, these measures have elevated input costs for shipyards and repair facilities, triggering a ripple effect that uplifts overall vessel construction and upkeep expenditures. At the same time, proposed levies on Chinese-built commercial ships entering U.S. ports, currently under consideration by federal trade authorities, could further increase freight rates and impair cost predictability for international shipping lines.

As a direct consequence, shipping companies are recalibrating their fleet expansion and modernization strategies. Those with older tonnage are accelerating retrofit projects to ensure compliance with energy efficiency ratings, while operators considering newbuild orders are revisiting shipyard selections and contracting terms to hedge against tariff-induced price fluctuations. Additionally, freight forwarders and cargo owners have adjusted procurement patterns to diversify sourcing beyond tariff-affected regions, shifting volumes towards suppliers in Southeast Asia and Latin America to manage landed cost volatility.

Furthermore, port authorities and terminal operators have experienced transient surges in cargo volumes as shippers expedite inbound shipments to beat tariff deadlines, followed by periods of suppressed activity once deadlines pass. These stop-start cycles have strained yard capacity and equipment utilization models, compelling stakeholders to invest in advanced berth scheduling tools and deploy temporary labor flex plans. In sum, U.S. tariff policy in 2025 has become a pivotal factor reshaping maritime economics, operational planning, and long-term investment decisions across the global shipping landscape.

Unveiling Strategic Segmentation Perspectives Across Services, Software, Technologies, Applications, End-User Industries, and Deployment Models

Maritime analytics solutions are increasingly designed to address multiple axes of market segmentation, beginning with the distinction between services and software offerings. Service providers encompass consultancy expertise, data-centric advisory, comprehensive maintenance and support frameworks, and bespoke system integration efforts, each tailored to accelerate client digitalization roadmaps. Concurrently, software suites range from asset performance management platforms to sophisticated data visualization interfaces, complemented by specialized fleet management systems, navigation and routing modules, and predictive analytics engines that forecast equipment lifecycle events.

On the technology front, the fusion of artificial intelligence, blockchain, IoT, and machine learning underpins the industry’s next-generation toolset. AI-driven platforms apply pattern recognition to identify inefficiencies, while blockchain networks secure transactional data across extended supply chains. IoT ecosystems capture granular vessel and cargo metrics, and machine learning models continuously refine predictive insights through iterative training on historical operational datasets.

Application-driven segmentation highlights use cases in fleet management-spanning fuel optimization, proactive maintenance scheduling, dynamic route optimization, and real-time vessel tracking-alongside port operations that focus on cargo logistics optimization, congestion monitoring, and performance analytics. Supply chain and logistics applications further extend analytics to cargo tracking, inventory management, and end-to-end visibility solutions, each critical for seamless cargo flows and risk mitigation.

End-user industries span defense and naval operations, fisheries and aquaculture sectors, oil and gas exploration and production, traditional shipping and logistics networks, and the tourism and cruise line segment, each with distinct regulatory and performance imperatives. Lastly, the choice between cloud-based and on-premise deployment modes offers stakeholders flexibility in architecting their analytics infrastructure, balancing considerations of data sovereignty, cybersecurity postures, and total cost of ownership.

This comprehensive research report categorizes the Maritime Analytics market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Technology

- Application

- End-User Industry

- Deployment Mode

Comparative Regional Analysis Highlighting Unique Drivers, Challenges, and Growth Opportunities in the Americas, EMEA, and Asia-Pacific Markets

Regional dynamics significantly shape the adoption curves and maturity levels of maritime analytics platforms. In the Americas, robust port infrastructure and expansive inland logistics networks drive demand for predictive maintenance and real-time visibility tools. North American carriers, in particular, leverage analytics to optimize cross-border freight movements and navigate a complex regulatory landscape that includes emissions reporting and trade compliance requirements.

Europe, Middle East & Africa present a tapestry of advanced and emerging markets. European Union directives on decarbonization have accelerated investments in digital twin and emissions monitoring systems, while Middle Eastern ports are undergoing rapid modernization, integrating smart infrastructure and AI-based terminal operations. In Africa, nascent trade corridors and the quest for infrastructure financing are catalyzing pilot analytics projects focused on port performance enhancement and cargo throughput optimization.

