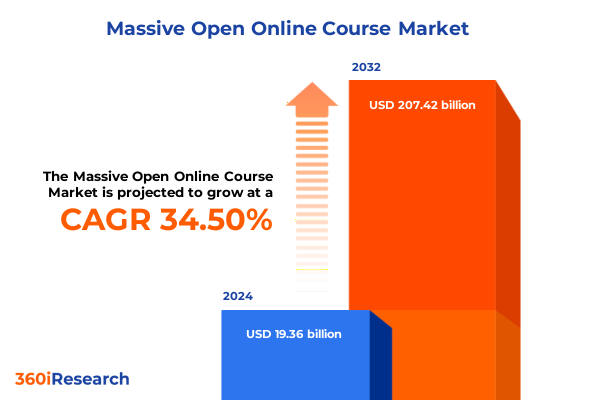

The Massive Open Online Course Market size was estimated at USD 25.99 billion in 2025 and expected to reach USD 34.52 billion in 2026, at a CAGR of 34.53% to reach USD 207.42 billion by 2032.

Understanding the Massive Open Online Course Ecosystem Through a Comprehensive Overview of Its Evolution and Present-Day Significance

Since their inception, Massive Open Online Courses have redefined how learners and educators connect, democratizing access to high-quality instruction on a global scale. Originally conceived as a means to break down geographical and financial barriers, open online education has evolved into a multifaceted ecosystem that serves students across demographics and professions. Fueled by rapid advancements in digital infrastructure, rising demand for upskilling, and the need for continuous professional development, the MOOC model has transcended its experimental roots to become a strategic pillar for academic institutions, corporate enterprises, and government initiatives alike.

As traditional delivery methods confront limitations in scalability and personalization, MOOCs present a compelling alternative by leveraging scalable platforms and data-driven learning paths. This shift is underscored by proliferation of asynchronous and synchronous learning modalities that promote both flexibility and real-time collaboration. Furthermore, ongoing innovations in adaptive learning algorithms, immersive technologies, and credentialing frameworks continue to expand the utility and credibility of online offerings. Transitioning beyond skepticism about instructional rigor or completion rates, institutions now integrate MOOCs into blended learning curricula, certification pipelines, and corporate training programs, recognizing their ability to generate measurable outcomes and broaden institutional reach.

Looking ahead, the interplay of technological innovation, regulatory landscapes, and shifting learner expectations sets the stage for an era in which Massive Open Online Courses will not only augment traditional education but also forge new pathways for lifelong learning and workforce transformation. With this context in mind, stakeholders must assess emerging opportunities and challenges to craft strategies that both honor the ethos of open access and sustain operational viability.

Analyzing the Fundamental Transformations Reshaping Open Online Education and Pioneering Innovative Learning Paradigms for Global Audiences

The open online education space is experiencing rapid metamorphosis as new technologies, pedagogical philosophies, and market demands converge. Artificial intelligence–powered tutoring systems and machine learning–driven analytics now tailor learning paths in real time, offering unprecedented levels of personalization. Within this evolving landscape, immersive technologies-such as virtual and augmented reality-are transcending the limitations of two-dimensional content, creating experiential learning modules that simulate laboratory experiments, historical re-enactments, or real-world scenarios.

Equally impactful is the rise of microcredentialing and stackable certificates, which empower learners to pursue competency-based mini-programs that align with immediate career goals. These flexible credentials are increasingly recognized by employers and academic institutions, reinforcing a shift toward skills-focused recognition over traditional degree pathways. Moreover, the proliferation of social learning environments within MOOC platforms fosters collaborative knowledge building, peer-to-peer interaction, and community-driven content curation, redefining the learner experience.

Advanced data analytics now enable course designers to refine content iteratively based on engagement metrics, dropout patterns, and feedback loops, driving continuous improvement cycles. Additionally, increasing partnerships between private sector enterprises, government bodies, and academic consortia are catalyzing innovation in content delivery and revenue diversification. In tandem, regulatory frameworks are adapting to address issues of data privacy, accreditation, and cross-border certification, ensuring that transformational shifts in the MOOC sphere adhere to evolving quality and compliance standards.

