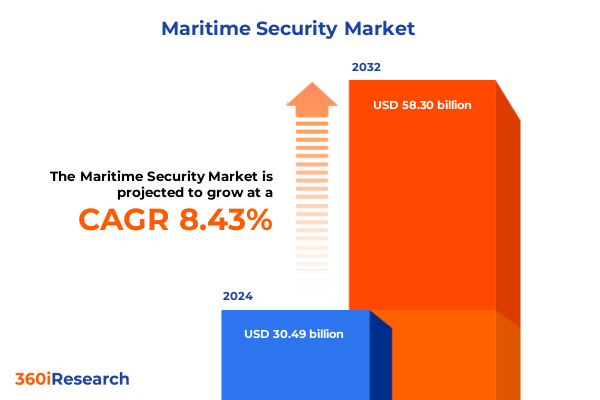

The Maritime Security Market size was estimated at USD 33.03 billion in 2025 and expected to reach USD 35.79 billion in 2026, at a CAGR of 8.45% to reach USD 58.30 billion by 2032.

Establishing the Strategic Imperative of Maritime Security Amid Intensifying Geopolitical Pressures and Evolving Technological Frontiers

The maritime domain is undergoing rapid transformation, driven by increasing geopolitical tensions, technological advancements, and the ever-expanding scope of maritime commerce. As critical sea lanes experience heightened traffic and strategic competition intensifies, the imperative for robust maritime security frameworks has never been more pronounced. Stakeholders ranging from national defense establishments to private maritime operators are reevaluating traditional security paradigms, seeking solutions that blend adaptive deterrence with real-time situational awareness.

In this context, emerging threats such as state-sponsored sabotage, asymmetric piracy operations, and cyber intrusions into critical vessel systems demand a multidimensional approach. Seamless integration of domain awareness tools, predictive analytics, and resilient command-and-control architectures can unify disparate security efforts and bolster defensive postures. A comprehensive understanding of these dynamics is essential for decision-makers seeking to allocate resources efficiently and anticipate evolving risks before they materialize.

Navigating the Convergence of Digitalization Cyber Threats and Environmental Drivers Shaping Next Generation Maritime Security Paradigms

The maritime security ecosystem is shifting away from siloed, reactive measures toward holistic, anticipatory strategies that emphasize digital convergence and cross-domain collaboration. Traditional surveillance networks, once predominantly reliant on radar sweeps and manned patrols, are now complemented by satellite-based sensors, unmanned surface vehicles, and machine-learning–driven anomaly detection. This fusion of platforms accelerates the detection of suspicious activity across vast sea expanses, enabling response teams to allocate assets with pinpoint precision.

Concurrently, environmental imperatives such as climate-driven migratory routes and extreme weather events are reshaping threat vectors. Ports and offshore installations must now factor in both human and natural disruptions when calibrating risk assessments. Adaptive resilience frameworks incorporate predictive climate models alongside vessel tracking protocols, ensuring that security architectures remain robust even under volatile environmental conditions. The result is a more fluid security posture that anticipates disruptions, rather than merely reacting to them.

Assessing the Multifaceted Consequences of United States 2025 Tariff Policies on Maritime Security Supply Chains and Cost Structures

In 2025, the United States introduced new tariffs affecting critical maritime components and services, altering global supply chain dynamics and cost structures. Equipment manufacturers and service integrators have responded by diversifying supplier portfolios, shifting procurement toward lower-tariff regions, and accelerating adoption of modular architectures to minimize tariff exposure. This strategic pivot has streamlined lead times for key subsystems but introduced complexities in quality assurance and interoperability testing.

Revealing In-Depth Perspectives from Comprehensive Component Security Type Platform Deployment and End User Segmentation Dimensions

Insight into the maritime security market emerges when examining segmentation across component, security type, platform, deployment, and end user dimensions. Within component segmentation, services encompass consulting and design, integration and deployment, maintenance and support, and training services, whereas solutions bifurcate into hardware-such as communication equipment, electro-optical sensors, and radar systems-and software, including analytics and command and control platforms as well as simulation and training applications. Security type segmentation spans access control and screening, communication and network security, data analytics and command and control, and surveillance and monitoring, revealing distinct investment priorities tied to threat profiles.

Platform-based analysis differentiates infrastructure from vessel type, the former covering coastal facilities, offshore platforms, ports, and shipyards while the latter includes bulk carriers, cargo ships, offshore support vessels, and tankers. Deployment insights contrast onboard vessels-with fixed and portable systems-and onshore installations such as coastal monitoring stations, control centers, and land-based radar. End users range from commercial shipping and cruise lines to naval and defense forces, offshore oil and gas operators, and ports and terminals. Each end user group brings unique operational imperatives that shape procurement cycles, service lifecycles, and integration strategies.

This comprehensive research report categorizes the Maritime Security market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component

- Security Type

- Platform

- Deployment

- End User

Highlighting Distinct Regional Dynamics Affecting Maritime Security Across Americas Europe Middle East Africa and Asia Pacific Zones

Regional analysis underscores markedly different security landscapes across the Americas, Europe, the Middle East and Africa, and Asia-Pacific. In the Americas, coastal nations emphasize integration of homeland security networks and cross-border intelligence sharing to address both narcotics trafficking and migratory challenges. Support infrastructure investments often prioritize fast-deployable surveillance platforms that can be scaled to cover thousands of nautical miles.

Europe, the Middle East, and Africa present a tapestry of evolving chokepoints and cultural complexities, where joint naval patrols and coalition frameworks are essential to secure critical maritime corridors. Nations in this bloc are upgrading legacy coastal facilities with advanced electro-optical sensors and networked radar arrays, striving for real-time interoperability despite varying regulatory regimes. In Asia-Pacific, territorial disputes and burgeoning offshore resource developments drive demand for layered situational awareness and redundant command-and-control nodes. Several governments have deployed autonomous monitoring buoys and enhanced cyber defenses to protect both state and commercial interests in contested waters.

