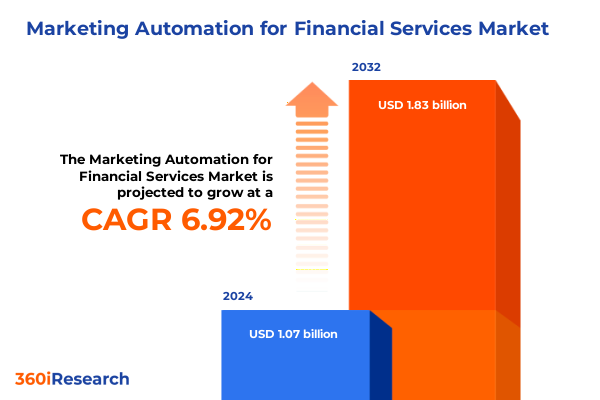

The Marketing Automation for Financial Services Market size was estimated at USD 1.14 billion in 2025 and expected to reach USD 1.22 billion in 2026, at a CAGR of 6.98% to reach USD 1.83 billion by 2032.

Charting the Rise of Marketing Automation in Financial Services and Unveiling Its Pivotal Role in Delivering Personalized Customer Engagement and Sustainable Growth

Recent research from Salesforce reveals that AI-led marketing automation is the fastest growing segment in financial services, with 65% of banking marketers currently leveraging automated personalization and 59% of capital markets teams planning to integrate such systems within two years. These technologies are not merely incremental upgrades; they represent a fundamental shift in how financial institutions engage clients across digital and traditional channels.

Moreover, leading consultancy findings underscore that organizations allocating a greater portion of their budget to marketing technology experience significant performance advantages. Companies investing more in marketing technology than in working media report an 18% greater sales lift and 7% higher revenue growth compared to peers, highlighting the critical ROI of marketing automation in driving business outcomes. As the financial services industry continues to embrace digital transformation, marketing automation platforms have emerged as indispensable tools for scaling personalization, streamlining campaign management, and optimizing resource allocation.

Against this backdrop, financial institutions are recalibrating their strategies to meet rising customer expectations for seamless, relevant interactions while adhering to stringent regulatory and privacy standards. From onboarding journeys to retention programs, marketing automation has become the backbone of customer engagement initiatives, enabling institutions to deliver the right message at the right moment with precision and consistency. This introduction sets the stage for exploring the broader shifts, impacts, and strategic imperatives shaping the marketing automation landscape in 2025.

Exploring the Transformative Technological and Operational Shifts Revolutionizing Financial Services Marketing Automation Landscape for 2025 and Beyond

The marketing automation arena is being reshaped by a series of dramatic technological and operational disruptions that promise to redefine customer engagement models. Foremost among these is the emergence of agentic AI platforms: autonomous digital agents designed to make decisions and execute tasks without constant human oversight. Leading professional services firms have introduced agentic AI systems built on advanced machine learning frameworks, aiming to optimize processes such as content creation, campaign orchestration, and compliance reviews, thereby unlocking new efficiencies while reducing operational costs.

Complementing this trend is the widespread adoption of generative AI, which is rapidly transitioning from proof-of-concept to core marketing functionality. Deloitte’s analysis indicates that 64% of brands plan to implement AI tools for automated content production, data-driven personalization, and campaign optimization, with organizations reporting faster execution, lower costs, and more relevant customer experiences. Alongside artificial intelligence, the industry’s pivot towards first-party data strategies has intensified as companies seek to navigate an evolving privacy landscape. With third-party cookies deprecated, financial institutions are investing in value-driven data collection programs, offering loyalty incentives and exclusive content in exchange for customer insights, thus ensuring compliance and reinforcing trust.

In tandem with these advances, the push toward true omnichannel engagement has accelerated. Clients now expect seamless experiences across mobile apps, web portals, call centers, and branch networks. Organizations are breaking down silos by unifying CRM systems, deploying real-time analytics, and leveraging location-based services to deliver contextually relevant messages and offers. As the confluence of AI, data privacy imperatives, and unified customer journeys gains momentum, marketing automation platforms are evolving into sophisticated engines that drive both strategic brand building and immediate performance outcomes.

