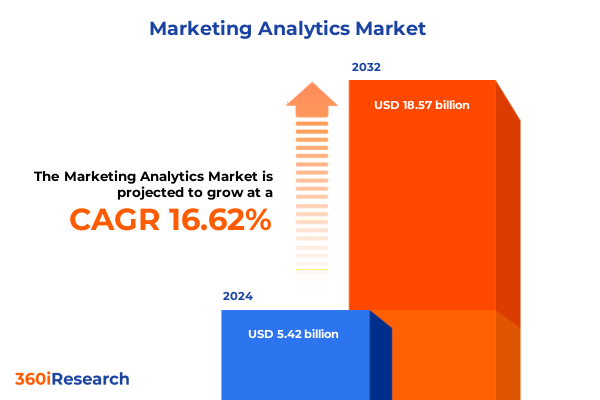

The Marketing Analytics Market size was estimated at USD 6.25 billion in 2025 and expected to reach USD 7.20 billion in 2026, at a CAGR of 16.83% to reach USD 18.57 billion by 2032.

Exploring the Evolving Landscape of Marketing Analytics and Its Strategic Imperatives for Modern Business Growth and Competitive Advantage

In the current business climate, marketing analytics has transitioned from a supporting tool to a central pillar of strategic decision-making. As organizations grapple with increasing data complexity, evolving privacy regulations, and heightened competition, the ability to extract timely, actionable insights from diverse data sources has become indispensable. Leading companies are now leveraging advanced analytics not only to measure past performance but also to anticipate future trends, optimize campaigns in real time, and deliver hyper-personalized experiences at scale.

This executive summary distills the most critical developments shaping the marketing analytics landscape. It begins by spotlighting the transformative technologies and regulatory frameworks driving change, then examines how recent U.S. tariff policies are influencing vendor pricing and customer behaviors. Following this, we delve into key segmentation dimensions-spanning service and software components, analytics types, deployment models, applied use cases, and end-user verticals-as well as regional adoption patterns across the Americas, EMEA, and Asia-Pacific. Leading vendor strategies are explored to illustrate how market participants are positioning themselves for growth, culminating in practical recommendations for industry leaders and a transparent account of the research methodology. This structured analysis is designed to equip decision-makers with an integrated view of current dynamics and actionable insights for the year ahead.

Examining the Pivotal Transformations Shaping Marketing Analytics Through AI Integration, Data Privacy Enhancements, and Real-Time Intelligence

Marketing analytics is undergoing a profound transformation as organizations harness the power of artificial intelligence and real-time data processing to drive campaign performance and customer engagement. AI-powered insights are now embedded across analytics platforms, enabling automated anomaly detection, predictive modeling, and prescriptive recommendations that guide marketing spend allocation. These advancements reduce decision latency and elevate the role of analytics from retrospective reporting to forward-looking strategy support. At the same time, the demand for unified data dashboards that consolidate metrics from SEO, social media, email marketing, and web analytics into a cohesive interface is accelerating, empowering teams to monitor performance holistically and adjust tactics instantaneously.

In parallel, heightened data privacy requirements have catalyzed the adoption of privacy-first approaches to analytics. With the deprecation of third-party cookies and the enforcement of regulations such as GDPR and CCPA, marketers are pivoting to first- and zero-party data collection methods, consent management platforms, and cookieless tracking frameworks to maintain insight depth without compromising compliance. Leading analytics vendors are integrating server-side tracking and advanced anonymization techniques to protect consumer data, thereby reinforcing brand trust while satisfying regulatory expectations. These shifts establish a new equilibrium where ethical data stewardship and analytical sophistication coexist, setting the stage for more resilient, customer-centric marketing operations.