Exploring the Ripple Effects of 2025 United States Tariff Policies on Cross-Border Digital Education Infrastructure and Cost Structures

In 2025, newly enacted tariff measures imposed by the United States government on imported digital infrastructure components and cross-border service fees have reverberated across the online education sector. Platforms that rely on offshore server hosting and international cloud services have encountered elevated operational costs, compelling some to absorb these expenses and others to adjust subscription fees for corporate and individual users. In particular, tariffs targeting network hardware have driven a reassessment of supply chain strategies, prompting institutions to explore domestic procurement or to negotiate long-term agreements with regional data centers.

Moreover, the cumulative impact of these policies has extended to content licensing arrangements. International partnerships for co-developed courses and joint degree programs now face increased complexity, as import duties and service levies inflate the cost of collaborative production. Consequently, several leading providers have enhanced their in-house development capabilities to mitigate reliance on third-party vendors, while others have restructured licensing agreements to shift cost burdens away from learners.

Amid these challenges, some platforms have leveraged tariff-induced pressures as a catalyst for strategic localization, investing in regionally hosted infrastructure to circumvent new duties and to bolster performance for end users. This recalibration has unlocked opportunities for domestic cloud providers and local content creators, fostering a more resilient and geographically diversified ecosystem. Nonetheless, ongoing monitoring of policy developments remains essential, as ripples from today’s tariff regulations will continue to influence platform economics and partnership models in the near term.

Unveiling Critical Perspectives Across Diverse Course Types Subjects Revenue Models Platforms Delivery Methods and End User Categories

The MOOC landscape is distinguished by a diverse array of course typologies ranging from broad, open-access offerings to highly curated small private online courses. At one end of the spectrum, Big Open Online Courses cater to mass audiences with standardized curricula and scalable lecturing formats, while connectivist models emphasize learner-driven knowledge networks and collaborative content creation. Distributed Open Collaborative Courses introduce co-instructional frameworks across multiple institutions, extending pedagogical reach through joint faculties. Extended MOOCs build upon core content with supplementary coaching and live sessions, whereas Small Private Online Courses deliver tailored learning experiences to select cohorts, often focusing on advanced or specialized topics.

Course subjects reflect similarly varied interests, encompassing fields as disparate as Arts & Humanities and Technology & Computer Science. While business management, health and medicine, and social sciences address professional development and personal enrichment needs, mathematics and data science courses have surged in relevance amid analytics-driven decision-making trends. Language learning offerings facilitate linguistic skill acquisition, and science and engineering modules continue to support STEM workforce pipelines.

Diversity also characterizes the revenue structures underpinning MOOC platforms. Corporate licensing agreements grant enterprise clients broad access to curated course libraries, while freemium models allow free entry-level participation with optional paid upgrades. Pay-per-course arrangements provide transactional flexibility, and subscription-based approaches deliver ongoing value through unlimited course access. Platforms distinguish themselves further through delivery channels: mobile applications enhance accessibility for on-the-go learners, and web-based portals offer robust interface functionalities. Similarly, some models favor instructor-led sessions that replicate traditional classroom dynamics, whereas self-paced alternatives empower learners to progress autonomously.

A spectrum of provider types spans private ventures, university-led initiatives, corporate training entities, and government or NGO-sponsored programs, each targeting end users aligned with academic, enterprise, nonprofit, or individual learning objectives. This mosaic of segmentation layers underscores the complexity and adaptability of the MOOC market as providers fine-tune offerings to align with evolving learner expectations.

This comprehensive research report categorizes the Massive Open Online Course market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Course Subject

- Revenue Model

- Platform Type

- Delivery Mode

- Provider Type

- End User

Discerning Regional Dynamics and Growth Drivers Shaping Americas Europe Middle East Africa and Asia-Pacific Online Learning Ecosystems

Regional dynamics play a pivotal role in shaping the growth trajectory of open online education. Across the Americas, North American institutions and enterprises have taken the lead in adopting MOOC-based upskilling initiatives, while Latin American governments and NGOs leverage courses in public literacy, workforce readiness, and digital inclusion programs. This regional cohort benefits from strong broadband penetration and supportive policy frameworks that recognize online education as a strategic tool for economic development.

Meanwhile, Europe, the Middle East, and Africa exhibit a mosaic of approaches: Western European universities integrate MOOCs into blended learning landscapes, forging pan-continental partnerships through transnational consortia. In contrast, Middle Eastern nations are investing in regional digital learning hubs to diversify economies and to equip youth with in-demand skills. African markets, supported by international aid and public-private collaborations, prioritize foundational literacy and digital skill courses, navigating infrastructure constraints through mobile-based platforms and offline download capabilities.