Analyzing the Cumulative Impact of United States Tariffs Through 2025 on Financial Services Marketing Ecosystems and the Broader Digital Supply Chain Dynamics

The cumulative impact of U.S. trade policy changes through 2025 has introduced new complexities for financial services providers, particularly those reliant on global digital infrastructure and outsourced creative production. In September 2024, the Biden administration confirmed a series of steep tariff increases on imports from China, including a 100% tariff on electric vehicles and 25% on critical minerals and steel, maintaining many of the Trump-era measures while targeting new product categories to safeguard strategic industries. These tariffs have raised costs for hardware components, data center equipment, and specialized electronics often integral to sophisticated martech deployments.

Amid these tariff hikes, regulatory relief emerged as the Office of the U.S. Trade Representative extended exclusions for specific technology products originally subject to Section 301 duties. On May 31, 2025, the USTR announced that previously reinstated exclusions and COVID-related waivers would be extended through August 31, 2025, mitigating a portion of the added expenses for imported servers, networking gear, and certain software-focused devices. This extension has provided temporary respite for financial institutions managing capital expenditure planning for on-premise deployments and hybrid infrastructure models.

Meanwhile, e-commerce dynamics have been reshaped by proposed rule changes that target the de minimis threshold for duty-free imports. In January 2025, the administration published rules to eliminate exemptions for goods subject to Section 301 and related tariffs under the $800 shipment value threshold, requiring more detailed Harmonized Tariff Schedule classifications and reducing the volume of low-value imports from major e-commerce channels. For marketing agencies and software integrators that rely on cross-border creative assets and specialized materials, these developments necessitate a reassessment of supply chain strategies, vendor agreements, and inventory management to ensure uninterrupted service delivery while controlling costs.

Uncovering Key Segmentation Insights by Solutions, Channels, Business Size, Deployment, Application, and End Users to Inform Targeted Marketing Automation Strategies

A nuanced understanding of the marketing automation market demands a multifaceted segmentation across solutions, channels, business size, deployment, application, and end-user dimensions. The market is dissected by solution categories, encompassing content marketing platforms that govern the entire content lifecycle, cross-channel campaign management systems that orchestrate interactions across touchpoints, and lead-to-revenue management platforms that align marketing outcomes with sales pipelines. Equally important are marketing resource management tools that optimize asset production workflows, real-time interaction management engines that deliver personalized engagements at scale, and through-channel marketing automation suites designed to coordinate messages across partner and reseller networks.

Beyond solutions, the landscape is partitioned by marketing channel, diverging into content and inbound marketing methodologies that cultivate organic engagement, email marketing automation capabilities that nurture prospects through tailored communications, SMS and mobile marketing modules optimized for timely alerts and promotional offers, and social media marketing infrastructures that drive brand awareness and community building. The dichotomy of large enterprises and small to medium-sized businesses introduces distinct strategic imperatives, with enterprise organizations often seeking comprehensive, integrated platforms while SMBs prioritize ease of use, rapid deployment, and cost-efficiency.

Deployment preferences further differentiate the market, as institutions weigh the benefits of cloud-based platforms that promise scalability and continuous innovation against on-premise solutions that offer tighter data control and compliance alignment. In terms of application, cross-selling and upselling use cases highlight automation’s role in expanding wallet share, while customer onboarding and engagement scenarios illustrate its capacity to accelerate time to value and reduce churn. Lead generation and nurturing applications focus on converting high-intent prospects, loyalty and retention programs leverage automated journeys to reinforce brand advocacy, and personalized marketing and retargeting solutions dynamically adapt messaging to individual customer contexts. Finally, end users span brokerage firms seeking agile client communications, credit unions emphasizing community-driven experiences, mortgage companies streamlining loan originations, retail and commercial banks pursuing omni-channel consistency, and savings and loans associations aiming to deepen local market penetration.

This comprehensive research report categorizes the Marketing Automation for Financial Services market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Solutions

- Business Size

- Deployment Type

- Application

- End-User

- Marketing Channel

Deriving Critical Regional Perspectives Across the Americas, Europe Middle East and Africa, and Asia Pacific to Guide Tailored Financial Services Marketing Automation Approaches

Regional dynamics exert a profound influence on how marketing automation strategies are formulated and executed within financial services institutions. In the Americas, where the United States represents the largest single-country market, digital transformation initiatives are driven by the imperative to modernize legacy systems and enhance competitiveness against fintech startups. Financial institutions in North America are investing heavily in cloud-native marketing automation platforms, integrating advanced analytics and AI-driven personalization engines to deliver seamless online and mobile experiences that resonate with increasingly digital-first consumers. Meanwhile, Latin American banks are adopting mobile-centric automation tools to bridge the digital divide and extend financial inclusion to underbanked populations.