Analyzing the Cumulative Effects of Recent U.S. Tariff Policies on Marketing Investments, Consumer Behaviors, and Corporate Profitability in 2025

The cumulative impact of U.S. tariff policies enacted through mid-2025 is exerting measurable pressure on both macroeconomic indicators and corporate profitability, with downstream effects on marketing budgets and investment priorities. Recent analysis indicates that aggregate tariffs, coupled with reciprocal measures from trading partners, are projected to lower real GDP growth by 0.8 percentage point over the calendar year 2025, while raising consumer prices by approximately 0.6% in the short term, equating to an average loss of purchasing power of $950 per household. This macroeconomic headwind is shaping the broader context within which marketers must justify spend allocation and demonstrate clear return on investment.

At the corporate level, major U.S. companies across multiple sectors are absorbing significant tariff-related costs, directly impacting net margins and constraining discretionary expenditures such as marketing. Automotive manufacturers have reported multi-billion dollar tariff hits for the year, while industrial and technology firms are noting compressed profits stemming from elevated import duties. Although some organizations have temporarily resisted passing costs to consumers, sustained tariff burdens are likely to necessitate price adjustments, which in turn could dampen consumer demand and compel marketing teams to intensify value-driven messaging strategies.

Sector-specific dynamics further complicate marketing planning. Consumer packaged goods brands facing increased raw material costs must balance transparent communication about price changes with maintaining brand loyalty. Automotive marketers are emphasizing financing incentives and quality differentials to offset higher sticker prices, while healthcare and pharmaceutical companies are adjusting promotional strategies in light of tariff-driven supply chain constraints. Across these environments, marketing analytics must integrate tariff impact modeling, scenario planning, and cross-channel attribution refinements to ensure that budget allocations and creative approaches align with shifting cost structures and consumer sensitivities.

Unveiling Critical Segmentation Perspectives That Drive Tailored Marketing Analytics Strategies Across Components, Types, Deployment Modes, and User Needs

Deep understanding of market dynamics requires a granular view of how components and service offerings align with organizational needs. On one hand, managed services and professional services deliver expert-led analytics strategy, deployment, and ongoing optimization, while software modules facilitate in-house analytical execution. Within software solutions, specialized applications for content marketing performance, customer journey analysis, email campaign measurement, SEO optimization, social media monitoring, and web behavior tracking each cater to distinct operational use cases. These differentiated offerings underscore how organizations calibrate investments between outsourcing and technology acquisition based on expertise, scale, and in-house data capabilities.

Equally important is the nature of analytics methodologies, which range from descriptive insights that report on historical performance to diagnostic techniques that uncover root causes, and predictive algorithms that forecast trends. Deployment preferences further shape solution selection, with cloud-based platforms offering scalability, rapid updates, and lower upfront costs, contrasted by on-premise implementations that deliver enhanced data sovereignty and customization for regulated industries. When combined with application-driven use cases-spanning brand optimization, campaign performance measurement, customer engagement and retention modeling, lead generation attribution, market intelligence, and tailored personalization-these dimensions provide a modular blueprint for developing end-to-end analytics architectures.

End-user verticals-from banking, financial services, and insurance to consumer goods, healthcare, telecommunications, media and entertainment, and retail and e-commerce-exhibit unique analytical requirements driven by data volume, regulatory constraints, and market complexity. Commercial financial firms prioritize risk analytics and customer lifetime value modeling; healthcare organizations require stringent data privacy controls for patient engagement metrics; media enterprises focus on cross-channel attribution and content consumption patterns; and retail players emphasize real-time personalization and inventory forecasting. A nuanced segmentation framework, therefore, empowers decision-makers to align technology, methodology, and domain expertise with specific business imperatives.

This comprehensive research report categorizes the Marketing Analytics market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component

- Types

- Deployment Mode

- Application

- End User

Gaining Key Regional Perspectives on Marketing Analytics Adoption and Innovation Across the Americas, EMEA, and Asia-Pacific Market Dynamics

Regional market landscapes for marketing analytics reveal distinct adoption patterns, investment drivers, and regulatory considerations that shape vendor offerings and buyer priorities. In the Americas, robust digital infrastructure and mature data governance frameworks foster high penetration of advanced analytics solutions, with enterprises prioritizing AI-driven customer insights, omnichannel measurement, and self-service business intelligence. North American organizations increasingly demand real-time dashboards and embedded analytics within operational workflows, while Latin American markets emphasize cost-effective cloud deployments and managed service arrangements to accelerate digital transformation.