Asia-Pacific remains a powerhouse of maritime innovation, driven by high-volume cargo flows and smart port initiatives in countries like Singapore, China, and Japan. Government-led programs promoting 5G-enabled IoT networks and digital twin deployments underscore the region’s commitment to redefining operational efficiency and environmental stewardship in line with ambitious sustainability targets.

This comprehensive research report examines key regions that drive the evolution of the Maritime Analytics market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Market Leaders and Innovators Driving Cutting-Edge Analytics Solutions That Transform Operations, Safety, and Cost Structures

A cohort of industry leaders and innovators is shaping the maritime analytics landscape with differentiated value propositions. ABB’s OCTOPUS marine software suite integrates propulsion, navigation, and energy system data into a unified operational dashboard, achieving fuel savings of up to 15% on select container and cruise vessels by analyzing real-time performance metrics. Wärtsilä’s Smart Marine Ecosystem, including its Fleet Operations Solution, employs AI algorithms to predict engine anomalies up to 50 hours ahead of failure, enabling operators to reduce unplanned downtime through timely maintenance interventions.

Kongsberg Gruppen’s digital twin offerings within its K-Digital Platform simulate vessel and port interactions under variable environmental conditions, facilitating remote decision-support and autonomous navigation advancements. In parallel, Inmarsat’s Fleet Xpress service, now securing connectivity for over 15,000 vessels globally, combines high-throughput satellite communications with embedded cybersecurity layers to protect critical IoT networks against rising maritime cyber threats.

In the software domain, NAVIS has launched its cloud-native N4 terminal operating system, which harnesses AI and machine learning to streamline cargo handling processes and reduce berth turnaround times. MarineTraffic’s partnership with satellite data providers has enhanced vessel tracking resolution, offering global coverage that underpins risk analytics and voyage planning applications. Collectively, these leading players are driving the transition toward open-architecture ecosystems, where interoperability and extensibility form the cornerstone of tomorrow’s maritime analytics solutions.

This comprehensive research report delivers an in-depth overview of the principal market players in the Maritime Analytics market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ABB Ltd.

- Amplitude, Inc.

- Avathon, Inc.

- BigOceanData

- Broadcom Inc.

- Datalastic

- Dataloy Systems AS

- DNV AS by Stiftelsen Det Norske Veritas

- eeSea ApS

- Experian Plc

- Forcepoint LLC

- Fortinet, Inc.

- Hewlett Packard Enterprise Development LP

- Inmarsat Global Limited by Viasat, Inc.

- Kayrros SAS

- Kongsberg Gruppen ASA

- Kpler Holding SA

- Leonardo S.p.A.

- LogRhythm, Inc.

- Maritime Holdings Group Inc.

- Open Text Corporation

- Oracle Corporation

- OrbitMI, Inc.

- Palo Alto Networks, Inc.

- Petabite GmbH

- Proofpoint, Inc.

- RightShip Pty Limited

- Ship Data Center Co., Ltd. by Nippon Kaiji Kyokai

- Shipnet AS by Volaris Group Inc.

- ShipsDNA

- Signal Group

- Spire Global, Inc.

- SRT Marine Systems plc

- Thales S.A.

- Veson Nautical LLC

- Windward Ltd. by FTV Management Company, L.P.

- Zeronorth A/S

Action-Oriented Recommendations to Empower Industry Stakeholders to Capitalize on Maritime Analytics for Strategic Decision-Making and Operational Excellence

Industry stakeholders must establish a clear digital transformation roadmap that prioritizes high-impact analytics use cases, such as predictive maintenance and route optimization. By initiating pilot projects that integrate sensor data and machine learning models, organizations can build internal expertise and demonstrate rapid return on investment, laying the groundwork for enterprise-wide deployments.

To mitigate supply chain volatility, maritime operators should diversify their data sources and partner with ecosystem stakeholders-ports, carriers, and technology vendors-to develop standardized data-sharing agreements. Collaborative analytics platforms that pool anonymized performance data can deliver more robust benchmarking insights and accelerate best practice adoption across the industry.