Across Europe, the Middle East, and Africa, regulatory frameworks such as GDPR and emerging data privacy directives shape the deployment of marketing automation solutions. European banks and insurers emphasize privacy-first architectures, embedding consent management features and secure data orchestration workflows into their automation pipelines. Institutions in the Gulf Cooperation Council and parts of Africa are leveraging automation to tailor product offerings to diverse customer segments, balancing rapid digital adoption with rigorous compliance requirements. In this region, partnerships between local banks and global technology vendors are forging innovative solutions that address both regional language nuances and regulatory complexities.

The Asia-Pacific region stands out for its accelerated adoption of digital banking and fintech collaboration. Markets such as Singapore, Australia, and China are pioneering integrated marketing automation deployments that harness real-time data and AI orchestration to drive hyper-personalization at scale. An Asian banking client achieved a 7% uplift in lifetime customer value through a unified automation platform that combined predictive analytics, AI-driven content recommendations, and omnichannel journey orchestration, demonstrating the transformative potential of these technologies. Emerging markets in Southeast Asia and India are rapidly following suit, with mobile-first campaigns and automated engagement models enabling financial institutions to capture new customer segments and foster deeper loyalty.

This comprehensive research report examines key regions that drive the evolution of the Marketing Automation for Financial Services market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Technology and Service Providers Shaping the Financial Services Marketing Automation Market and Their Strategic Innovations in 2025

A competitive analysis of the marketing automation landscape reveals a diverse ecosystem of technology and service providers, each bringing unique capabilities to financial services clients. Salesforce has emerged as a pioneer by embedding AI-driven personalization and real-time decisioning into its Marketing Cloud solutions, enabling institutions to deliver precise, contextually relevant messages across email, mobile, and social channels. Adobe has bolstered its leadership through the integration of generative AI within Marketo Engage and Adobe Experience Cloud, allowing marketers to automate content creation, streamline campaign workflows, and optimize asset delivery with unprecedented speed and scale. Oracle’s Eloqua platform continues to offer robust campaign automation and lead nurturing capabilities, backed by extensive integration with CRM and data management systems, while IBM’s Watson Marketing suite emphasizes AI-powered analytics and cognitive insights to tailor customer journeys.

Beyond these marquee vendors, specialized players are gaining traction by addressing niche requirements and offering modular solutions. SAS provides advanced analytics and predictive modeling engines that enhance segmentation accuracy and attribution measurement. HubSpot caters to the SMB segment with an intuitive automation interface and integrated inbound marketing tools. Emerging startups and regional service integrators complement this roster by offering bespoke automation services, data integration expertise, and localized support models. Collectively, these companies are driving relentless innovation, forging partnerships, and expanding their footprints to meet the evolving needs of financial services organizations seeking to strengthen customer relationships and unlock operational efficiencies.

This comprehensive research report delivers an in-depth overview of the principal market players in the Marketing Automation for Financial Services market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Act-On Software, Inc. by Banzai International, Inc.

- ActiveCampaign, LLC

- Adobe Inc.

- Aritic by DataAegis Software Pvt Ltd.

- Autopilot HQ, Inc

- Calyx Technology, Inc.

- Cetrix Cloud Services

- Fiserv, Inc.

- HubSpot, Inc.

- Lead Liaison LLC

- LeadSquared Inc.

- Microsoft Corporation

- NOVICAP Limited

- Ontraport, LLC

- Optimizely, Inc.

- Oracle Corporation

- Resulticks Inc.

- Salesforce, Inc.

- SalesPanda

- SAP SE

- Seismic Software Holdings, Inc.

- SharpSpring, Inc.

- Sitecore, Inc.

- Teradata Corporation

- Total Expert Inc.

Actionable Recommendations for Financial Services Leaders to Accelerate Marketing Automation Adoption, Enhance Customer Experience, and Drive Operational Excellence

To harness the full potential of marketing automation, financial services leaders should prioritize establishing clear governance frameworks that assign ownership for technology investments, data quality, and campaign performance. Instituting cross-functional centers of excellence brings marketing, sales, compliance, and IT stakeholders together, promoting alignment on objectives, data standards, and success metrics. By doing so, institutions can accelerate time to value, mitigate operational silos, and ensure cohesive execution of automation initiatives.

Next, leaders must invest in upskilling and change management to bridge the talent gap inherent in advanced automation deployments. Equipping marketing teams with data literacy, AI proficiency, and agile methodologies empowers them to iterate rapidly, optimize workflows, and extract meaningful insights from customer interactions. In parallel, embedding privacy-by-design principles and robust consent management practices will reinforce customer trust and safeguard compliance, as regulatory scrutiny intensifies globally.