In Europe, Middle East, and Africa, evolving privacy regulations and GDPR enhancements have heightened emphasis on secure data handling and privacy-by-design analytics architectures. Organizations across EMEA are balancing compliance imperatives with the pursuit of AI-enabled marketing automation and personalized customer experiences. Regional initiatives such as the Digital Markets Act and localized data residency requirements are influencing deployment strategies, compelling vendors to offer on-premise or hybrid solutions alongside cloud platforms. Meanwhile, Middle Eastern enterprises are investing in AI talent and government-sponsored innovation programs, and African markets are demonstrating rapid uptake of mobile-first analytics for consumer finance and retail use cases.

The Asia-Pacific region presents a combination of high growth potential and diverse regulatory environments. China, India, Southeast Asia, and Australia each exhibit unique challenges and opportunities. Advanced economies like Japan and Australia are adopting predictive and prescriptive analytics at scale, focusing on customer retention, market expansion, and automation of campaign optimization. Emerging markets are leveraging mobile data, local social platforms, and affordable cloud-based services to circumvent resource constraints. Cross-border data flow policies, partnerships with local technology providers, and localization of AI models are key factors enabling analytics adoption across the Asia-Pacific landscape.

This comprehensive research report examines key regions that drive the evolution of the Marketing Analytics market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Marketing Analytics Vendors and Their Strategic Innovations in AI, Customer Data Platforms, and Unified Measurement Solutions

In the competitive marketing analytics landscape, several leading technology providers are shaping industry standards through strategic innovation and ecosystem partnerships. Major enterprise software vendors have integrated advanced AI engines into their analytics suites, enabling automated insights generation, natural language querying, and embedded prescriptive recommendations. These players are also investing heavily in customer data platform capabilities to unify fragmented data sources, facilitate advanced segmentation, and support real-time execution of personalized campaigns across digital and offline channels.

Smaller specialized firms are carving out niches by offering modular, domain-focused analytics solutions that address the unique needs of marketing operations teams. Through targeted acquisitions and open API architectures, these vendors extend their platforms’ functionality, integrating third-party data enrichment, consent management, and privacy-compliant tracking modules. Partnerships with cloud hyperscalers and collaboration with systems integrators have enabled rapid time to value for customers, while professional services arms provide consulting and technical support to ensure successful deployments. The strategic moves of these companies illustrate a market gravitating toward unified, AI-driven, and privacy-centric analytics ecosystems that can scale across global enterprises.

This comprehensive research report delivers an in-depth overview of the principal market players in the Marketing Analytics market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Accenture PLC

- Adobe Inc.

- AgencyAnalytics Inc.

- CallRail Inc.

- CleverTap

- Funnel.io

- Google LLC by Alphabet Inc.

- HubSpot, Inc.

- International Business Machines Corporation

- Invoca,Inc.

- Mailchimp by Intuit Inc.

- Microsoft Corporation

- Mixpanel, Inc.

- MoEngage Private Limited

- Mutinex Pty Ltd.

- Nielsen Holdings plc

- Oracle Corporation

- OWOX, Inc.

- Pegasystems Inc.

- Salesforce, Inc.

- SAS Institute Inc.

- Semrush Holdings, Inc.

- Singular Labs, Inc.

- SproutLoud by Ansira Partners II, LLC.

- Supermetrics Oy

- Teradata Corporation

- TransUnion company

- Whatconverts by Icon Digital LLC

Formulating Practical Recommendations for Industry Leaders to Leverage Analytics, Navigate Regulatory Shifts, and Drive Sustainable Business Growth

To capitalize on emerging marketing analytics opportunities, industry leaders should invest in advanced AI and machine learning capabilities that support both predictive accuracy and prescriptive guidance. Implementing self-service analytics platforms with intuitive user interfaces will democratize data access across departments, fostering a culture of data-driven decision-making. Additionally, organizations must establish robust governance frameworks to manage data quality, privacy compliance, and ethical use of customer information, ensuring that analytical innovations align with evolving regulatory standards.

