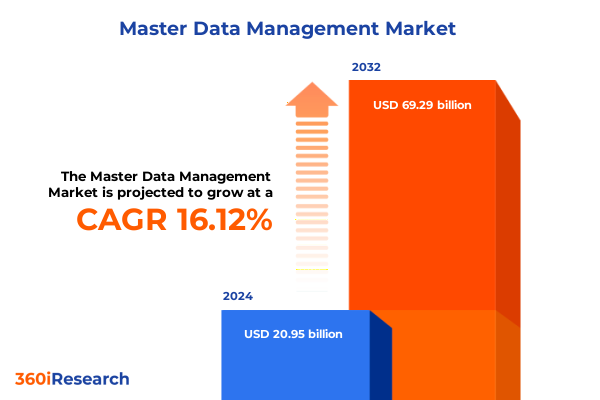

The Master Data Management Market size was estimated at USD 24.40 billion in 2025 and expected to reach USD 28.01 billion in 2026, at a CAGR of 16.07% to reach USD 69.29 billion by 2032.

Establishing the Essential Framework for Master Data Management to Achieve Consistency, Governance, and Strategic Alignment Across Enterprises

Master data management has emerged as a foundational capability for organizations striving to derive maximum value from their data assets, ensuring consistency across complex IT environments and driving informed decision-making. As enterprises navigate an era defined by digital transformation and heightened regulatory requirements, the establishment of robust governance frameworks and clear strategic objectives becomes paramount. This report delivers a comprehensive executive summary that distills critical insights into the current state of master data management, shedding light on evolving best practices and emerging opportunities.

This introduction sets the stage by outlining the primary goals of the analysis: to illuminate transformative shifts reshaping the master data management landscape, to evaluate the cumulative impact of United States tariff changes effective in 2025, to surface granular segmentation and regional perspectives, and to synthesize leading vendor strategies. It underscores the importance of aligning master data initiatives with overarching business imperatives, such as operational efficiency, risk mitigation, and competitive differentiation. Readers will gain a clear understanding of the report’s scope and analytical approach, establishing a solid foundation for the deeper exploration that follows.

Exploring How Cloud-Native Architectures and AI-Driven Governance Are Reshaping Master Data Management Practices

In recent years, master data management has undergone transformative evolution as organizations embrace advanced technologies and prioritize data-driven agility. The widespread shift toward cloud-native architectures has redefined deployment paradigms, enabling scalable, real-time data synchronization across distributed environments. Concurrently, the integration of artificial intelligence and machine learning has infused traditional master data platforms with predictive capabilities, automating classification, anomaly detection, and data quality remediation.

Moreover, a growing emphasis on data fabric and data mesh patterns has further decentralized governance, empowering cross-functional teams to steward critical data domains collaboratively. This cultural shift toward federated ownership is reinforced by stringent regulatory landscapes-ranging from global privacy directives to sector-specific compliance mandates-which compel enterprises to enforce rigorous lineage and auditability controls. As organizations adapt to these pressures, the role of master data management expands beyond system consolidation, evolving into a strategic linchpin for driving innovation, fostering transparency, and unlocking new avenues for value creation.

Assessing the Strategic Consequences of the 2025 United States Tariff Adjustments on Master Data Management Investments

The tariff landscape in the United States experienced significant restructuring in early 2025, with new duties applied to a range of hardware components and software services integral to master data management deployments. These adjustments have incrementally raised capital expenditures for on-premises infrastructure, prompting many organizations to reassess their total cost of ownership and weigh the benefits of shifting workloads to domestic or cloud-hosted environments.

As import levies have added to the price of specialized data integration appliances and third-party consulting engagements, enterprises are exploring innovative procurement strategies. Long-term managed service agreements, vendor partnerships prioritizing localized support, and hybrid cloud architectures have emerged as viable approaches to mitigate the impact of tariffs. Furthermore, in response to cost pressures, institutions have accelerated investments in automation-centric data quality tools that reduce labor dependencies and shrink the budgetary footprint associated with professional integration services. Ultimately, these tariff-driven economic levers are catalyzing a broader reevaluation of infrastructure footprints and supplier ecosystems.