In the Asia-Pacific region, rapid digital adoption and government-driven upskilling agendas have fueled expansive growth. Established providers forge localized partnerships across India, Southeast Asia, and Oceania, tailoring content to regional languages and compliance standards. Mobile-first strategies accommodate large segments of learners who access content via smartphones, while investments in cloud infrastructure ensure reliable delivery. Across these territories, the interplay of public policy, technological readiness, and demographic trends drives unique market dynamics that reward platforms with adaptive content strategies and strategic regional alliances.

This comprehensive research report examines key regions that drive the evolution of the Massive Open Online Course market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Strategic Initiatives and Competitive Positioning Among Leading Global MOOC Platforms Driving Innovation and Partnerships

Leading MOOC providers differentiate themselves through ambitious content partnerships, technological innovation, and strategic alliances. A subset of global platforms has prioritized enterprise licensing models, forging deep relationships with multinational corporations to deliver tailored training pathways and proprietary upskilling programs. Others have invested heavily in academic collaborations, co-branding courses with renowned universities to enhance credibility and attract diverse learner cohorts.

Strategic acquisitions and mergers have reshaped competitive positioning, as platforms integrate niche providers specializing in fields like data science, cybersecurity, or creative arts to broaden portfolio depth. Collaborative ventures with technology vendors embed AI-driven analytics and adaptive learning engines within platforms, offering personalized trajectories and robust learner support. Simultaneously, partnerships with government bodies and philanthropic organizations have enabled large-scale deployments in emerging markets, reinforcing social impact agendas alongside commercial objectives.

Regional players are emerging as formidable competitors by leveraging local content expertise, language customization, and culturally relevant pedagogical methods. These entities often form consortiums that pool resources across universities and enterprises to co-develop courses aligned with regional labor market needs. By combining global best practices with local insights, they challenge incumbent platforms to refine their localization strategies.

In this competitive climate, leading companies are increasingly judged not only by catalog size or user volume, but by their ability to deliver targeted learning outcomes, innovative credentialing options, and seamless integration with enterprise learning ecosystems. As a result, the future market leaders will be those that continuously refine their value propositions through strategic alliances and technology-driven differentiation.

This comprehensive research report delivers an in-depth overview of the principal market players in the Massive Open Online Course market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Alison

- Codecademy Inc.

- Coursera Inc.

- edX LLC

- FutureLearn Limited

- Instructure Inc.

- Iversity

- Kadenze

- Khan Academy Inc.

- LinkedIn Corporation

- MasterClass

- Miríadax

- NovoEd

- OpenLearning

- Pluralsight LLC

- Skillshare Inc.

- Swayam

- Udacity Inc.

- Udemy Inc.

- XuetangX

Empowering Industry Leaders with Strategic Recommendations to Enhance Course Delivery Monetization and Learner Engagement in Open Online Education

To thrive in the evolving MOOC environment, providers should prioritize the development of modular, microcredential-based content that aligns directly with industry competency frameworks. By partnering with corporate clients and professional associations, platforms can ensure relevance and drive credential recognition among employers. Next, integrating advanced analytics to deliver adaptive learning experiences will enhance engagement and completion rates; investment in AI‐powered feedback loops can support learners with real-time performance insights and targeted remediation.

Expanding mobile-first initiatives remains essential to capture the growing segment of learners who access content primarily through smartphones. Optimizing user interfaces for varied device specifications and network conditions will broaden reach across emerging markets. At the same time, strengthening platform interoperability through open APIs and standards such as Learning Tools Interoperability will enable seamless integration with learning management systems and enterprise resource planning solutions.

Diversifying revenue streams will bolster financial resilience. Beyond traditional subscription and pay-per-course options, platforms can explore cohort-based coaching, corporate upskilling bundles, and certification exam partnerships. Additionally, building out white-label solutions for universities and enterprises can unlock new licensing revenue while reinforcing brand credibility. Providers must also maintain rigorous data privacy and security protocols to comply with regional regulations such as GDPR and evolving U.S. data protection frameworks.

