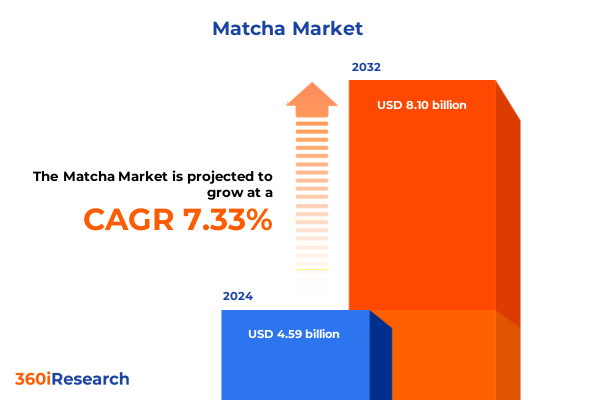

The Matcha Market size was estimated at USD 4.92 billion in 2025 and expected to reach USD 5.26 billion in 2026, at a CAGR of 7.39% to reach USD 8.10 billion by 2032.

Discovering the Unique Appeal and Expanding Potential of Grade-Specific Matcha Products Amid Evolving Consumer Preferences in Wellness and Culinary Applications

Matcha has evolved from its storied origin in Japanese tea ceremonies into a global phenomenon appreciated for both its sensory uniqueness and functional benefits. Rigid adherence to quality standards has given rise to well-defined grades, each delivering a distinct flavor profile, color vibrancy, and nutrient concentration. Ceremonial grade matcha continues to command respect among traditional enthusiasts, while culinary and ingredient grades broaden its appeal by catering to food manufacturers, beverage innovators, and wellness brands.

Driven by a confluence of wellness trends and premiumization in the beverage market, consumers are increasingly drawn to matcha’s rich antioxidant content, calming yet sustained energy release, and versatility across preparation methods. This growing interest is being fueled by lifestyle influencers, digital recipes, and in-store demonstrations that celebrate matcha’s vibrant green hue and ceremonial heritage. As a result, supply chain stakeholders are investing in direct partnerships with tea cultivators to ensure traceability and consistency from farm to cup.

With its inherent adaptability, matcha has transcended the tea aisle to become a staple ingredient in protein bars, dairy-free lattes, and skincare formulations. This broadening application scope underscores the category’s transformative potential. By understanding the nuanced preferences of modern consumers-from ritualistic tea ceremonies to on-the-go energy solutions-industry participants can harness the full spectrum of matcha’s attributes to drive new avenues of innovation and market penetration.

Tracing the Dynamic Evolution of Matcha Market Driven by Lifestyle Trends, Product Innovations, and Sustainability Commitments Across Diverse Consumer Segments

Over the past decade, matcha has undergone a profound metamorphosis catalyzed by lifestyle shifts emphasizing holistic well-being and clean-label formulations. Health-conscious consumers now prioritize source transparency and functional benefits, prompting brands to highlight matcha’s chlorophyllrich composition and naturally occurring L-theanine. Digital communities and influencers have accelerated this narrative, showcasing matcha as a gateway to mindful consumption and calm alertness rather than a mere caffeine alternative.

Concurrently, product innovation has surged with novel delivery formats such as single-serve capsules, ready-to-drink powders, and fortified tablets. These advancements cater to diverse consumption occasions, from pre-workout routines to mid-afternoon pick-me-ups, ensuring that matcha integrates seamlessly into fast-paced lifestyles. Sustainability commitments from both farm cooperatives and packaging suppliers are further reshaping industry norms, as traceable sourcing and biodegradable packaging resonate deeply with eco-aware demographics.

As market participants embrace cross-category collaborations, we observe matcha’s application expanding beyond beverages into confectionaries, cosmetics, and dietary supplements. These transformative shifts underscore matcha’s unique role at the nexus of taste, health, and experiential consumption. By continuously refining sourcing partnerships, optimizing formulation technologies, and amplifying authentic storytelling, stakeholders can capitalize on the evolving landscape and cement matcha’s status as a premium wellness ingredient.

Evaluating the Comprehensive Impact of 2025 United States Import Tariffs on Matcha Supply Chains, Pricing Structures, and Market Accessibility

The introduction of targeted United States import tariffs in early 2025 has created a complex regulatory environment for matcha distributors and retailers. These measures, aimed at balancing trade deficits, have increased landed costs for popular premium grades sourced predominantly from East Asia. As import duties rise, distributors face heightened cost pressures that cascade into retail pricing, threatening to dampen consumer demand in price-sensitive segments.

Supply chain strategies have adapted in response, with companies seeking tariff mitigation through diversification of sourcing origins, leveraging duty-drawback programs, and renegotiating supplier contracts to share incremental costs. Some producers have accelerated onshore blending and packaging operations to reclassify goods under domestic value-added criteria. This shift has resulted in more resilient supply chains but has introduced complexities in quality assurance and grade consistency.

In parallel, forward-looking distributors are emphasizing premium experiences rather than competing on price alone. By educating consumers on the distinct characteristics of ceremonial-grade versus culinary-grade matcha, brands can articulate the value proposition that justifies premium positioning. Ultimately, while the 2025 tariffs challenge the industry to refine operational efficiencies, they also incentivize deeper collaboration between growers, processors, and distributors to sustain growth and preserve market momentum.