Marketing teams should also prioritize the integration of cross-channel attribution models that leverage real-time data streams and AI-driven weighting algorithms to accurately assess campaign performance. Adopting hybrid deployment strategies-combining cloud scalability with on-premise controls-will enable firms to meet global data residency requirements while benefiting from rapid platform enhancements. Finally, fostering close collaboration between analytics practitioners, IT, and business stakeholders will ensure that insights translate into actionable strategies, driving revenue growth, operational efficiency, and competitive differentiation.

Detailing the Rigorous Research Framework That Underpins the Comprehensive Analysis of Marketing Analytics Trends, Data Collection, and Validation Processes

This research report is grounded in a comprehensive, multi-methodology framework designed to capture the full spectrum of marketing analytics developments. Primary data collection included in-depth interviews with senior marketing executives, data scientists, and IT leaders across key industries to validate strategic priorities, deployment challenges, and technology requirements. Secondary research encompassed a systematic review of industry publications, vendor white papers, and regulatory documents to triangulate market trends and innovation trajectories.

Quantitative analyses involved the aggregation and normalization of adoption and investment data from public disclosures, technology partner reports, and market intelligence databases-ensuring that findings reflect the most current and accurate information. Advanced text mining and sentiment analysis techniques were applied to social media and customer feedback data to identify emerging use cases and sentiment shifts related to privacy, AI transparency, and real-time decision support. Rigorous validation steps, including peer review by domain experts and cross-verification against multiple data sources, underpin the credibility of the insights presented in this report.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Marketing Analytics market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Marketing Analytics Market, by Component

- Marketing Analytics Market, by Types

- Marketing Analytics Market, by Deployment Mode

- Marketing Analytics Market, by Application

- Marketing Analytics Market, by End User

- Marketing Analytics Market, by Region

- Marketing Analytics Market, by Group

- Marketing Analytics Market, by Country

- United States Marketing Analytics Market

- China Marketing Analytics Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1272 ]

Summarizing the Strategic Insights and Future Imperatives That Will Shape the Next Era of Data-Driven Marketing Excellence and Competitive Leadership

As marketing analytics continues to evolve, its strategic value has never been more pronounced. Organizations that adopt AI-powered frameworks, uphold rigorous privacy standards, and adapt to trade-driven cost pressures will be best positioned to outpace competitors and deepen customer engagement. The integration of unified data platforms, real-time dashboards, and sophisticated attribution models will enable marketing teams to optimize budgets, improve campaign effectiveness, and demonstrate clear return on investment.

Looking ahead, the next wave of innovation will be driven by immersive technologies, explainable AI, and edge analytics-all promising to deliver insights with greater speed, transparency, and contextual relevance. Industry leaders must remain vigilant to regulatory shifts and geopolitical developments, ensuring their analytics architectures are agile and resilient. By leveraging the strategic insights and actionable recommendations outlined in this executive summary, decision-makers can confidently navigate the complexities of 2025 and secure a sustainable growth trajectory in an increasingly data-driven world.

Engaging with Expert Guidance to Acquire the In-Depth Marketing Analytics Report and Accelerate Strategic Decision-Making with Associate Director Ketan Rohom

For organizations aspiring to stay ahead in the rapidly evolving world of marketing analytics, accessing comprehensive, data-driven research is essential. Associate Director Ketan Rohom invites you to explore this detailed market research report, designed to provide deep insights into AI-powered analytics, privacy-compliant strategies, and the latest global trade dynamics shaping the industry. By securing this report, you will gain practical frameworks, case studies, and expert commentary that can inform your strategic decisions and elevate your marketing performance. Connect with Ketan Rohom today to acquire your copy of the full report and unlock the actionable intelligence necessary to drive measurable results and sustainable growth.

- How big is the Marketing Analytics Market?

- What is the Marketing Analytics Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?