Finally, cultivating a robust community through mentorship programs, peer-to-peer networks, and industry forums will elevate learner satisfaction and foster ongoing engagement. By embracing these strategic imperatives, industry leaders can position themselves for sustainable growth and enduring impact in the open online education domain.

Detailing the Comprehensive Research Framework Employing Primary and Secondary Approaches Data Triangulation and Qualitative Interviews

This analysis is underpinned by a robust research framework combining both primary and secondary methodologies. Primary research involved in-depth interviews with senior executives from leading MOOC platforms, corporate training directors, and academic consortium representatives. Additionally, a series of structured surveys captured perspectives from instructional designers, technology partners, and learners across regions and sectors, yielding qualitative insights into emerging demands and pain points.

Secondary research drew upon authoritative white papers, thought leadership publications, and regulatory filings to map technological advancements, policy developments, and partnership models that shape the MOOC landscape. Publicly disclosed corporate materials and case studies informed the examination of strategic initiatives and revenue structures.

To ensure rigor and validity, data triangulation was employed, cross-verifying findings across distinct sources and research instruments. Quantitative usage metrics and engagement statistics were analyzed to contextualize survey feedback, while thematic coding of interview transcripts illuminated recurring trends and strategic priorities. Peer review sessions with external subject matter experts provided an additional layer of quality assurance, refining analytical frameworks and verifying interpretative accuracy.

This multifaceted approach enabled a comprehensive understanding of market dynamics, competitive positioning, and stakeholder requirements. The resulting insights offer a balanced fusion of empirical data, expert opinion, and real-world case examples, equipping decision-makers with the intelligence necessary to navigate an increasingly complex open online education ecosystem.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Massive Open Online Course market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Massive Open Online Course Market, by Type

- Massive Open Online Course Market, by Course Subject

- Massive Open Online Course Market, by Revenue Model

- Massive Open Online Course Market, by Platform Type

- Massive Open Online Course Market, by Delivery Mode

- Massive Open Online Course Market, by Provider Type

- Massive Open Online Course Market, by End User

- Massive Open Online Course Market, by Region

- Massive Open Online Course Market, by Group

- Massive Open Online Course Market, by Country

- United States Massive Open Online Course Market

- China Massive Open Online Course Market

- Competitive Landscape

- List of Figures [Total: 19]

- List of Tables [Total: 1272 ]

Synthesizing Key Insights to Illuminate the Future Trajectory of Massive Open Online Courses and Guide Stakeholder Decision-Making

Through a meticulous synthesis of market intelligence, this executive summary illuminates the defining trends, strategic inflection points, and operational imperatives within the Massive Open Online Course sector. From transformative pedagogical innovations to the nuanced effects of evolving trade policies, stakeholders are presented with a clear portrait of both challenges and opportunities. Segmentation insights reveal the necessity of tailored strategies that align with course typologies, subject areas, revenue models, and learner demographics, while regional analyses underscore the importance of contextualizing offerings to local market dynamics.

Leading companies have demonstrated that strategic partnerships, technology investments, and agile business models are essential to maintaining competitive advantage. The actionable recommendations distilled herein provide a roadmap for enhancing learner engagement, optimizing monetization structures, and reinforcing platform interoperability. As data privacy and regulatory landscapes continue to evolve, a proactive stance on compliance and ethical data management will be as critical as pedagogical excellence.

In sum, this synthesized landscape analysis equips educational institutions, enterprises, and policymakers with the insights needed to steer strategic decisions and drive impactful outcomes. As the MOOC domain advances toward greater personalization, credential recognition, and global accessibility, the imperative for informed, agile leadership has never been stronger.

Connect with Ketan Rohom to Unlock Actionable Market Intelligence and Secure Your Comprehensive Report on the Booming MOOC Industry Today

Connect with Ketan Rohom, Associate Director, Sales & Marketing, to secure your copy of this comprehensive market research report and gain immediate access to insights that will chart your success in the fast-evolving MOOC landscape. This exclusive analysis delivers practical guidance on adapting to emerging technologies, navigating regulatory headwinds, and fine-tuning offerings to meet diverse learner needs. By partnering directly with our sales leadership, you will be guided through tailored solutions that integrate the report’s strategic recommendations and segmentation intelligence into your organizational priorities. Act now to position your institution or enterprise at the forefront of online education innovation and harness the full potential of global learning markets.

- How big is the Massive Open Online Course Market?

- What is the Massive Open Online Course Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?