Uncovering Critical Insights Across Multi-Dimensional Matcha Market Segmentation Based on Grade, Form, Application, Distribution Channels, and End Users

Examining market segmentation through the lens of grade reveals critical distinctions among ceremonial, culinary, and ingredient matcha. Ceremonial grade sustains its allure among purists who prize its delicate flavor and striking green intensity, whereas culinary grade is favored by foodservice operators seeking a cost-effective balance of taste and color. Ingredient-grade matcha, often incorporated into nutritional blends and health bars, underscores the ingredient’s functional versatility.

When considered by product form, matcha’s footprint spans capsules, leaf, powder, and tablets, each format tailored to specific consumer demands. Powder form remains the cornerstone for traditional tea preparation and innovative beverage concoctions. Capsules and tablets, however, cater to the convenience-driven segment prioritizing dosage accuracy and portability. Leaf form, while niche, appeals to aficionados who value artisanal preparation methods and minimize processing influences.

An in-depth look at applications reveals distinct growth vectors within beverages, confectionaries, cosmetics, and dietary supplements. Beverages include latte formulations for café menus, smoothie integrations for health brands, and ready-to-serve teas retailing through cold-chain channels. Within confectionaries, matcha fortifies bakery goods, artisanal chocolates, and dessert offerings with both flavor and functional claims. In cosmetics, haircare and skincare lines leverage antioxidant and soothing properties. Dietary supplements capitalize on matcha’s cognitive support benefits through encapsulated and powder blends.

Distribution channels further refine market access into offline and online pathways. Offline channels encompass convenience stores, specialty retailers, and supermarket-hypermarket anchors that provide in-store sampling and brand visibility. Online channels are divided between direct brand websites fostering consumer loyalty and broader e-commerce platforms that expand reach. Finally, end user considerations demarcate foodservice and household consumption, with cafés, hotels, and restaurants driving bulk procurement while household users seek premium, at-home experiences.

This comprehensive research report categorizes the Matcha market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Grade

- Form

- Application

- Distribution Channel

- End User

Highlighting Distinct Regional Dynamics Influencing Matcha Consumption Patterns, Trade Flows, and Growth Opportunities in Americas, EMEA, and Asia-Pacific Markets

Regional dynamics have become a defining force in shaping matcha’s global footprint. In the Americas, consumer fascination with functional beverages has fueled demand for premium matcha, particularly in urban centers where wellness trends coincide with café culture. Importers in North America are fine-tuning product assortments to include ceremonial-grade offerings alongside innovative ready-to-drink formulations.

The Europe, Middle East & Africa region presents heterogeneous growth patterns driven by evolving regulatory frameworks and diverse consumer palates. Western Europe leans toward artisanal matcha preparations within specialty tea shops, while the Middle East demonstrates increasing appetite for high-caffeine, adaptogenic blends. Regulatory variations around novel food approvals in some EMEA jurisdictions necessitate agile product reformulations to align with local standards.

In Asia-Pacific, the birthplace of matcha, consumer sophistication continues to mature. Established markets such as Japan and South Korea uphold rigorous quality hierarchies, whereas emerging economies like Australia and India embrace matcha-driven confections and dietary supplements. Integration into mainstream retail channels across Asia-Pacific underscores matcha’s transition from niche wellness item to an everyday lifestyle ingredient, signaling sustained expansion opportunities.

This comprehensive research report examines key regions that drive the evolution of the Matcha market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Matcha Industry Innovators Demonstrating Strategic Partnerships, Product Differentiation, and Competitive Positioning Driving Market Value

Leading players in the matcha industry are differentiating through strategic partnerships, vertical integration, and product innovation. Several companies have forged direct relationships with tea estates in Uji, Nishio, and Kagoshima to secure exclusive harvests and reinforce provenance claims. These alliances enhance traceability while enabling premium branding initiatives.

In addition, a cohort of market participants is integrating processing and packaging operations closer to end markets to improve tariff resilience and shorten lead times. This approach facilitates customizable blends and formulation variations, empowering companies to respond rapidly to consumer feedback. Meanwhile, emerging players are focusing on clean-label positioning by sourcing organic, shade-grown leaves and incorporating renewable energy technologies in production facilities.

Competitive positioning is further shaped by collaborations with research institutions to quantify functional attributes, driving clinical validation for cognitive support and metabolic health benefits. By leveraging scientific endorsements, companies differentiate offerings and build consumer confidence. As the landscape matures, those who align product authenticity with operational efficiencies and evidence-based claims will maintain robust competitive edges.

This comprehensive research report delivers an in-depth overview of the principal market players in the Matcha market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Aiya Co., Ltd.

- AOI Tea Company

- Associated British Foods plc

- DavidsTEA Inc.

- DoMatcha by Andrews & George Company Limited

- Harney & Sons Fine Teas, LLC

- ILEM JAPAN LTD.

- Ippodo Tea Co., Ltd.