This comprehensive research report examines key regions that drive the evolution of the Maritime Security market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Deciphering Strategic Positioning and Innovation Trajectories of Leading Corporations in the Maritime Security Global Ecosystem

Leading corporations are leveraging strategic partnerships and technology incubators to cement their positions within the maritime security value chain. Major defense contractors have expanded their portfolios through targeted acquisitions of smaller, specialized firms offering advanced sensor platforms or AI-enabled analytics, thereby accelerating innovation cycles. Meanwhile, dedicated maritime technology providers are establishing centers of excellence in coastal hubs, co-locating research teams with naval bases to refine prototypes under real-world conditions.

Simultaneously, software-centric companies are forging alliances with hardware manufacturers to deliver integrated command-and-control suites that unify vessel tracking, threat analytics, and response orchestration. This shift towards turnkey solutions has elevated customer expectations for end-to-end accountability, compelling providers to offer comprehensive training services and maintenance support throughout the solution lifecycle. The competitive interplay between legacy defense primes and agile innovators continues to spur rapid enhancements in system interoperability and cybersecurity hardening.

This comprehensive research report delivers an in-depth overview of the principal market players in the Maritime Security market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Ambrey Limited

- BAE Systems plc

- Black Pearl Maritime Security Management Limited

- Diaplous Maritime Services Ltd.

- Elbit Systems Ltd.

- ESC Global Security AS

- Honeywell International Inc.

- L3Harris Technologies, Inc.

- MMS Maritime (India) Pvt. Ltd.

- Neptune Maritime Security Group Ltd.

- OSI Maritime Systems Ltd.

- Raytheon Anschütz GmbH

- Saab AB

- Seagull Maritime AS

- Securitas AB

Implementing Forward-Looking Strategies and Collaborative Frameworks to Enhance Resilience Agility and Technological Adoption in Maritime Security Operations

Industry leaders must adopt forward-looking strategies that foster cross-sector collaboration, prioritize agile technology adoption, and institutionalize resilience. Establishing open architecture standards can enable seamless integration of best-of-breed sensors with emerging AI-driven analytics, mitigating vendor lock-in while accelerating capability upgrades. Furthermore, cultivating public-private partnerships with coast guards and port authorities is essential for building shared situational awareness and coordinating rapid response frameworks across jurisdictions.

Leaders should also invest in specialized workforce development programs that bridge skill gaps in cybersecurity and unmanned systems operations. Embedding continuous learning pathways into internal training curricula ensures agility in the face of evolving threat vectors. Finally, scenario-based tabletop exercises involving multidisciplinary stakeholders can validate incident response playbooks, identify latent vulnerabilities, and embed a culture of proactive risk management throughout the organization.

Outlining Rigorous Mixed Methodology Approaches Including Data Collection Analysis and Validation Protocols Underpinning Maritime Security Research

The research methodology integrates a mixed-methods approach combining primary interviews with naval officers, port directors, and system integrators alongside secondary analysis of open-source defense publications, patent filings, and industry white papers. Qualitative insights derived from structured stakeholder discussions have been triangulated with quantitative data points on procurement cycles, equipment deployments, and incident response timelines.

A multi-stage validation protocol was employed to ensure data integrity. Initial findings were cross-referenced with field reports and regulatory filings, followed by peer review workshops with subject matter experts. This iterative process of data collection, analysis, and validation underpins the robustness of the study, ensuring that conclusions reflect both strategic foresight and operational realities.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Maritime Security market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Maritime Security Market, by Component

- Maritime Security Market, by Security Type

- Maritime Security Market, by Platform

- Maritime Security Market, by Deployment

- Maritime Security Market, by End User

- Maritime Security Market, by Region

- Maritime Security Market, by Group

- Maritime Security Market, by Country

- United States Maritime Security Market

- China Maritime Security Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 2226 ]

Synthesizing Key Findings and Strategic Imperatives to Chart the Future Course of Maritime Security Governance and Innovation

Bringing together the core findings from geopolitical dynamics, technological integration, tariff impacts, and segmentation insights reveals a maritime security landscape defined by complexity and rapid evolution. Decision-makers must balance the need for advanced surveillance and response capabilities with the practical constraints of supply chain disruptions and regional regulatory variances. Companies able to harmonize hardware and software offerings within open architecture frameworks will be best positioned to meet diverse end user requirements.

Moreover, the interplay between environmental considerations and emerging threat vectors underscores the importance of adaptive resilience strategies. As the industry charts its future course, continual investment in collaborative platforms, workforce development, and scenario-based planning will be paramount. The road ahead will require both strategic agility and steadfast commitment to innovation to safeguard maritime assets against an increasingly multifaceted array of risks.

Encouraging Industry Leaders to Engage with Associate Director Sales Marketing for Tailored Insights and Access to the Comprehensive Maritime Security Report

To secure your competitive edge and operational foresight, engage directly with Ketan Rohom, whose expertise bridges the gap between maritime security challenges and pragmatic solutions. Leverage his insights to tailor strategies that resonate with your organizational objectives, ensuring your decision-making is informed by the most up-to-date intelligence and industry best practices. By partnering with Ketan Rohom, you gain privileged access to detailed analyses, scenario planning, and customized briefings designed to address your specific risk profile and growth ambitions. Reach out today to transform complex maritime security data into actionable initiatives that fortify your maritime assets and streamline compliance with evolving regulations

- How big is the Maritime Security Market?

- What is the Maritime Security Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?