Regulatory compliance will hinge on comprehensive emissions monitoring and reporting frameworks. Leaders must invest in digital twin and IoT solutions that capture voyage-level fuel consumption and carbon intensity metrics, ensuring alignment with IMO CII requirements. Establishing cross-functional teams comprising technical, legal, and sustainability experts will streamline compliance workflows and minimize operational disruptions.

Finally, building a skilled workforce capable of interpreting advanced analytics outputs is paramount. Companies should implement targeted training programs and forge academic partnerships to cultivate data science talent within the maritime domain. These efforts will foster an organizational culture where data-driven decision-making becomes the norm rather than the exception.

Detailing Robust Research Methodologies Combining Secondary Data Analysis, Expert Interviews, and Qualitative and Quantitative Techniques for Market Insights

This research synthesizes insights gathered through a rigorous secondary data analysis of regulatory filings, industry publications, and financial disclosures. It incorporates a comprehensive review of policy documents from bodies such as the International Maritime Organization and trade press coverage from outlets including Reuters and The Wall Street Journal.

Primary research was conducted via in-depth interviews with maritime C-suite executives, port authority leaders, and technology solution architects. Expert discussions provided qualitative validation of quantitative findings and surfaced emerging challenges and opportunities that may not yet be fully captured in published data.

Market triangulation techniques were applied to reconcile top-down macroeconomic indicators with bottom-up project-level intelligence, ensuring robust cross-verification of trends and trajectories. Data modeling leveraged both historical performance metrics and forward-looking scenario analyses to contextualize strategic imperatives under varying trade policy and technology adoption assumptions.

Throughout the methodology, strict data validation protocols were observed, including source triangulation, consistency checks, and expert peer reviews, resulting in a high-confidence set of conclusions and recommendations tailored to decision-makers in the maritime analytics ecosystem.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Maritime Analytics market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Maritime Analytics Market, by Type

- Maritime Analytics Market, by Technology

- Maritime Analytics Market, by Application

- Maritime Analytics Market, by End-User Industry

- Maritime Analytics Market, by Deployment Mode

- Maritime Analytics Market, by Region

- Maritime Analytics Market, by Group

- Maritime Analytics Market, by Country

- United States Maritime Analytics Market

- China Maritime Analytics Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1749 ]

Synthesizing Core Findings to Articulate Key Takeaways and Future Outlook for Stakeholders Navigating the Evolving Maritime Analytics Ecosystem

The confluence of technological convergence, evolving trade policies, and regulatory imperatives signals a pivotal moment for maritime analytics adoption. Organizations that proactively harness AI, digital twins, IoT, and blockchain will gain a decisive edge in operational efficiency and compliance management. By embedding analytics at the core of fleet, port, and supply chain operations, stakeholders can achieve measurable improvements in asset utilization, cost control, and environmental performance.

Moreover, the 2025 U.S. tariff landscape underscores the strategic importance of agile analytics capabilities that can adapt to policy-driven disruptions. Companies equipped with comprehensive data platforms are better positioned to navigate tariff-induced cost pressures and reroute cargo volumes with minimal operational friction. Meanwhile, collaborative data-sharing initiatives promise to raise industry-wide benchmarks and accelerate the diffusion of best practices.

Looking ahead, the maritime analytics sector is poised for continued growth as sustainability goals intensify and digital ecosystems mature. Firms that balance technological investment with organizational readiness-developing talent, forging partnerships, and refining data governance-will emerge as market leaders. Ultimately, the integration of advanced analytics will not only optimize today’s operations but also chart a more resilient and sustainable course for global shipping in the decades to come.

Engage with Ketan Rohom to Access Comprehensive Maritime Analytics Research and Data-Driven Insights for Strategic Investment and Operational Leadership

For organizations seeking an in-depth exploration of maritime analytics trends, leading technologies, and actionable insights into emerging trade policies, contact Ketan Rohom, Associate Director of Sales & Marketing at 360iResearch. Ketan can guide you through the comprehensive report, share tailored data on your specific areas of interest, and facilitate access to the full suite of analytical tools and datasets that will empower your strategic decision-making. Engage directly to discuss customized research packages, licensing options, and collaborative workshops designed to maximize the value of your investment. Unlock the complete report today and position your organization at the forefront of maritime analytics excellence.

- How big is the Maritime Analytics Market?

- What is the Maritime Analytics Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?