- ITO EN, Ltd.

- Japan GreenTea Co.,Ltd.

- Keicha Tea World, Inc.

- Kettl, Inc.

- LifeTime Tea. LLC

- McCormick & Company, Incorporated

- Nestle S.A.

- Numi Organic Tea, LLC

- Riching Matcha

- Takezwa Seicha Co., Ltd.

- The Republic of Tea, Inc.

- Unilever PLC

Presenting Actionable Recommendations for Matcha Industry Leaders to Harness Emerging Trends, Streamline Operations, and Elevate Consumer Engagement

Organizations seeking to capitalize on matcha’s momentum should prioritize integrated value chain strategies. Strengthening direct sourcing agreements with veteran cultivators ensures consistent quality while building brand narratives around authenticity and heritage. Concurrently, investing in onshore blending and packaging capabilities can mitigate tariff impacts and accelerate time-to-market for emerging product lines.

Innovation should focus on expanding application boundaries through cross-industry partnerships. Collaborating with food manufacturers and personal care brands to co-create matcha-infused products amplifies distribution channels and introduces matcha to new consumer cohorts. Augmenting these collaborations with digital marketing campaigns that highlight scientific research and experiential storytelling will deepen consumer engagement and justify premium pricing structures.

For long-term resilience, industry leaders are encouraged to adopt sustainable practices across cultivation, processing, and packaging. Implementing regenerative agriculture techniques and eco-conscious packaging not only aligns with consumer expectations but also lays the foundation for favorable regulatory positioning. By weaving these strategic recommendations into core business plans, organizations will unlock new growth vectors and cement matcha’s role as a mainstream functional ingredient.

Detailing the Robust Research Methodology Underpinning the Matcha Market Study Including Primary Surveys, Expert Interviews, and Data Triangulation Processes

This study draws upon a comprehensive, multi-tiered research framework designed to deliver robust and actionable insights. Primary research comprised in-depth interviews with cultivators, processors, distributors, and key decision-makers within top-tier matcha-consuming organizations. These interviews were structured to uncover strategic priorities, pain points, and emerging trends across both established and developing markets.

Complementing primary insights, the research methodology integrated extensive secondary data collection from trade associations, industry publications, regulatory filings, and academic studies focusing on phytochemical analysis and consumer behavior. Data triangulation was employed to validate findings by cross-referencing multiple sources and ensuring consistency in market narratives. This approach fortified the reliability of qualitative observations and quantitative indicators.

Geographic market mapping was conducted to analyze regional trade flows, regulatory environments, and distribution infrastructures. Expert panels in North America, EMEA, and Asia-Pacific provided localized perspectives on consumer trends and compliance requirements. The iterative research process involved continuous validation loops, whereby preliminary insights were refined through follow-up dialogues, ensuring a nuanced understanding of supply chain dynamics and growth catalysts.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Matcha market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Matcha Market, by Grade

- Matcha Market, by Form

- Matcha Market, by Application

- Matcha Market, by Distribution Channel

- Matcha Market, by End User

- Matcha Market, by Region

- Matcha Market, by Group

- Matcha Market, by Country

- United States Matcha Market

- China Matcha Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1908 ]

Synthesizing Key Findings and Strategic Implications of the Matcha Market Analysis to Empower Stakeholders with Actionable Insights for Future Growth

The analysis converges on several critical themes: the imperative for transparent sourcing, the growing importance of diversified product formats, and the strategic necessity of tariff resilience mechanisms. By aligning product portfolios with consumer-driven wellness narratives and delivering scientifically validated benefits, stakeholders can reinforce matcha’s premium positioning. Regional distinctions underscore the need for bespoke market strategies that account for regulatory landscapes and cultural consumption habits.

Segmentation insights reveal that while traditional ceremonial matcha maintains its prestige, growth opportunities lie in culinary and ingredient grades adapted for cross-industry integration. Similarly, the expansion of convenience-driven formats such as capsules and tablets opens new channels for health-focused consumers, while e-commerce platforms play an increasingly pivotal role in shaping purchase behaviors.

In synthesizing these findings, it becomes evident that the matcha market is at an inflection point where innovation, sustainability, and strategic partnerships will determine leadership status. Stakeholders who proactively embrace these imperatives are well-positioned to harness matcha’s full market potential and achieve sustained competitive advantage.

Contact Ketan Rohom, Associate Director of Sales & Marketing, to Secure Your Comprehensive Matcha Market Report and Propel Your Strategic Decision-Making Today

I invite you to connect with Ketan Rohom, the Associate Director of Sales & Marketing at 360iResearch, to secure exclusive access to the comprehensive Matcha Market Research Report. By partnering with Ketan, you will gain tailored insights and strategic guidance designed to inform every critical decision on product development, distribution, and consumer engagement. This report offers unparalleled depth into segmentation trends, regional dynamics, and competitive innovations-equipping you to navigate complex market headwinds and unlock new growth opportunities. Reach out to Ketan Rohom today to obtain your personalized copy and transform these insights into actionable strategies that will elevate your market positioning and drive long-term success

- How big is the Matcha Market?

- What is the Matcha Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?