Uncovering Distinct Demand Drivers Across Components, Deployment Modes, Organization Sizes, and Industry Verticals

A granular examination of market segmentation reveals divergent trajectories across key dimensions, providing vital context for tailored solution strategies. When analyzed by component, demand for services outpaces pure software acquisition, as clients seek end-to-end managed offerings that complement consulting, implementation, and ongoing support and maintenance activities. Within professional services, the consulting phase consistently drives initial engagements, while subsequent implementation and comprehensive support services sustain long-term partnerships.

Shifts in deployment mode illuminate a clear preference for cloud-hosted master data platforms, with public, private, and hybrid cloud models each addressing distinct organizational risk and performance profiles. While public cloud solutions appeal to agile, rapid-onboarding use cases, private and hybrid configurations cater to entities requiring strict data residency and governance controls. Evaluating organization size underscores that large enterprises maintain expansive, multi-domain master data initiatives across global operations, whereas small and medium enterprises favor modular, easy-to-deploy packages that scale with growth.

Vertical analysis exposes that financial services organizations-including banking, capital markets, and insurance-prioritize master data initiatives to streamline compliance and risk management. Healthcare providers and the life sciences extend master data efforts to unify patient, research, and product information. Manufacturing, particularly automotive and electronics and high tech, leverages streamlined data models to optimize supply chains. Finally, brick and mortar and e-commerce retail segments harness master data unification to deliver consistent customer experiences and accelerate omnichannel strategies.

This comprehensive research report categorizes the Master Data Management market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component

- Deployment Mode

- Organization Size

- Industry Vertical

Analyzing How Regional Regulations, Cloud Adoption Patterns, and Provider Ecosystems Shape Master Data Management Strategies Globally

Regional dynamics significantly influence the adoption and evolution of master data management practices, reflecting localized regulatory, economic, and technological factors. In the Americas, enterprises benefit from mature cloud markets and a robust ecosystem of managed service providers, often leading innovation in integrating data governance with artificial intelligence. The region’s regulatory environment continues to evolve, incentivizing organizations to refine master data processes that uphold data privacy frameworks and foster customer trust.

Across Europe, the Middle East and Africa, data sovereignty and compliance with stringent privacy regulations remain paramount, prompting a rise in private and hybrid cloud deployments that ensure control over cross-border data flows. Investments in advanced data stewardship tools are on the rise, supported by government initiatives that advocate digital transformation. Meanwhile, the Asia-Pacific landscape is characterized by rapid digitalization in emerging economies, driving demand for scalable, cloud-native master data solutions. Local service providers are forging strategic partnerships with global vendors to deliver flexible offerings that address diverse performance and security requirements.

This comprehensive research report examines key regions that drive the evolution of the Master Data Management market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Evaluating How Vendors Leverage Mergers, Partnerships, and AI Innovation to Differentiate Master Data Management Offerings

Leading technology providers and consulting firms are actively enhancing their master data management portfolios through strategic alliances, acquisitions, and product innovation. Enterprise stalwarts with broad software suites have intensified investment in cloud-based master data modules, leveraging existing infrastructure footprints to cross-sell enhanced data governance capabilities. Specialized vendors are differentiating via tailored industry solutions, embedding domain-specific workflows and compliance frameworks into core offerings.

Service providers with managed services expertise are capitalizing on the growing demand for fully outsourced data stewardship, bundling proactive monitoring, continuous data quality improvement, and digital governance playbooks. Partnerships between global cloud hyperscalers and niche MDM platforms are proliferating, offering customers pre-integrated, turnkey solutions that accelerate time to value. Meanwhile, emerging players emphasize AI-driven enrichment and automation to reduce manual intervention, positioning themselves as agile alternatives to legacy systems. Collectively, these competitive dynamics underscore the importance of adaptability, vertical specialization, and holistic service delivery in winning market share.

This comprehensive research report delivers an in-depth overview of the principal market players in the Master Data Management market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Ataccama Corporation

- Cincom Systems, Inc.