Finally, adopting a modular, API-driven architecture facilitates incremental innovation and seamless integration with emerging technologies. Financial services organizations should embrace hybrid deployment models-leveraging cloud scalability for rapid experimentation while maintaining on-premise controls for sensitive workloads. By implementing iterative proof-of-concept pilots, measuring performance against clear benchmarks, and scaling successful use cases, industry leaders can drive sustainable growth, deliver hyper-personalized experiences, and build resilient marketing automation ecosystems.

Outlining a Rigorous Research Methodology Incorporating Primary and Secondary Data Sources, Expert Interviews, and Comprehensive Market Analysis Techniques

This research combines qualitative and quantitative methodologies to ensure rigor and relevance. Secondary research synthesized insights from industry reports, regulatory filings, corporate announcements, and reputable news outlets, providing a comprehensive view of market dynamics and emerging trends. Primary research comprised in-depth interviews with senior marketing, digital transformation, and technology executives from leading financial institutions, supplemented by surveys targeting practitioners responsible for automation strategy and execution.

Analytical frameworks, including SWOT assessment, Porter's Five Forces, and segmentation analysis, were employed to evaluate competitive landscapes, vendor positioning, and customer adoption patterns. Regional analyses leveraged macroeconomic indicators, digital maturity indices, and regulatory overviews to contextualize marketing automation deployment across geographies. Data triangulation ensured validation of findings and minimized bias. The research team adhered to industry best practices and ethical standards, maintaining confidentiality protocols for primary respondents and transparently documenting methodological assumptions to support reproducibility and executive decision-making.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Marketing Automation for Financial Services market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Marketing Automation for Financial Services Market, by Solutions

- Marketing Automation for Financial Services Market, by Business Size

- Marketing Automation for Financial Services Market, by Deployment Type

- Marketing Automation for Financial Services Market, by Application

- Marketing Automation for Financial Services Market, by End-User

- Marketing Automation for Financial Services Market, by Marketing Channel

- Marketing Automation for Financial Services Market, by Region

- Marketing Automation for Financial Services Market, by Group

- Marketing Automation for Financial Services Market, by Country

- United States Marketing Automation for Financial Services Market

- China Marketing Automation for Financial Services Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1113 ]

Summarizing Key Executive Takeaways on Marketing Automation Trends, Tariff Impacts, Segmentation, Regional Dynamics, and Strategic Imperatives for Financial Services

In summary, the marketing automation landscape within financial services is undergoing profound transformation, driven by breakthroughs in AI, evolving regulatory requirements, and shifting customer expectations. The intersection of agentic AI, generative content engines, and first-party data strategies is redefining how institutions deliver personalized experiences, optimize resource allocation, and measure performance. Concurrently, U.S. tariff policies and global trade dynamics introduce new operational considerations for infrastructure planning and supply chain management.

A granular segmentation lens reveals that solutions range from content marketing platforms and omnichannel campaign management tools to specialized applications for lead nurturing and loyalty programs, each tailored to distinct business models and end-user needs. Regional nuances further shape platform adoption, with North American institutions leading cloud-based innovation, EMEA firms prioritizing privacy-first architectures, and Asia-Pacific markets driving hyper-personalization at scale. Leading technology providers, including Salesforce, Adobe, Oracle, and IBM, continue to expand their automation portfolios, while agile vendors and integrators offer targeted solutions that cater to emerging market segments.

As the industry navigates these trends, actionable recommendations emphasize governance, talent development, and modular architectures to ensure sustainable adoption and impact. The robust research methodology and expert insights presented herein offer a strategic roadmap for executives seeking to harness marketing automation as a core driver of customer engagement and operational excellence.

Compelling Call To Action to Connect with Ketan Rohom and Secure the Comprehensive Marketing Automation Research Report Driving Informed Executive Decisions

For executives poised to capitalize on these insights, access to comprehensive analysis is just one conversation away. Reach out to Ketan Rohom, Associate Director of Sales & Marketing, to discuss how this research can empower your strategic priorities and drive measurable outcomes. Leverage tailored briefings, gain exclusive data access, and secure the actionable intelligence your leadership team needs to navigate the evolving marketing automation landscape. Contact Ketan today to obtain the full report and position your organization at the forefront of innovation and growth.

- How big is the Marketing Automation for Financial Services Market?

- What is the Marketing Automation for Financial Services Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?