- EnterWorks, Inc.

- IBM Corporation

- Informatica Inc.

- Magnitude Software, Inc.

- Oracle Corporation

- Pitney Bowes Inc.

- Profisee Group, Inc.

- QlikTech International AB

- Riversand Technologies, Inc.

- SAP SE

- SAS Institute Inc.

- Semarchy Inc.

- Stibo Systems A/S

- Syniti

- Talend Inc.

- Tamr, Inc.

- TIBCO Software Inc.

Implementing Governance Structures, Hybrid Architectures, and AI Tools to Strengthen Master Data Management Outcomes

Industry leaders aspiring to excel in master data management must pursue a multifaceted approach that reconciles strategic vision with tactical execution. First, establishing a centralized governance council with cross-functional representation ensures alignment between data stewardship objectives and broader business goals. Embedding machine learning–enabled data quality tools within daily operations amplifies productivity and curtails manual discrepancies.

To mitigate risks associated with tariff-driven cost fluctuations, decision-makers should adopt hybrid cloud architectures that balance total cost of ownership with compliance needs. Engaging in deep vendor due diligence and negotiating flexible service-level agreements will further safeguard investments. Moreover, fostering a culture of continuous data literacy through targeted training initiatives empowers stakeholders to harness master data assets effectively. By forging ecosystem partnerships-especially with providers specializing in domain-driven data models-organizations can accelerate innovation and reduce implementation complexity.

Outlining Rigorous Primary and Secondary Research Protocols to Deliver Accurate, Actionable Master Data Management Insights

This study synthesizes insights derived from a rigorous research framework combining primary and secondary methodologies to ensure robust, actionable findings. Primary research entailed in-depth interviews with senior data executives and solution architects across diverse industries, complemented by structured surveys capturing the perspectives of IT leaders on adoption drivers, technology preferences, and deployment challenges.

Secondary research leveraged authoritative publications, vendor whitepapers, regulatory filings, and technical journals to validate primary data and uncover emerging trends. A comprehensive vendor landscape analysis was conducted, assessing product capabilities, service portfolios, strategic partnerships, and growth trajectories without relying on proprietary forecasts. Data triangulation techniques were applied to reconcile disparate sources, and quality assurance protocols were enforced throughout the research lifecycle to guarantee accuracy, consistency, and relevance.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Master Data Management market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Master Data Management Market, by Component

- Master Data Management Market, by Deployment Mode

- Master Data Management Market, by Organization Size

- Master Data Management Market, by Industry Vertical

- Master Data Management Market, by Region

- Master Data Management Market, by Group

- Master Data Management Market, by Country

- United States Master Data Management Market

- China Master Data Management Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1908 ]

Reflecting on Cloud Evolution, AI Integration, and Economic Dynamics to Drive Strategic Master Data Management Initiatives

In conclusion, master data management stands at the intersection of technological innovation, regulatory imperatives, and strategic business imperatives. The convergence of cloud-native platforms, AI-driven governance, and evolving tariff landscapes is reshaping how organizations architect, adopt, and operationalize unified data strategies. By leveraging nuanced segmentation and regional perspectives, enterprises can tailor master data initiatives to their unique operational contexts and growth objectives.

The competitive landscape underscores the imperative for adaptability, whether through strategic partnerships, advanced automation, or comprehensive service offerings. As data complexity escalates, effective master data management emerges not merely as an operational necessity but as a catalyst for sustained competitive advantage. This executive summary offers a consolidated foundation for decision-makers to chart their next steps with confidence and conviction.

Connect Directly with Our Expert to Acquire the Full Master Data Management Market Research Report and Drive Strategic Growth

To secure an authoritative roadmap for mastering data complexities and unlocking strategic growth, reach out to Ketan Rohom, Associate Director, Sales & Marketing at 360iResearch. His expertise in guiding organizations through intricate data management journeys ensures you receive tailored insights and actionable strategies. Engage today to obtain the complete market research report and position your enterprise at the forefront of robust master data management solutions.

- How big is the Master Data Management Market?

- What is the Master Data Management Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?